Author: Chilla

Translator: Block unicorn

Preface

There is a principle in behavioral economics regarding mental accounting. People's attitudes towards money can vary depending on where it is stored. One hundred dollars in a checking account feels freely disposable, while one hundred dollars in a retirement account feels untouchable. Although money itself is interchangeable, its storage location can influence your perception of it.

Frax founder Sam Kazemian refers to this as "net worth theory." People tend to place their spending money where most of their wealth already exists. If your wealth is primarily concentrated in a Charles Schwab stock and bond account, you will want to keep your dollars in the associated bank account because transferring funds between the two is very convenient. If your wealth is mainly in an Ethereum wallet and DeFi positions, you will want your dollars to interact with the DeFi world just as easily.

For the first time in history, a significant number of people are keeping the vast majority of their wealth on-chain. They are tired of constantly transferring money through traditional banks just to buy a cup of coffee.

New crypto banks are addressing this issue by building platforms that integrate all functions in one place. With these platforms, you can save money using interest-bearing stablecoins and spend with a Visa card without needing to touch traditional bank accounts.

The rapid growth of these platforms is a response to the market's realization that cryptocurrencies finally have enough real users and sufficient on-chain real funds, making it worthwhile to build such platforms.

Seamless Integration of Stablecoins into Daily Spending

For over a decade, cryptocurrencies have promised to eliminate intermediaries, reduce fees, and give users more control. But there has always been one problem: merchants do not accept cryptocurrencies, and it is impossible to convince all merchants to accept them simultaneously.

You cannot pay your rent with USDC. Your employer will not pay your salary in ETH. Supermarkets do not accept stablecoins. Even if you invest all your wealth in cryptocurrencies, you still need a traditional bank account to live normally. Each exchange between cryptocurrency and fiat incurs fees, settlement delays, and friction.

This is why most crypto payment projects have failed. BitPay tried to get merchants to accept Bitcoin directly. The Lightning Network built peer-to-peer infrastructure but faced challenges in liquidity management and routing reliability. Both failed to gain significant adoption because the conversion costs were too high. Merchants need to be sure that customers will use this payment method. Customers need to be sure that merchants will accept this payment method. No one wants to be the first to act.

New crypto banks hide the coordination problem from view. You spend stablecoins from your self-custodied wallet. The new bank converts the stablecoins into dollars and settles with merchants via Visa or Mastercard. Coffee shops receive dollars as usual. They are unaware of the cryptocurrency transactions involved.

You do not need to convince all merchants to accept cryptocurrencies. You just need to simplify the conversion process, allowing users to pay with cryptocurrencies at any merchant that accepts regular debit cards (which is basically everywhere).

Three pieces of infrastructure will mature simultaneously in 2025, making this possible after years of failed attempts.

First, stablecoins have been legitimized. The GENIUS Act, passed in July 2025, provides a clear legal framework for stablecoin issuance. Treasury Secretary Scott Benset predicts that by 2030, the transaction volume of payments using stablecoins will reach $3 trillion. This is equivalent to the U.S. Treasury officially announcing that stablecoins have become part of the financial system.

Second, card infrastructure has been commoditized. Companies like Bridge provide out-of-the-box APIs that allow teams to launch complete virtual banking products within weeks. Stripe acquired Bridge for $1.1 billion. Teams no longer need to negotiate directly with card networks or build banking partnerships from scratch.

Third, people now truly hold wealth on-chain. Early attempts at cryptocurrency payments failed because users did not hold significant amounts of crypto net worth. Most savings were kept in traditional brokerage accounts and 401k retirement plans. Cryptocurrencies were seen as speculative tools rather than places to store a lifetime of savings.

Now, the situation is different. Young users and crypto-native users hold significant wealth in Ethereum wallets, staking positions, and DeFi protocols. People's mental accounts have shifted. Keeping funds on-chain and spending directly from on-chain is much easier than converting them back to bank deposits.

Products and Their Functions

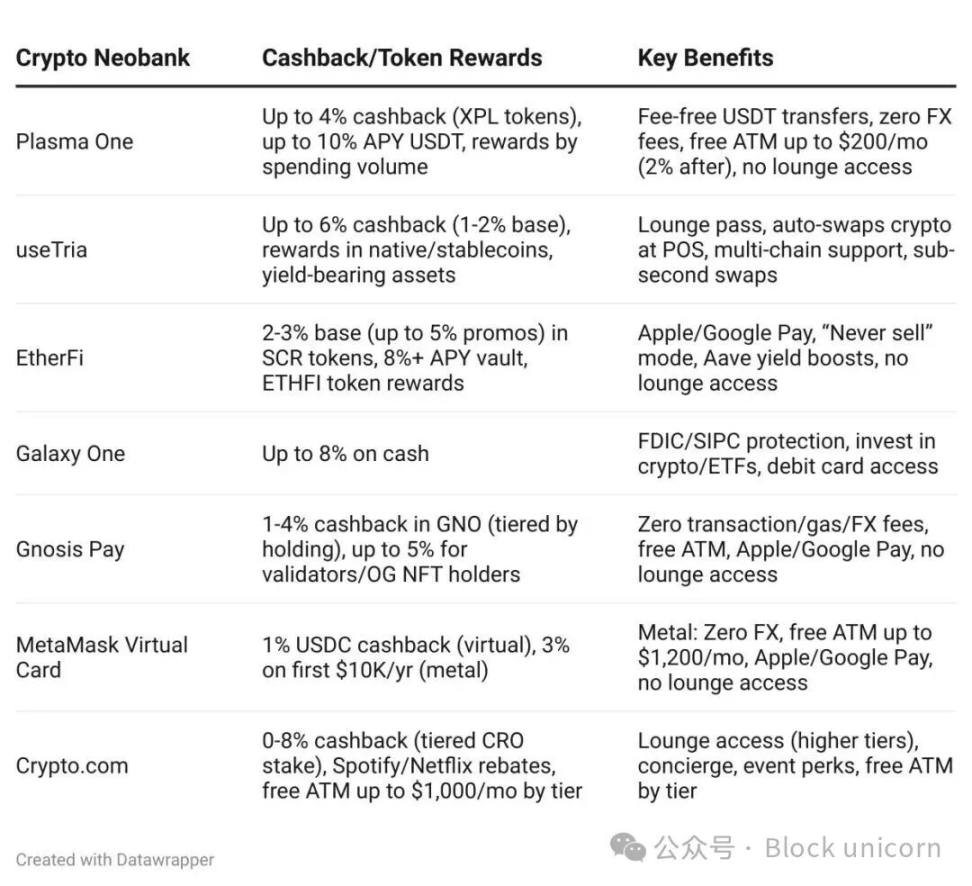

The differences between new crypto banks primarily lie in yield rates, cashback rates, and geographic coverage. However, they all address the same core issue: enabling people to use their cryptocurrency assets without relinquishing self-custody or frequently converting them into bank deposits.

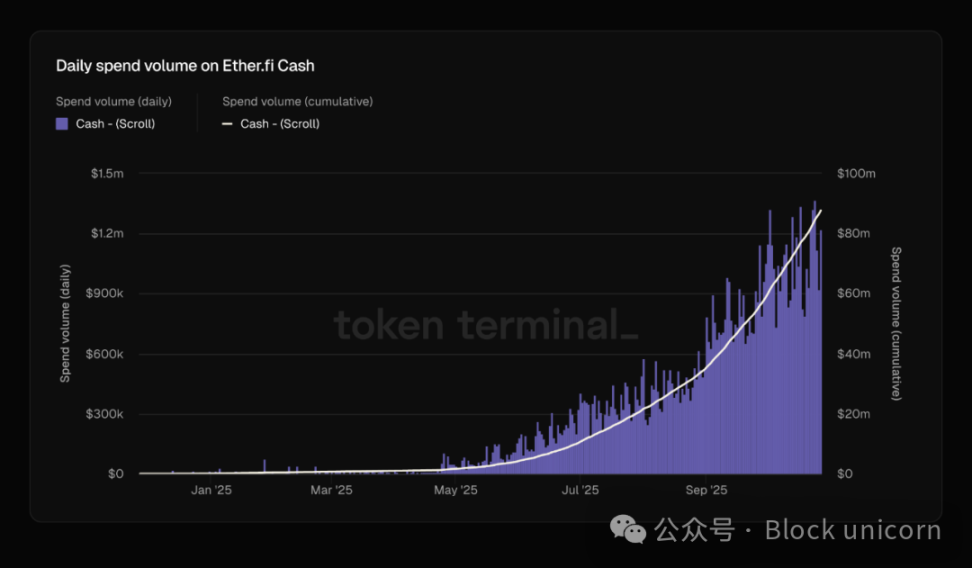

EtherFi processes over $1 million in credit card spending daily, having doubled in the past two months. Similarly, the issuance and destruction rates of Monerium's EURe stablecoin have also seen significant growth.

This distinction is crucial because it indicates that these platforms are facilitating real economic activity, not just speculation between cryptocurrencies. Funds are flowing out of the crypto circle and into the broader economic system.

That bridge that has always been missing has finally been built.

In the past year, the competitive landscape has changed dramatically. Plasma One launched as the first stablecoin-native new bank, focusing on emerging markets with limited access to dollar acquisition channels. Tria, built on Arbitrum, offers self-custody wallets and gas-free transactions. EtherFi has evolved from a liquidity re-staking protocol into a mature new bank with a total value locked (TVL) of $11 billion. Mantle's UR prioritizes Swiss regulation and compliance, targeting the Asian market.

With various strategies, they all solve the same problem: how to allow on-chain wealth to be spent directly without spending time dealing with traditional banks?

New crypto banks, even if smaller in scale, can still compete for another reason: the users themselves are more valuable. The average checking account balance for Americans is about $8,000. In contrast, crypto-native users often conduct six-figure or even seven-figure transactions across different protocols, blockchains, and platforms. Their transaction volume is equivalent to that of hundreds of traditional bank customers combined. This fundamentally changes the traditional unit economics. New crypto banks do not need millions of users to be profitable; they only need thousands of the right customers. Traditional banks pursue economies of scale because the revenue from each customer is limited. In contrast, new crypto banks can build sustainable businesses even with a smaller user base because each customer’s value in transaction fees, exchange fee income, and asset management is 10 to 100 times that of traditional banks. Everything changes when ordinary users no longer deposit their $2,000 paycheck twice a month like they do with traditional banks.

Each new crypto bank has independently built the same architecture: separate spending and savings accounts. Payment stablecoins like Frax's FRAUSD, backed by low-risk government bonds, aim for widespread adoption to simplify merchant integration. In contrast, yield-bearing stablecoins like Ethena's sUSDe optimize returns through complex arbitrage trades and DeFi strategies that can generate annualized yields of 4-12%, but their complexity exceeds merchants' assessment capabilities. A few years ago, DeFi attempted to merge these categories, assuming all assets were yield-bearing, but later found that the friction caused by merging these functions far outweighed the problems they solved. Traditional banks separate checking and savings accounts due to regulatory requirements. Cryptocurrencies are fundamentally re-examining this separation because you need a payment layer that maximizes acceptance and a savings layer that maximizes yield. Trying to optimize both simultaneously only harms both.

New crypto banks can offer yields that traditional banks cannot match. They leverage the government bond yields that back stablecoins, simply adding a payment process for compliance. Traditional banks cannot compete on interest rates because their cost structures are fundamentally higher, due to expenses like physical branches, legacy systems, and compliance overhead. New banks eliminate all these costs and pass the savings back to users.

The cryptocurrency space has seen multiple attempts to build payment systems. What is different this time?

This time is different because all three necessary conditions are finally in place simultaneously. The regulatory framework is clear enough, banks are willing to participate; the infrastructure is mature enough for teams to deliver products quickly; and most importantly, the number of on-chain users is sufficient, and their wealth is substantial enough to ensure market viability.

People's mental accounts have shifted. In the past, people stored wealth in traditional accounts and speculated with cryptocurrencies. Now, people store wealth in cryptocurrencies and only convert it to fiat when they need to spend. New banks are building the infrastructure to accommodate this shift in user behavior.

Money has always been the story we tell about value. For centuries, this story required intermediaries to validate it—banks kept the books, governments backed the currency, and card organizations processed transactions. Cryptocurrencies promised to rewrite this story without intermediaries, but it turns out we still need someone to bridge the old and new narratives. New banks may play such a role. What is fascinating is that in building the bridge between two monetary systems, they are not creating something entirely new. They are merely rediscovering patterns that emerged a century ago because these patterns reflect the fundamental nature of humanity's relationship with money. Technology is constantly changing, but the story we tell about what money is and where it should exist remains surprisingly unchanged. Perhaps this is the real lesson: we thought we were disrupting finance, but in reality, we were just moving wealth to places that align with existing narratives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。