Original Title: "Doubling Revenue, Tripling Profit: 'America's Retail Investor Hub' Robinhood's Earnings Exceed Expectations, 'Event Contracts' Experience Explosive Growth | Earnings Report Insights"

Original Authors: He Hao, Long Yue, Wall Street Insights

"America's Internet Celebrity Brokerage" Robinhood delivers impressive third-quarter results.

The online brokerage announced its third-quarter earnings on Wednesday, showing that both revenue and profit exceeded Wall Street expectations. Thanks to a comprehensive increase in cryptocurrency, options, and stock trading volumes, the company's transaction-based revenue more than doubled year-on-year, driving net profit from $150 million in the same period last year to $556 million. Meanwhile, cryptocurrency revenue surged by 300%, although it fell short of expectations.

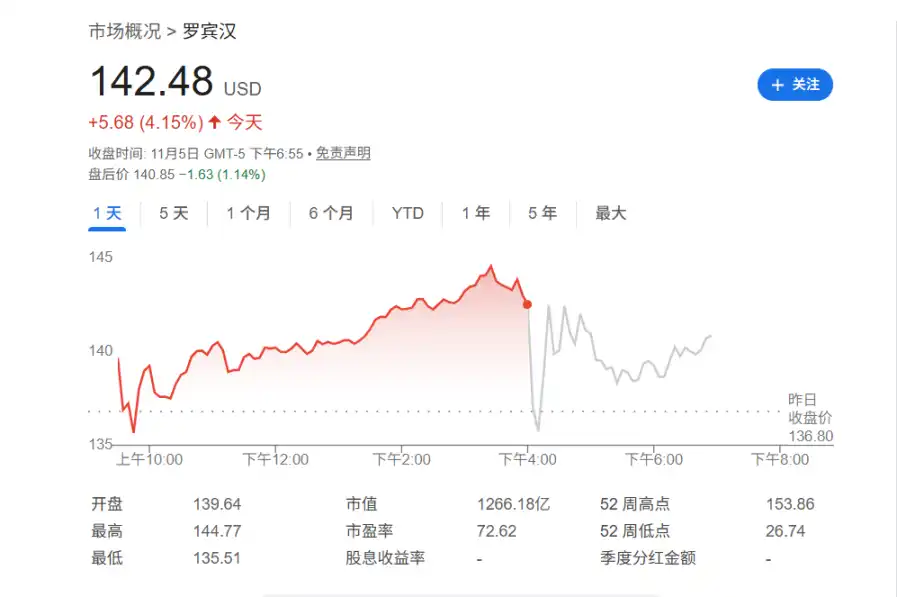

Despite the strong performance, Robinhood's stock price saw a slight decline in after-hours trading. The company also announced a significant executive change, with Chief Financial Officer (CFO) Jason Warnick, who has served for over seven years, planning to retire in 2026. The company has appointed Shiv Verma, Senior Vice President of Finance and Strategy, as his successor. This smooth transition is aimed at ensuring continuity in the company's strategy.

So far this year, Robinhood's stock price has risen nearly 270% and was included in the S&P 500 index in the third quarter. What was once seen as a trend of retail investing during the pandemic seems to have evolved into a force shaping the market, and Robinhood is successfully capitalizing on this trend.

Robinhood's Third Quarter Earnings Highlights: Performance Exceeds Expectations, Trading Revenue Doubles

Key Financial Data:

· Revenue: Third-quarter net revenue of $1.27 billion, analysts expected $1.21 billion.

· EBITDA: Third-quarter adjusted EBITDA of $742 million, analysts expected $726.9 million.

· Earnings Per Share: $0.61, expected $0.53, compared to $0.17 in the same period last year.

· Net Profit: Net profit increased to $556 million, significantly higher than last year's net profit of $150 million.

· ARPU: Third-quarter ARPU (Average Revenue Per User) was $191, analysts expected $182.

· Monthly Active Users: Third-quarter monthly active users reached 13.8 million, analysts expected 13.31 million.

Segment Data:

· Third-quarter transaction-based revenue was $730 million, analysts expected $725.8 million.

· Third-quarter cryptocurrency revenue was $268 million, surging 300%, but below analysts' expectations of $287.2 million.

· Third-quarter options revenue was $304 million, analysts expected $301.3 million.

The core driver of performance growth comes from the strong recovery in trading business. In the third quarter, the company's transaction-based revenue reached $730 million, more than doubling year-on-year. Among them, stock trading revenue grew by 132%, options trading revenue increased by 50%, while cryptocurrency trading revenue soared by 300% to $268 million, slightly below analysts' expectations of $287.2 million.

"Event Contracts" Become a New Growth Engine

One of the most striking highlights of the earnings report is the explosive growth of the "Event Contracts" (Prediction Markets) business. In the third quarter, the trading volume of event contracts on the platform surged to 2.3 billion, more than double that of the previous quarter.

According to retiring CFO Jason Warnick, the fourth quarter has started even stronger, with trading volume in October alone surpassing 2.5 billion. This includes about $25 million from the platform's prediction market business.

Recently, Robinhood expanded the scope of event contracts from the initial focus on sports and finance to include politics, entertainment, and technology. Through a partnership with Kalshi, Robinhood allows users to bet on the "yes/no" outcomes of future events in sports, politics, entertainment, and technology.

Warnick stated in the announcement that the prediction market business has become one of the company's new annual revenue streams of about $100 million. Incoming CFO Shiv Verma also emphasized in an interview, "This is a new asset class, and we want to be at the forefront; this is one of the areas we are focusing our investments on."

Event contracts still account for only a small portion of Robinhood's overall revenue. However, the prediction market business has seen rapid growth in recent weeks: Analysts at Piper Sandler estimate that trading volumes on Kalshi and competing platform Polymarket nearly doubled in October. Analysts also noted that this past weekend marked the two most active trading days on these platforms since the 2024 election.

However, these types of prediction market contracts—especially those related to sports and entertainment—have also sparked controversy, as they blur the lines between investing and gambling.

Executives Speak: Banking and Venture Capital Businesses to Launch Sequentially

Robinhood CEO Vlad Tenev stated in a statement:

"Our team continues to rapidly roll out new products, driving record business performance in the third quarter, and we will not slow down—our prediction market business is growing rapidly, Robinhood's banking services are gradually coming online, and our venture capital business is also about to launch."

CFO Jason Warnick stated in the announcement:

"The third quarter once again achieved strong and profitable growth, and we continue to diversify our business, adding two new business lines with annual revenues of about $100 million or more—Prediction Markets and Bitstamp."

CFO Announces Retirement Plans, Internal Promotion of Successor

Robinhood announced in its earnings report that CFO Jason Warnick will retire in 2026. The executive, who previously worked at Amazon, has served at Robinhood for over seven years and has been a key figure in the company's development.

According to the plan, Warnick will complete the handover in the first quarter of 2026 and will continue to serve as a strategic advisor until September 1, 2026. The company has appointed Shiv Verma, Senior Vice President of Finance and Strategy, as the next CFO. This move is seen as an internal promotion to ensure a smooth transition of the company's financial strategy.

Analysis and Commentary: Diversification Strategy Shows Results, Moving Towards a Fintech Company

Robinhood has been working to diversify its revenue sources to reduce reliance on trading business. Earlier this week, the company announced a partnership with Sage Home Loans to enable its customers to access home loans. Additionally, the company plans to launch a closed-end fund to allow U.S. retail investors to access private companies.

Analysts noted that Robinhood's third-quarter performance, which exceeded Wall Street expectations, continues its strong performance this year, making it one of the standout companies among large tech stocks in the U.S. Robinhood is betting that a new generation of investors will want to not only trade stocks but also bet on sports, culture, and political events on the same platform. So far, this bet seems to be paying off.

As Robinhood expands its business into comprehensive wealth management, the company is gradually narrowing the gap with Coinbase. The company has been actively attracting customers from Fidelity and Schwab by offering deposit matching incentives and is driving growth in its managed asset scale through the acquisition of TradePMR.

Robinhood primarily targets retail investors. Initially known for its user-friendly platform that allows beginners to easily buy and sell stocks, its trading business has now significantly expanded: in the third quarter, nearly 90% of Robinhood's trading-related revenue came from categories other than stocks, including options, futures, and cryptocurrencies.

David Bartosiak, a stock strategist at Zacks Investment Research, wrote in a morning report: "This is no longer the Robinhood of the pandemic. It is now more streamlined, more diversified, and is quietly growing into a true fintech competitor."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。