Good evening everyone, I am Jiang Xin. The market has been very harsh these past few days, and some bullish traders and bottom fishers have been washed out by the market, including many whales and smart money. Looking back at the previous rebounds, they were very confident, thinking about the frustrations they endured during their time as short sellers, experiencing a role reversal. The market is tough, and there's no need to kick someone when they're down, after all, the cruelty of the market has exceeded my expectations.

Let's briefly review the intraday market trends. Starting from 11 PM on November 4th, Ethereum experienced a six-hour continuous bearish candle, with the price crashing from 3580 to around 3050, a drop of five hundred points in a single day. Meanwhile, Bitcoin fell from around 104800 to 98888, a position that is heavily sarcastic, dropping less than five thousand points. The process included two buying opportunities, with considerable trading volume, indicating that someone was defending the 100k level.

The three consecutive bullish candles at 9 AM and 7 PM, the former had reduced volume, while the latter had relatively small trading volume, can be inferred as just a process of short covering, as there was no stable recovery. The divergence around 101500 pushed higher, merely liquidating high-leverage short positions. After completing the rebound, the downtrend will continue. Ethereum's rhythm is still more aggressive than Bitcoin's; the one-hour three consecutive bullish candles at 5 AM rebounded quickly, already having short covering. The second bullish candle, which synchronized with Bitcoin, had reduced volume and faced pressure around 3350. The third bullish candle at 7 PM moved steadily, but there is still pressure.

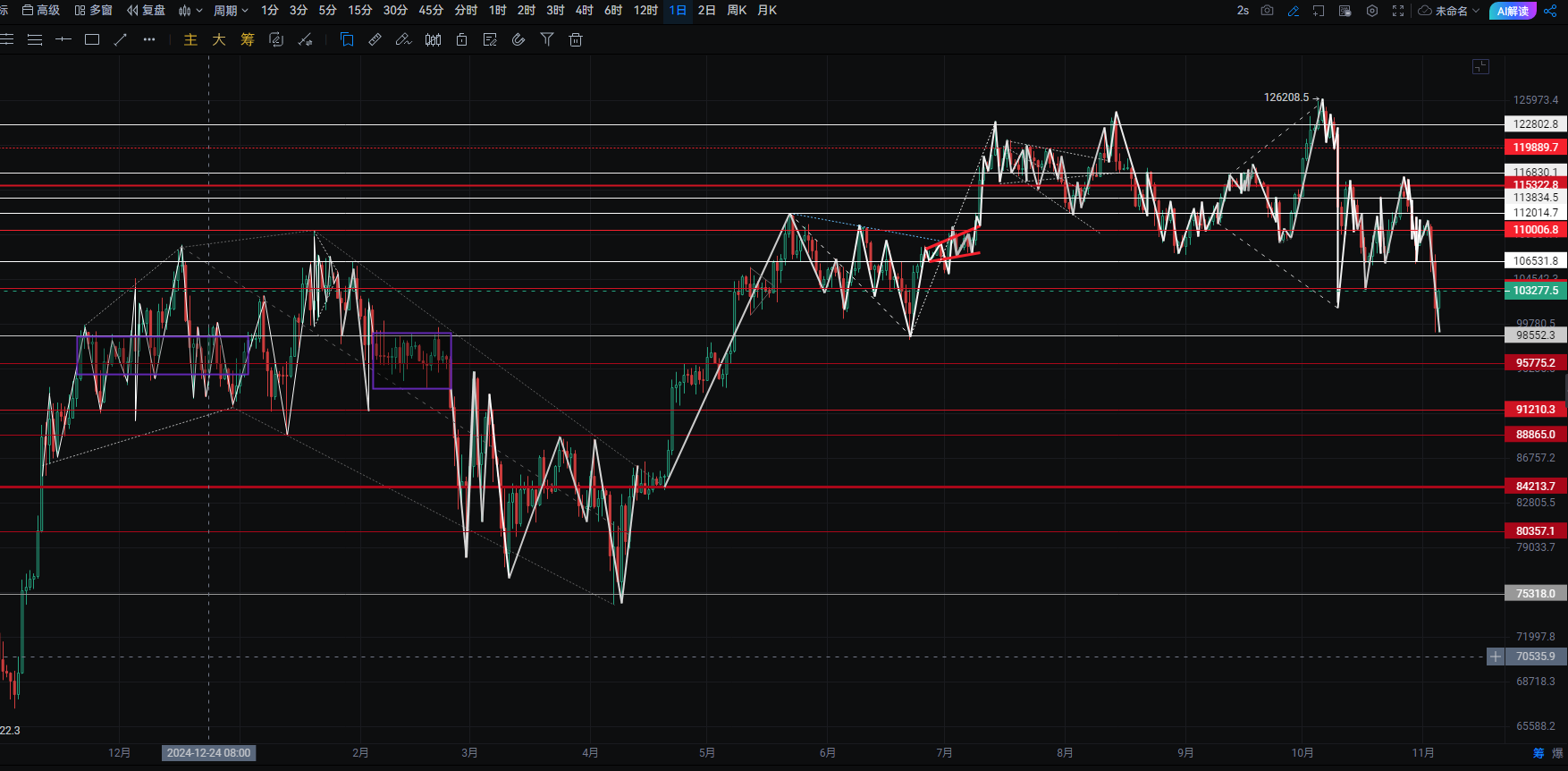

We continue the downtrend, treating the rebound process as a short opportunity. The important divergence points for Bitcoin and Ethereum are 101200, 102500, 103500 for Bitcoin, and 3175, 3250, 3300, 3350, 3380 for Ethereum. It is suggested to short Bitcoin at 103200, add at 104200, and set a stop loss at 104850. For Ethereum, short at 3350, add at 3380, and set a stop loss at 3420, or short heavier at 3380 with a stop loss at 3420. You can start with a bottom position at the current price, and the average price should be better than ours.

Looking at the medium term, we expect lower lows. In the short term, Bitcoin is looking at 100k, while Ethereum is testing around 3250. If it breaks down, it will test 3200 and oscillate around this range. Bitcoin's wave oscillation is around 100k-103200, while Ethereum oscillates conservatively between 3180-3380, handling segments according to emotional divergence points.

The morning rebound did not align with action and knowledge; otherwise, it would have been quite enjoyable.

If you want to follow Jiang's public account: Jiang Xin on Chan

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。