Why recently encouraging everyone to take more rest? Today, let's talk about the core reasons behind it and some potential issues triggered by the government shutdown.

In the past few days, everyone has felt that the market atmosphere is not quite right—whether it's stocks, commodities, or cryptocurrencies, everything is falling. If you take a look at the market, you'll find that it's not just one country or sector that's having problems, but a global sell-off of risk assets. Tonight, U.S. stocks have plummeted (as shown in the image below).

On the surface, didn't the Federal Reserve just cut interest rates on October 30? Logically, a rate cut should mean "easing," and market liquidity should be more relaxed, leading to a rebound in asset prices. Instead, the opposite has happened—the market has tightened. To clarify this, we need to discuss the root of "liquidity."

💧 Liquidity suddenly tightens: Less money leads to market panic

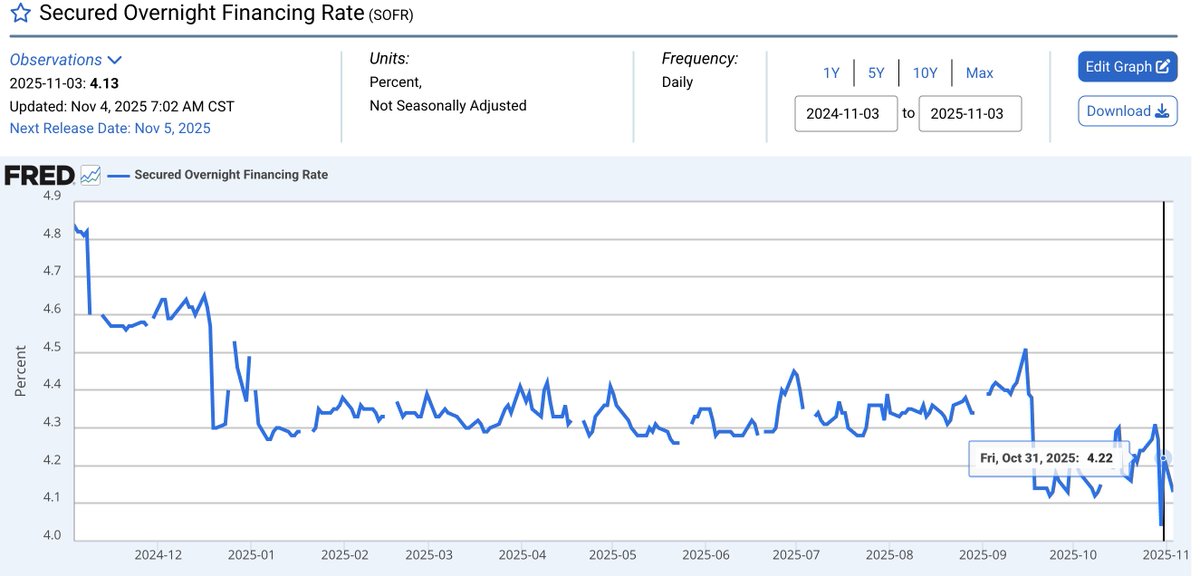

Let's look at a very key indicator—the Secured Overnight Financing Rate (SOFR), as shown in the image below.

This essentially represents the "short-term borrowing cost" in the U.S. financial system, equivalent to the "overnight lending rate" between banks and institutions. Normally, after the Federal Reserve cuts interest rates, this rate should also decrease.

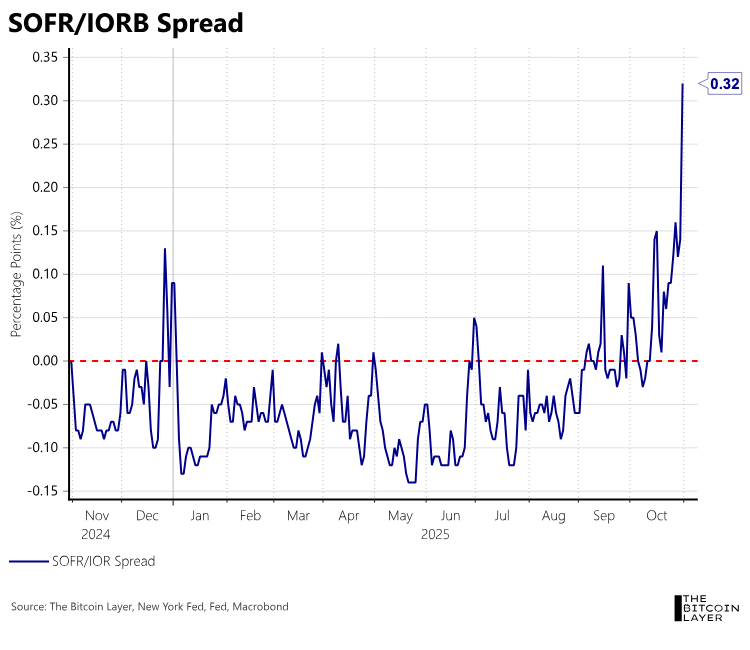

However, it has instead surged to 4.22%, which is 32 basis points higher than the Federal Reserve's set reserve rate (as shown in the image below). This is the largest "decoupling" since the COVID crisis in 2020. What does this mean? It means the banking system is short on cash.

During the 2020 crisis, it was a sudden pandemic and global panic, with everyone scrambling for cash. This time, it's not a natural disaster but a man-made liquidity crunch, primarily caused by the government shutdown.

🧱 Core source: U.S. government shutdown + Federal Reserve still reducing its balance sheet

Let me first talk about the "culprit" this time—the U.S. government shutdown.

The U.S. government has now been shut down for 35 days, tying the record for the longest shutdown in history (the last time was also during Trump's administration at the end of 2018).

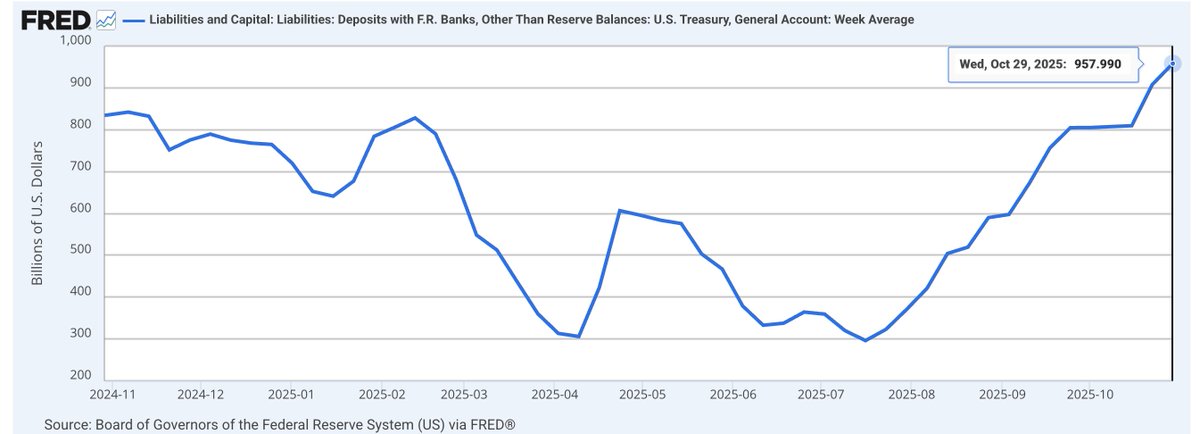

After the government shutdown, the Treasury has no new budget or revenue sources, but it still needs to maintain basic national operations, such as military salaries, healthcare, and social welfare… What to do? It can only "suck blood" from the market—issuing short-term government bonds to borrow as much cash as possible from the market (as shown in the image below, the Treasury has nearly $1 trillion in reserves).

At the same time, although the Federal Reserve has cut interest rates, it has not stopped reducing its balance sheet (which means withdrawing dollars from the market). Powell stated that the balance sheet reduction will officially end on December 1.

The result is: on one hand, the Treasury is sucking money; on the other hand, the Federal Reserve is also collecting money. These two "money-devouring beasts" are working together to drain market liquidity.

⚠️ Consequences: Risk assets under pressure, money fleeing to safe-haven assets

When there is a shortage of dollars in the market, institutions will sell off their stocks, commodities, and cryptocurrencies to exchange for cash or short-term government bonds.

So you will see recently: the S&P 500 and U.S. stock futures have started to decline; #BTC and #ETH are falling in sync; even gold and oil can't hold up.

This drop is not due to a deterioration in fundamentals but is purely a liquidity issue.

It can be understood as—"It's not that I don't have confidence, but I need to pay off my debts first."

📝 This time is different from 2020: This is a controllable "man-made tension"

The liquidity collapse in 2020 was due to global panic and the sudden pandemic, with no one knowing where the bottom was. This time is different; it is highly controllable—because it is caused by the government shutdown and balance sheet reduction.

So as long as: the U.S. government reopens, and the Treasury no longer needs to hoard cash; or the Federal Reserve ends balance sheet reduction early, releasing liquidity.

If liquidity can return immediately, the market is likely to rebound quickly. The Treasury still has nearly $1 trillion in cash reserves (the highest since 2021), and once the government resumes normal operations, this money will flow back into the market, almost like an "instant recovery."

📈 My own strategy and advice: This cannot be considered a true "crisis"; it can be understood as a "liquidity misfire." Currently, there is no need to panic too much; this wave of decline is not due to issues with corporate profits, technological prospects, or #AI innovations, but rather a lack of money in the market.

Therefore, my approach is: in the short term, I will control my positions and not push too hard; keep cash and observe the progress of the U.S. government; if I see the Treasury resuming spending and the Federal Reserve softening its tone, I will increase my positions in tech stocks, #AI, and #BTC, which are more elastic. Because once liquidity returns, these risk assets will be the first to be sought after by funds. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。