As of November 2025, although inflation is gradually slowing down, the pace remains relatively slow, and the market is still filled with uncertainties regarding a smooth journey ahead. Meanwhile, the ongoing government shutdown in the United States adds pressure to an already fragile economic recovery.

For traditional financial markets, November represents a "reality test." Central banks around the world are probing the limits of easing policies to see if they can continue to cut interest rates without reigniting inflation. After significant fluctuations, energy prices are stabilizing, and the upcoming fiscal plans from major economies like the UK will reveal how countries can balance economic growth and fiscal discipline as they move towards 2026.

In the cryptocurrency market, the pace is equally tight. Institutional funds continue to flow into Bitcoin ETFs, token unlocks are testing the market's absorption capacity, and new projects are reigniting interest in DeFi and AI-related ecosystems.

It can be said that the market atmosphere in November will set the tone for the global market in 2026.

Quick Summary

- The cryptocurrency market remains active, with a focus on token unlocks (SUI, HYPE), the presale of Infinex at the end of November, and the rising popularity of the x402 protocol.

- The U.S. government shutdown continues to affect the release of official data, leaving traders to rely on estimates from private institutions until a new agreement is reached.

- Inflation and employment data are the core focus, with CPI and PPI (November 13-14) and the non-farm payroll report (November 7) determining whether the Federal Reserve will continue to cut rates in December.

- China and Europe will also release key signals, including the Loan Prime Rate (LPR, November 20), Eurozone Purchasing Managers' Index (November 21), and the UK's Autumn Budget (November 26).

- The key event in the energy market is the OPEC+ meeting (November 30), whose production decisions may influence inflation trends and market risk sentiment, extending into 2026.

November Key Calendar Overview

Macro Focus

Cryptocurrency Market Focus

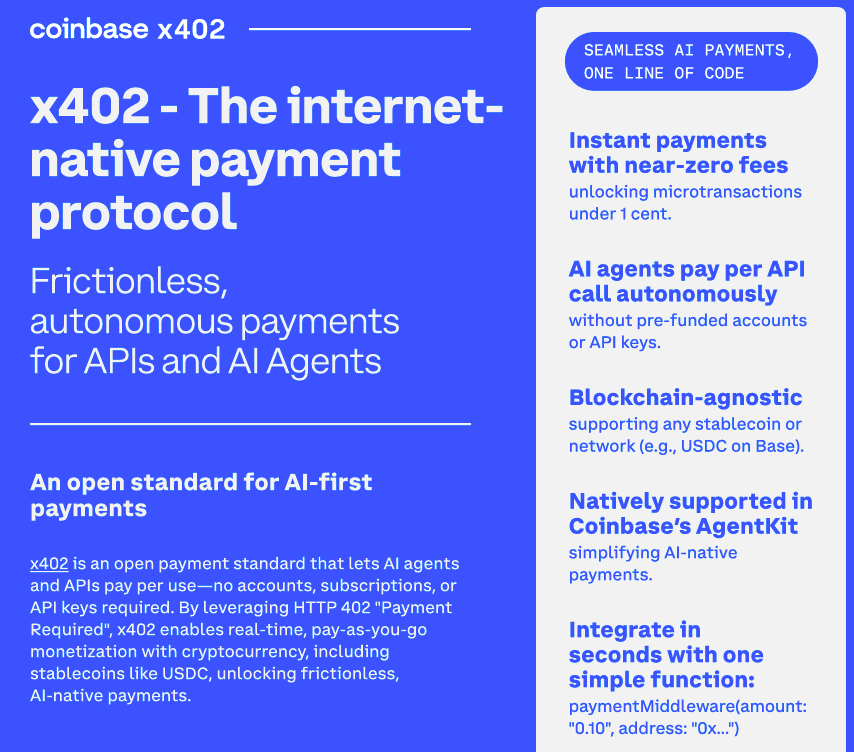

On November 1, approximately 44 million tokens of Sui will be unlocked, testing the market's capacity to absorb new Layer-1 supply. On November 3, Aster DEX will launch a stricter VIP reward system to encourage long-term holding and active trading. Later this month, Hyperliquid will initiate monthly token unlocks along with a buyback plan to balance market supply and demand; meanwhile, the DeFi platform Infinex, created by the founder of Synthetix, will begin its presale, aiming to make it easier for ordinary users to participate in on-chain trading. At the same time, the x402 protocol continues to expand its "HTTP native" payment network, enabling on-chain machine payments between APIs and AI agents, laying the foundation for future decentralized machine trading.

Global Macro Focus

The market rhythm in November is dense and critical, with important economic data and policy decisions coming from the U.S., Europe, and Asia. For traders, these numbers will determine whether risk assets can continue to rise or if market sentiment will shift back to caution.

Why It Matters: These data points will collectively influence global bond yields, capital flows, and risk appetite. If inflation remains stable and policies gradually ease, risk assets may continue to rise; however, if unexpected events occur, the market is likely to enter a profit-taking phase.

A. United States

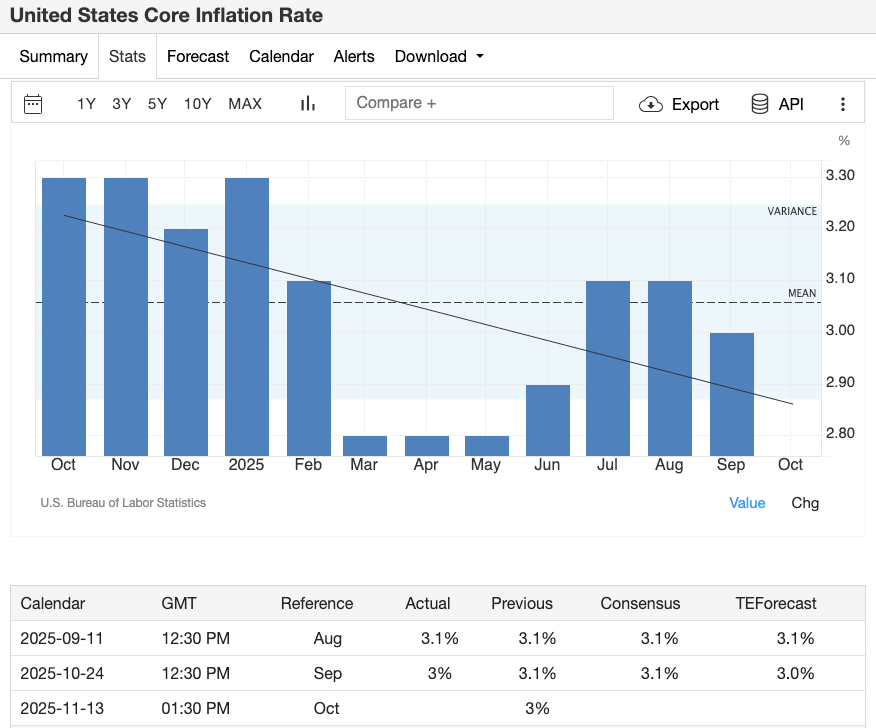

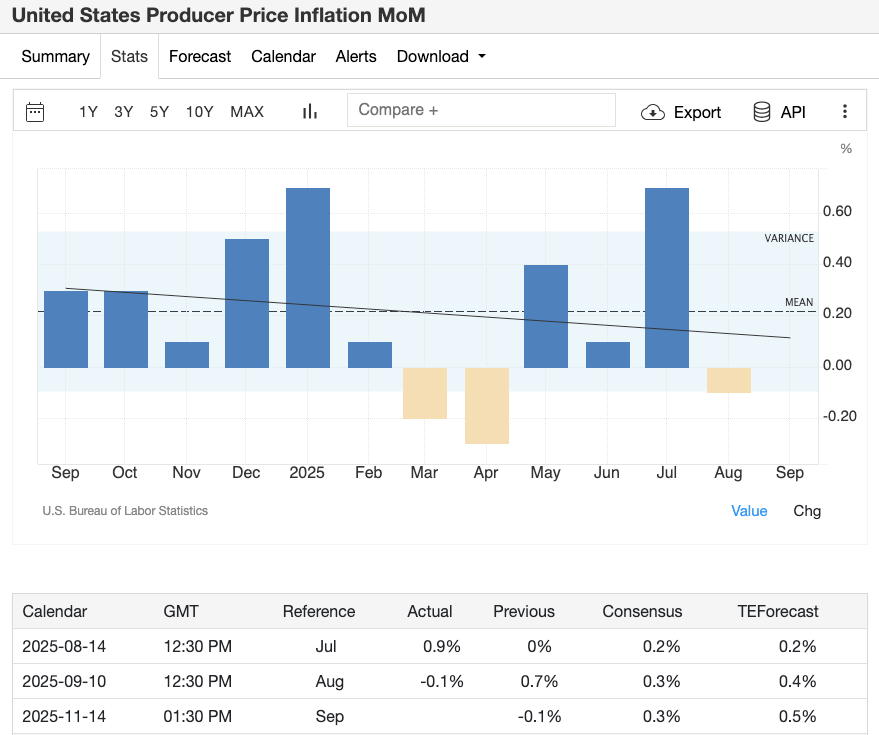

1. Inflation Data (CPI and PPI – November 13-14)

Inflation remains the most closely watched indicator by the Federal Reserve and global traders. The Consumer Price Index (CPI) and Producer Price Index (PPI) will reveal how quickly prices are cooling after a year of consecutive rate cuts.

- If CPI is below 3%, it will support the Fed's decision to continue easing in December.

- If inflation unexpectedly rises, the market may lower expectations for further rate cuts, pushing yields and the dollar higher.

Image Source: U.S. Core Inflation Rate (Trading Economics)

Image Source: U.S. Core Inflation Rate (Trading Economics)

Image Source: U.S. Producer Price Month-on-Month Change (Trading Economics)

Image Source: U.S. Producer Price Month-on-Month Change (Trading Economics)

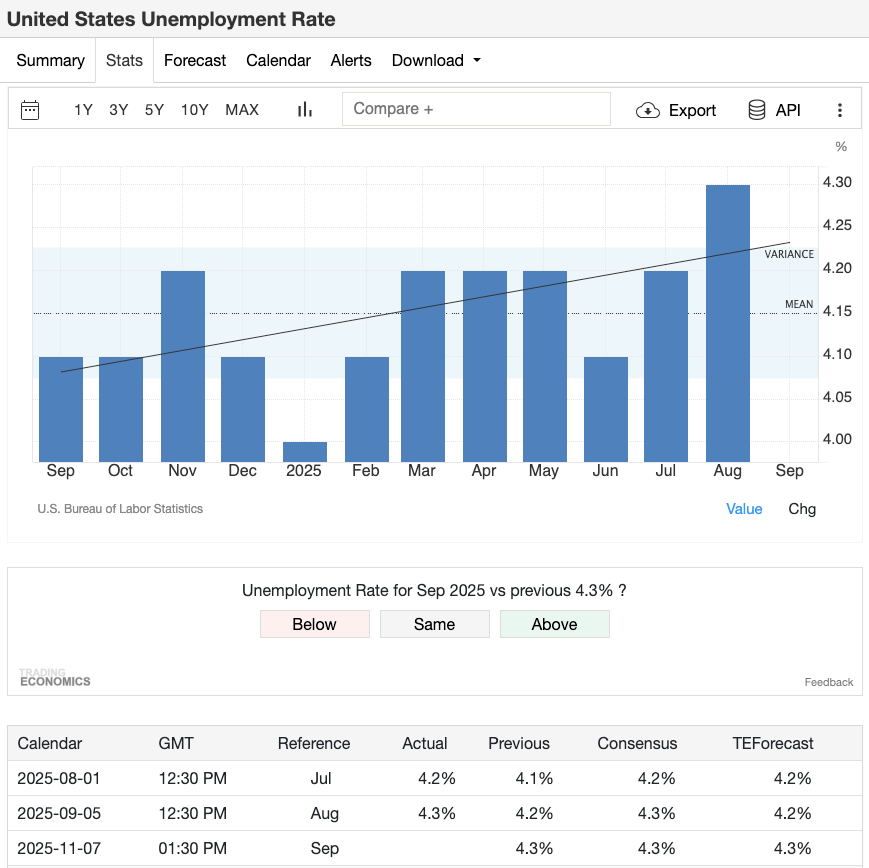

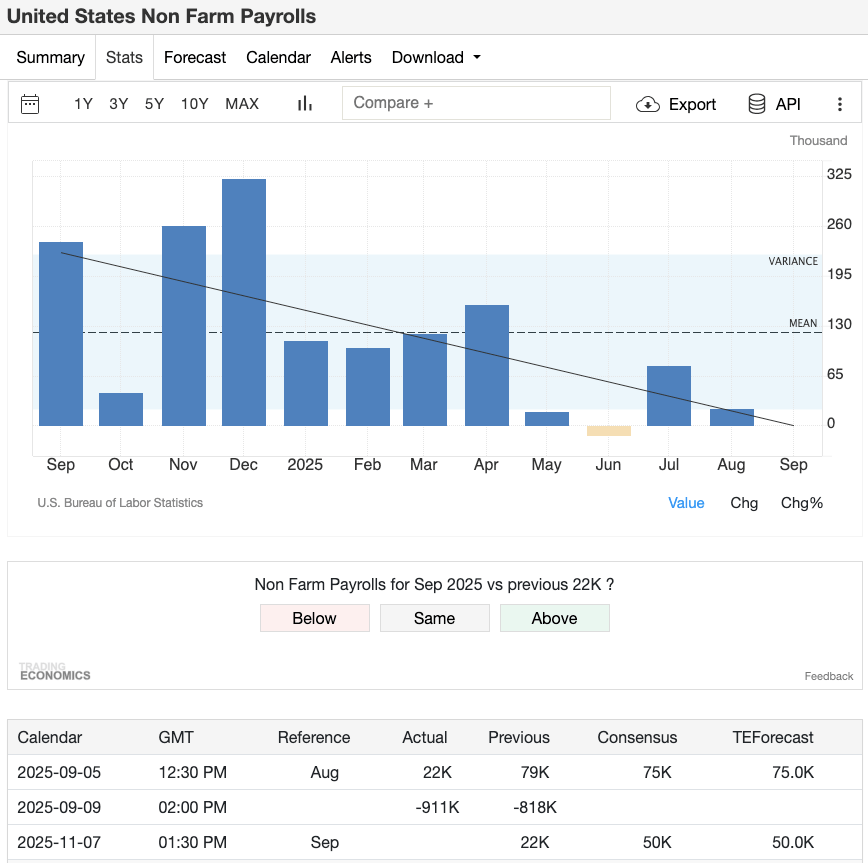

2. Employment Report (November 7)

The October employment report will be the first undisturbed data after the government shutdown. Economists generally expect moderate hiring, with the unemployment rate remaining around 4.3%.

- If the data is weak, it will support the case for continued rate cuts.

- If new jobs are strong, the dollar may strengthen, while stocks and crypto assets may see a short-term pullback.

Image Source: U.S. Unemployment Rate (Trading Economics)

Image Source: U.S. Unemployment Rate (Trading Economics)

Image Source: U.S. Non-Farm Payroll Numbers (Trading Economics)

Image Source: U.S. Non-Farm Payroll Numbers (Trading Economics)

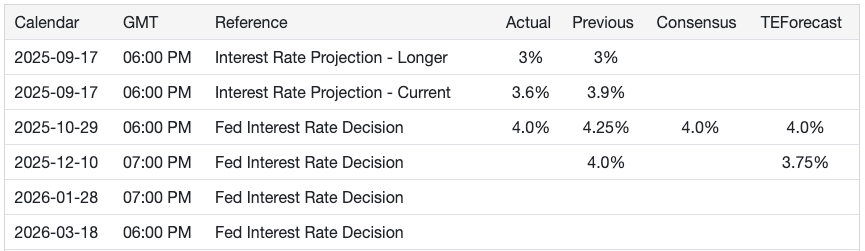

3. FOMC Meeting Minutes (November 19)

The Federal Reserve will release the minutes from the October 28-29 meeting on November 19. The content will reveal how officials discussed the latest rate cut and subsequent policy direction. Traders will focus on hints regarding balance sheet policy or further easing.

Image Source: U.S. Federal Funds Rate (Trading Economics)

Image Source: U.S. Federal Funds Rate (Trading Economics)

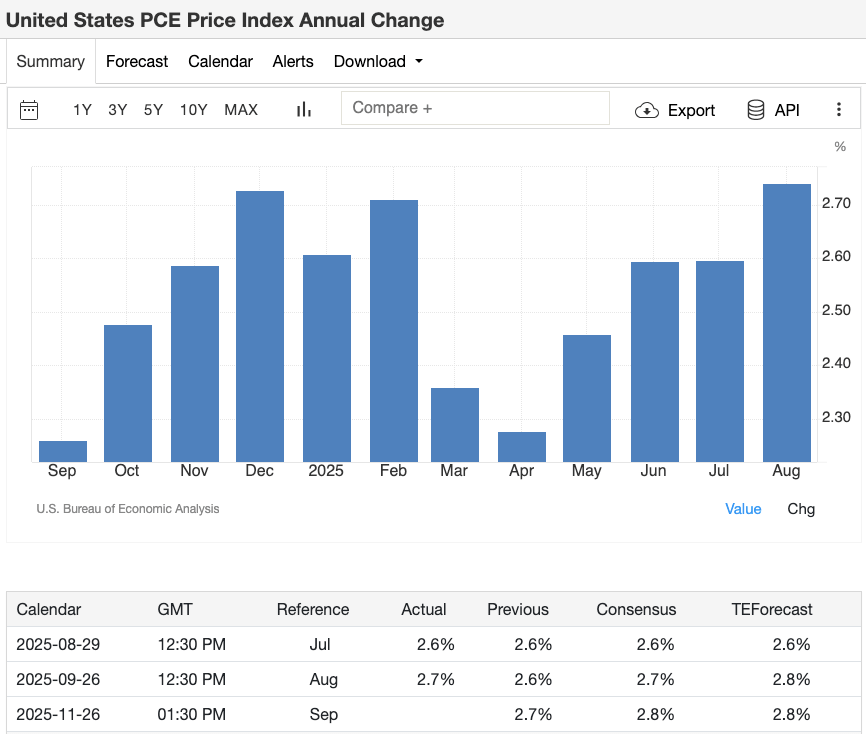

4. Core PCE Price Index (November 26)

The Core Personal Consumption Expenditures (PCE) index is known as the Fed's preferred inflation measure, excluding volatile food and energy prices to reflect the true trend of inflation.

- If the reading is close to or below 2.8%, it will strengthen market expectations for a rate cut in December and enhance investor confidence in the continued slowdown of inflation.

- If the data is above expectations, it may trigger cautious sentiment in risk assets, leading the market to question whether the Fed can continue easing.

Compared to CPI, PCE typically does not cause violent fluctuations, but it is closely watched because it directly impacts the Fed's long-term inflation model.

Image Source: U.S. Core PCE Price Index (Trading Economics)

Image Source: U.S. Core PCE Price Index (Trading Economics)

B. Europe and the UK

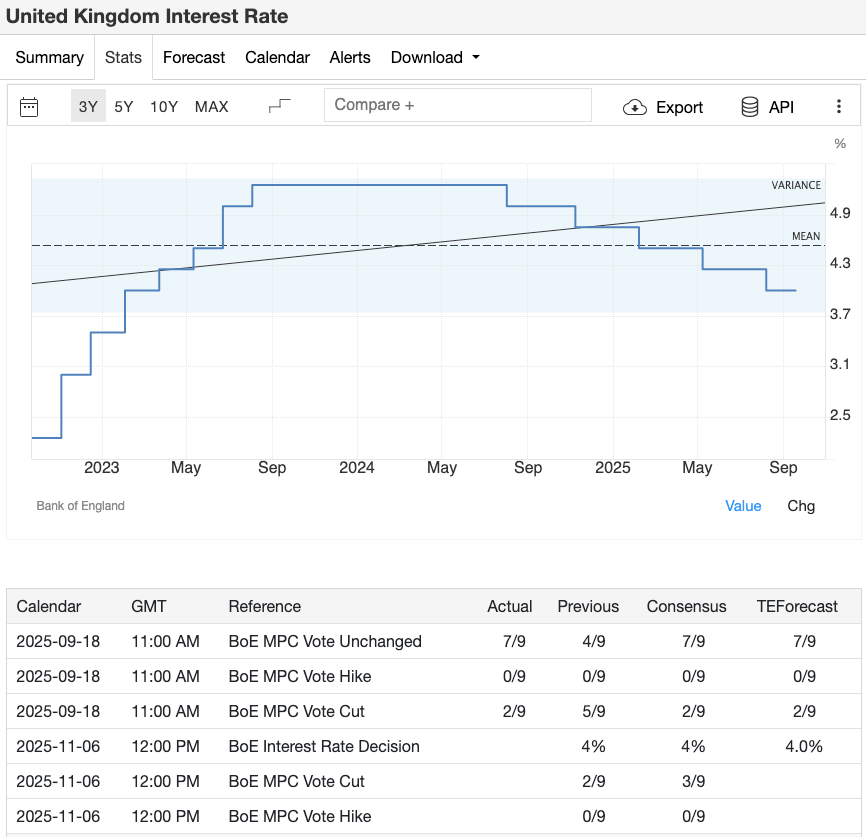

1. Bank of England Meeting (November 6)

The market generally expects the Bank of England to maintain the interest rate at 4.00%. Although inflation is gradually declining, it remains above target levels, and the labor market is still tight. The accompanying Monetary Policy Report may hint for the first time that a rate cut cycle could begin early next year.

Image Source: UK Benchmark Interest Rate (Trading Economics)

Image Source: UK Benchmark Interest Rate (Trading Economics)

2. Eurozone PMI Data (November 21)

October's data recorded the best performance in over a year. The November reading will test whether the recovery is sustainable, especially in the manufacturing and services sectors.

3. UK Autumn Budget (November 26)

This budget will determine the UK's fiscal priorities leading up to 2026. The market will closely watch tax policies, adjustments to public spending, and whether measures to stimulate growth will be introduced, as these could impact UK bond yields and the pound's trajectory.

C. Asia

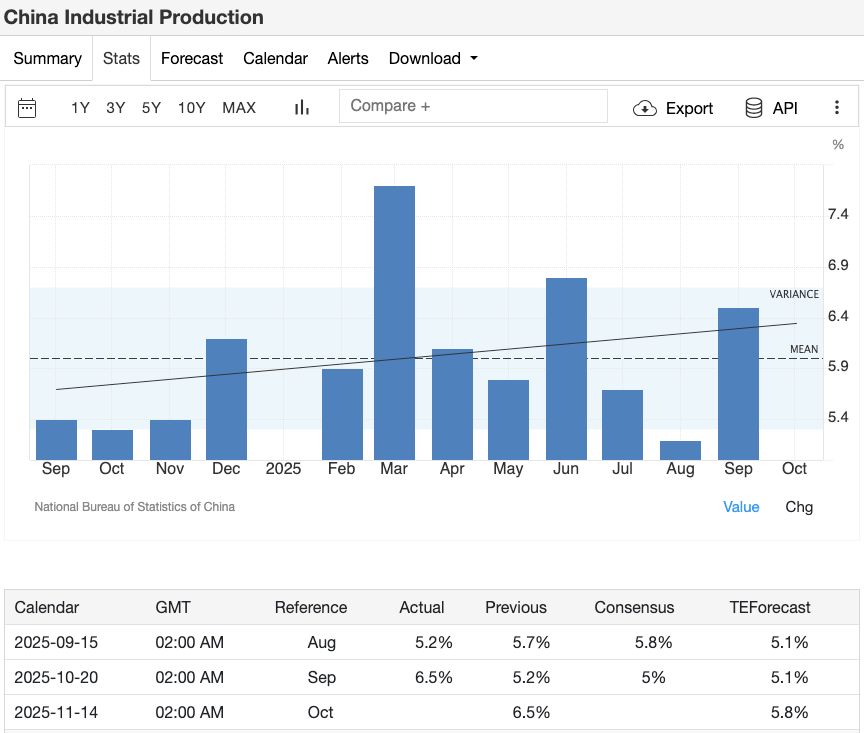

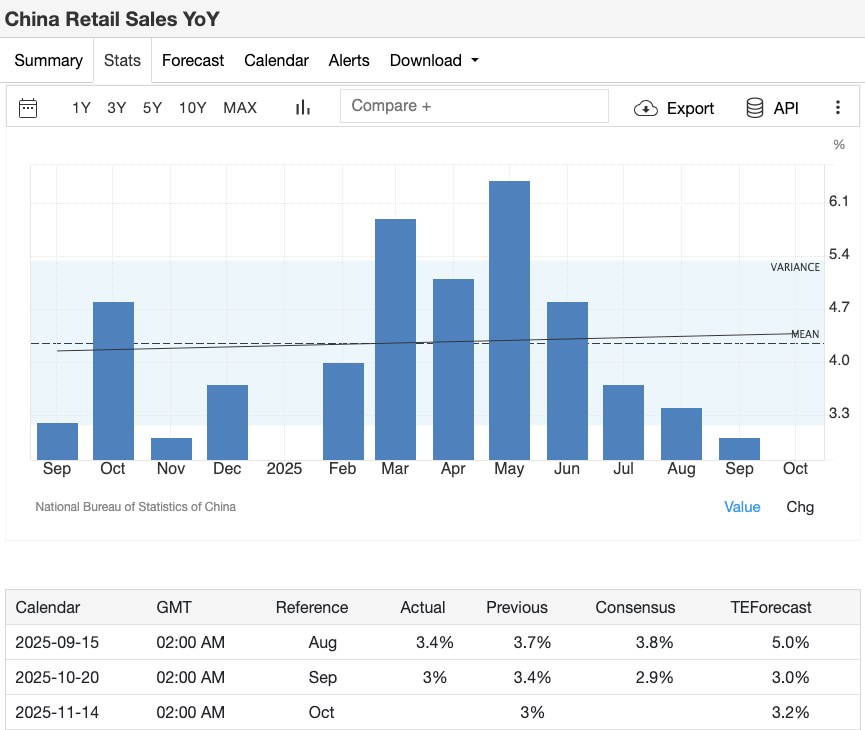

1. China Economic Activity Data (Around November 16)

Data on retail sales, industrial output, and fixed asset investment will reflect whether recent stimulus policies are beginning to take effect. Strong performance will help boost regional market confidence and commodity prices.

Image Source: China Industrial Production (Trading Economics)

Image Source: China Industrial Production (Trading Economics)

Image Source: China Total Retail Sales Year-on-Year (Trading Economics)

Image Source: China Total Retail Sales Year-on-Year (Trading Economics)

2. Loan Prime Rate (LPR, November 20)

LPR remains the benchmark for credit costs in China. If deflationary pressures persist, there is a possibility that the central bank may slightly lower rates by 10 basis points to show its willingness to support credit expansion and stabilize economic growth.

Energy and Geopolitics

In recent months, energy prices have slightly retreated, but crude oil remains a key factor influencing inflation and investor sentiment. This November, traders are primarily focused on three things: the latest decisions from OPEC+, the progress of the U.S. government shutdown, and the global political landscape that may stir the market before the year ends.

U.S. Government Shutdown

The U.S. government shutdown has entered its second month, with no substantial progress, leaving the market in a state of uncertainty.

- Impact: Important data such as GDP, employment, and inflation have been delayed, making it more difficult for the Federal Reserve to assess the economic situation.

- Market Reaction: Investors remain cautious, with bond yields slightly declining, while the dollar remains strong as a safe-haven asset.

- Next Steps: Congress is working to push through a short-term agreement to reopen the government and resume data releases. Until then, traders can only rely on data from private institutions and overall market sentiment to gauge trends.

Image Source: MSN

Image Source: MSN

OPEC+ Meeting (November 30)

OPEC+ member countries will hold a meeting at the end of the month to assess production plans for 2026. Their decisions will directly impact future energy price trends.

- If current production levels are maintained: Crude oil prices may remain just above $60 per barrel, a level that is comfortable for both producers and consumers.

- If further production cuts are made: Oil prices may rise again, slowing the decline in inflation.

- If production is increased: Oil prices may fall, but this could also reflect weakening global demand.

Currently, OPEC+ seems more inclined to maintain price stability rather than adopt aggressive cut or increase strategies. Stable oil prices help central banks continue to pursue easing policies. However, if OPEC+ suddenly changes its strategy, it could quickly alter inflation expectations, thereby affecting exchange rates, stock markets, and various assets.

Image Source: SisaJournal

Image Source: SisaJournal

Global Hotspots

Currently, the easing of U.S.-China trade relations, the fragile ceasefire situation in Gaza, and the war in Ukraine are shaping the global economic outlook. When the situation remains stable, energy prices typically stabilize as well; however, if any party escalates the conflict again, oil and commodity prices may rise sharply, presenting new challenges for central banks in controlling inflation.

Key Events in the Cryptocurrency Market

Major Dynamics to Watch

Liquidity and Market Fund Movements

- ETF Fund Inflows: BlackRock's IBIT remains the largest driver of the U.S. spot Bitcoin ETF. If inflows continue in November, it will be key to maintaining BTC's upward momentum.

- Derivatives Expiration: Deribit options and CME Bitcoin futures will expire simultaneously on November 28 at 08:00 (UTC), coinciding with the U.S. Thanksgiving week. A decrease in liquidity may lead to increased price volatility.

Market Narrative Observations

- Infinex: If presale demand is strong, it may drive more attention to DeFi projects that "make it easy for ordinary users to get started."

- Hyperliquid: The effectiveness of its unlock and buyback mechanisms will influence the market's long-term trust in decentralized derivatives platforms.

- x402: Attention should be paid to actual API integrations and trading cases to observe whether machine payments are truly moving from concept to practical application.

Image Source: x402 Project One-Page Overview (x402.org)

Image Source: x402 Project One-Page Overview (x402.org)

Summary: How to Prepare for the Market

In November 2025, the intertwining themes of macroeconomics and cryptocurrency will determine the next steps for the market. Whether it’s inflation data, central bank meetings, or token unlocks, these are not isolated events but key signals reflecting changes in global capital, confidence, and liquidity.

To seek stability and success, consider the following:

- Mark Key Dates: Highlight November 7, 13, 19, 20, 21, 26, 28, and 30 on your calendar; the data or policy decisions on these days may trigger rapid market movements.

- Control Leverage: Avoid high-leverage operations before the release of major data such as employment reports or CPI, as sudden volatility can lead to forced liquidations.

- Check Positions: Market liquidity is usually lower during Thanksgiving week, making price fluctuations easier to amplify. Adjust positions in advance to prevent unexpected risks.

- Maintain Diversification: Allocate both traditional and digital assets to spread investment risk.

- Focus on Facts, Not Noise: Follow official data and confirmed news rather than market rumors.

For novice traders, the goal is not to predict every piece of data but to understand "when the data is most important." Mastering timing, learning to control risk, and calmly responding after real data is released will put you ahead of most trend-chasing investors.

FAQ

1. What impact does the U.S. government shutdown have on the market?

It leads to delays in the release of key data such as GDP and inflation, causing traders to rely on private estimates, thus increasing short-term market volatility.

2. If CPI data is weak, will the Federal Reserve definitely cut rates in December?

Not necessarily. While it may support rate cut expectations, if inflation does not consistently approach 2%, the Fed will remain cautious.

3. What impact will the OPEC+ decision at the end of the month have?

If production levels are maintained, oil prices will remain stable; if further cuts are made, inflation may rise; if production is increased, it may indicate weakening global demand.

4. Will the government shutdown affect investors' views on the dollar?

Not significantly. The dollar remains strong as a safe-haven asset, while bond yields have slightly declined.

5. Does token unlocking always lead to price declines?

Not necessarily. If projects communicate adequately in advance and market demand is strong, the downside potential for prices is usually limited.

6. What are the main themes in the cryptocurrency market this month?

The focus is on the "simplified DeFi" driven by Infinex and the AI machine payment concept brought by the x402 protocol.

7. How should novice traders respond to November's volatility?

Maintain low leverage, pay attention to key dates, and try to avoid frequent trading around major data releases. Stability is more important than impulsiveness.

Quick Links

- XT Labs Leads: RWA Global Banking Alliance Launches in Hong Kong, Bitcoin Asia Conference 2025 Witnesses XT Smart Chain Driving Global Asset Tokenization

- XT.COM Comprehensive Upgrade | Explore Crypto, Trust Trading at New Heights

- How to Invest 100,000 USDT in Wealth Management? XT Simple Earn Helps You Achieve Stable 10%+ Passive Income

About XT.COM

Founded in 2018, XT.COM is a leading global digital asset trading platform, now boasting over 12 million registered users, with operations in over 200 countries and regions, and an ecosystem traffic exceeding 40 million. XT.COM cryptocurrency trading platform supports over 1,300 quality coins and 1,300 trading pairs, offering spot trading, margin trading, futures trading, and other diversified trading services, equipped with a secure and reliable RWA (Real World Assets) trading market. We always adhere to the philosophy of "Exploring Crypto, Trusting Trading," committed to providing global users with a safe, efficient, and professional one-stop digital asset trading experience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。