Bitcoin fell nearly 5% in October, breaking the "Uptober" rally for the first time in seven years, with market attention now focused on whether historical patterns will hold true in November. Bitcoin recorded a drop of about 4% in the recently concluded October, marking the first break of the "Uptober" trend since 2018. This trend was primarily influenced by multiple factors, including market panic triggered by Trump's tariff policy against China, profit-taking by long-term holders, and the U.S. government shutdown.

1. Breaking the October Spell

In October 2025, Bitcoin broke the seven-year "Uptober" upward trend, with a monthly decline of nearly 4%, making it the worst October since 2018.

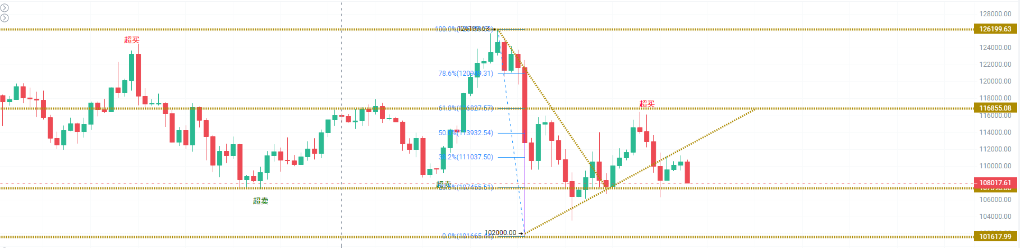

● Throughout October, Bitcoin fell from a high of $125,000 at the beginning of the month to a low of $104,782.88 between October 10-11, and then hovered below $110,000 by the end of the month.

● This performance ended the popular "Uptober" superstition among cryptocurrency investors—over the past 12 years, Bitcoin has seen gains in 10 out of 12 Octobers, with a success rate of 83%.

2. Why the Market is Under Pressure

Tariff Shock and Market Liquidation

● The turning point in the market occurred on October 11, when U.S. President Trump announced a 100% tariff on Chinese imports and threatened to implement export controls. This news triggered a historic large-scale liquidation in the cryptocurrency market, with a single-day liquidation amount reaching $19 billion, causing Bitcoin's price to plummet over 10% in a very short time.

● Adam McCarthy, a senior research analyst at digital market data provider Kaiko, commented: "The liquidation on the 11th really reminded people that this asset class is very narrow; even Bitcoin and Ethereum can still experience a 10% pullback within 15-20 minutes."

Profit-Taking by Long-Term Holders

● On-chain data indicates that long-term holders (LTH) have been selling Bitcoin since July 1. According to analyst Axel Adler Jr., these investors have distributed about 810,000 BTC, reducing their total holdings from 15.5 million to 14.6 million.

● Despite facing this selling pressure, Bitcoin still reached an all-time high of $126,210 on October 7, indicating that market demand was strong enough to absorb a large supply.

Macroeconomic Uncertainty Looms

● The U.S. Federal Reserve has delayed market expectations for further rate cuts this year, coupled with the U.S. government shutdown preventing the release of key economic data, leading to investor doubts about the global monetary policy path.

● Meanwhile, several influential figures have expressed concerns about the overvaluation of the stock market. JPMorgan CEO Jamie Dimon warned earlier this month that the risk of a significant adjustment in the U.S. stock market has increased over the next six months to two years.

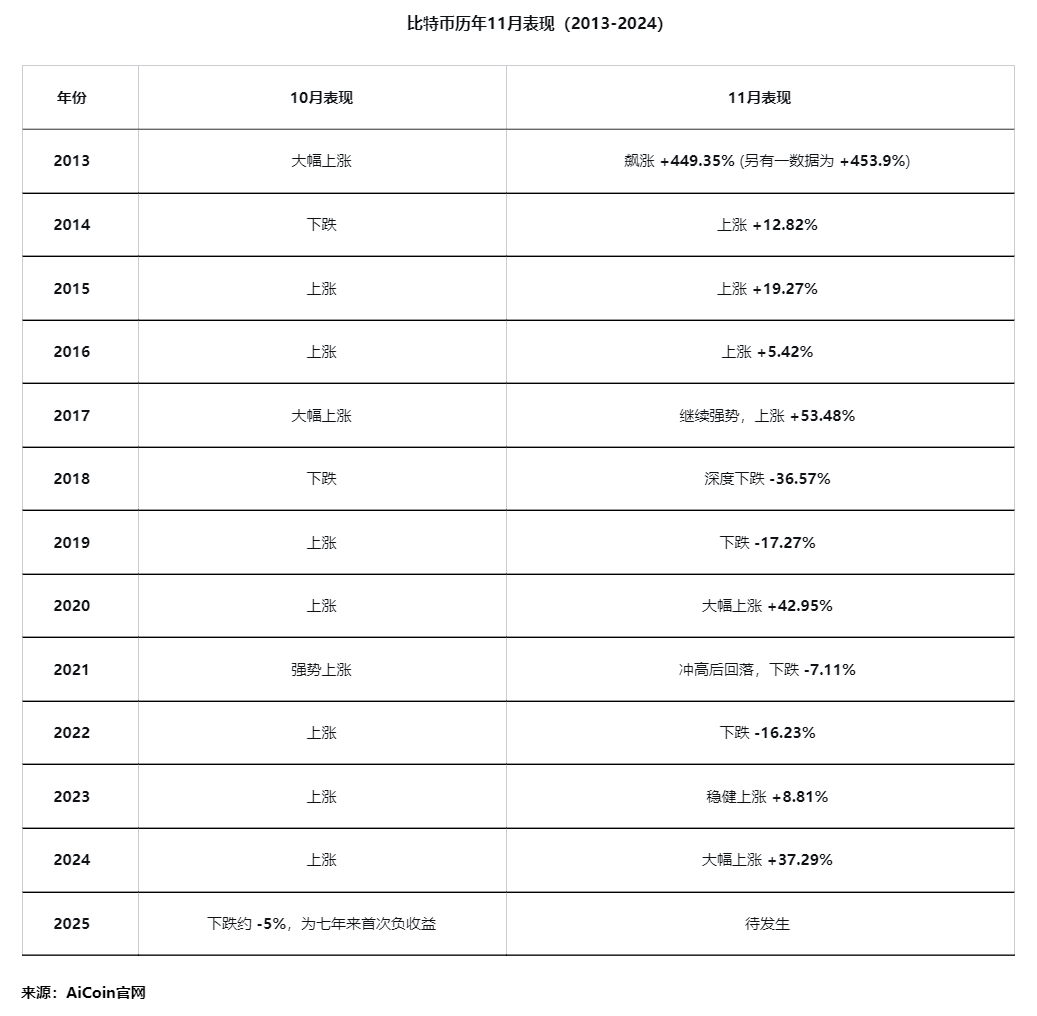

3. Historical Performance in November

Despite the disappointing performance in October, historical data suggests that November could be a strong month for Bitcoin.

● According to AiCoin data, since 2013, Bitcoin has recorded 8 gains and 4 losses in November, with an average return of 46.02%. This average is significantly boosted by an exceptional increase of 449.35% in 2013. Excluding this outlier, the average return drops to about 9.35%, with a median return of 10.82%, which better represents typical performance.

Trader Daan Crypto Trades points out that November and December have historically been important market turning points. These months have witnessed cycle peaks in 2013, 2017, and 2021, as well as cycle lows in 2018 and 2022.

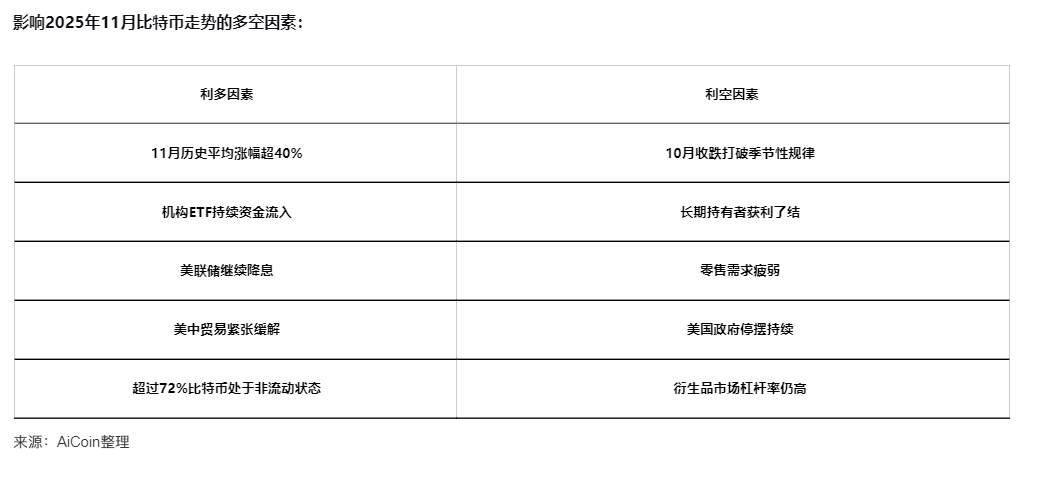

4. Intertwined Bullish and Bearish Factors

Positive Signals Persist

Despite the poor performance in October, several positive factors continue to support the market:

● Institutional funds are undeterred by volatility and continue to buy. In the third quarter, net inflows into Bitcoin spot ETFs reached $7.8 billion, although this was down from $12.4 billion in the second quarter, the net inflow throughout the third quarter confirmed stable buying by institutional investors. The first week of October recorded a net inflow of $3.2 billion, setting a new record for weekly inflows in 2025.

● Meanwhile, publicly traded company MicroStrategy continued to buy during the market correction, purchasing 220 BTC on October 13 and 168 BTC on October 20, totaling 388 BTC in one week.

● On-chain indicators also show that the market's health is good. Unrealized losses around $107,000 account for only about 1.3% of Bitcoin's market value, far below levels seen in previous bear markets.

Macroeconomic Factors are Key

The performance of Bitcoin in November 2025 will depend on the evolution of several macroeconomic factors:

● Federal Reserve Policy: The Federal Reserve cut rates by 25 basis points at the end of October, bringing the key lending rate to a three-year low. However, Fed Chair Jerome Powell dampened expectations for further rate cuts, stating that a December cut is "not a given."

● U.S. Government Shutdown: The U.S. government shutdown has entered its fifth week, nearing the longest record in U.S. history. The ongoing deadlock between Republicans and Democrats over government spending has created uncertainty.

● U.S.-China Trade Relations: Talks between the U.S. President and the Chinese President are seen as a positive step towards easing trade tensions. The agreement includes the U.S. reducing tariffs on Chinese goods in exchange for Beijing cracking down on fentanyl trade.

Market Structure Changes

The market crash on October 11 proved that the Bitcoin market has shifted from retail dominance to institutional dominance.

Unlike the panic that spread in the retail-dominated market at the end of 2021, this time the pullback was limited. After large-scale liquidations, institutional investors continued to buy, indicating that they are firmly defending the market's downside.

5. Divergent Expert Opinions

Market analysts have differing views on Bitcoin's prospects for November:

● Vasily Girya, CEO of GIS Mining, stated that Bitcoin may continue to trade within a broad range of $102,000 to $122,550 between October 31 and November 9. He noted, "The current price of about $110,000 reflects a balance between cautious investor optimism and ongoing macroeconomic uncertainty."

● Markus Thielen, an analyst at 10x Research, emphasized that when analyzing seasonal charts, it is essential to consider other influencing factors. He suggested paying attention to developments in U.S.-China trade relations, Federal Reserve policy, and the resolution of the U.S. government shutdown.

● Bitcoin Vector, a technical analyst, pointed out that every time Bitcoin tests the $106,000-$108,000 range, volatility decreases, which is a sign of market resilience. However, the company noted that Bitcoin needs to quickly reclaim the cost basis area for holders to prevent downward pressure from re-emerging.

6. Investment Strategy Recommendations

For short-term traders, key price levels should be monitored.

● According to Vasily Girya's analysis, $106,000 is a critical support level; if it breaks, it could trigger a new round of margin position liquidations and accelerate a pullback to the psychologically important area of $100,000-$102,000.

● On the upside, if Bitcoin successfully stabilizes above $111,700, it will pave the way for a retest of the local high of $115,900, followed by the historical high of $126,199.

● For long-term investors, the current environment remains favorable for accumulation. Institutional adoption is accelerating Bitcoin's integration into traditional finance.

The historical performance of November gives the market hope, but the uniqueness of 2025 lies in the fact that macro factors have surpassed seasonal patterns, becoming the key force driving short-term prices. If Bitcoin can successfully hold the critical support level of $110,000, and if U.S.-China trade tensions do not escalate further, combined with the strong historical performance of November, Bitcoin still has the potential to challenge higher price levels before the end of the year.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。