The following guest post comes from BitcoinMiningStock.io, a public markets intelligence platform delivering data on companies exposed to Bitcoin mining and crypto treasury strategies. Originally published on Oct. 30, 2025, by Cindy Feng.

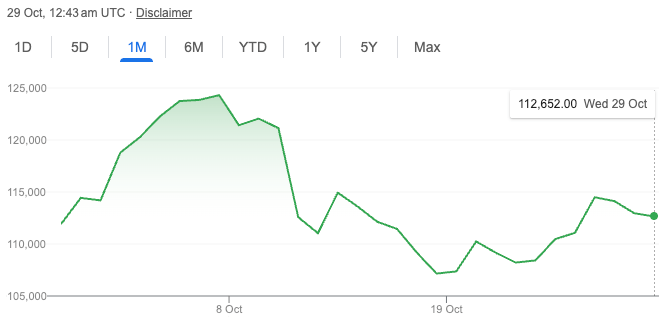

Earlier this month, the crypto market experienced one of its most brutal shakeouts on record: over $19 billion in leveraged positions were liquidated overnight, the largest single-day wipeout in the industry’s history. Bitcoin, which had set a new all‑time high of $125,835 just days earlier, plunged in the aftermath of the event, hovering around the $110,000 level.

Bitcoin Price (screenshot from Google Finance)

Leverage in this case, amplified the pain. For many retail and institutional traders, margin and derivatives exposure turned a price dip into a full-blown disaster.

But what if there was another way to access amplified Bitcoin upside without using leverages at all?

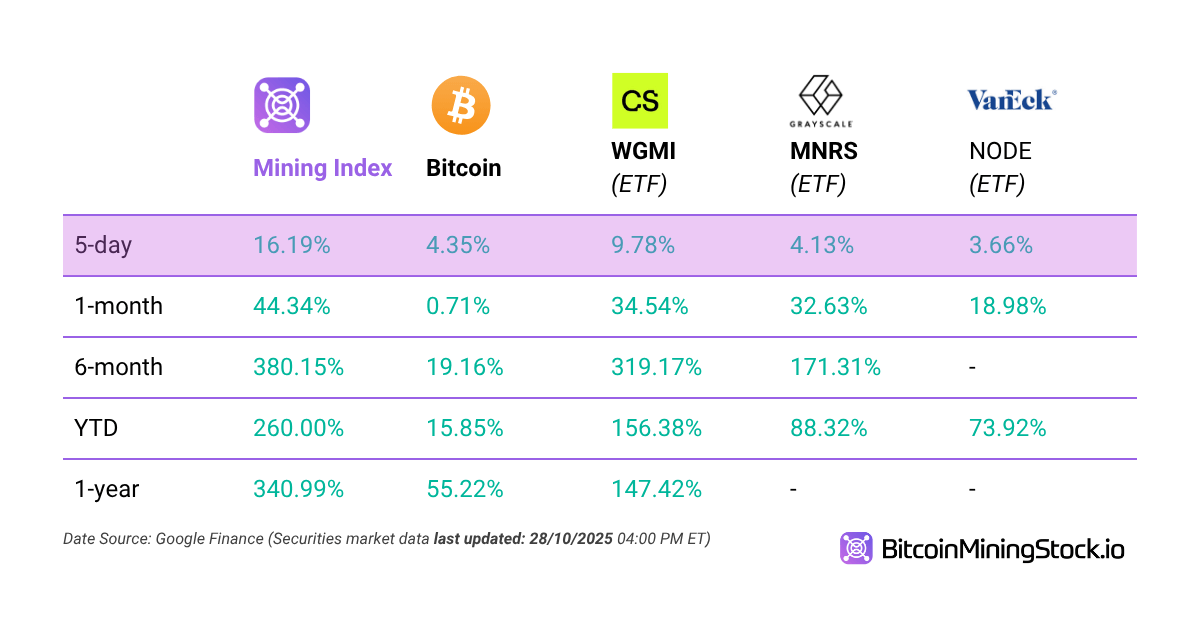

Enter Bitcoin mining stocks, which are often viewed as the “high-beta” plays in the ecosystem. These companies tend to move more aggressively than Bitcoin itself, in both directions. At the time of writing, Bitcoin is trading at $112,652, a 0.71% gain over the past month; While Bitcoin mining stocks surged 44.34%, according to our Bitcoin Mining Index.

For investors looking to tap into this built-in operational leverage without picking individual stocks or touching derivatives, Bitcoin mining ETFs may offer a compelling solution.

Let me explain.

What Are Bitcoin Mining ETFs?

For those unfamiliar with the term, an ETF (Exchange-Traded Fund) is an investment vehicle that bundles a group of equities into a single product that can be traded on the stock market, just like an individual stock.

In the case of Bitcoin mining ETFs, the fund consists of publicly listed Bitcoin mining companies. Rather than buying shares of each miner individually, investors can gain broad exposure to the mining sector through a single ticker.

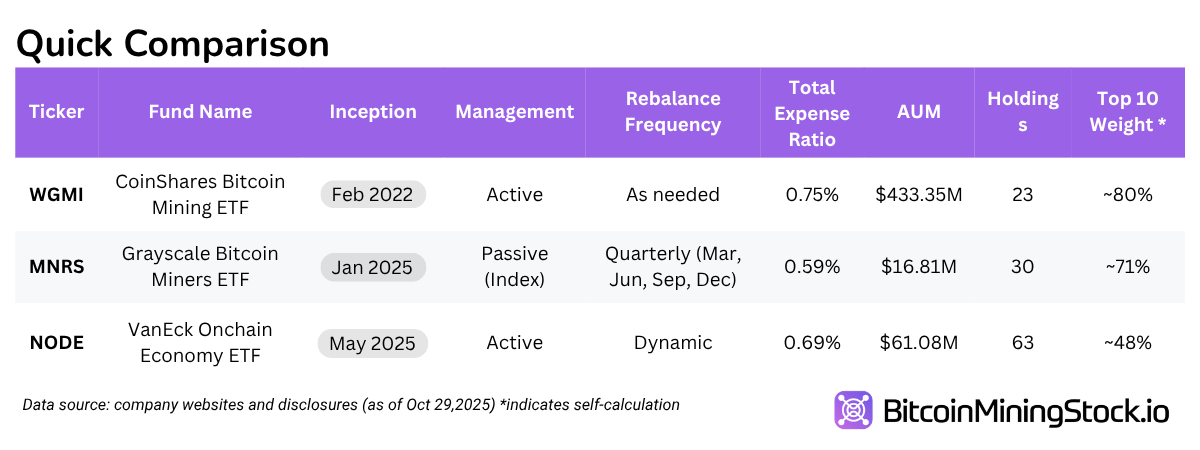

The first Bitcoin mining ETF, WGMI, launched in 2022. Its performance has generally mirrored Bitcoin’s price cycles, amplifying both the upside during rallies and the downside during corrections. As more miners went public and institutional interest grew, Grayscale also launched its own mining ETF, MNRS, in early 2025. A few months later, VanEck’s digital assets team launched NODE. While NODE isn’t exclusively a mining ETF, a large portion of its holdings are mining-related companies, making it relevant for inclusion in the current report.

While all three ETFs offer exposure to the same underlying theme, their construction, weighting, and management style differ significantly. This is why their performance trajectories don’t line up evenly.

WGMI: High Beta, Active Bets

Launched in February 2022, the CoinShares Bitcoin Mining ETF (WGMI) is an actively managed fund that focuses on public Bitcoin miners (≥ 50% revenue/profits from Bitcoin mining operations) and supporting infrastructure (companies providing specialized chips, hardware, software, or other services to Bitcoin mining companies).

Managers select companies based on fundamental metrics, such as hash rate growth, treasury policy, energy mix, and emerging revenue opportunities like AI/HPC. WGMI does not follow a set rebalancing schedule, adjustments are made opportunistically by portfolio managers to reflect shifting fundamentals and market trends.

Currently, its top 10 holdings represent over 80% of assets, with heavy exposure to names like IREN, Cipher, and Bitfarms.

Of the three ETFs, the performance of WGMI is the most closely aligned with our market-cap-weighted Bitcoin mining index.

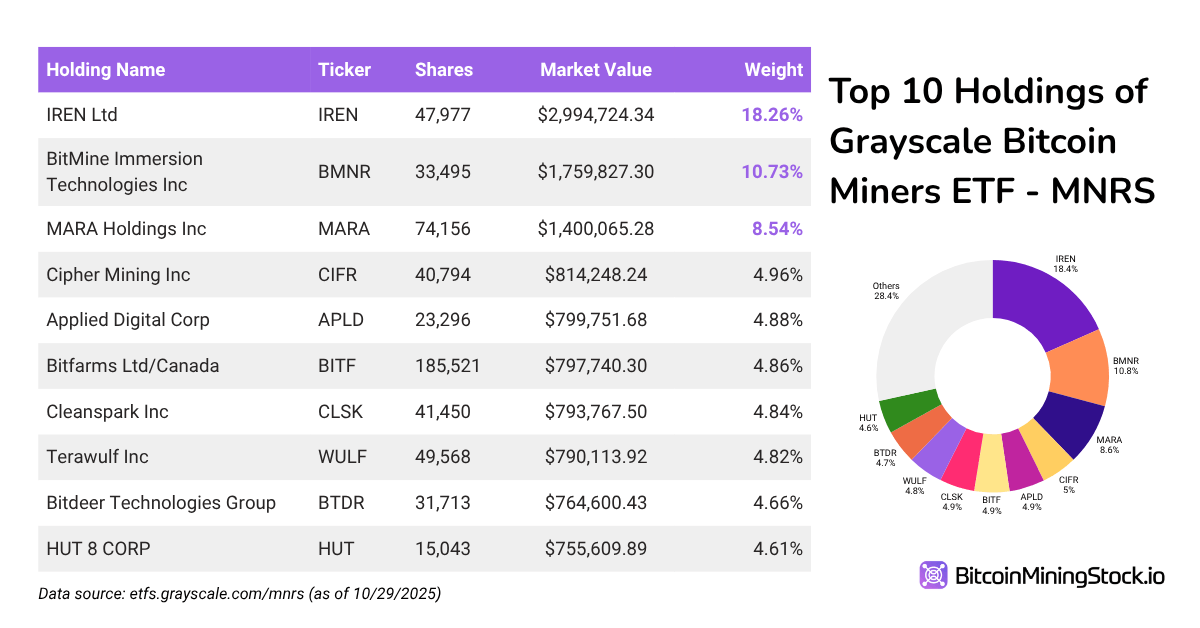

MNRS: Passive Exposure with Systematic Rules

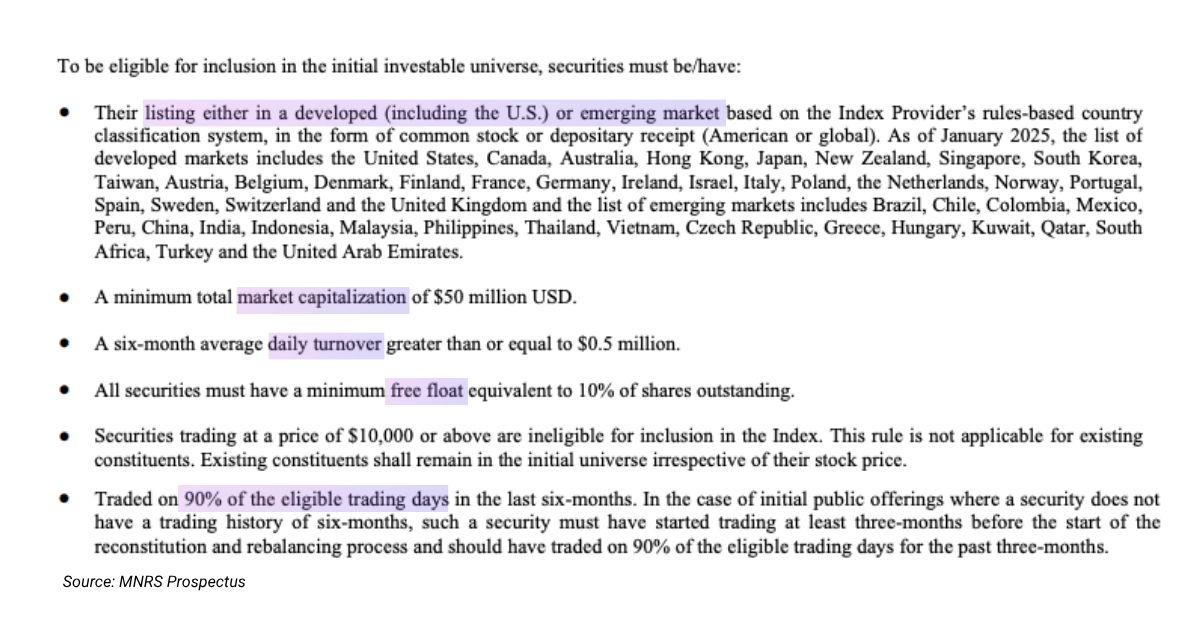

Launched in January 2025, the Grayscale Bitcoin Miners ETF (MNRS) offers passive exposure to the Bitcoin miners and the Bitcoin mining ecosystem by tracking the Bitcoin Miners Index. The index applies quantitative screens to select constituents, with criteria based on pure-play (≥50% revenue from mining), market capitalization (≥$50 million), and liquidity.

Selecting Criteria

Rebalancing and reconstitution occur quarterly, using data from the prior month-end. This means any fundamental shifts in a company’s profile may not be reflected in the ETF until the next cycle. Currently, its top 10 holdings represent ~71% of assets. While this makes it slightly less concentrated than WGMI, the structure does not consider qualitative risks such as capital allocation, energy strategy, or management quality. These omissions can lead to misalignments during volatile periods.

That said, the low 0.59% expense ratio makes MNRS the most cost-efficient option among the peer group.

NODE – Broader Scope, Miner-Literate Management

Launched in May 2025, the VanEck Onchain Economy ETF (NODE) is actively managed and takes a broader approach than its peers. While not explicitly a Bitcoin mining ETF, 80% of NODE’s top 10 holdings are public Bitcoin miners, making it a meaningful proxy for sector exposure within a diversified crypto equity portfolio.

The same as WGMI, NODE does not follow a fixed rebalancing calendar. Portfolio changes are driven by a blend of crypto market indicators, such as Bitcoin beta, sector volatility, and macroeconomic signals.

NODE’s edge lies in its management team’s mining literacy. VanEck portfolio leads, such as Matthew Sigel, are actively engaged in sector comments and disclosure, enabling the fund to respond quickly to market shifts across mining, tokenization, and digital infrastructure themes.

With 63 holdings and a top 10 concentration of ~48%, NODE offers the widest diversification among the group. Essentially, investors get access to mining, tokenization, and digital infrastructure themes in one wrapper. This fund can also allocate up to 25% of its assets to crypto-related ETPs, which allows more flexibility to make tactical adjustments between regular rebalancing periods.

Final Thoughts

Bitcoin mining stocks have the potential to outperform BTC itself during bull runs, but they also introduce more volatility and timing risk. For investors seeking to ride the cycle without leverage, mining ETFs offer a way to do just that with the added benefit of diversification and structured rebalancing.

That said, it’s worth recognizing that each ETF presents a different approach:

- WGMI offers amplified upside, but with more single-stock and sector concentration. Investors should stay aware of sector rotation risks.

- MNRS is a low-cost, rules-based tracker of the sector. It works well for those who want exposure without day-to-day oversight. However, its rules can occasionally lag reality.

- NODE provides a broader vehicle with real sector intelligence behind the wheel. It’s not as tightly tied to Bitcoin mining stocks, but still offer significant miner exposure.

This isn’t a recommendation. But for those tracking the Bitcoin mining sector; or building structured exposure to the digital assets economy, these ETFs are worth watching closely. In this market, leverage isn’t always about borrowing. Sometimes, it’s about choosing the right structure, and letting the sector work for you.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。