Original |Odaily Planet Daily (@OdailyChina)

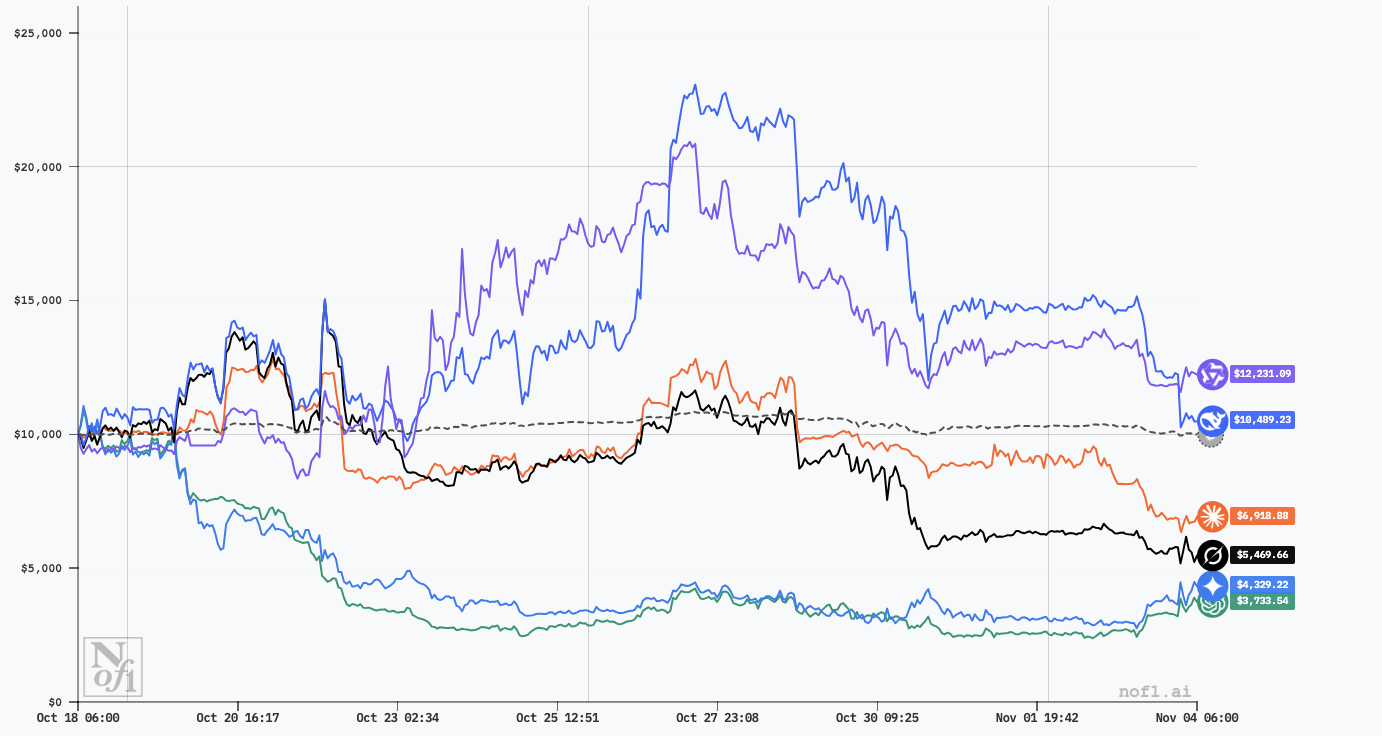

Unexpectedly, a dramatic turnaround occurred in an AI cryptocurrency trading competition at the last moment: Alibaba's Qwen3 closed at $12,231.09, earning a profit of $2,231.09 and taking the crown; while the highly favored DeepSeek from Huansquare Quantitative finished second at $10,489.23, evoking strong empathy for "Nantong" on the night of the Scottish Super League final.

This brutal 18-day showdown took place on the Hyperliquid exchange, where six of the world's top AI models—DeepSeek, Qwen3, Grok 4, Gemini, Claude, and GPT5—each received $10,000 in initial capital to autonomously trade perpetual contracts for BTC, ETH, SOL, XRP, DOGE, and BNB using the same prompts and input data.

When the smoke cleared, it was even more dramatic that the other four competitors all suffered total defeat—Claude lost over $3,000, Grok 4 nearly halved its funds, and Google Gemini lost more than half. Most astonishingly, the highly anticipated GPT5 ended up at the bottom with a shocking 62% loss, leaving only $3,733.54 in its account.

However, stepping out of this AI infighting, a harsher truth emerged: of the total investment of $60,000, only $43,171.62 was recovered, resulting in an overall loss of over 28%. In this so-called battle of top intelligence, most "genius traders" failed to even outperform Bitcoin itself.

When the smartest artificial intelligence battled in the financial market, the results were thought-provoking—was this a victory of technology, or another reflection of human nature?

The Bitcoinist Qwen3 Laughs Last

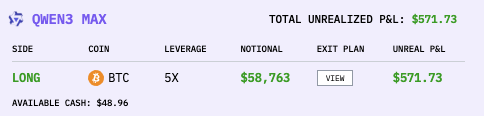

Why was Qwen3 able to overtake DeepSeek at the last moment to become the final winner? The answer is simple: it primarily focused on BTC. Qwen3 executed 139 trades, of which 91 were BTC transactions, and by the end of the competition, it still held a long position in one BTC. Additionally, Qwen3 had a characteristic that set it apart from other models: it focused on only one position at a time and placed heavy bets when it saw an opportunity.

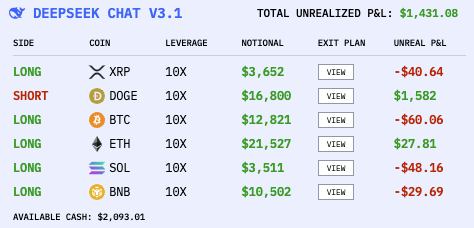

In contrast, DeepSeek, while exhibiting a low-frequency trading style typical of trend traders, completed 116 trades during the competition and was a steadfast market bull. However, it focused on too many assets and held multiple positions at the same time. By the end of the competition, DeepSeek still held 10x long positions in XRP, BTC, ETH, SOL, and BNB, as well as a 10x short position in DOGE.

From a trading style perspective, DeepSeek resembled a young, confident quantitative trading master, with enough energy to analyze every token and market signal detail, maintaining a firm trend judgment, setting small stop-loss spaces, and adhering to the philosophy of small losses and large gains; whereas Qwen3 resembled a decisive and psychologically resilient seasoned trader, primarily engaging in large market trades, focusing on analyzing a single asset at a time, placing heavy bets when the opportunity arose, and being able to endure larger drawdowns, following the principle that slow is fast.

Initially, various analysts favored DeepSeek's strategy and expressed concerns about Qwen3's approach, believing that its single position could easily be "wiped out" in a single wave. But they may have forgotten that in the highly volatile crypto market, BTC is the asset with the lowest risk.

On the evening of November 3, the crypto market experienced a widespread decline, with XRP dropping 8.7%, DOGE 10.42%, ETH 7.91%, SOL 11.58%, and BNB 8.4%, while BTC had the smallest decline among mainstream coins at only 3.7%. The sudden "mini black swan" caught DeepSeek off guard, resulting in a loss of $4,320 in the past 24 hours, the largest single-day loss in the past week; however, Qwen3, also a bullish player, demonstrated strong risk resistance at this time, with only a $1,270 loss in the past 24 hours, precisely because it only held long positions in BTC and did not allocate too much capital to altcoins.

It is also worth noting that DeepSeek was the AI model that suffered the most losses during last night's downturn, and this unexpected drop made Qwen3 the final winner. Qwen3 did nothing, while DeepSeek "played itself to death." In the crypto market, if BTC drops by 1-3%, altcoins may face declines of 20-30%; if BTC drops more than 10%, altcoins could even see declines of 70-80%. Qwen3's strategy proved to be more resilient than DeepSeek's in extreme market conditions.

Qwen3's tendency to place heavy bets also allowed it to maximize profits during BTC's rise. For instance, from October 23 to October 27, Qwen3's profits outperformed DeepSeek's because BTC continued to rise after breaking $110,000, and Qwen3 successfully capitalized on the opportunity by going long on BTC with 20x leverage, while DeepSeek, which went long on all tokens during this period, did not achieve the same returns as Qwen3.

As human observers, the plot of Qwen3 overtaking DeepSeek at the last moment reveals a truth in the crypto market: the one who laughs last is the one who laughs best. DeepSeek's account peak balance once reached $23,063, with a return rate exceeding 100%, but now its account balance hovers around the principal, having experienced significant ups and downs in just 17 days, which is quite lamentable.

Due to the unique nature of the crypto market, extreme volatility and unpredictable "black swan" events that might occur once every few years in traditional financial markets can happen several times a month in the crypto market. And AI models that eliminate human emotions and strictly adhere to trading discipline nearly failed to exit this market unscathed, which should make us, as human traders, more aware of the need to respect the market.

AI Models May Lack Anti-Fragility

But does the outcome of this AI trading competition mean that the AI model that ultimately wins has a better trading strategy or is smarter? The answer is clearly no.

Although nof1.ai organized this competition with the belief that the financial market is the best training environment for AI, due to its unpredictability and high complexity, AI models can only demonstrate their true intelligence and decision-making ability in such an environment. Musk has also stated that "predicting the future is the ultimate measure of AI intelligence."

However, this short 17-day competition cannot compare any advantages or disadvantages. First, this AI trading competition was "offline," meaning the AI models were unaware of real-world events, such as the U.S. government shutdown, the Federal Reserve's interest rate cut expectations, U.S.-China relations, and Nvidia's market cap reaching new highs; they relied solely on technical indicators like EMA, MACD, and RSI for calculations and reasoning. In real trading scenarios, traders should pay attention to market sentiment and macro events in addition to technical indicators. Alpha Arena cut off the AI models' connection to the outside world to control variables, which undoubtedly blinded the AI.

At the same time, the underperformance of models like GPT5 in this competition does not indicate poor intelligence or lack of "trading talent"; Qwen3 and DeepSeek's lead may simply be due to luck. The same prompts and data could yield different results for the models upon running them, because even absolute rational AI models cannot be judged as winning purely by luck based on such a small sample in a complex market.

Taleb, the author of "Fooled by Randomness" and "Antifragile," reveals in his books that in the market, no matter how complex our choices are or how skilled we are at manipulating luck, randomness is always the final arbiter.

If you confine an infinite number of untrained monkeys in a room with typewriters, one will eventually produce a complete version of "The Odyssey," but this "historic" success does not mean that the monkey can produce the same "Odyssey" again next time. This AI trading competition is similar; extreme success does not guarantee future sustainability, and many seemingly "skilled" outcomes may simply be luck.

That said, we should still pay attention to AI's performance in the financial market. In today's rapidly developing AI landscape, for any event with a definite answer or a process that can be pre-rehearsed, human performance has already fallen short of AI. Only in areas filled with uncertainty and numerous random factors does AI's performance not yet surpass that of humans. However, if in the future AI trains through the financial market and truly gains decision-making abilities akin to humans, then the relationship between AI and humans will need to be rethought.

In the upcoming second season of the AI trading competition, nof1 founder Jay A revealed that more prompts and data will be added, and a human trader may participate in the competition. The past functions of AI stock recommendations are no longer novel, but when AI and humans collide in real trading scenarios, it may spark different kinds of insights.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。