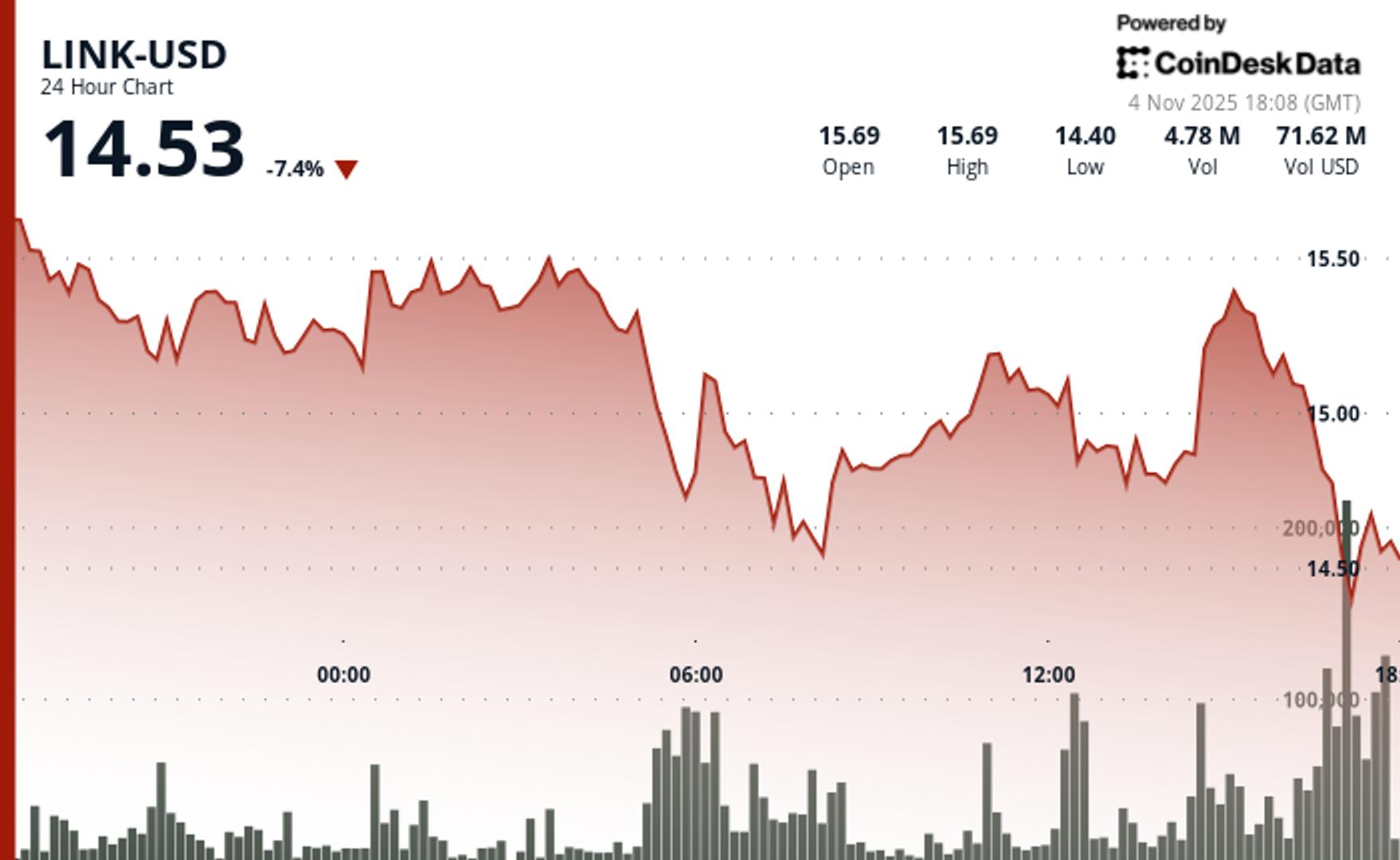

Native token of oracle network Chainlink broke through key technical support levels on Tuesday, dropping 6% to below $14.50, CoinDesk data shows.

The decline accelerated on massive volume that surged 57.81% above the seven-day average, signaling aggressive distribution rather than thin-market selling, CoinDesk Research's technical analysis model noted.

The weak price action went down despite major institutional partnership announcements that would typically fuel rallies.

Swiss banking giant UBS completed the world's first end-to-end tokenized fund transaction using Chainlink's Digital Transfer Agent standard. Meanwhile, FTSE Russell announced plans on Monday to bring Russell 1000, 2000, and 3000 indices onto blockchain rails tapping Chainlink's DataLink services.

Technical Weakness vs Banking Adoption: What Traders Should Watch

With major partnerships failing to prevent the support breakdown, LINK demonstrates how short-term technicals often override fundamental developments.

The decisive break below the $15.26 support level occurred during morning trading on exceptionally high volume of 4.69 million tokens, establishing a clear descending channel that accelerated into the close.

The final trading hour proved particularly destructive as LINK crashed from $15.22 to $14.70 on massive volume exceeding 3.5 million tokens. The breakdown confirmed the broader bearish structure while potentially creating oversold conditions for any recovery attempt.

Key Technical Levels Signal Further Downside for LINK

- Support Zones: Critical test at $14.50-$14.60 demand zone following breakdown.

- Volume Analysis: 57.81% surge above seven-day average validates breakdown move.

- Chart Patterns: Descending channel formation confirms bearish momentum shift

- Targets & Risk: Further weakness toward $14.00 likely before stabilization occurs.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。