Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

The China-U.S. economic and trade relationship has made positive progress, with both sides reaching a consensus during consultations in Kuala Lumpur. The U.S. side will cancel the 10% "fentanyl tariff" and continue to suspend the 24% reciprocal tariff for one year, while also suspending export controls on 50% of penetrating rules and the 301 investigation into maritime issues with China for one year. In response, China has also adjusted its countermeasures. However, investor concerns about the Federal Reserve's interest rate cut prospects continue to fester, leading to a gloomy market sentiment after the FOMC meeting, with Meta's stock price plummeting 11% due to its AI spending plans. Regarding the much-discussed AI wave, UBS reports that while bubble conditions are maturing, key peak signals have yet to appear. The current 35 times price-to-earnings ratio of the Mag 6 tech giants is far below the levels seen during the tech bubble, indicating that the market is still in the "early stages of a potential bubble."

Additionally, Goldman Sachs CEO warned that the continuously rising U.S. debt level, nearing $40 trillion, could push the economy to the brink of "liquidation" without corresponding economic growth support. Notably, financial technology giant Fiserv saw its stock price plummet about 44% in a single day due to management errors, failed pricing strategies, and performance far below expectations, resulting in a market value loss of approximately $30 billion.

In the Bitcoin market, prices fluctuated after the FOMC meeting, briefly dropping below $107,000. Multiple analysts have differing views on the market outlook but are generally focused on key support levels. Analyst Killa believes that while the overall structure remains bullish, the price has failed to break the monthly opening price three times. If it falls below the $107,000-$108,000 range, it could trigger a deeper correction to $101,000-$102,000, or even touch the $97,000-$98,000 area below $100,000. To confirm the continuation of a bull market, a weekly close above $115,000 is needed. Crypto Chase views the area around $100,000 as the last opportunity for Bitcoin to challenge its historical high in the short term and plans to position long orders near that level. Ted emphasizes that since the first quarter of 2023, Bitcoin's weekly closing price has never fallen below the 50-period moving average, making it crucial to maintain this level for the bull market. From a cyclical perspective, analyst Mister Crypto reminds that it has been 558 days since the 2024 halving, entering a historical window for market peaks in bull markets. Jesse Olson also pointed out the bearish MACD crossover appearing on the three-week chart, a signal that accurately predicted market tops in 2017 and 2021. Despite short-term pressure, Coinbase increased its holdings by 2,772 Bitcoins in the third quarter, and Strategy recently transferred 22,704 BTC to a new wallet.

Ethereum is also under pressure, with prices fluctuating around the $4,000 mark, failing to establish a solid footing. Market data shows a low premium rate in the Ethereum futures market, weak ETF fund flows, and a decline in the number of active addresses and network fees by 4% and 16%, respectively, reflecting a lack of current market demand. Analyst Man of Bitcoin points out that Ethereum's price reversed before reaching the $3,681 support level, and if it can break the descending trend line, it may signal the start of a new upward trend. However, another analyst, Crypto_Jobs, takes a cautious stance, suggesting a potential bearish "double test" on the daily chart, with prices possibly retreating to the $3,450 or $3,200 support areas, warning that a drop below $3,180 would be detrimental to the mid-term bullish outlook. Nevertheless, some analysts remain relatively optimistic; FibonacciTrading believes that even a pullback to $3,300 would be a healthy adjustment within an upward trend. Cactus states that as long as the support area of $3,800-$4,200 is maintained, an upward trend in the fourth quarter is still expected. From a long-term perspective, Standard Chartered's head of digital asset research, Geoffrey Kendrick, predicts that the RWA tokenization market will reach $2 trillion by 2028, believing that "the vast majority" of this activity will occur on the Ethereum network. Additionally, Coinbase also increased its holdings by 11,933 Ethereum in the third quarter.

Since the launch of the Solana spot ETF, the ecosystem has continued to attract capital. The U.S. Solana spot ETF recorded a net inflow of $37.33 million on October 30, achieving three consecutive days of net inflows. Bitwise's Matt Hougan is optimistic that Solana can gain more market share in the growing stablecoin and tokenization markets due to its technological advantages. However, analyst Ted believes that the altcoin market may struggle to see a comprehensive rebound before the Federal Reserve initiates quantitative easing. Additionally, Kite (KITE) announced that it will launch on Binance Alpha on November 3, with its token economic model allocating 48% of its share to the ecosystem and community. Since its token was listed for pre-trading on Binance, it has continued to rise, increasing by 33% in the past 24 hours.

2. Key Data (as of October 31, 13:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, CoinMarketCap, GMGN)

Bitcoin: $109,632 (YTD +17.31%), daily spot trading volume $6.988 billion

Ethereum: $3,831 (YTD +14.87%), daily spot trading volume $3.49 billion

Fear and Greed Index: 31 (Fear)

Average GAS: BTC: 1 sat/vB, ETH: 0.1 Gwei

Market share: BTC 59.4%, ETH 12.6%

Upbit 24-hour trading volume ranking: XRP, ETH, BTC, SOL, ENSO

24-hour BTC long-short ratio: 48.9%/51.1%

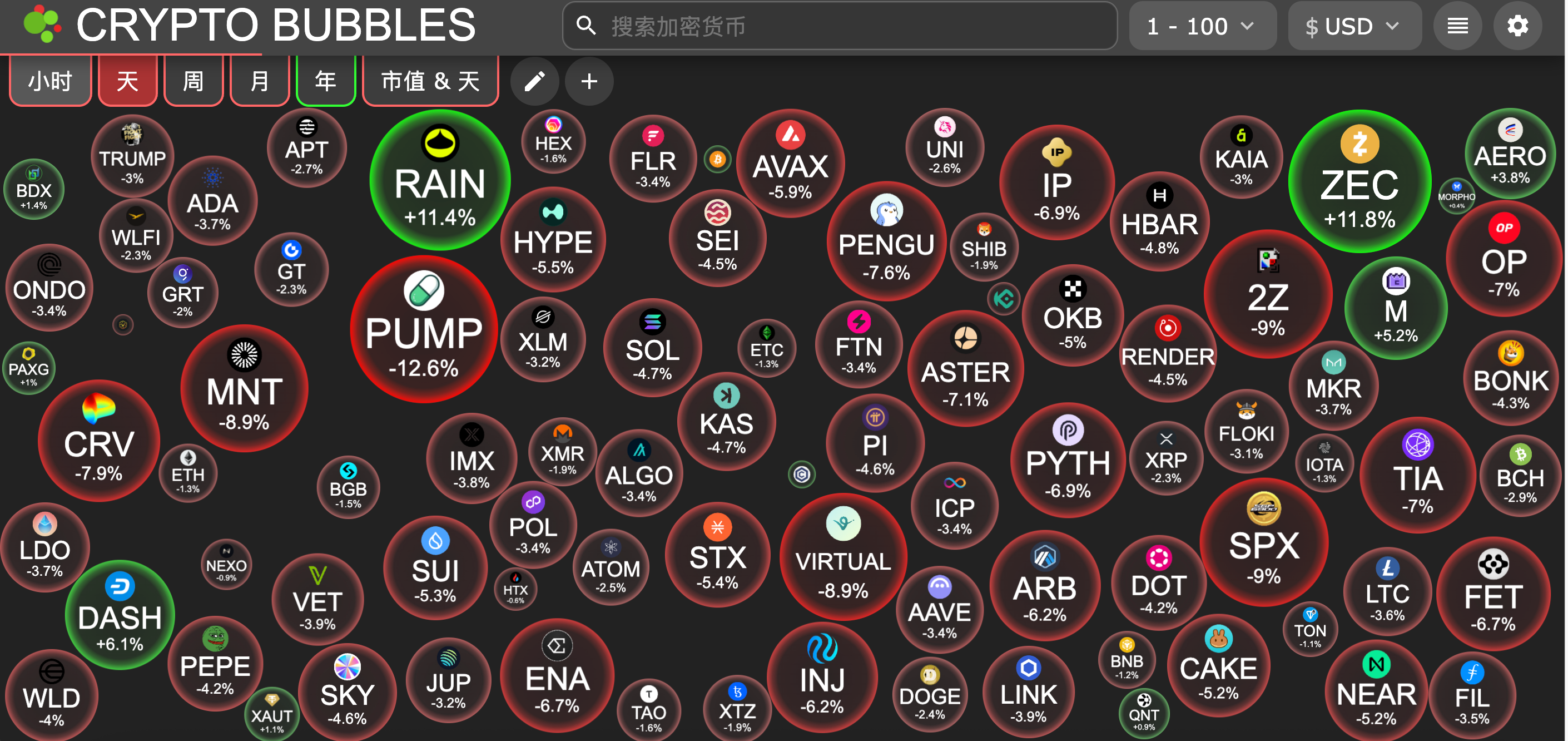

Sector performance: L2 sector down 6.98%, NFT sector down 5.66%

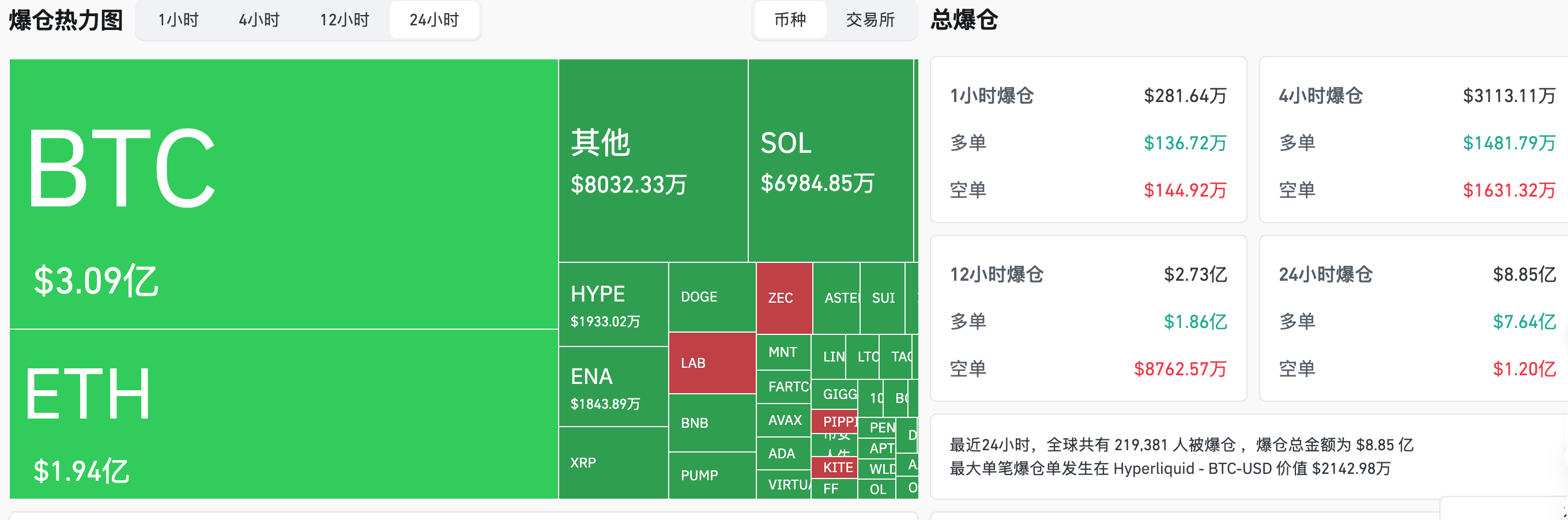

24-hour liquidation data: A total of 219,381 people were liquidated globally, with a total liquidation amount of $885 million, including $309 million in BTC, $194 million in ETH, and $19.336 million in HYPE.

BTC medium to long-term trend channel: upper line ($112,306.24), lower line ($110,082.35)

ETH medium to long-term trend channel: upper line ($4,007.59), lower line ($3,928.24)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of October 30)

Bitcoin ETF: -$488 million, with no net inflows in 12 ETFs

Ethereum ETF: -$184 million, with no net inflows in 9 ETFs

4. Today's Outlook

Binance Alpha will launch NB, BAY, and BEAT tokens and conduct airdrops

Binance Wallet's second phase Prime Sale Pre-TGE will launch Momentum (MMT)

Binance will remove ATA/BTC, LAYER/BNB, and POWR/ETH spot trading pairs

Optimism (OP) will unlock approximately 31.34 million tokens at 8 AM on October 31, accounting for 1.71% of the current circulation, valued at approximately $14.2 million;

Immutable (IMX) will unlock approximately 24.52 million tokens at 8 AM on October 31, accounting for 1.24% of the current circulation, valued at approximately $13.3 million;

Sui (SUI) will unlock approximately 43.96 million tokens at 8 AM Beijing time on November 1, accounting for 1.21% of the current circulation, valued at approximately $113 million;

EigenCloud (EIGEN) will unlock approximately 36.82 million tokens at noon on November 1, accounting for 12.10% of the current circulation, valued at approximately $41.6 million;

Top gainers among the top 100 cryptocurrencies by market capitalization today: Zcash up 11.8%, Rain up 11.4%, Dash up 6.1%, MemeCore up 5.2%, Aerodrome Finance up 3.8%.

5. Hot News

Strategy transferred 22,704 BTC, approximately $2.45 billion, to multiple new addresses

The Jupiter community is voting on whether to burn the previously repurchased 130 million JUP

Bitmine reportedly received 44,036 ETH, worth $166 million, from CEX through two new wallets

Jump Crypto transferred $205 million in SOL to Galaxy Digital and received 2,455 BTC

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。