Recently, the cryptocurrency market has been difficult to describe, with continuous declines, while the US stock market remains sunny. In such a completely decoupled situation, perhaps an effective mixed allocation is the best strategy. With the introduction of more and more #RWA US stock tokenization platforms, crypto investors have new options. As the saying goes: "People move to survive, trees move to die." With the recent US earnings season, there are certainly some good opportunities.

It is worth mentioning that among the many #RWA US stock tokenization platforms, #Bitget has recently launched the "US Earnings Season 0 Trading Fee Promotion," which is worth trying. 🧐

As we all know, every earnings season is the golden period of the greatest volatility in the US stock market. The market is like a roller coaster, especially for technology and #AI stocks. Volatility = opportunity, which is a very good time for us short-term, swing, and even medium-term investors.

Moreover, the most crucial aspect is "0 trading fees," which effectively increases the yield. Currently, it supports 103 mainstream US stocks, covering basically all popular stocks. Traditional brokers charge several dollars in fees for buying and selling US stocks, especially for high-frequency or short-term trading, which creates significant cost pressure. #Bitget has eliminated trading fees, effectively returning the profit margin to users.

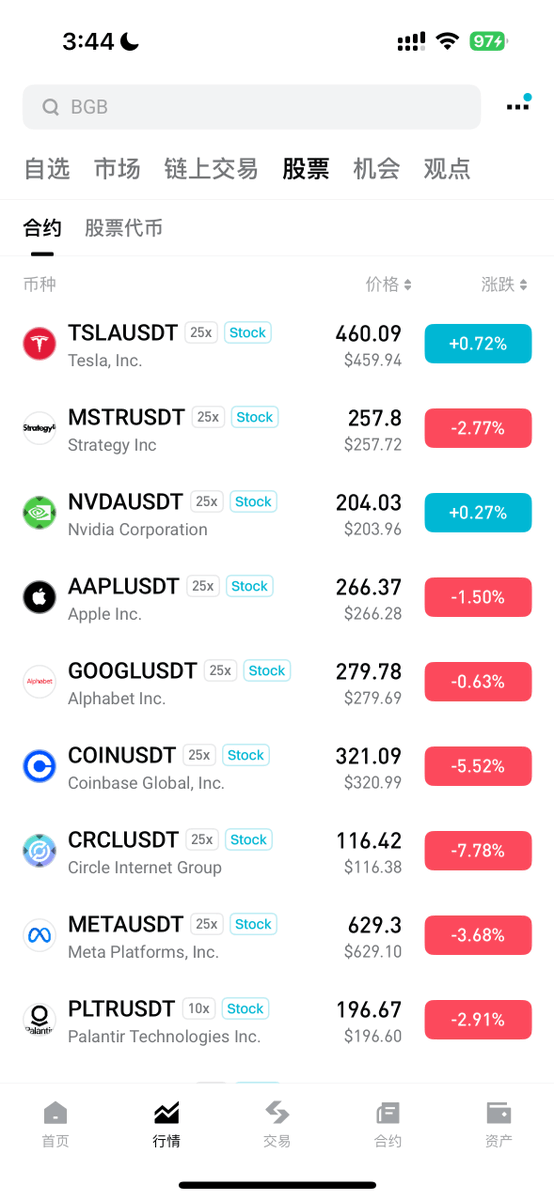

Finally, in today's #RWA platforms, liquidity is a core test of their value. #Bitget's US stock tokens are not the kind of "shadow assets" on the blockchain; they are directly connected to the US stock market liquidity through #Ondo, with prices, depth, and transaction speed synchronized with NASDAQ and NYSE. Simply put, when you buy $TSLA, $NVDA, or $AAPL on #Bitget, its price depth is completely consistent with the real US market. I have tried other platforms before, and when I wanted to take a short wave, I was slipped by 3%, which was a total loss. On #Bitget, I have personally tested it and found basically no slippage, with depth visibly solid.

Participation link🔗: https://partner.hdmune.cn/bg/3A41EU

Overall, the trend of #RWA tokenization is becoming increasingly evident, and it can be said to be a grand wave; those who follow it will prosper, while those who resist will perish. With various platforms competing, I believe this is a good opportunity, just like the initial DEFI Summer. Only with more and more people entering the market can #RWA grow and thrive. This time, #Bitget's 0 trading fee US stock promotion is a significant investment, not just a promotional gimmick, but a real effort: it improves the risk-reward ratio for short-term trading; provides the optimal execution experience for on-chain US stock trading; and allows crypto investors to participate in the fluctuations of the real US stock market without barriers. This opportunity should not be missed! I also look forward to more real-world applications of "asset on-chain" accelerating to fruition in the future. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。