Original Title: Bitcoin's Silent IPO: Why This Consolidation Isn't What You Think

Original Author: Jordi Visser

Translated by: SpecialistXBT, BlockBeats

Editor's Note: As Bitcoin remains stagnant for an extended period and market sentiment is low, the author draws on the post-IPO distribution model from traditional financial markets to interpret the current divergence of Bitcoin from risk assets, the awakening of ancient on-chain addresses, and the large sell-offs by OGs as a healthy "transfer of the baton." Crypto punks are passing the torch to institutional investors and later followers, and the short-term pain may be nurturing long-term strength.

The following is the full content:

Pain is Real

To be frank, the sentiment in the cryptocurrency space is quite terrible right now.

The S&P 500 is nearing all-time highs. The Nasdaq is soaring. Gold has just surpassed $4,300. Tech stocks are rebounding. By all traditional standards, we are in a risk-on environment. Money is flowing into risk assets. Investor demand is strong.

And Bitcoin? Bitcoin… is completely still.

Consolidation. Frustrating. Boring. You can choose any word to describe it, but none can mask the sense of defeat that permeates the community. Twitter is filled with anxious questions: "Why is everything else going up, but BTC isn't moving?"

This cognitive dissonance is evident. We have successfully launched Bitcoin ETFs, and funds are flowing in every month. Institutional adoption is accelerating. The "Genuis Act" has passed, and the "Clairty Act" is on the way. There is no regulatory crackdown. No major hacking incidents. No collapse of fundamental narratives. All those things that should matter… have happened.

Yet, here we are, watching other assets rebound while Bitcoin remains stagnant.

Over the past few years, my connection with the crypto community has deepened, giving me a unique perspective. I observe two worlds: the traditional fiat financial system and the crypto ecosystem, and I begin to see a pattern reminiscent of the world I grew up in. The similarities are striking, as are the differences. But sometimes, the similarities manifest in unexpected ways.

What if everyone is wrong?

What if Bitcoin hasn't "broken," but is finally experiencing its "IPO" in the traditional financial world?

Bridging Two Worlds

My journey in crypto has been enlightening precisely because I haven't abandoned my understanding of traditional markets. I brought that lens with me. I increasingly realize that while Bitcoin's origins are revolutionary and inherently decentralized, the economic model it follows is as old as capitalism itself.

Early investors take on significant risks. If their investments succeed, they deserve substantial returns. But ultimately, and this is crucial, they need to realize those gains. They need liquidity. They need to exit. They need to diversify.

In the traditional world, this moment is called an IPO (Initial Public Offering). It is the moment when early believers cash out, when founders become wealthy, when venture capitalists return funds to their limited partners. This is not a moment of failure; it is a moment of success. Companies do not die during an IPO. They transform. They mature. Ownership becomes dispersed.

Bitcoin has never had a traditional IPO because it has never had a "company." But economic forces do not disappear due to structural differences. They simply manifest in different ways.

Revealing the Truth of Divergence

Let's talk about what we are really seeing in the market right now.

Bitcoin has historically moved in tandem with tech stocks. It has been correlated with liquidity and "risk appetite." For years, you could predict Bitcoin's direction by observing the Nasdaq index. But since December 2024, this correlation has recently been completely broken.

This has left people confused. It has puzzled algorithmic traders. It has baffled momentum investors. When risk assets rebound and Bitcoin does not participate, the narrative shifts to "there's something wrong with Bitcoin."

But what I have learned from observing traditional markets is that this is precisely what happens during the IPO distribution period.

When a company goes public and early investors begin to sell their positions, that stock often consolidates even during a broader market rebound. Why? Because a specific dynamic is at play. Early investors are not panic selling. They are methodically distributing their positions. They are careful. They do not want to crash the price. They are patient. They have waited years for this moment. They can wait a few more months to get it right.

Meanwhile, new investors are entering, but cautiously. They are not chasing highs. They are buying on dips. They are waiting to become aggressive after the distribution is complete.

The result? A frustrating consolidation. The fundamentals are fine. The market is rebounding. But that stock is just… sitting there. Don’t believe me? Look at Circle or Coreweave. They had early spikes after their IPO pricing, but since then, it’s been consolidation.

Sound familiar?

If this were macro-driven weakness, Bitcoin would be falling alongside risk assets, not diverging from them. If this were a true "crypto winter," we would see panic, capitulation selling, and correlation sell-offs across the entire space. Instead, we see a more specific situation: methodical, patient selling being absorbed by stable buying.

This selling approach feels like saying, "I’m done, it’s time to move on," rather than "I’m scared."

Evidence is Piling Up

Next, an unexpected piece of evidence emerged, though perhaps it should have been anticipated.

In a recent earnings call, Mike Novogratz announced that Galaxy Digital sold $9 billion worth of Bitcoin for a client. $9 billion. Think about that number. This is not retail panic. This is not some trader getting shaken out. This is an OG in the industry methodically exiting a massive position.

But they are taking profits. They are realizing gains. They are doing exactly what early investors should do when an asset matures and liquidity is finally sufficient to support large exits.

And that OG is not alone.

If you know how to interpret it, on-chain data is telling a clear story. Those "ancient" Bitcoins, those that have been dormant for years, some since the price was in single digits, are suddenly becoming active. Not all at once. Not in panic. But steadily and methodically since this year, especially since summer. Those addresses that accumulated coins when Bitcoin was just a crypto punk experiment are finally starting to move their holdings.

Look at the Fear and Greed Index. Look at the sentiment on social media. Community morale is low. Retail is capitulating. This is the emotional state you would expect when "smart money" is distributing to "weak hands."

But most people overlook: if you understand what stage we are in, this sentiment is actually bullish.

The Psychology of Early Holders

Put yourself in their shoes: what if you were someone who mined Bitcoin in 2010, or bought in at $100, or even $1,000?

You’ve been through Mt. Gox. You’ve experienced (multiple) Chinese bans. You’ve endured the bear market of 2018. You’ve lived through the pandemic. You’ve faced regulatory uncertainty. You’ve dealt with mainstream media calling it a scam for over a decade.

When almost no one believed, you did. You took the risk. You won. Bitcoin's success has exceeded almost everyone’s wildest expectations.

But now what?

You are sitting on generations of wealth. The living environment has changed. Maybe you are nearing retirement. Maybe your kids are going to college. Maybe you want to diversify into AI, or buy a yacht the size of Bezos's, start a business, or simply enjoy the fruits of your patience.

And for the first time ever, you can actually exit your position without crashing the market.

This is something new.

For years, liquidity was non-existent. Try selling $100 million worth of Bitcoin in 2015, and you would crash the price. Try selling $1 billion in 2019, and you’d face the same problem. The market could not absorb it.

But now? ETFs are providing institutional buying. Big companies are holding Bitcoin on their balance sheets. Sovereign wealth funds are getting involved. The market has finally matured to the point where early holders can exit large positions without causing chaos.

The key insight here: they choose to do this in a risk-on environment precisely because that is when buyers have capital. When stocks are rebounding, when confidence is high, when liquidity is abundant, that is the best time to distribute. Selling in fear would crash Bitcoin. But selling when other assets are strengthening? That’s just smart business.

This is exactly what the OG whales have been waiting for. Not the price—they’ve had that for a long time. But liquidity. Market depth. The real ability to exit.

The mission is accomplished. Bitcoin has proven itself. Now it’s time to reap the rewards.

Why This Isn't a Bear Market

I can almost hear the skeptics saying, "This just sounds like you are defending a bear market before the four-year cycle ends."

So let’s talk about why this is fundamentally different.

Bear markets are driven by fear, macro conditions, and a loss of confidence in the underlying narrative. Remember 2018? Exchanges were collapsing. ICOs were exposed as scams. The entire space felt fraudulent. People were selling because they thought Bitcoin might go to zero.

Remember March 2020? A global pandemic. Everything was crashing. People were selling because they needed cash to survive.

That is not the case now.

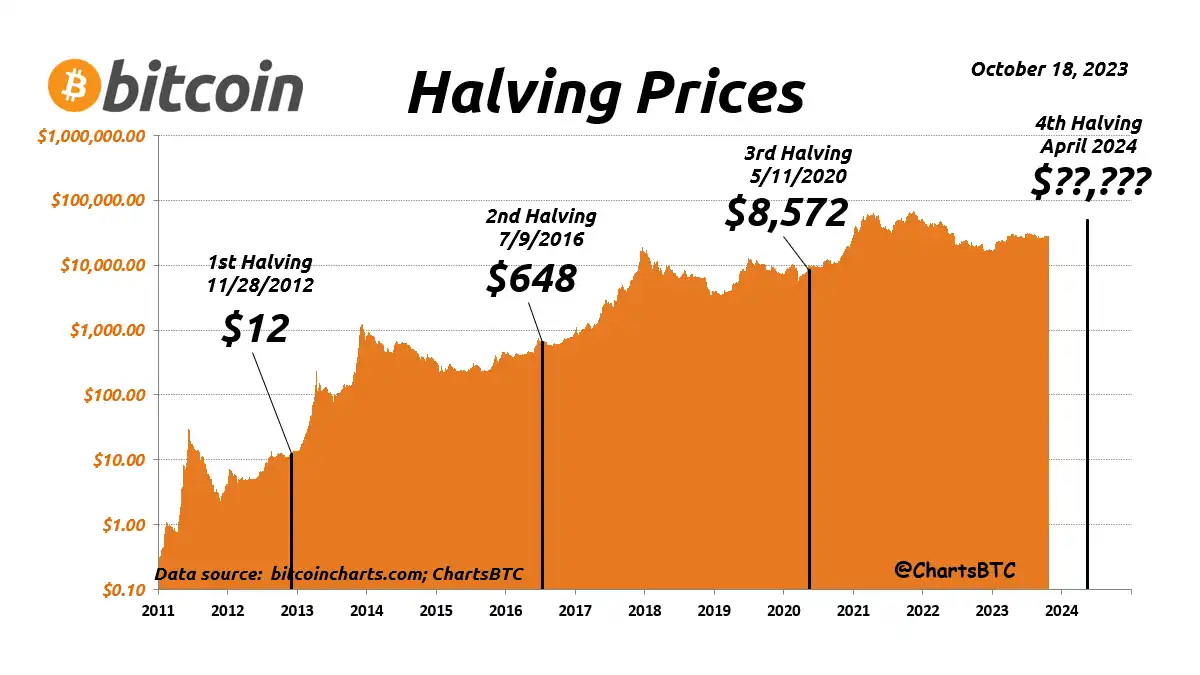

Now, Bitcoin's fundamentals can be said to be the strongest they have ever been. ETFs have been approved—something everyone said would never happen. Institutional adoption is accelerating. The halving is occurring as scheduled, just like the precise clockwork of every four years. The network is more secure than ever. Hash rates are at all-time highs. The adoption of stablecoins is accelerating, asset tokenization is on the horizon, and the volume of network effects is about to explode. The dream of cryptocurrency is finally starting to become a reality.

Still, everyone must remember that cryptocurrency is only three years removed from its darkest moments (price crashes, fraud exposures, severe regulatory backlash). Altcoins are still down 20-50% from those peaks. For the past two years, Bitcoin has been holding up the entire space.

Before that bubble appeared, venture capitalists (VCs) and hedge funds were the primary investors in cryptocurrency, and they have yet to recover. They are still licking their wounds from investing in cryptocurrency and SaaS (Software as a Service), which have been disrupted by the rise of AI.

Sellers are not selling because they have lost confidence; they are selling because they have won.

This is the key distinction.

In a bear market, there are no buyers. Prices crash because everyone wants to exit, and no one wants to enter. But look at what is actually happening now: Bitcoin is consolidating, not crashing. Every dip sees buyers stepping in. Prices are not making new lows but are maintaining within a range.

Buyers are entering. They are just less aggressive. They are just less emotional. They are patiently accumulating, waiting for the distribution to complete.

This is the pattern you see after a large IPO lock-up period ends. Stocks do not crash. They consolidate. Early investors sell. New long-term holders accumulate. Ownership shifts from visionaries to institutions.

Lessons from Traditional Markets

If you want to understand Bitcoin's current phase, look at what happened after the IPOs of the greatest tech companies.

Amazon went public in 1997 at $18 per share. Within three years, it reached $100. Then, for the next two years, even as the internet continued to grow, it barely moved. Why? Because early investors and employees could finally cash out. They were selling. Many who believed in Amazon at $1 sold at $100. They were not wrong; they made 100 times their investment. But the stock had to digest that distribution before it could rise again.

Google's IPO in 2004 saw the stock consolidate for nearly two years post-IPO. Facebook? The same pattern in 2012-2013. The end of lock-up periods led to significant volatility and sideways trading.

This is normal. This is healthy. This is what success looks like.

Companies do not fail at this stage. Assets do not disappear. What happens is a "transfer of the baton." Early believers pass the torch to a new generation of holders who buy at higher prices and have different time horizons.

From crypto punks to institutions. From liberal idealists to corporate treasuries. From true believers to trustees managing billions in assets.

There is no good or bad. Just evolution. Just the natural lifecycle of a truly successful asset.

The Old and the New

This transition is profound and worth recognizing.

Bitcoin was born from an ideology. It was created by crypto punks who believed in decentralization, in breaking free from government control, and in the certainty of mathematics over institutional trust. Early adopters were rebels, outsiders, and visionaries who saw what others could not.

Those individuals are stepping back. They are passing the torch. And the entities taking over are less concerned with ideology and more focused on returns. BlackRock does not care about "being your own bank." They care about portfolio diversification and risk-adjusted returns.

Is this a loss? In some ways, yes. Bitcoin may never have that radical energy it once did. The days of 100x returns in a year may be over. The kind of volatility that created life-changing wealth will likely moderate as ownership becomes more dispersed.

But this is also a victory. Because Bitcoin has survived long enough to become "boring." It has successfully proven itself to the point where the original believers can truly cash out. It has demonstrated its worth to the world, so much so that the most conservative financial institutions are buying it.

More importantly, from a market structure perspective, this distribution is extremely bullish in the long run.

Why Decentralization Beats Centralization

This is a point I learned from observing traditional markets that perfectly applies to Bitcoin: centralization is fragile, while decentralization is anti-fragile.

When Bitcoin is primarily held by a few thousand early adopters, the market is inherently unstable. A handful of wallets can significantly shake the price. One person deciding to sell can trigger a chain reaction in the market. Price volatility occurs because the holder base is volatile.

But as ownership becomes decentralized, with millions of investors holding smaller positions instead of thousands holding large ones, the market structurally becomes more stable.

Think about it practically: if 100 people own 50% of the supply, and one person decides to sell, that’s a 0.5% shock to the market. That would shake the price. But if 1 million people own 50% of the supply, and 10,000 decide to sell, that’s still only 0.5% of the supply, but it’s spread across thousands of transactions at different times, locations, and prices. The impact is diluted.

This is what happens after an IPO. The initial shareholder base is small: founders, early employees, venture capitalists. After the IPO and the end of lock-up periods, ownership fragments. Millions of shareholders replace hundreds. Index funds. Retail investors. Institutions.

Stocks become less volatile, not because the company is less exciting, but because the ownership structure is more robust.

Bitcoin is undergoing exactly the same transformation. Those OG whales who could once shake the market are now selling to thousands of institutional investors through ETFs, to millions of retail investors through exchanges, to corporate treasuries, and to pension funds.

Every Bitcoin that shifts from concentrated hands to decentralized ones is making the network more resilient. It stabilizes prices. It matures the asset.

Yes, this means the crazy years of 10x returns may be over. But it also means the risk of catastrophic crashes due to concentrated sell-offs is decreasing.

A decentralized holder base is what distinguishes speculative assets from lasting stores of value. It allows something to graduate from being a "magical internet currency" to becoming a "global monetary asset."

Future Timelines

If this argument is correct—and I believe the evidence strongly suggests it is—what should investors expect?

First, patience. The IPO distribution phase typically lasts 6-18 months. We may have already been in this process for several months, but it may not be over yet. Moreover, Bitcoin's time cycles move faster than fiat assets. I think, in Bitcoin time, we are well past six months. For now, continue to expect consolidation. Continue to expect Bitcoin to be frustrating for failing to rebound alongside risk assets. Continue to expect market sentiment to remain low for a while, but stay alert because (the reversal) will have no signals. It will start suddenly because the good news is already there.

Second, reduced volatility. As ownership becomes decentralized, the extreme volatility seen in previous cycles will moderate. The 80% drawdowns that were once commonplace may turn into 50% drawdowns, and 50% drawdowns may become 30%. A 10x rebound may turn into a 3x rebound. This will disappoint fallen gamblers but excite risk managers.

Third, correlation with traditional risk assets may resume, but only after the distribution phase is complete. Once the OG whales have sold out, once ownership is sufficiently fragmented, Bitcoin is likely to start tracking market sentiment again. It will just manifest with more stability and less volatility.

Fourth, and most crucially: sentiment will only improve after the distribution is largely complete. Right now, morale is low because people do not understand what stage we are in. They are waiting for Bitcoin to "catch up" to stocks. They are worried about the four-year cycle. Please be patient. Once the heavy selling pressure is lifted, once institutional patience has absorbed the OG supply, the path forward will become clearer.

The exact timeline is unknowable. But if you have seen this pattern in traditional markets, you will recognize it.

The Maturation of an Asset Class

Every revolutionary technology goes through this evolution.

The internet had its early believers, who built companies without business models, only the belief that connectivity would change the world. They were right. Many of them became extremely wealthy. Then came the internet bubble burst and consolidation. Ownership shifted. Dreamers gave way to operators. The internet did not die; it actually delivered on its promise, just with a timeline longer than the early hype.

Personal computers. Mobile phones. Cloud computing. Artificial intelligence. Every transformative technology follows a similar arc. Early believers take on significant risks. If the technology succeeds, they deserve substantial returns. Eventually, they realize those returns. Then comes a transition period that feels like failure but is actually maturation.

Bitcoin is following exactly the same script.

OG holders took risks when Bitcoin could have gone to zero. They endured ridicule, regulatory uncertainty, and the growing pains of technology. They built infrastructure, weathered the collapse of Mt. Gox, resisted scaling wars, and preached when no one was willing to listen.

They won. They succeeded. Bitcoin is now a $1 trillion asset recognized by the largest financial institutions in the world.

And now they are taking their well-deserved profits.

This is not the end of Bitcoin. This is not even the beginning of the end. This is the end of the beginning.

From speculation to institutions. From crypto punk experiment to global asset. From centralization to decentralization. From volatility to stability. From revolutionary to foundational.

Opportunities in Distribution

Here is what gives me faith: I now see both sides of the equation.

I understand how traditional finance works. I understand the patterns of IPOs, lock-up expirations, and institutional accumulation. I also understand the crypto community, the hopes, the frustrations, and the belief that "this time is different."

Sometimes, it really is different. Sometimes, it is not.

What is happening to Bitcoin now is no different. It is just the same economic forces that have governed markets for centuries playing out in a novel context.

The frustration that everyone feels? It is not a sign of failure. It is a sign that we are in the most difficult part of the journey—early believers cashing out while later believers feel they have missed out. It is uncomfortable. It is frustrating. But it is necessary.

And here is the key insight that should give long-term investors confidence: once this distribution phase is complete, Bitcoin will be structurally stronger than ever before.

When ownership is dispersed among millions of investors rather than concentrated in the hands of a few thousand early whales, the asset will become more resilient. It will be less susceptible to manipulation by a single entity. More stable. More mature. More capable of absorbing real capital without generating extreme volatility.

The IPO is nearing completion. OG whales are getting their returns. And on the other end is a Bitcoin preparing for the next phase: no longer a speculative tool for massive returns, but a foundational monetary asset with a decentralized, stable holder base.

For those who bought in at $100 dreaming of $10 million, this may sound boring. But for institutions managing trillions of dollars, companies seeking treasury diversification, and nations exploring reserve assets, "boring" is exactly what they want.

The excitement of centralization is being replaced by the durability of decentralization. Early believers are passing the torch to long-term holders who buy at higher prices and have different motivations.

This is what success looks like. This is how Bitcoin is experiencing its IPO.

Once it is complete, once the distribution process is finished, once ownership is sufficiently fragmented, true institutional adoption can genuinely begin. Because the market will ultimately be able to absorb real capital without worrying about a large concentrated position waiting to exit.

Consolidation is frustrating. Sentiment is poor. The divergence from risk assets is confusing.

But the fundamentals are stronger than ever. And this structure—ownership shifting from concentration to decentralization through distribution—is precisely what Bitcoin needs to upgrade from a revolutionary experiment to a lasting monetary asset.

OG whales are experiencing their liquidity events. Let them go. It is what they deserve. What they leave behind is a Bitcoin that is stronger, more decentralized, and more resilient than when they accumulated it.

This is not a reason for despair. This is a reason to buy.

The volatility of Bitcoin is the price of its birth. Its stability will be the proof of its maturity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。