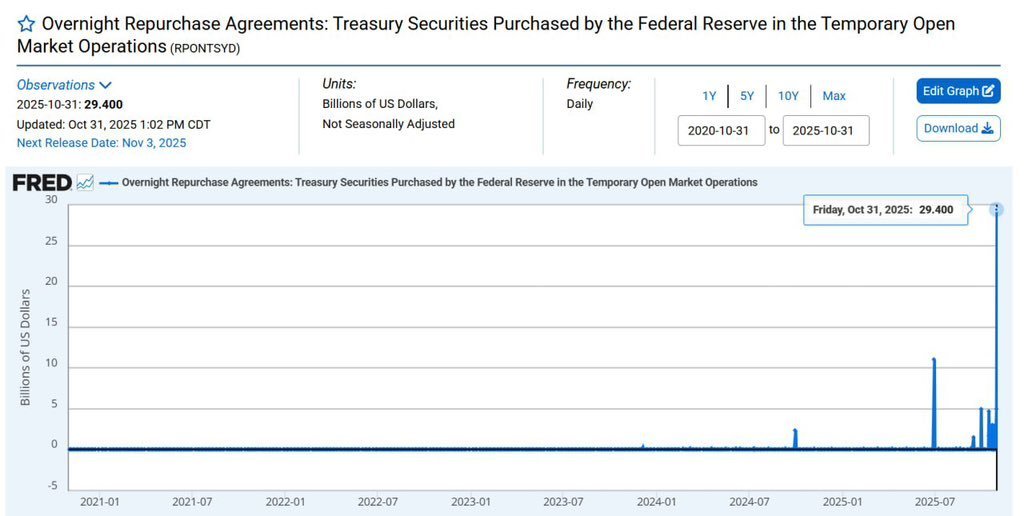

Just now, a friend privately messaged me about this image. It shows the scale of U.S. Treasury purchases by the Federal Reserve in temporary open market operations, which we commonly refer to as overnight repurchase agreements (Repo).

We can see that on October 31, 2025, the overnight repo suddenly surged to $29.4 billion. For the past few years, this figure has been almost consistently close to zero, until this year when a noticeable jump began to occur, and the frequency and scale of recent surges have been increasing.

Generally, such changes indicate that there is short-term dollar liquidity pressure in the funding market, where banks or institutions need cash and can only pledge U.S. Treasuries to the Federal Reserve in exchange for funds. The Federal Reserve then provides liquidity to the system through repo operations.

This type of counter-cyclical repo essentially belongs to structural liquidity support, which is not equivalent to comprehensive QE, but is usually seen as a signal of "implicit easing," indicating that the funding environment is not completely loose and that the Federal Reserve is passively alleviating tension.

Currently, the scale is not large, which does not indicate a crisis, but it reflects that the short-term funding chain is starting to tighten, and we need to closely monitor whether this trend continues to expand. If the Federal Reserve can achieve further easing, it would be beneficial for risk assets like $BTC.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。