Crypto ETF Flows Turn Red Except for Solana’s $15 Million Surge

The red tide in crypto exchange-traded funds (ETFs) showed no signs of easing as investors pulled hundreds of millions from bitcoin and ether funds for a fifth straight day. Yet amid the selloff, solana’s ETFs continued to shine, small in scale but steady in sentiment, offering a glimmer of optimism in an otherwise bruised market.

Bitcoin ETFs faced another brutal trading day, with $577.74 million in outflows spread across seven funds. Fidelity’s FBTC bore the heaviest hit, suffering a massive $356.58 million withdrawal. Ark & 21Shares’ ARKB followed with $128.07 million in exits, while Grayscale’s GBTC lost $48.89 million.

Additional outflows came from Vaneck’s HODL (-$17.04 million), Valkyrie’s BRRR (-$11.34 million), Franklin’s EZBC (-$8.72 million), and Bitwise’s BITB (-$7.10 million). With a staggering $8.94 billion in trading volume, bitcoin ETF net assets fell sharply to $134.53 billion, marking one of the steepest drops in recent weeks.

Six days of straight inflows for solana ETFs.

Ether ETFs joined the exodus, losing $219.37 million across four funds. Blackrock’s ETHA led with $111.08 million in redemptions, trailed by Grayscale’s Ether Mini Trust at $68.64 million. Fidelity’s FETH and Grayscale’s ETHE both saw outflows nearing $20 million each. The day’s $4.15 billion in trading volume reflected continued investor uncertainty, pushing net assets down to $21.12 billion, a low not seen in weeks.

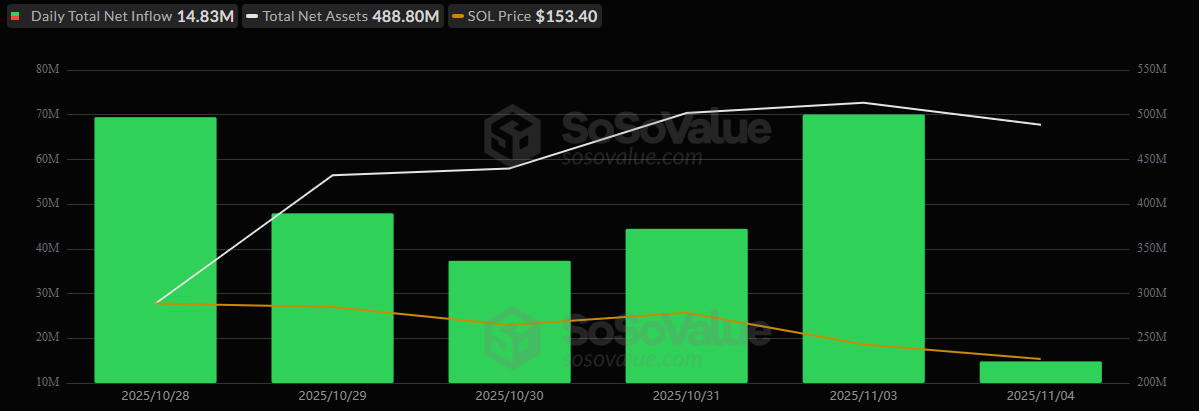

Meanwhile, solana ETFs kept their winning streak alive, attracting $14.83 million in fresh inflows. Bitwise’s BSOL pulled in $13.16 million, while Grayscale’s GSOL added $1.67 million, pushing total net assets to $488.80 million on $68.53 million in volume.

Even as bitcoin and ether ETFs face relentless outflows, solana continues to capture investor confidence, a quiet but telling signal of a potential shift in tides in the crypto ETF market.

FAQ📉

- Why did bitcoin and ether ETFs see massive outflows again?

Investors withdrew $797 million from bitcoin and ether ETFs as market sentiment stayed risk-off for a fifth straight day. - Why are solana ETFs still attracting inflows?

Solana ETFs brought in $15 million, showing continued investor confidence in its network despite broader crypto weakness. - Which funds were hit hardest by redemptions?

Fidelity’s FBTC and Blackrock’s ETHA led the outflows, losing $356 million and $111 million, respectively. - What does this mean for crypto ETF investors?

The data suggests capital is rotating away from bitcoin and ether toward alternative assets like solana for near-term exposure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。