Author: @0xkyle

Translation: AididiaoJP, Foresight News

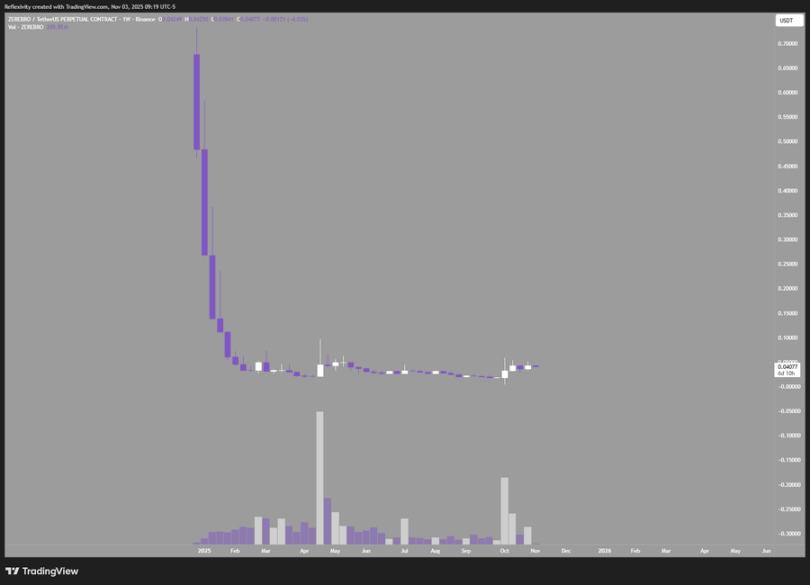

As a trader, the core goal is always to seek high-confidence investment opportunities with asymmetric return potential. I am passionate about uncovering these high-risk, high-reward trades, such as Solana at $20, Node Monkes at 0.1 BTC (which later rose to 0.9 BTC), and Zerebro with a market cap of $20 million, among others.

However, such asymmetric opportunities are increasingly rare today. There are many reasons for this, which together form a large and tricky problem.

Take this chart as an example; it shows Zerebro, which skyrocketed from a $20 million market cap to a peak of $700 million, yielding a 30x return; but it also fell 99% from its peak, almost back to its original starting point.

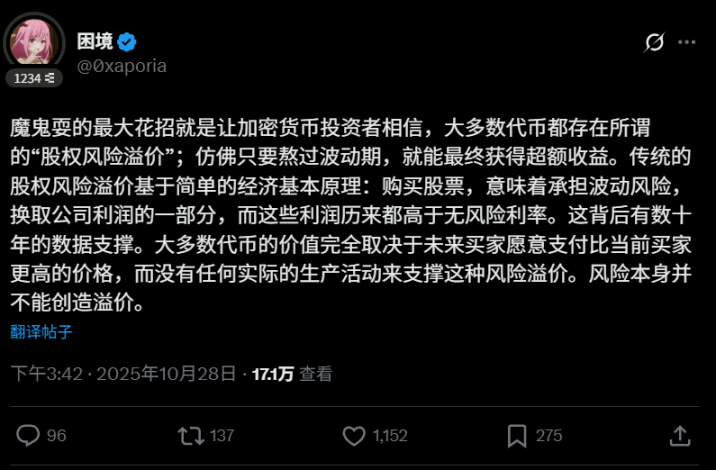

This leads to the first question: It is well known that most tokens in this industry "eventually need to be sold off." This creates a vicious cycle that hinders the generation of long-term appreciating assets. Over 90% of crypto assets are essentially driven by speculation, but pure speculation is not a perpetual motion machine; when market participants lose interest or cannot continue to profit, speculative demand will fade. User @0xaporia's tweet hits the nail on the head:

The second issue is the structural flaws in the crypto market. The pinning incident on October 10 fully exposed this: major exchanges caused significant losses for a large number of users, with over $40 billion in open contracts evaporating in an instant, teaching all participants a financial lesson: if there is a possibility of error, it will definitely occur. This risk makes institutions and large funds hesitant; if there is a risk of going to zero, why take the chance?

The third and fourth issues have existed for a long time: first, the daily issuance of new tokens is rampant, and second, the initial valuations of these tokens are excessively high. Each new project dilutes the overall market liquidity, and high-valuation issuances compress the profit space for public market investors. Of course, you can choose to short, but if the entire industry relies on shorting for profit, it is not a good thing in the long run.

There are other issues not mentioned, but the above points are the most noteworthy. Returning to the main topic of this article: why are asymmetric opportunities hard to find in the current crypto market?

- High-quality projects are issued at excessively high valuations, with prices fully or even overly reflecting expectations.

- The flood of token issuances dilutes value; today a perfect L1 appears, and tomorrow another one emerges, raising doubts about their legitimacy.

- The rapid iteration speed of the industry makes it difficult to establish long-term investment beliefs; leading projects may lose their advantages within a year.

- Market structure issues hinder capital entry; investors demand higher returns to compensate for the risk of going to zero, and if actual returns are insufficient, the investment logic collapses.

Most critically, the majority of tokens are essentially just financing tools; selling tokens raises funds for operations, while true value is concentrated in equity. These tokens, which lack value accumulation and do not represent company equity, are essentially just speculative tools akin to a game of hot potato, rather than true investments.

These are not new viewpoints. Why do I reiterate them? Because despite being well-known, no one changes their investment approach. People continue to chase new narratives and hype new trends, repeating ineffective strategies. This is akin to the definition of madness: repeating the same behavior while expecting different results.

I am always in pursuit of the next asymmetric opportunity. If one follows the rules, they can only achieve mediocre returns. I believe the next asymmetric opportunity in crypto lies in:

- Mining yields

- Equity investments in blockchain companies

- Exchange platform tokens

- Finding severely undervalued assets, which do exist but are rare.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。