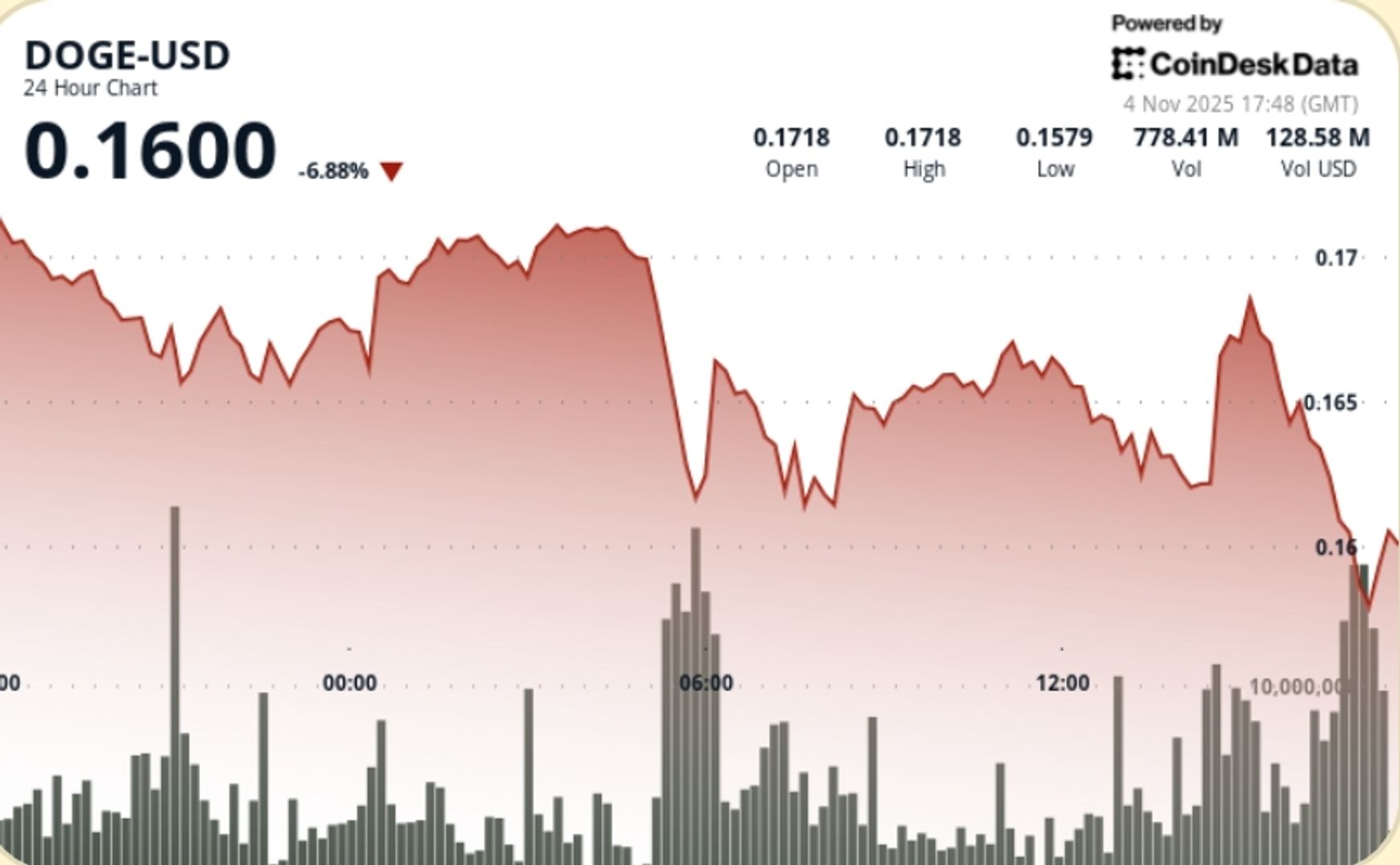

Dogecoin slid 6.7% to $0.1605 over the last session, cracking key $0.17 support as large players exited into weakness. Volume spiked ~76% above the seven-day average, reinforcing a clear distribution signal rather than emotional retail flow. Bears now control structure with $0.16 acting as the next battleground.

What to Know

• DOGE fell from $0.1719 to $0.1605, losing 6.7%

• Volume jumped 76% above weekly average; one 1.44B-token spike capped recovery

• Final-hour cascade flushed price to $0.1600 on 59M DOGE block sell

• Underperformed CD5 by ~1.4% → token-specific weakness

News Background

The move extends a multi-session unwind driven by whale rotation out of meme exposure and tightening liquidity across alt majors. A 1.44B DOGE wall near $0.1702 rejected buyers during the morning defense attempt, triggering algo-led stops and accelerating the leg down. That failure now marks decisive overhead resistance as traders fade strength until trend confirmation flips. Broader flows show reduced leverage and concentration in BTC, leaving DOGE bid-light as macro jitters weigh on higher beta plays.

Price Action Summary

• Initial fade from $0.1719 stalled near $0.1650 → then cascade into $0.1600

• Largest liquidation: ~59M DOGE dumped between 16:20–16:25

• Session climax confirmed by sideways drift + volume collapse post-flush

• Highest wick rejection at $0.1702 after 1.44B DOGE turnover (~158% above 24h avg)

• Low printed at $0.1600; late-session stabilization but no strong bounce

Technical Analysis

• Trend: Lower-high structure, bearish continuation bias

• Support: $0.1600 initial defense; next liquidity pocket $0.1550–$0.1500

• Resistance: $0.1630 tactical cap; $0.1702–$0.1714 firm supply zone

• Volume: Conviction selling — 158% spike at rejection confirms distribution

• Structure: Breakdown below $0.17 invalidates prior consolidation base

• Momentum: Oversold readings developing but no reversal signal — risk of drift grind lower without catalyst

What Traders Are Watching

• Can $0.1600 hold into U.S. hours or do funds force a wick toward $0.1550–$0.1500

• Return of spot bids vs continued whale net-outflow behavior

• Whether CD5 stabilizes — DOGE lagging increases fragility

• Reaction to any bounce attempts into $0.1630 and $0.1700 supply zones

• Liquidity behavior if BTC volatility picks up again

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。