This article is from: @yqacc_

Translation|Odaily Planet Daily (@OdailyChina); Translator| Ethan (@ethanzhangweb3)

In 1994, Marc Andreessen made a critical mistake that he later acknowledged: Netscape failed to integrate payment functionality into its browser. Due to regulatory uncertainty and the risk aversion of financial institutions, Netscape's collaboration plans with Visa and Microsoft's plans with MasterCard fell through. This led to an advertising surveillance-centric business model becoming the default choice for the internet over the past thirty years—an industry worth trillions built on comprehensive behavioral tracking rather than direct value exchange.

Today, AI Agents are breaking this balance. Autonomous systems neither watch ads nor can be analyzed through psychographic profiling, and they have no attention resources to monetize. Content publishers face a binary choice: either allow parasitic scraping that undermines content creation motivation or build direct payment mechanisms. The x402 protocol is currently the most promising attempt to activate the long-dormant "402 Payment Required" status code in the HTTP standard, combining this status code with blockchain settlement and cryptographic authorization mechanisms.

The timing is perfect. Blockchain infrastructure has matured with the development of Layer 2 networks, achieving transaction costs below 1 cent and confirmation speeds in sub-second levels. The circulating supply of stablecoins exceeds $42 billion across more than 20 chains. Google's A2A protocol has explicitly anticipated an Agent ecosystem of "paying for and charging for services." However, through studying the v1 specifications, v2 proposal changes, and observing early ecosystem developments, we find that its infrastructure has fundamental limitations that could hinder the widespread adoption of x402 without significant revisions.

This article provides a systematic critique based on principles of distributed systems, payment protocol economics, and practical deployment cases, and then outlines the core architectural transformation directions needed to support internet-level deployments.

Understanding the x402 Architecture

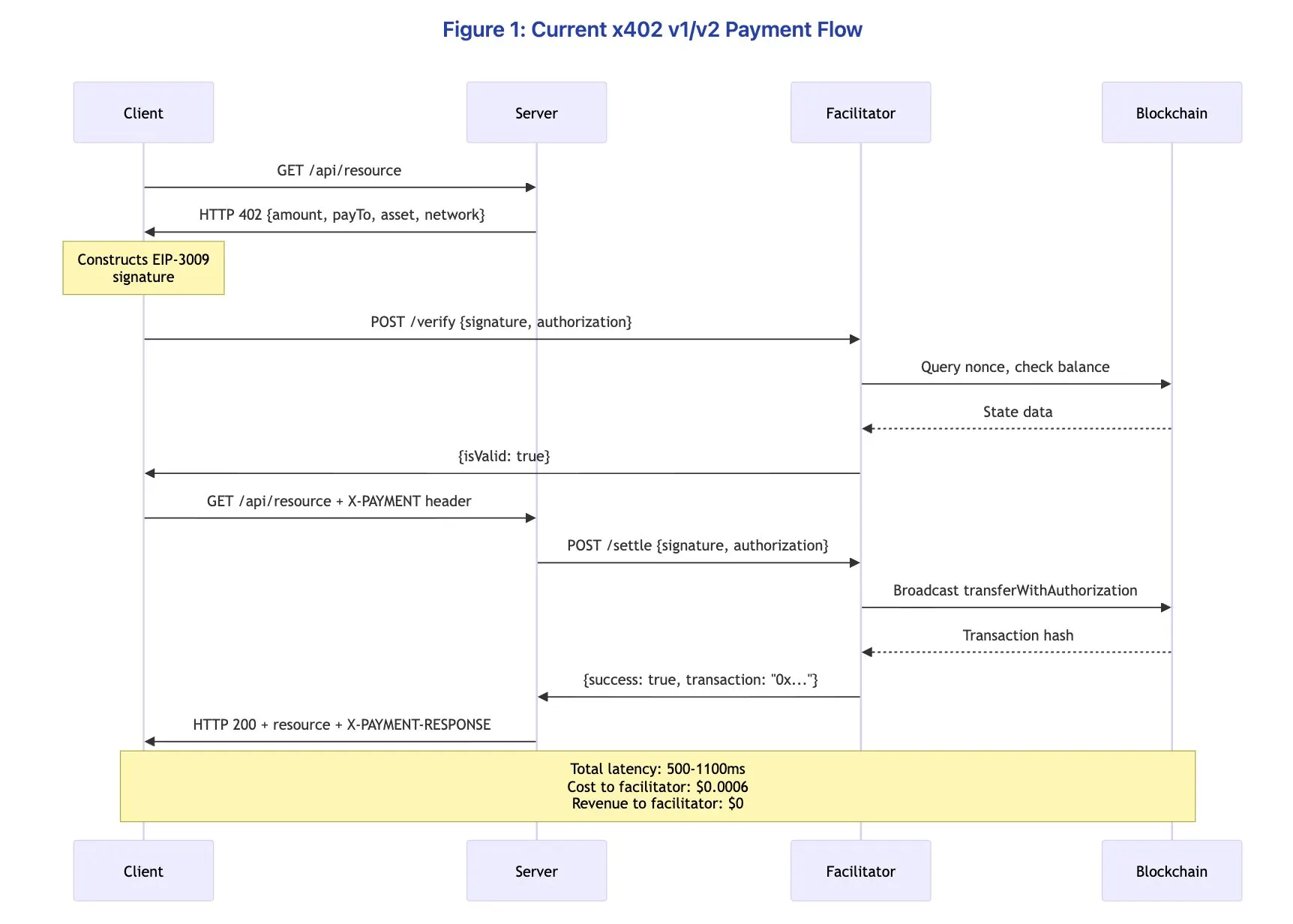

The protocol utilizes the EIP-3009 transferWithAuthorization() method to achieve "gasless" stablecoin transfers.

Specifically, the client constructs a cryptographic signature authorization that allows a third party (i.e., Facilitator, the intermediary executor) to perform the transfer operation on its behalf.

Figure 1: Current x402 v1/v2 payment flow

Key Finding: This design provides cryptographic payment verification functionality without requiring merchants to directly handle private keys or manage blockchain infrastructure. Settlement occurs on chains like Base (Ethereum Layer 2), with final confirmation times around 200 milliseconds and fuel costs below $0.0001. The protocol appears simple and elegant, but this superficial simplicity conceals several deep architectural flaws.

Issue 1: Economic Model Imbalance of the Facilitator

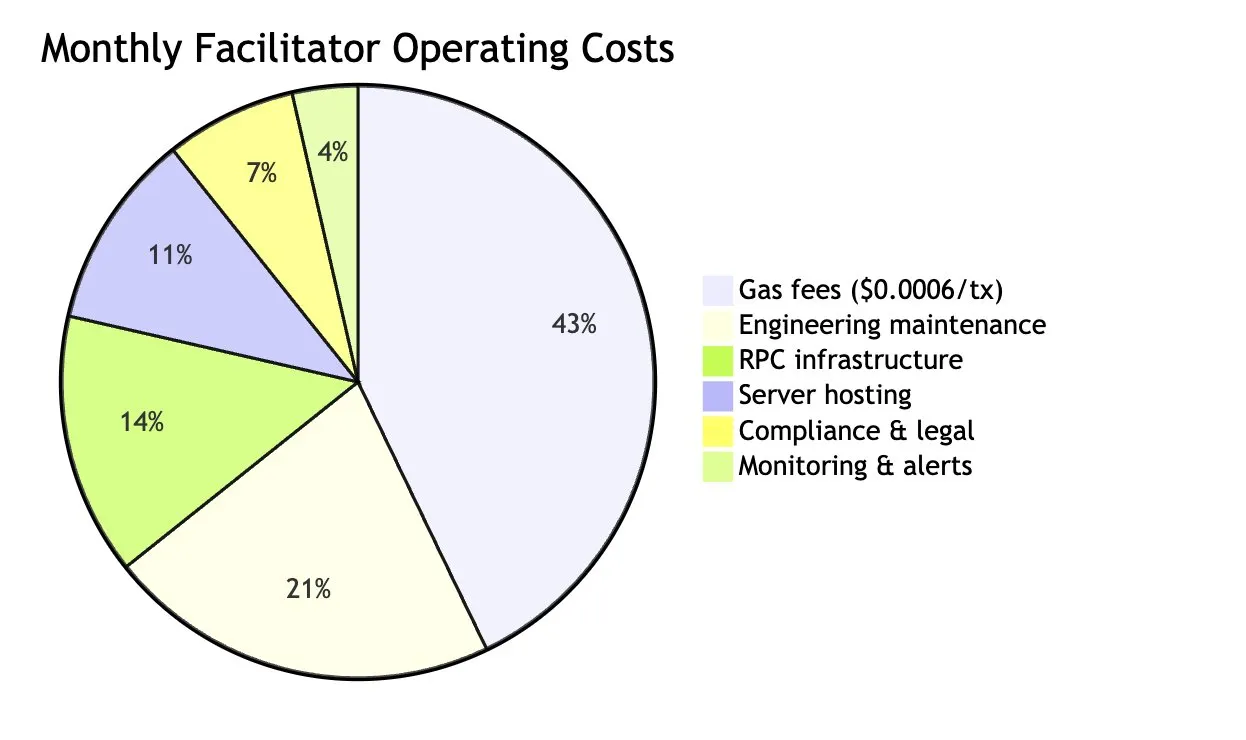

The Facilitator must perform three functions: cryptographic verification of EIP-3009 signatures, broadcasting transactions to the blockchain, and providing API infrastructure. For these services, the compensation the Facilitator receives from the protocol is exactly zero. It is essential to clarify its economic mechanism: Coinbase's CDP Facilitator currently provides fee-free processing for USDC transactions on the Base chain. Each transaction consumes about $0.0006 in fuel for the Facilitator. Assuming 1 million transactions processed monthly, the fuel cost alone reaches $600 (not including server infrastructure, RPC node access, monitoring systems, compliance expenses, and engineering maintenance costs). The Facilitator has no cost recovery mechanism at the protocol level.

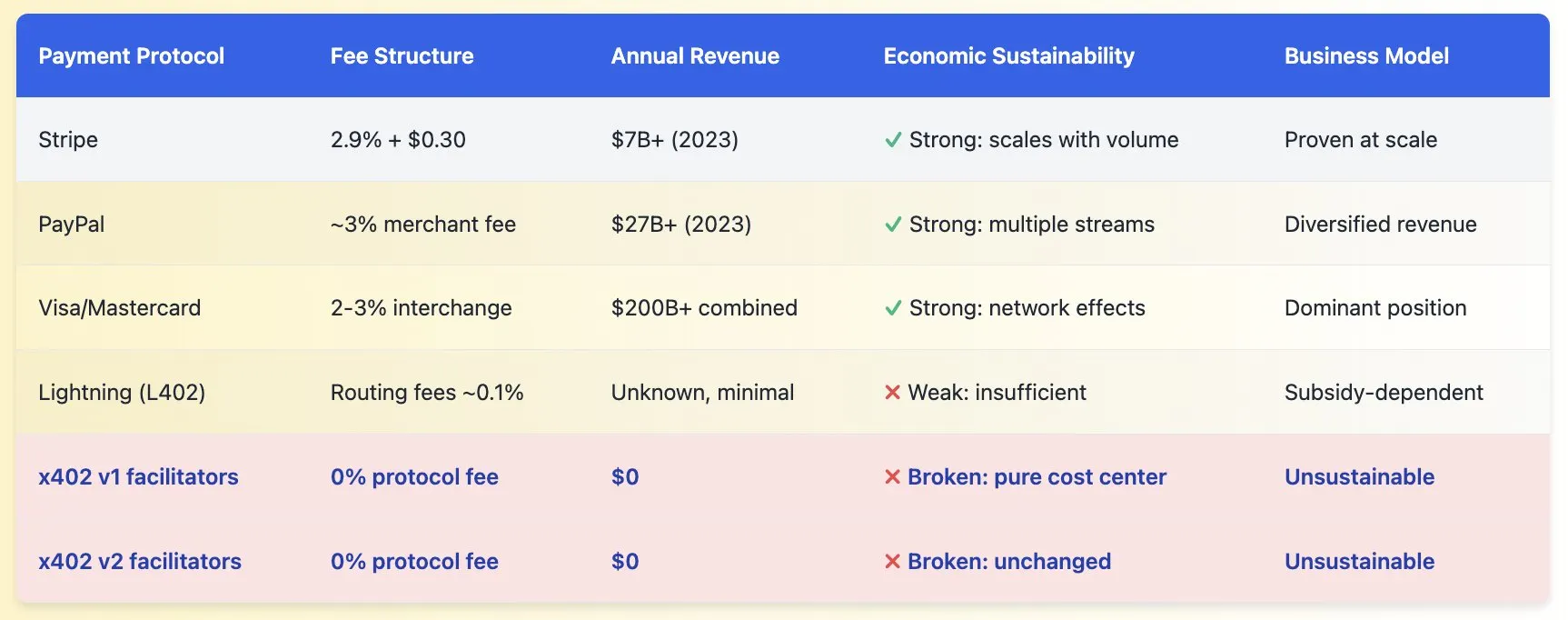

Table 1: Comparison of Payment Protocol Economic Sustainability

Figure 2: Facilitator Cost Breakdown (Monthly Processing of 1 Million Transactions)

Key Conclusion: Compared to all successful payment protocols in internet history: Stripe charges 2.9% + $0.3 per transaction; PayPal's merchant fee rate is about 3%; credit card networks extract 2-3% fees through merchant discount rates. These protocols can capture value because they provide value, thereby establishing sustainable business models that scale with transaction volume. However, the x402 Facilitator model, while providing real value, completely fails to capture value.

Issue 2: Two-Stage Settlement Causes Delays and Atomicity Failures

The current architecture requires two independent blockchain interactions: a verification phase (checking signature validity and random number status) and a settlement phase (executing the actual transfer). This design simultaneously leads to performance degradation and correctness issues.

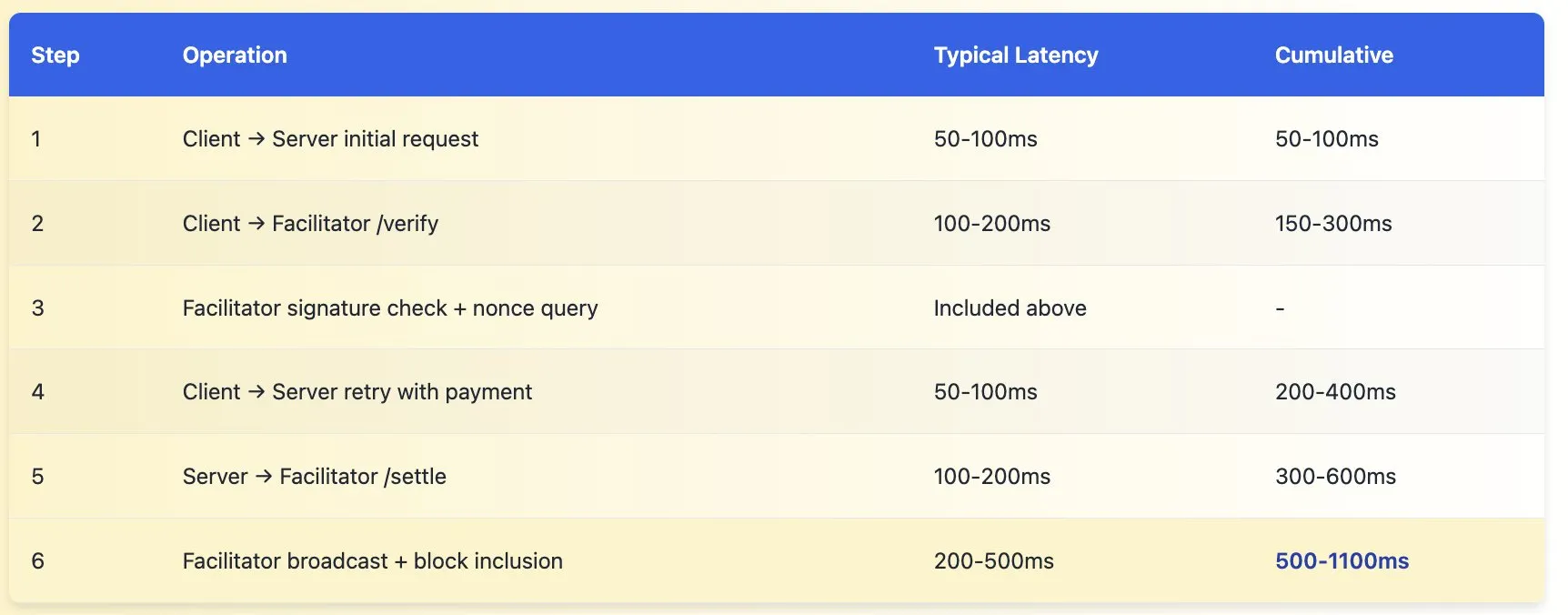

Table 2: Single x402 Payment Delay Analysis

For a single request, a delay of 500-1100 milliseconds is acceptable. However, in practical application scenarios, cumulative effects arise:

- An autonomous research Agent collects data from 100 x402 protected APIs: payment overhead leads to delays of 50-110 seconds;

- Trading bots update positions from 50 real-time data sources: delays reach 25-55 seconds;

- AI assistants invoke 20 tools during conversations: delays reach 10-22 seconds.

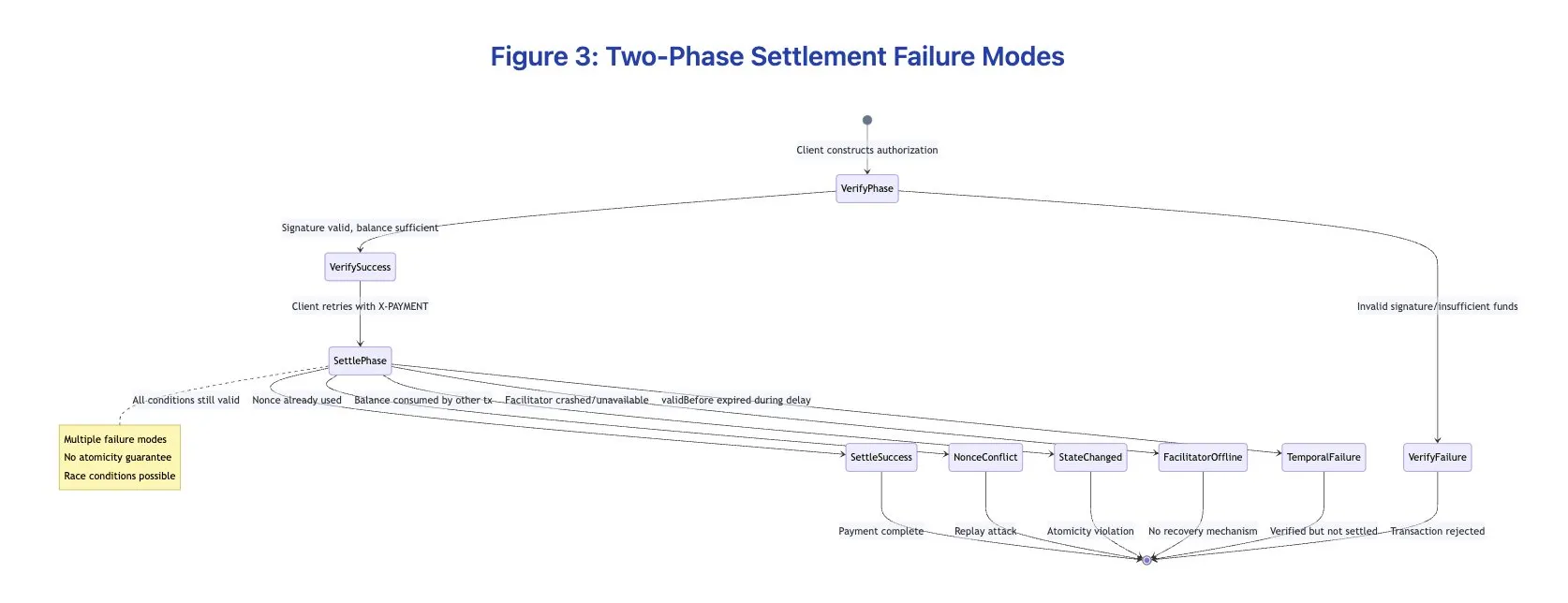

Figure 3: Two-Stage Settlement Failure Modes

Violating distributed system principles: these are not hypothetical issues, but the fundamental consequences of splitting atomic operations (payments) into a two-stage protocol. Since the 1970s, distributed systems research has made it clear: two-stage protocols are vulnerable when atomic alternatives exist. The database field has profoundly recognized this through the two-phase commit protocol (2PC)—this protocol can lead to system hangs and state inconsistencies due to coordinator failures. x402 must avoid repeating this mistake.

Issue 3: EIP-3009 Exclusivity Disrupts Token Ecosystem

The protocol mandates the use of the EIP-3009 transferWithAuthorization() method for payment settlement. Theoretically, any token compliant with EIP-3009 could be compatible with x402, but in reality, the number of stablecoins that meet this standard is far fewer than the economically mainstream stablecoin set.

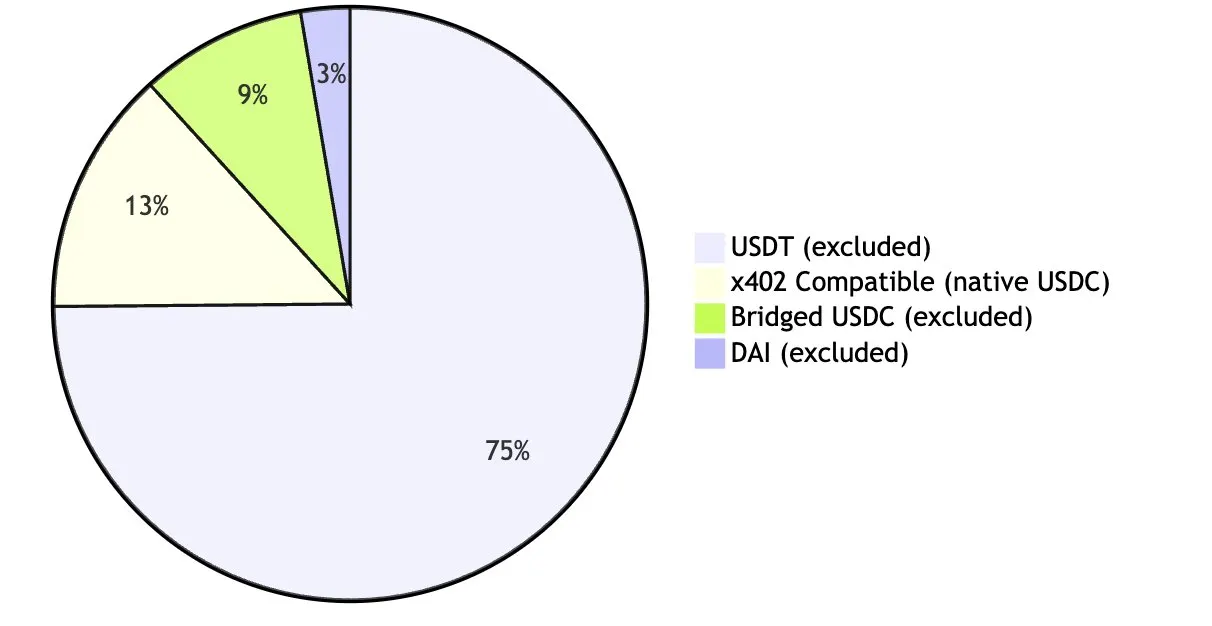

Table 3: Stablecoin Compatibility Matrix

Figure 4: Coverage of the Stablecoin Market

This means that the x402 v1 version has compatibility issues with 40% of its primary target tokens. The situation is even more severe for other stablecoins: USDT has never implemented EIP-3009 and has no related plans, and as the largest stablecoin with a circulation exceeding $140 billion, its absence has significant implications. DAI adopts a different standard (EIP-2612 permission) and achieves similar functionality through a differentiated interface.

Issue 4: Multi-Chain Support is Misleading

The protocol specification claims that x402 supports "Base, Solana, and any EVM network through self-hosted Facilitators," seemingly achieving chain-agnostic flexibility. However, a closer examination of the implementation details reveals that multi-chain support falls far short of expectations.

Table 4: Network Support Matrix for Facilitators

Each Facilitator supports a different subset of networks, with variations in configuration requirements, differing token lists, and varying levels of operational maturity. The protocol lacks a discovery mechanism for clients to query "which chains does this merchant support," forcing service providers to specify a single network in the 402 response, compelling clients to either pre-fund on a specific chain or forgo the transaction.

Issue 5: Facilitator is an Unnecessary Middle Layer

Let’s question the fundamental premise of this architecture: why is a Facilitator absolutely necessary in this design? Common justifications do not hold up under scrutiny.

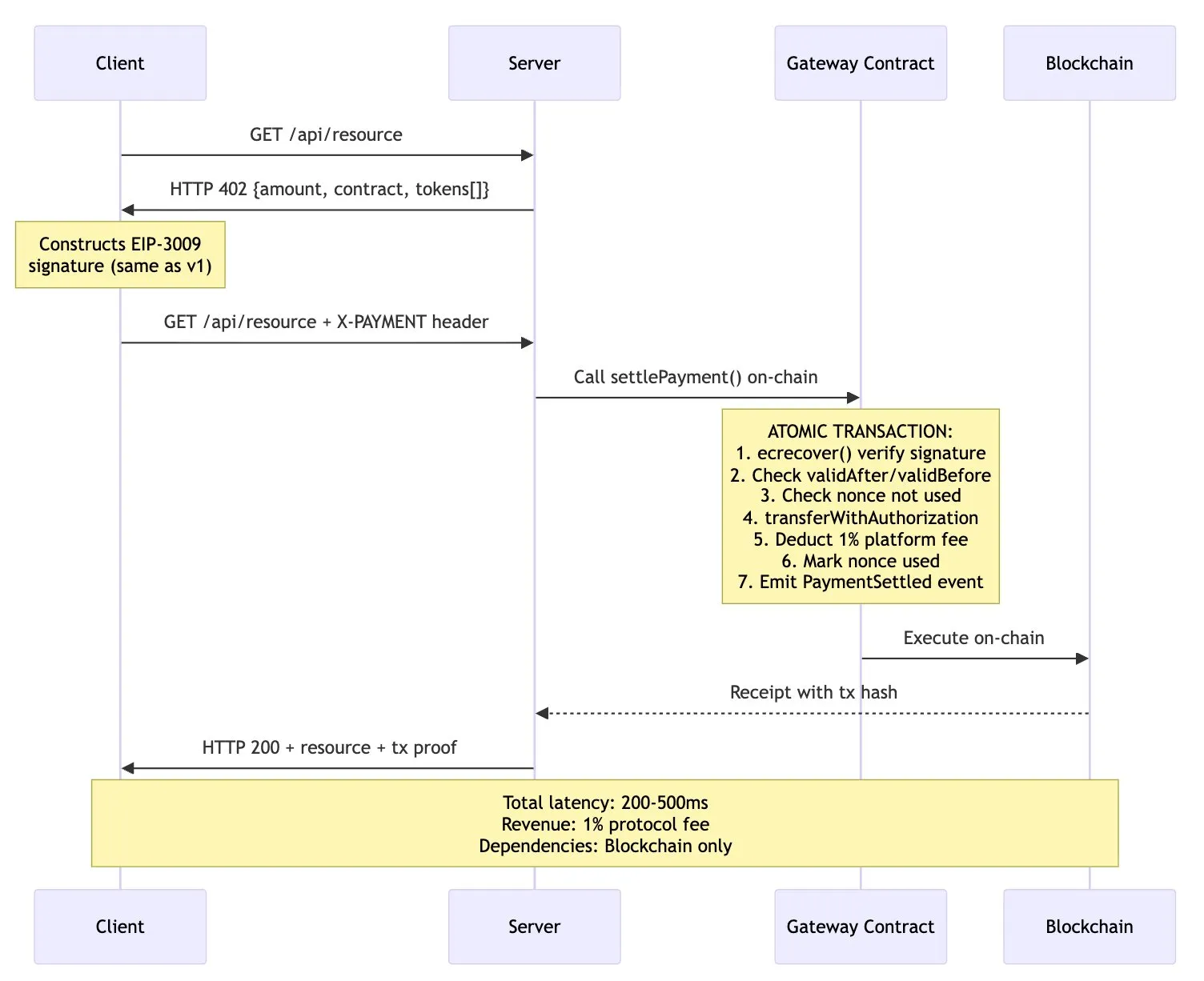

Figure 5: Alternative Architecture—Direct Settlement via Smart Contracts

This alternative design proposal has multiple advantages:

- Atomicity: Verification and settlement are completed in the same on-chain transaction;

- Reduced Latency: Eliminates one network round trip (from 500–1100ms to 200–500ms);

- Reliability: No longer relies on the online rate of the Facilitator or the availability of its API;

- Economic Sustainability: Protocol fees are directly deducted on-chain (e.g., 1% platform fee);

- Transparency: All settlement logic is on-chain and auditable.

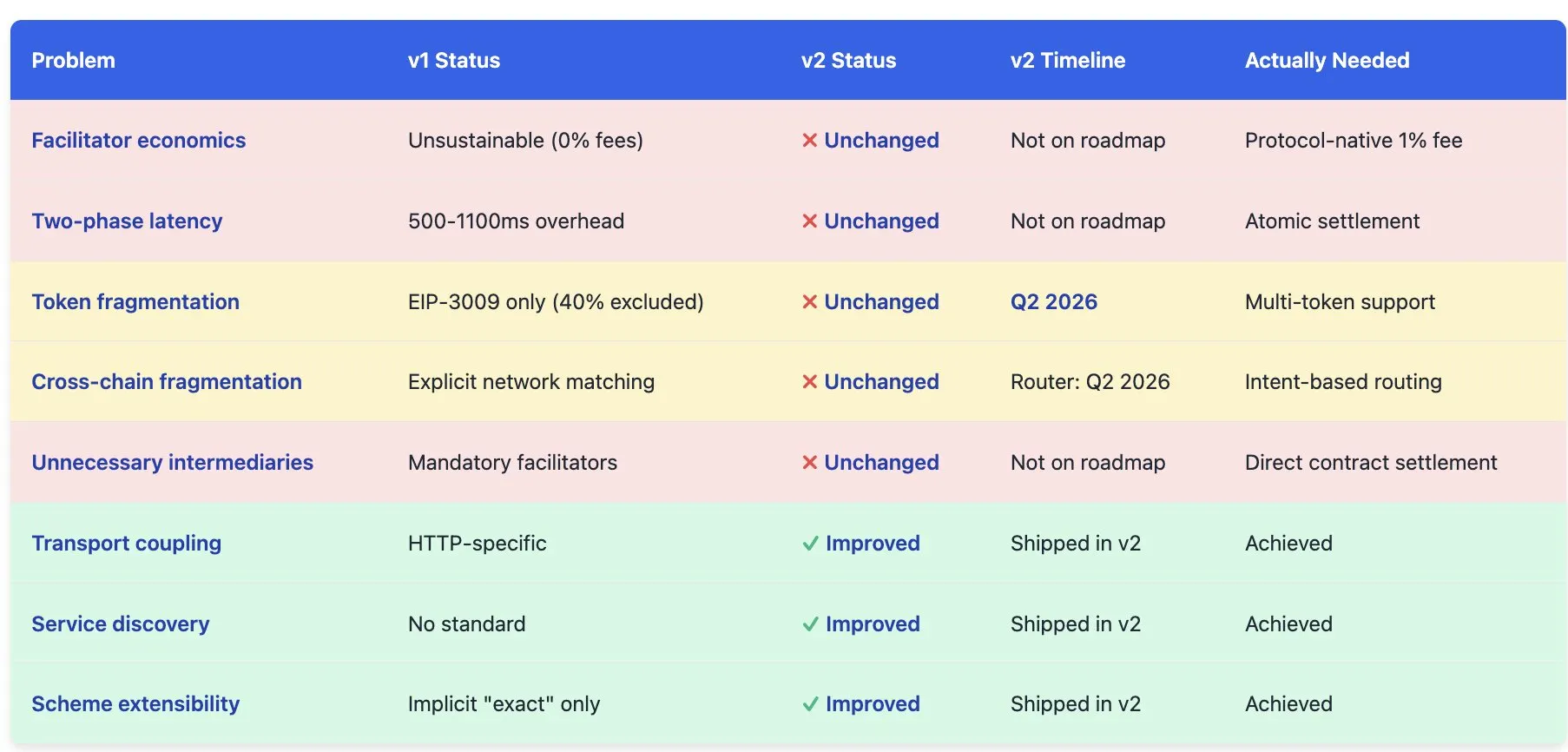

v2 Proposal: Improvements and Legacy Defects

The x402 team has released a v2 specification branch, attempting to address some of the v1 limitations through "transport-agnostic restructuring." However, after reviewing the change logs, roadmap, and specification documents, it is evident that while v2 achieves incremental improvements, it does not resolve the aforementioned fundamental architectural issues.

Changes in v2:

- Transport Abstraction: The protocol is divided into three layers: type (data structure), logic (scheme), and representation (HTTP, MCP, A2A);

- Scheme Extensibility: Standardizes "precise billing" schemes and supports new types of schemes (pay-per-use, e-commerce scenarios);

- Service Discovery: Introduces Bazaar API for discovering x402 resources.

Core Issues Unchanged in v2:

- Maintains the original Facilitator architecture (Client → Facilitator/Verification → Facilitator/Settlement → Merchant);

- Maintains a zero-fee economic model (Facilitator still receives no compensation);

- Retains the two-stage settlement model;

- Continues EIP-3009 exclusivity (token support postponed to Q2 2026);

- Still requires explicit network matching (no cross-chain abstraction);

- Still enforces the Facilitator intermediary mechanism.

Table 5: Comparison of Issue Resolution Across Versions

Conditions Required for Internet-Level Adoption

Based on thirty years of research on distributed systems and payment protocols, I propose the following architectural principles:

- Achieve economic sustainability through protocol fees: On-chain deduction of a 1% settlement fee to create stable revenue;

- Achieve atomic settlement through smart contracts: Single on-chain transactions eliminate race conditions;

- Token Flexibility: Simultaneously support EIP-3009, EIP-2612 permissions, and standard ERC-20;

- Chain Abstraction: Implement intent-based routing through Circle cross-chain transfer protocol and Across protocol;

- Minimal Trust: Direct settlement mechanisms without mandatory Facilitator involvement.

Table 6: Comprehensive Comparison of Architectural Proposals

Conclusion

x402 v1 has made substantial progress in addressing a problem that has plagued the industry for thirty years. With mature blockchain infrastructure, micropayments have become economically viable. The Agent economy has further generated an urgent demand for machine-native payment protocols. Coinbase's endorsement and integration with Google A2A provide institutional credibility, and its technical path (HTTP 402 status code + blockchain settlement + cryptographic authorization) is inherently reasonable.

However, good vision and corporate support do not guarantee the success of the protocol. The Facilitator model creates an unsustainable economic mechanism—key infrastructure is trapped in long-term losses. The delays and atomicity failures brought about by the two-stage settlement architecture can be completely avoided through atomic solutions. The exclusivity of EIP-3009 disrupts the token ecosystem, excluding 40% of the USDC supply and almost all competitive stablecoins. Multi-chain support remains nominal, and end users still face the reality of inter-chain fragmentation. While direct settlement via smart contracts can offer better features, the Facilitator still exists as a redundant intermediary.

Although the v2 proposal has made improvements in transport abstraction, service discovery, and billing model extensibility, it has not addressed core issues such as economic models, two-stage settlement, token restrictions, and cross-chain fragmentation. The roadmap postpones key fixes until Q2 2026. A self-sufficient internet requires a self-sufficient payment system—x402 v1 has proven technical feasibility, v2 has shown incremental improvements, but a true solution still requires breakthrough changes.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。