In the past week, the cryptocurrency market has experienced a sharp price decline, with several mainstream and smaller coins dropping to recent lows. The price of Bitcoin (BTC) has fallen below the $104,000 mark again, while the decline of altcoins has been even more severe, leading to a significant drop in market confidence. This crash has sparked widespread discussion among industry investors and analysts. So, why has the crypto market seen such a drastic drop? What are the underlying reasons behind this? Let’s break it down.

First: Low Sentiment and Confidence, Market Recovery Requires Time

Market sentiment determines the price floor and ceiling, and the current situation is clearly at a confidence low. The October 11 crash not only led to a sharp decline in market liquidity but also caused many short-term investors to choose to temporarily withdraw and observe, further driving market sentiment down to freezing point. After a long period of highs and activity, the market needs time to digest previous capital flows and price fluctuations, and new supportive signals have yet to emerge, while signs of large-scale capital inflows remain unclear.

Clearly, the low point is also caused by market participants' concerns about the macro environment, such as global economic uncertainty and geopolitical risks, which have intensified investors' defensive psychology. Negative sentiment and capital outflows create a short-term vicious cycle, and to truly shift towards a healthy recovery track, the market will need to undergo a period of emotional repair, from rebuilding investor confidence to increasing active participation.

Moreover, the overall market performance is also profoundly influenced by the next round of policy news. Adjustments in tariff policies, macroeconomic data, and capital movements may collectively determine when the market can regain momentum, but this process is expected to be far from short. The market may face a longer period of low volatility consolidation, and a genuine warming of sentiment will require clearer positive signals, such as the re-entry of mainstream capital and improvements in the macroeconomic situation.

Second: Cooling Institutional Demand, Intensifying Sell-off Tidal Effect

One of the main driving forces behind cryptocurrencies comes from institutional funds, and the movement of institutional capital often has a decisive impact on market trends. However, the volume of institutional buying of Bitcoin has noticeably decreased recently. The previously marked continuous accumulation behavior has gradually weakened in recent weeks, leading to a reduction in market support.

As global economic uncertainty intensifies, institutional funds have begun to shift towards traditional safe-haven assets, such as gold and U.S. Treasury bonds, reducing their overall allocation to crypto assets. Under the influence of large-scale capital flows, the market has formed a "tide-out effect," where the withdrawal of major funds further reduces market liquidity and triggers a large number of traders' stop-loss liquidations. This phenomenon has been exacerbated by the leverage amplification effect in the market, resulting in the recent wave of crashes.

Third: Awakening of Dormant Funds, Concentrated Release of Sell-off Pressure

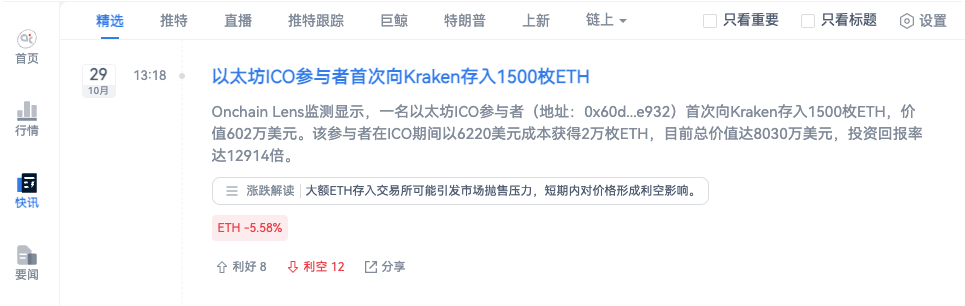

Wallet addresses that have been dormant for a long time are becoming active, with large amounts of funds being transferred to exchanges. This indicates that some long-term holders or early whales who entered the market have chosen to take profits at this stage. Data shows that the inflow of funds from cold wallets to exchanges has recently reached a peak, directly leading to the market beginning to release sell pressure.

Rather than viewing this round of sell-off as a panic reaction, it can be interpreted as a rational adjustment of capital. Many investors, after experiencing significant gains over the past two years, have chosen to cash out when the market situation is unclear, and their actions have further altered the balance of power between buyers and sellers, prompting more short-term investors to follow suit in selling.

This phenomenon reflects a market psychology: the active concentrated release of funds has a more profound long-term impact on the market than panic, and it is also one of the necessary processes for the market to gradually enter a low-volatility state.

What Insights Can We Draw From This?

Long-term investors need to adjust their mindset: The crash does not signify the end of the market but may represent a reshuffling and adjustment of capital and prices. For investors who are optimistic about long-term value, the market's low point provides an opportunity for reallocation.

Short-term traders should pay attention to liquidity changes: Low market liquidity often accompanies increased risks, and short-term operations should avoid high-leverage trading to adopt more robust capital management strategies.

Focus on market bottom signals: The return of capital and the restoration of confidence are key to the market's rebound. If we can see long-term capital re-entering or a gradual improvement in market sentiment, it may signal the start of a new market cycle.

Looking Ahead: A Cooling Period After the Crash

The current crash market reflects a certain degree of maturity in the crypto space. The cooling period after deleveraging is not only a process of self-adjustment for the market but also a window for investors to reassess risks and opportunities. Although the market remains volatile in the short term, it is foreseeable that after sufficient emotional digestion, the cryptocurrency market still possesses long-term attractiveness.

The crash may just be a necessary stage in the growth process of the crypto market, and for investors who truly understand value, this may well be the starting point for a new market cycle.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group:

https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group:

https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。