Bitcoin fell below $100K on Tuesday for the first time since May 2025. Liquidations across the broader crypto market topped $2 billion. How did a privacy-focused second-generation cryptocurrency like zcash (ZEC) manage to escape the carnage relatively unscathed with a 38% weekly gain to boot? There probably isn’t one single answer, but perhaps a chance meeting between Arthur Hayes, co-founder of crypto derivatives firm Bitmex and Naval Ravikant, co-founder of fundraising platforms AngelList and Coinlist, sparked a historic ZEC rally that on Tuesday evening, left traders scratching their heads.

“Sat next to @naval at dinner,” Hayes tweeted. “He shilled me $ZEC. I aped. All my brokers said I couldn’t trade, so I had to have it.”

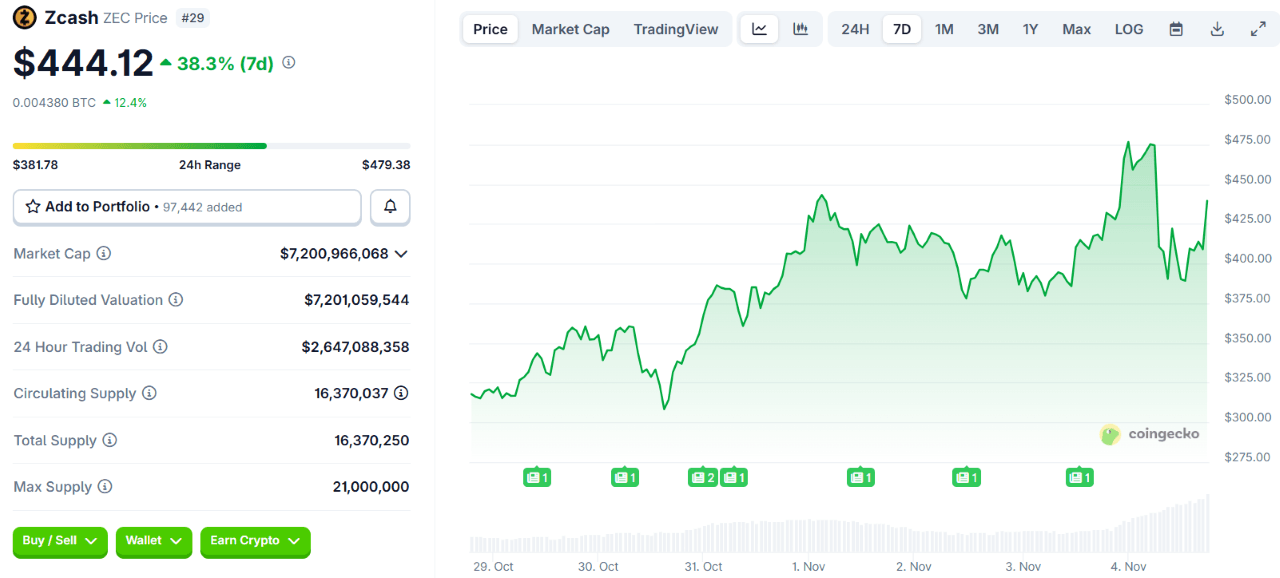

That was on October 2, 2025. The following four weeks saw the cryptocurrency climb roughly 160%, according to data from Coingecko. Hayes has now turned into zcash’s loudest cheerleader and predicted the digital asset will skyrocket all the way to a dizzying $10,000. “Nothing stops this train,” Hayes tweeted “$ZEC to $10k.” He posted that prediction twice, sending the digital asset up 30% the first time, then 15% higher a few days later.

(Zcash is up nearly 40% for the week, while almost all other major cryptocurrencies are showing double-digit negative returns.)

Others have pointed to positive developments within the zcash community and increased demand for privacy-centric assets as additional catalysts. Earlier this year in August, Zooko Wilcox, former CEO of Electric Coin Company, the original creator of zcash, joined Shielded Labs, an independent zcash affiliate, to work on advancing the cryptocurrency’s transition to a hybrid proof-of-stake (PoS) consensus mechanism. Then in September, Europeans began to get increasingly antsy about the possible introduction of a central bank-issued digital euro as early as 2029. Such a move would be a paradigm shift in the realm of monetary policy because the European Central Bank would be able to issue currency directly to digital wallets belonging to EU residents without the need for retail banks. What could possibly go wrong if a central government has direct access and maybe even control over the wallets of its citizenry?

Such concerns have created buying momentum for zcash, monero, and other privacy-focused digital assets, perhaps even more so than a few casual tweets. But even if Hayes’s and Ravikant’s serendipitous dinner conversation didn’t spark October’s zcash rally after all, it certainly poured gasoline on the fire.

“I don’t know much about markets or crypto trading, but to me this looks like evidence of something important happening,” Wilcox said on Tuesday. “I’d be interested to hear from a crypto markets expert weighing in on what, if anything, this means.”

- Why is Zcash surging while other cryptos crash?

A mix of celebrity hype, renewed interest in privacy coins, and technical upgrades has sent ZEC soaring 160% amid market turmoil. - Did Arthur Hayes cause the Zcash rally?

Many believe his viral tweets about buying ZEC after a dinner with Naval Ravikant helped ignite the rally. - What fundamentals are supporting Zcash’s rise?

The project’s shift toward a proof-of-stake model and leadership changes at Shielded Labs have boosted investor confidence. - Why are Europeans suddenly eyeing privacy coins?

Growing fears over a potential digital euro and government access to citizens’ wallets are driving demand for privacy-focused assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。