Solana ETFs Shine Amid Heavy Bitcoin Outflows and Ether Stability

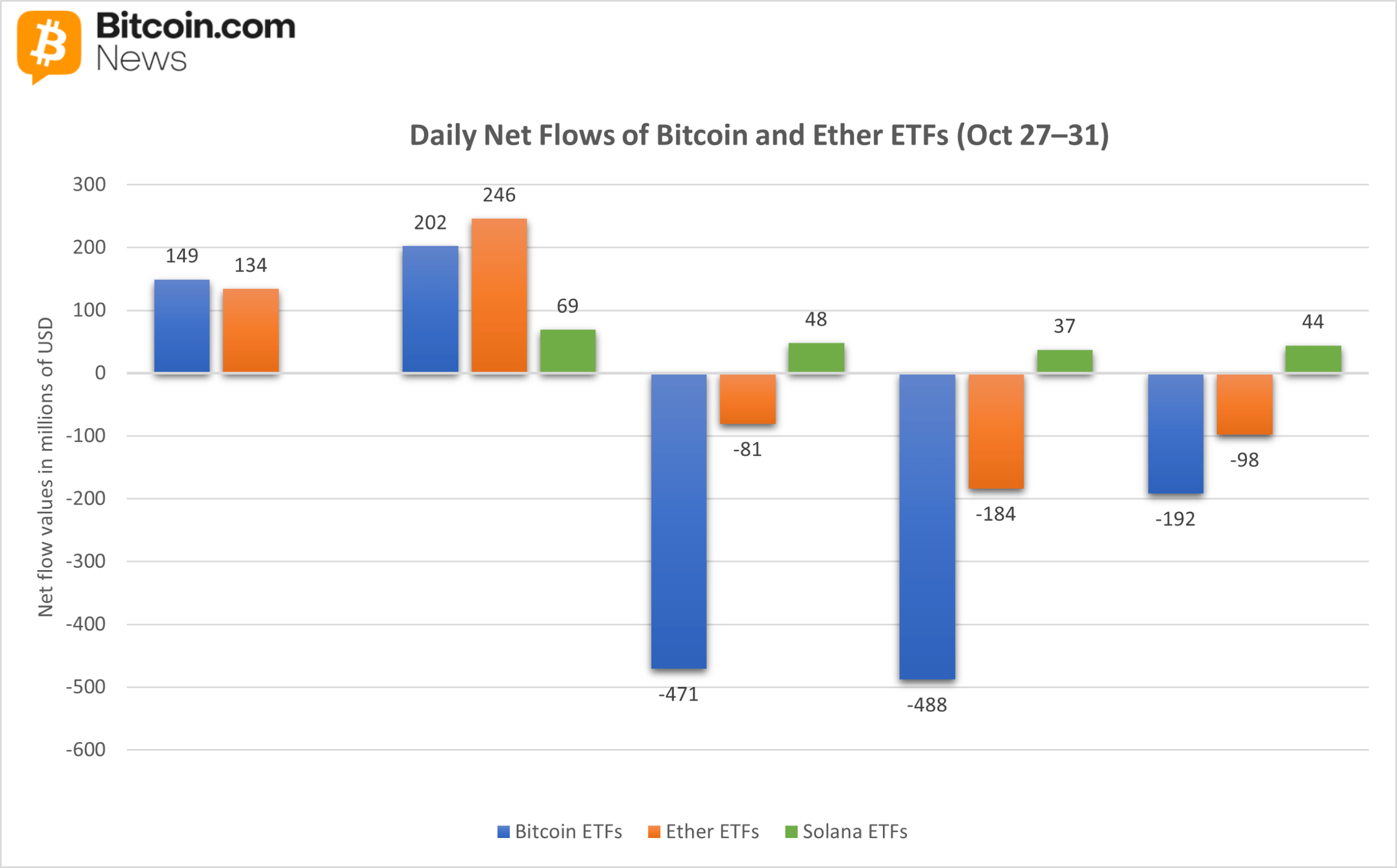

October’s final week left a trail of contrasts across the crypto exchange-traded fund (ETF) landscape. Bitcoin ETFs endured one of their toughest weeks of the month, ether ETFs managed to stay afloat, and the newly launched solana ETFs surged with enthusiasm, drawing strong institutional and retail interest.

Bitcoin ETFs collectively suffered $798.95 million in outflows, marking the second-largest weekly redemption event since August. What began as a good week with two days of inflows quickly spiraled into huge redemptions for the rest of the week. Blackrock’s IBIT bore the brunt with $403.41 million exiting, followed by Fidelity’s FBTC with $155.83 million. Ark & 21shares’ ARKB also struggled, losing $76.48 million, Bitwise’s BITB lost $79.06 million, and Grayscale’s GBTC lost $68.14 million.

Smaller exits were seen on Invesco’s BTCO with $7.96 million, Grayscale’s Bitcoin Mini Trust with $4.28 million, and Vaneck’s HODL with $3.78 million. Trading activity remained robust at $24.75 billion, but total net assets for bitcoin ETFs slid to $147.73 billion by week’s end.

Bitcoin and ether ETFs started the week well but ended in huge redemptions, with ether ETFs managing to still close positive.

Ether ETFs, meanwhile, eked out a $15.97 million net inflow, driven primarily by renewed confidence in Grayscale’s products. Grayscale’s Ether Mini Trust led with $56.05 million in inflows, with Blackrock’s ETHA adding $13.59 million to offset redemptions elsewhere.

Grayscale’s ETHE, Bitwise’s ETHW, and Fidelity’s FETH each lost $22.32 million, $15.21 million, and $4.33 million, respectively. Other minor outflows were seen on Franklin’s EZET ($4.23 million), 21Shares’ TETH ($3.15 million), Vaneck’s ETHV ($2.41 million), and Invesco’s QETH ($2.02 million). Despite the redemptions, net assets managed to close the week slightly above $26 billion.

But the story of the week belonged to solana ETFs, which exploded onto the scene with $199.21 million in inflows during their first full week of trading. Bitwise’s BSOL captured the lion’s share at $197.03 million, while Grayscale’s GSOL, which launched mid-week, attracted a promising $2.18 million. Together, they closed the week with combined net assets of $502 million, a strong debut that signals investor appetite for alternative layer-1 exposure beyond bitcoin and ether.

As October closed, the message from ETF flows was clear: bitcoin investors pulled back sharply, ethereum held its ground, and solana, the market’s rising star, captured the spotlight with a breakout first week.

FAQ🪙

- Why did bitcoin ETFs see major outflows this week?

Bitcoin ETFs lost nearly $800 million as investors took profits and rotated out amid broader market caution. - How did ether ETFs perform during the same period?

Ether ETFs stayed resilient with $16 million in net inflows, signaling steady institutional confidence despite volatility. - What made solana ETFs stand out?

Solana ETFs debuted with $199 million in inflows, led by Bitwise’s BSOL, marking one of the strongest crypto ETF launches of 2025. - What does this shift mean for investors?

The contrast shows investors are diversifying beyond bitcoin and ether, with growing enthusiasm for Solana’s expanding ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。