Prices reflect positions, while legal documents state facts.

Written by: Daii

Just now, Bitcoin has once again fallen below the $100,000 mark. That long bearish candle turned the volume on social media up to maximum:

Some say, "The algorithm was broken, so funds fled," while others directly translated "custody in the U.S." to "the U.S. cracked the private key." But prices can express emotions, yet they do not equate to stating facts.

This is not an article advocating for long or short positions—during the most glaring volatility, what should be done instead is to lay out the documents and set the timeline straight:

What exactly did the U.S. confiscate, how did they confiscate it, and does it have any relation to "the algorithm being compromised"?

Next, we will clarify the matter according to established points: first, untangle "the sequence of rumor ignition," then distinguish "algorithm vs access," and finally, using publicly available cases and procedures, answer a simple question—

Why did Chen Zhi's batch of coins go from personal self-custody to being under U.S. judicial supervision?

First, the timeline:

On October 10 (Friday), after the U.S. President announced new measures imposing a 100% tariff on Chinese imports, the leverage chain began to loosen; that night—leading into the next day—a chain reaction of forced liquidations occurred. Within 36 hours from October 10 to 11, approximately $19 billion in leveraged positions were wiped out, with Bitcoin briefly dropping to the $104,7xx range; Ethereum and small-cap coins fell even more sharply, and the market entered a "black weekend" narrative. (Reuters)

On October 11 (Saturday), the clearing records of exchanges and perpetual contract platforms were refreshed: the headline "historical largest scale forced liquidation in a single day" dominated news feeds and social media hot lists, with public sentiment focusing on "who triggered this round of liquidity crunch." (coinglass)

On October 14 (Tuesday), the U.S. Department of Justice (DOJ) unsealed an indictment: it accused Chen Zhi, chairman of the Prince Group, of conspiracy to commit telecommunications fraud and money laundering, and filed the largest civil forfeiture lawsuit in history against approximately 127,271 Bitcoins—stating that these Bitcoins were previously stored in "unhosted wallets," with the private keys held by Chen Zhi himself, and are now "under the custody of the U.S. government." On the same day, the U.S. Treasury's OFAC and the British government simultaneously issued extensive sanctions. (justice.gov)

In the 48 hours following October 14, several types of content conflated "custody in the U.S." with "being cracked by the U.S.":

- News aggregators and self-media simplified "unhosted wallets being judicially confiscated" to "the government cracked the private key." (For example, British media reports and secondary reprints repeatedly emphasized "127,271 BTC has been mastered by the U.S.," often omitting the legal context of "judicial confiscation/custody" when readers shared it.) (theguardian.com)

Community posts on trading platforms and forums attracted clicks with titles like "U.S. government wallet added 127,000 coins," and the comments section saw highly upvoted speculations of "the algorithm being broken," further amplifying the misunderstanding. (Reddit)

Urban media and portals highlighted "historical largest" and "already in U.S. custody" in their headlines, but readers often interpreted "gaining access/control" as "technically cracking Bitcoin." (cbsnews.com)

From October 15 to 21, contrary to the "de-leveraging" in the crypto market, gold reached a new historical high: after breaking $4,100 on the 13th, it surpassed $4,200 on the 15th, and by the 20th-21st, it briefly touched a peak of $4,381 per ounce, with the narrative quickly switching to "gold is safer." (Reuters)

On October 31 (Friday), Bitcoin recorded its first monthly decline in October since 2018.

Thus, many people hastily concluded: "The algorithm was compromised, so the coin price fell, and funds turned to gold." The reason this rumor "seems valid" is that price—news—fear has been pieced together into a false causal chain.

Now you should be very clear that this is a typical post hoc attribution fallacy and narrative stitching: the main reason for Bitcoin's decline is de-leveraging and liquidity withdrawal; the DOJ document speaks of access/control transfer, not algorithm compromise; gold's strength is more a result of macro risk aversion and interest rate expectations.

However, there is still one thing you may not yet understand: how exactly did the U.S. gain control over Chen Zhi's Bitcoin?

1|What exactly did the U.S. "break"?

If we look at the original indictment, the answer is almost self-evident:

The U.S. did not "break the algorithm," but rather obtained "access and control" over these coins.

In a press release on October 14, 2025, the DOJ stated that it filed the largest civil forfeiture in history against approximately 127,271 Bitcoins, clearly indicating that these assets are "currently in U.S. custody"—the wording points to custody and control, rather than "cracking the private key." The same document also noted that these Bitcoins were previously stored in unhosted wallets, with the private keys held by Chen Zhi himself, further indicating that access rights were transferred from the individual to law enforcement, rather than the algorithm being compromised.

The same day, accompanying actions also confirmed the narrative of "judicial and sanction pathways": the Treasury announced unprecedented joint sanctions against the Prince Group's transnational criminal organization, naming Chen Zhi and freezing a wide range of associated entities and channels; the British government simultaneously issued enforcement notices and asset freezing information. This is a typical "case pathway"—indictment + forfeiture + sanctions, which is entirely different logic and departmental division from "technical decryption." (home.treasury.gov)

More detailed facts are also in the official documents: the indictment and forfeiture complaint released by the Eastern District of New York U.S. Attorney's Office detailed the legal and evidentiary chain of "how to locate and claim forfeiture," but never claimed to have "reverse-engineered" the 256-bit private key through mathematical means. In other words, what was transferred was the "usage rights" of the key, not the "mathematics" of Bitcoin; "custody in the U.S." means custody and execution under judicial control, not "algorithm failure." (justice.gov)

Reverse-engineering Bitcoin private keys through mathematical means, while a dream for many, is fundamentally an impossible task on Earth before the advent of quantum computers.

2|Why is it nearly impossible to "break" Bitcoin?

First, let's clarify the material of Bitcoin's "door."

Bitcoin uses elliptic curve digital signatures, with the curve being secp256k1; a private key is a 256-bit random number, and the security of the signature is equivalent to solving an elliptic curve discrete logarithm. This is not a project that can be "cracked" just by maxing out a graphics card; it is a mathematical problem for which no known efficient algorithm can complete in a feasible time. The U.S. National Institute of Standards and Technology (NIST) has assessed the 256-bit elliptic curve as having a security strength equivalent to about 128 bits, which is considered a long-term acceptable strength baseline; and Bitcoin developer documentation also clearly states: the private key is 256 bits of random data, based on secp256k1 to generate public keys and signatures. (nvlpubs.nist.gov)

Many rumors of "the algorithm has been broken" like to bring up "quantum" as a hammer. Indeed, Shor's algorithm can theoretically break discrete logarithms, but the premise is a fault-tolerant large-scale quantum computer. In reality, academia in 2025 can only demonstrate "breaking" 5-bit level elliptic curve toys on 133-qubit hardware—this is more like a model experiment under a microscope, with an astronomical gap from 256-bit production-level strength. Precisely because both industry and regulation understand this time scale, NIST has already released the first batch of ** post-quantum cryptography (PQC) standards (FIPS 203/204/205) in 2024, paving the way for future migration, but this does not mean "today's ECDSA has already fallen."** Misinterpreting forward-looking preparations as "current decryption" is a common switch in rumors. (arxiv.org)

In other words, ECDSA has not yet been "broken" by real-world computing power; what is truly frequently compromised is human access and operation—not the algorithm itself. (bitcoinops.org)

So, how did the U.S. obtain the private keys that were originally under Chen Zhi's control?

3|How did the U.S. "obtain the private keys"?

There are usually only two types of pathways: human or object—either someone hands it over, or there is something present.

Past major cases tell us that the "key" is often not extracted from mathematics, but found from people and devices.

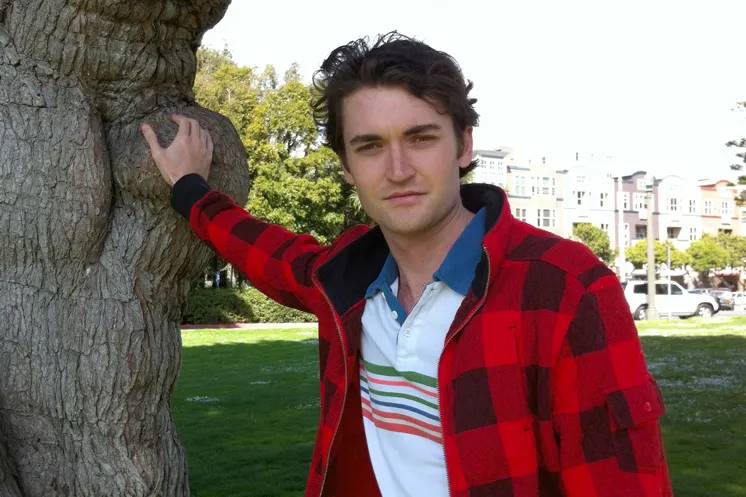

On October 1, 2013, the FBI arrested Ross Ulbricht at the San Francisco Public Library. He was accused of operating the large dark web drug and crime market Silk Road. Investigators created a disturbance at the scene, quickly controlling him and his computer, and obtained access to the laptop for evidence collection with a search warrant.

From 2015 to 2016, the FBI took over the servers of a dark website involved in child exploitation images during the "Playpen" operation and applied for a network investigative technique (NIT) search warrant to conduct limited, targeted remote evidence collection on "anonymous computers logging into the site." They deployed court-approved probes to the target computers to capture unlock codes or sensitive fragments in memory.

This sparked a major discussion across multiple circuits regarding the Fourth Amendment and Federal Rules of Criminal Procedure 41: under what circumstances can a judge issue a "remote search warrant"? What are the boundaries of NIT usage? Starting in 2016, Rule 41(b)(6) added remote search permissions under specific circumstances, providing a clearer procedural framework for such cases. (congress.gov)

This is also why many security tutorials emphasize: private keys and mnemonic phrases should be stored offline.

Fast forward to November 2021. During a search of James Zhong's home, law enforcement seized hardware and records from a popcorn tin in an underground safe and a bathroom closet, legally confiscating 50,676 Bitcoins. This was the criminal proceeds from his earlier telecommunications fraud related to a "withdrawal loophole" on Silk Road. (justice.gov)

Connecting the clues from these cases, you will find that the so-called "U.S. breaking Bitcoin" has always been about "access"—devices, passwords, cloud backups, accomplices, and the psychological defenses of the individuals involved; it is not about the "algorithm" supported by secp256k1 and 2^256.

In the case of Chen Zhi, the public documents only tell us "the key is now in the hands of the U.S." without disclosing the specific details of how the key was obtained. So, let's boldly hypothesize: what if the U.S. really did break the Bitcoin algorithm?

4|Counter-evidence: What would happen if the algorithm were truly broken?

Let's conduct a thought experiment: suppose an organization really "breached" ECDSA/secp256k1. That would mean they hold the "nuclear button" of the entire human financial system. In this case, the least likely thing to happen would be to publicly confiscate Chen Zhi's 127,000 BTC and issue a press release—this would be equivalent to announcing to the world, "We can unlock this thing."

If there were indeed a "mathematical nuclear bomb" that penetrated the secp256k1 signature system, the blockchain would not just give you a news headline; it would "scream" both on-chain and off-chain simultaneously.

The first to move would be the most vulnerable batch of coins: the "Satoshi-era" Bitcoins in early P2PK addresses, as well as old P2PKH addresses that have reused public keys. Chaincode Labs has calculated more specifically: approximately 600,000 to 1.1 million "Satoshi-era" Bitcoins remain in P2PK where the public key is fully exposed; once the public key → private key can be reverse-engineered, they would be the first to suffer. Such a run-like migration and large-scale theft could not happen quietly; blockchain explorers would trigger alarms like seismographs, and social media and blockchain intelligence accounts would explode within minutes. (Deloitte)

The second visible signal would be "the founder's wallet moved." The industry consensus that Satoshi Nakamoto's approximately 1.1 million early miner coins "have not moved since 2009-2010" is almost written into Bitcoin's collective memory. Any "prehistoric UTXO large-scale movement" would be captured in seconds by watchers across the network and pushed by the media as a "black swan." If ECDSA were truly breached, you would see this batch of the oldest coins being "tested first." But the reality is: these coins remain as still as a rock, and every "false alarm" is quickly clarified, which is precisely the reverse evidence chain that "the algorithm has not been broken." (The Digital Asset Infrastructure Company)

The third chain reaction would spill over into the crypto world: a large portion of "signatures" in the online world would simultaneously fail. Once the "mathematical foundation" collapses, it wouldn't just be wallets on fire; bank websites, browser green locks, and corporate certificates would all face widespread replacement. At that time, you wouldn't just read about "a certain case being confiscated," but rather see emergency migration announcements issued by certificate authorities and regulators across the entire network. The real world has not shown any signs of such a "simultaneous collapse." (nvlpubs.nist.gov)

Comparing these "expected worlds" with the reality we are experiencing, the logic becomes clear:

If ECDSA were truly breached, you would first see intense, synchronous, and undeniable shockwaves in both the blockchain and internet infrastructure; rather than a misinterpretation of "custodial wording" in a specific case as "the algorithm being broken."

This is the "fingerprint-level" method for distinguishing rumors from facts.

Conclusion

That recent long bearish candle has pushed "fear" to the center of everyone's screen. Prices are indeed speaking, but they only speak the language of emotions: leveraged liquidations, liquidity withdrawals, risk aversion switches—these will lower the curve but cannot prove that the algorithm has been broken. Mistaking "the transfer of access rights under legal procedures" for "the mathematics being penetrated" is merely a reason panic finds for itself.

Please separate the two matters at hand: prices reflect positions, while legal documents state facts.

The market will continue to fluctuate; that is its norm; but common sense should not plummet along with the volatility.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。