The cryptocurrency market changed overnight, with $1.2 billion in wealth evaporating within 24 hours, leaving 340,000 investors trapped. From November 3 to 4, Eastern Eight Time, the cryptocurrency market experienced a sudden "bloodbath." Bitcoin plummeted from the $110,000 mark to below $105,000, falling over $5,000 in a single day. Ethereum fared even worse, dropping nearly 9% and breaking below the critical support level of $3,600.

This crash led to massive liquidations. According to AiCoin data, over the past 24 hours, the total liquidation amount in the cryptocurrency market exceeded $1.2 billion, with more than 340,000 people liquidated, over 90% of whom were long positions.

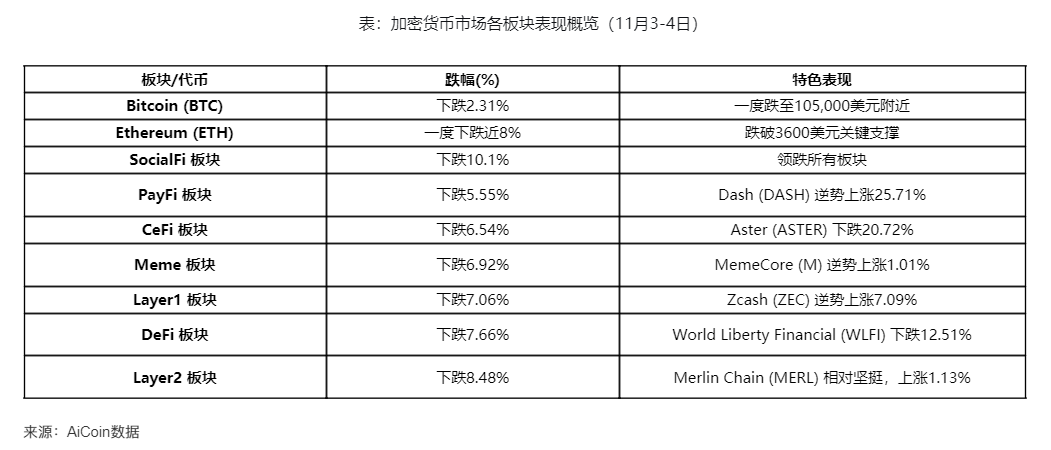

1. Market Performance: Widespread Collapse, SocialFi Sector Leads the Decline

● The recent cryptocurrency crash was widespread, with Bitcoin dropping nearly 5% at one point, hitting a low below $105,000, marking a new low in recent months. As of the time of writing, Bitcoin was down over 3%, priced at $106,200. Ethereum also saw a significant drop of nearly 9%, falling below the critical support level of $3,600, down about 25% from its high of $4,885 on August 22.

● Other smaller market cap cryptocurrencies experienced even larger declines. Solana, BNB, Dogecoin, and Cardano all followed suit. As of the time of writing, XRP was down 7.5%, while BNB, Cardano, and Dogecoin were down over 8%, and Solana was down over 11%.

● The cryptocurrency market's various sectors generally fell by about 2% to 10%. The SocialFi sector led the decline with a drop of 10.1%, with Toncoin (TON) within that sector falling by 10.67%. The PayFi sector dropped 5.55%, the CeFi sector fell 6.54%, the Meme sector decreased by 6.92%, the Layer1 sector was down 7.06%, the DeFi sector fell 7.66%, and the Layer2 sector dropped 8.48%.

Here are the performance details of major cryptocurrencies and sectors:

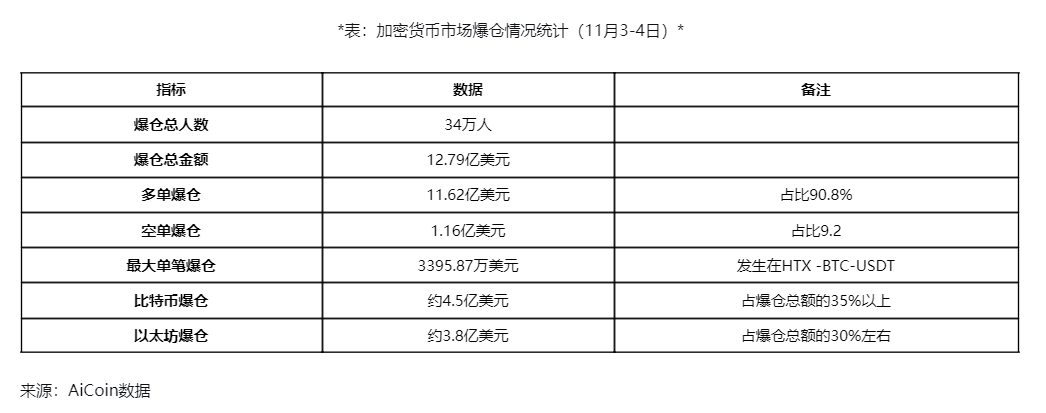

2. Liquidation Situation: Long Positions Suffer Heavy Losses, 340,000 Liquidated

This sudden crash resulted in one of the largest liquidation events of the year.

According to the latest data from AiCoin, there were a total of 340,000 liquidations in the cryptocurrency market over the past 24 hours, with a total liquidation amount reaching $1.279 billion. Among these, long positions accounted for $1.162 billion in liquidations, while short positions were only $116 million.

The largest single liquidation occurred in the BTC-USDT trading pair on the HTX exchange, valued at $33.9587 million. Such a large-scale liquidation of long positions indicates that market expectations for continued price increases were very strong, and this round of decline completely shattered the bulls' hopes.

3. Causes of the Crash: Negative Factors Resonating, Balancer Hacked

Analysts point out that this cryptocurrency crash is the result of multiple negative factors resonating.

● Hawkish Statements from the Federal Reserve Impact the Market. Recently, several Federal Reserve officials made strong statements, suggesting that a rate cut in December is "not a foregone conclusion." Federal Reserve Governor Lisa Cook stated that a rate cut in December is possible, but it will depend on subsequent new information. This uncertainty has clearly shifted investor sentiment towards a defensive stance.

● Balancer Hacked. The decentralized finance protocol Balancer, based on Ethereum, suffered a hack that may have resulted in losses exceeding $100 million. This vulnerability is the latest in a series of bearish events over the past few weeks that have left cryptocurrency investors on edge. The latest data shows that Balancer's losses have actually reached $120 million.

● Significant Outflows of Institutional Funds. A recent report from digital asset management firm CoinShares indicates that last week, U.S. Bitcoin exchange-traded funds (ETFs) became a major area of institutional fund outflows, with redemptions reaching $946 million. The iShares Bitcoin Trust (IBIT) saw outflows of about $400 million in a single week, the largest outflow among the 11 spot Bitcoin funds currently trading.

AiCoin data shows that institutional demand for Bitcoin has significantly slowed. Over the past three weeks, the weekly net inflow of BlackRock's spot Bitcoin ETF has been less than 600 Bitcoins. In contrast, during previous major uptrends in this cycle, the ETF's weekly net inflow often exceeded 10,000 Bitcoins, indicating a significant decline in current inflows compared to then.

● CoinShares Research Director James Butterfill noted in the report: "Despite recent rate cuts in the U.S., cryptocurrency investment products still recorded a net outflow of $360 million last week."

● Due to Federal Reserve Chairman Powell's indication that a rate cut in December is "not a foregone conclusion," this hawkish stance, combined with the absence of key economic data releases, has left investors in a wait-and-see mode. Meanwhile, some cryptocurrency-related stocks are also under pressure, with Circle closing down over 7% on Monday, Coinbase down nearly 4%, and MicroStrategy down 1.8%.

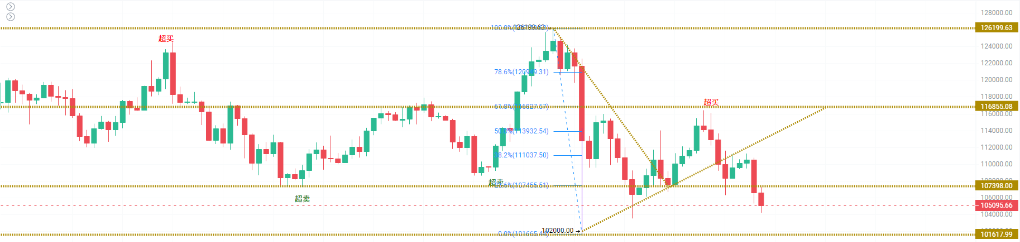

4. Technical Analysis: Key Support Level Breached, Downward Risks Intensify

From a technical analysis perspective, Bitcoin's trajectory is concerning.

● Katie Stockton, founder and managing partner of Fairlead Strategies, stated in a report on Monday that Bitcoin has fallen below the 200-day moving average—one of the most widely watched indicators defining long-term trends. The 200-day moving average at $109,800 had previously served as a support level for Bitcoin, and its breach may signal further declines for the cryptocurrency.

● Stockton pointed out, "From a technical standpoint, we believe Bitcoin's adjustment phase will continue for several weeks." She added that Bitcoin's next support level is around $94,200.

5. Market Outlook: Key Support Level Under Pressure, Market Sentiment Cautious

Analysts generally hold a cautious outlook for the market's direction.

● Bitcoin's price is currently testing the $105,000 key support level. If selling pressure increases further, Bitcoin's price may drop towards $100,000, which would be the lowest level in the past two weeks. Such a decline could trigger short-term liquidation pressure and increase uncertainty for investors.

● On-chain data indicates that long-term holders (LTHs) have begun to slow their selling pace. On-chain data shows that these holders have reduced their Bitcoin holdings by over 46,000 Bitcoins in recent days. While there are still signs of selling activity, this decline may signal a shift towards long-term conviction and a reduction in profit-taking.

As Bitcoin's price fluctuates around $105,000, both bulls and bears are fiercely contesting this critical position. Whether the Federal Reserve will continue to cut rates in December will be a key variable influencing the market's direction.

If the support at $105,000 is breached, it could trigger a larger chain reaction of sell-offs. However, if it stabilizes at the current position, the market may regain confidence and attempt a counterattack towards the $110,000 mark.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。