A new Cryptoquant report shows that U.S. investors are easing off bitcoin and ethereum exposure, signaling a cooling phase rather than renewed accumulation.

The blockchain analytics firm notes that spot exchange premiums, exchange-traded fund (ETF) flows, and futures basis rates all point to investors shifting toward profit-taking and caution. Researchers highlight that spot bitcoin ETFs in the U.S. have turned into net sellers, logging a seven-day average outflow of 281 BTC — one of the weakest readings since April.

Ethereum ETFs have fared little better, with inflows nearly flat since mid-August, underscoring diminished investor confidence in adding more exposure after both assets’ late-September highs.

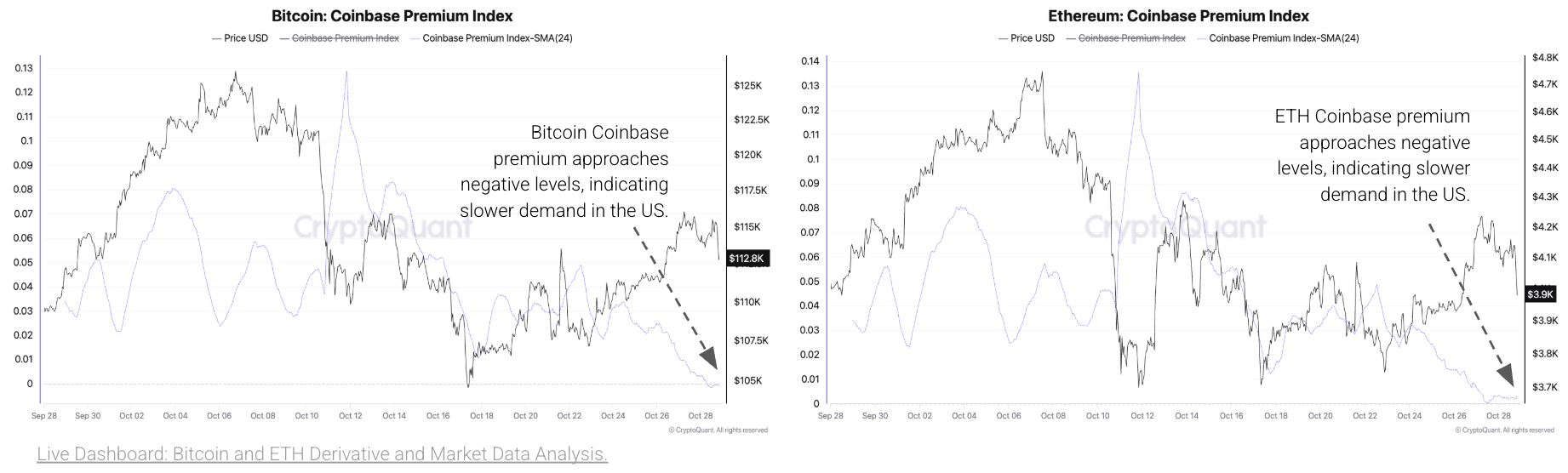

Source: Cryptoquant report.

The report adds that spot demand has cooled sharply on U.S. crypto exchanges. Cryptoquant’s data show the Coinbase premium for both bitcoin and ethereum hovering near zero for the first time since early September. Historically, price rallies align with a positive premium, so this flattening implies that domestic buying pressure has evaporated.

Cryptoquant’s futures analysis paints a similar picture. The Chicago Mercantile Exchange (CME) bitcoin annualized basis has slipped to 1.98%, the lowest level in more than two years, reflecting tepid demand for leveraged exposure. Ethereum’s six-month futures basis, sitting at 3.0%, marks its weakest point since July, signaling that traders aren’t eager to pile back in.

According to Cryptoquant’s researchers, the combined data suggest the market is in a “cooling sentiment” phase after bitcoin hit $126,000 and ethereum touched $5,000 in late September. Both institutional and retail investors appear to be waiting for new catalysts before reigniting risk appetite.

In short, Cryptoquant’s latest onchain metrics indicate that U.S. enthusiasm for the top two digital assets has hit pause — at least for now — as the market consolidates gains and reassesses direction.

- What did Cryptoquant’s new report find? Cryptoquant researchers found that U.S. demand for Bitcoin and Ethereum has slowed across both spot and futures markets.

- What does the Coinbase premium reveal, according to Cryptoquant? The near-zero premium indicates weakened U.S. buying pressure for both Bitcoin and Ethereum.

- How are ETFs performing based on Cryptoquant data? U.S. Bitcoin ETFs have seen steady outflows, while Ethereum ETF inflows have stalled since mid-August.

- What’s next for Bitcoin and Ethereum per Cryptoquant? The firm says traders are waiting for fresh catalysts before reentering risk positions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。