Weekend Recommended Reading: MegaETH Public Sale Raises Over $1.2 Billion, Is a Wave of Altcoin ETFs Coming?

Organized by: Nona

This Week's Focus

[

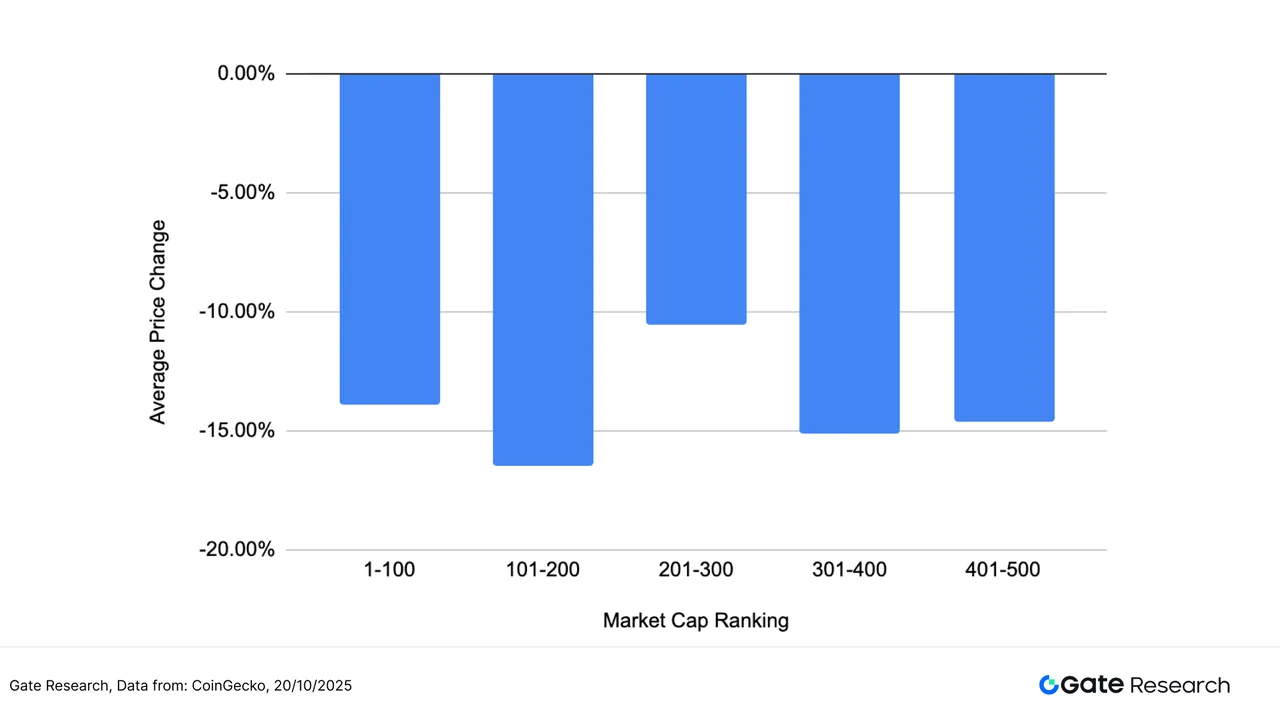

This classic market behavior of "buying the expectation, selling the fact" has long become a fixed script in the crypto market before and after major macro events. Since the market flash crash on "10.11", Bitcoin's price has continued to fluctuate within the range of $103,000 - $116,000. Now that the interest rate cut expectations have materialized, the market is calm. Will the future trend be consolidation or a breakout?

](<p class=)

[](<p class=)Public sale raised over $1.2 billion, oversubscribed 24 times. Will MegaETH be the next "wealth myth"?

So, why is the MegaETH public sale so popular? What charm does it possess that attracts a large number of investors? This article will analyze from multiple dimensions including the background of the MegaETH project, financing situation, and token economics.

[

It is worth mentioning that the Fusaka upgrade covers 12 core Ethereum Improvement Proposals (EIPs), aimed at comprehensively enhancing Ethereum's scalability, operational efficiency, and security. Specific improvements include increasing block gas limits, expanding "Blob" capacity, and introducing new node security features.

](<p class=)

[]( <p class=)China Asset Management and Bitwise have successively launched Solana ETFs. Is a "listing wave" of altcoin ETFs coming?

Previously, the market generally expected that Solana, XRP, and other altcoin ETFs would be launched one after another. However, the listing of Hong Kong's first Solana spot ETF successfully attracted the attention of many investors, further focusing market attention on Solana ETFs. Meanwhile, the progress of Solana ETFs in the U.S. market has shown a more positive trend.

[

For decades, online advertising has been the only way to survive on the internet. Everyone is competing for attention. To achieve this, companies collect all possible data around you, create user profiles, and show you ads.

](<p class=)

[Featured Recommendations](<p class=)

The $500 billion "waterfall effect": An article exploring how staking ETFs and DAT companies are reshaping the Ethereum market ecosystem

As ETFs make staking rewards simple, transparent, and accessible, investors may increasingly view ETH as a speculative asset rather than a productive asset. This contrasts sharply with Bitcoin, which is seen as "digital gold" with no returns. Over time, this dynamic may exacerbate the differentiated narrative between ETH and BTC: BTC as a scarce store of value, while ETH serves both as a store of value and a revenue-generating asset.

[

Driven by agents, stablecoins, and composable markets, we are moving towards a world where all information can be priced. This should mean that fake news will gradually fade away, and exaggerated statements will find it hard to thrive. Creators do not need to produce in large quantities, and individuals can gain capital market endorsement for the viewpoints they consume. This is undoubtedly a progress.

](<p class=)

[](

Who would have thought that Nvidia took only 113 days to once again stage the "AI miracle" in the capital market, becoming the world's first publicly traded company with a market value exceeding $5 trillion. This figure surpasses the annual GDP of almost all countries except the U.S. and China, and far exceeds the total market value of the entire crypto market (approximately $3.8 trillion).

<div class=)[

The brick walls of the White House East Wing are coming down, and new halls are being laid. In this "reconstruction ceremony," new financial backers are entering the scene. The rules of the game in Washington have not changed—only this time, crypto capital has finally received its ticket to enter.

](<p class=)

[Ten News You Can't Miss This Week](<p class=)

In fact, behind the surge in the crypto asset market led by Bitcoin in the first half of the year, institutional investors are an important "driving force." As ETH, SOL, and BNB have been included in the asset reserves of some listed companies and even used by multiple companies as treasury targets, the institutional market has once again shown strong incremental potential.

[]( CEX Top Players: How to Stand Firm in the Institutional Wind?

In fact, behind the surge in the crypto asset market led by Bitcoin in the first half of the year, institutional investors are the important "driving force." As ETH, SOL, and BNB have been included in the asset reserves of some listed companies and even used by multiple companies as treasury targets, the institutional market has once again shown strong incremental potential.

<span style=)

[]( CEX Top Players: How to Stand Firm in the Institutional Wind?

In fact, behind the surge in the crypto asset market led by Bitcoin in the first half of the year, institutional investors are the important "driving force." As ETH, SOL, and BNB have been included in the asset reserves of some listed companies and even used by multiple companies as treasury targets, the institutional market has once again shown strong incremental potential.

<span style=)

[]( CEX Top Players: How to Stand Firm in the Institutional Wind?

In fact, behind the surge in the crypto asset market led by Bitcoin in the first half of the year, institutional investors are the important "driving force." As ETH, SOL, and BNB have been included in the asset reserves of some listed companies and even used by multiple companies as treasury targets, the institutional market has once again shown strong incremental potential.

<span style=)

[]( CEX Top Players: How to Stand Firm in the Institutional Wind?

In fact, behind the surge in the crypto asset market led by Bitcoin in the first half of the year, institutional investors are the important "driving force." As ETH, SOL, and BNB have been included in the asset reserves of some listed companies and even used by multiple companies as treasury targets, the institutional market has once again shown strong incremental potential.

<span style=)

[]( CEX Top Players: How to Stand Firm in the Institutional Wind?

In fact, behind the surge in the crypto asset market led by Bitcoin in the first half of the year, institutional investors are the important "driving force." As ETH, SOL, and BNB have been included in the asset reserves of some listed companies and even used by multiple companies as treasury targets, the institutional market has once again shown strong incremental potential.

<span style=)

[]( CEX Top Players: How to Stand Firm in the Institutional Wind?

In fact, behind the surge in the crypto asset market led by Bitcoin in the first half of the year, institutional investors are the important "driving force." As ETH, SOL, and BNB have been included in the asset reserves of some listed companies and even used by multiple companies as treasury targets, the institutional market has once again shown strong incremental potential.

<span style=)

[]( CEX Top Players: How to Stand Firm in the Institutional Wind?

In fact, behind the surge in the crypto asset market led by Bitcoin in the first half of the year, institutional investors are the important "driving force." As ETH, SOL, and BNB have been included in the asset reserves of some listed companies and even used by multiple companies as treasury targets, the institutional market has once again shown strong incremental potential.

<span style=)

[]( CEX Top Players: How to Stand Firm in the Institutional Wind?

In fact, behind the surge in the crypto asset market led by Bitcoin in the first half of the year, institutional investors are the important "driving force." As ETH, SOL, and BNB have been included in the asset reserves of some listed companies and even used by multiple companies as treasury targets, the institutional market has once again shown strong incremental potential.

<span style=)

[]( CEX Top Players: How to Stand Firm in the Institutional Wind?

In fact, behind the surge in the crypto asset market led by Bitcoin in the first half of the year, institutional investors are the important "driving force." As ETH, SOL, and BNB have been included in the asset reserves of some listed companies and even used by multiple companies as treasury targets, the institutional market has once again shown strong incremental potential.

<span style=)

[]( CEX Top Players: How to Stand Firm in the Institutional Wind?

In fact, behind the surge in the crypto asset market led by Bitcoin in the first half of the year, institutional investors are the important "driving force." As ETH, SOL, and BNB have been included in the asset reserves of some listed companies and even used by multiple companies as treasury targets, the institutional market has once again shown strong incremental potential.

<span style=)

[]( CEX Top Players: How to Stand Firm in the Institutional Wind?

In fact, behind the surge in the crypto asset market led by Bitcoin in the first half of the year, institutional investors are the important "driving force." As ETH, SOL, and BNB have been included in the asset reserves of some listed companies and even used by multiple companies as treasury targets, the institutional market has once again shown strong incremental potential.

<span style=)

[

Shanghai Commercial Bank plans to launch a joint Visa credit card with HashKey Exchange

Insider: The U.S. Senate Agriculture Committee is about to release a bipartisan draft bill regarding the structure of the crypto market

The Hong Kong Securities and Futures Commission has listed the virtual asset trading platform VEX on its warning list

Mastercard Hong Kong Monetary Authority: Seven banks hope to acquire the crypto infrastructure startup Zerohash for $2 billion within the year

<li class=)launch tokenized deposits

]( CEX Top Players: How to Stand Firm in the Institutional Wind?

In fact, behind the surge in the crypto asset market led by Bitcoin in the first half of the year, institutional investors are the important "driving force." As ETH, SOL, and BNB have been included in the asset reserves of some listed companies and even used by multiple companies as treasury targets, the institutional market has once again shown strong incremental potential.

<span style=)

[]( CEX Top Players: How to Stand Firm in the Institutional Wind?

In fact, behind the surge in the crypto asset market led by Bitcoin in the first half of the year, institutional investors are the important "driving force." As ETH, SOL, and BNB have been included in the asset reserves of some listed companies and even used by multiple companies as treasury targets, the institutional market has once again shown strong incremental potential.