Robinhood's ultimate goal is not merely to become another brokerage, but to evolve into the core financial operating system for a new generation of investors through its rapid product iteration capabilities and integrated platform experience.

Written by: Nicholas Grous, Varshika Prasanna, ARK Invest

Compiled by: Nicky, Foresight News

TL;DR

Robinhood's business model began with a structural challenge to the profit model of traditional brokerages (commissions and fees). Its "commission-free" strategy is not just simple price competition, but a core design aimed at lowering the barriers for retail investors. This move has triggered a structural adjustment in the industry, forcing traditional giants to follow suit, objectively reshaping the business model and consumer expectations in the retail brokerage industry.

Progressive Three-Tier Strategic Framework:

Expansion of Brokerage Services: With commission-free stock trading as its cornerstone, Robinhood has built a young, mobile-native user base. Subsequently, it systematically expanded its product offerings to options, cryptocurrencies, and even prediction markets, with the strategic intent of becoming a comprehensive trading venue covering multiple asset classes, integrating trading behavior with cultural and entertainment elements to enhance user engagement.

Building a Financial Ecosystem: Based on brokerage relationships, the company extends into adjacent fields such as banking, credit, retirement, and wealth management through its subscription service Robinhood Gold as a hub. This strategy aims to enhance user stickiness and lifetime value by integrating multiple financial service verticals. The key lies in leveraging the advantages of a technology platform to compress costs in traditional areas (such as low thresholds for managing accounts and no annual fees for credit cards), returning the saved profits to users, thereby building competitive barriers.

Connecting Intergenerational Wealth Transfer: The top-level design of this strategy targets the anticipated intergenerational wealth transfer. Robinhood's high penetration among the younger generation positions it structurally to inherit assets such as stocks, retirement accounts, and cash that are expected to transfer in the future. The broadening of its product line is aimed at aligning its platform capabilities with the asset classes that will be transferred in the future, thus converting its current user base advantage into future asset management scale.

Robinhood's ultimate goal is not merely to become another brokerage, but to evolve into the core financial operating system for a new generation of investors through its rapid product iteration capabilities and integrated platform experience. Its success will depend on whether it can systematically convert the users acquired in its early brokerage business into deep users of its entire financial ecosystem and effectively capture the corresponding asset share during the long intergenerational wealth transfer process.

Introduction

For decades, traditional financial institutions have profited from brokerage commissions, options fees, overdraft penalties, and advisory fees. Consumers felt trapped due to a lack of alternative options and high switching costs, while banks and brokerages misinterpreted this as loyalty to their exploitative and unfriendly models.

Robinhood emerged in response. The company has a clear mission of "democratizing financial services for everyone," launching commission-free trading through a simple, mobile-first interface. This reset consumer expectations, forcing the entire industry to further lower fees and opening up asset classes that were previously only available to institutions to the general public.

This article will analyze Robinhood's winning strategy:

Mastering Brokerage Services: Explaining how Robinhood democratizes brokerage services and reshapes the industry landscape.

Integrating Personal Financial Product Systems: Detailing how Robinhood integrates various services to create a unified ecosystem.

Wealth Transfer: Analyzing the opportunities brought by intergenerational trends, which may place Robinhood at the core of a total addressable market (TAM) exceeding $600 billion.

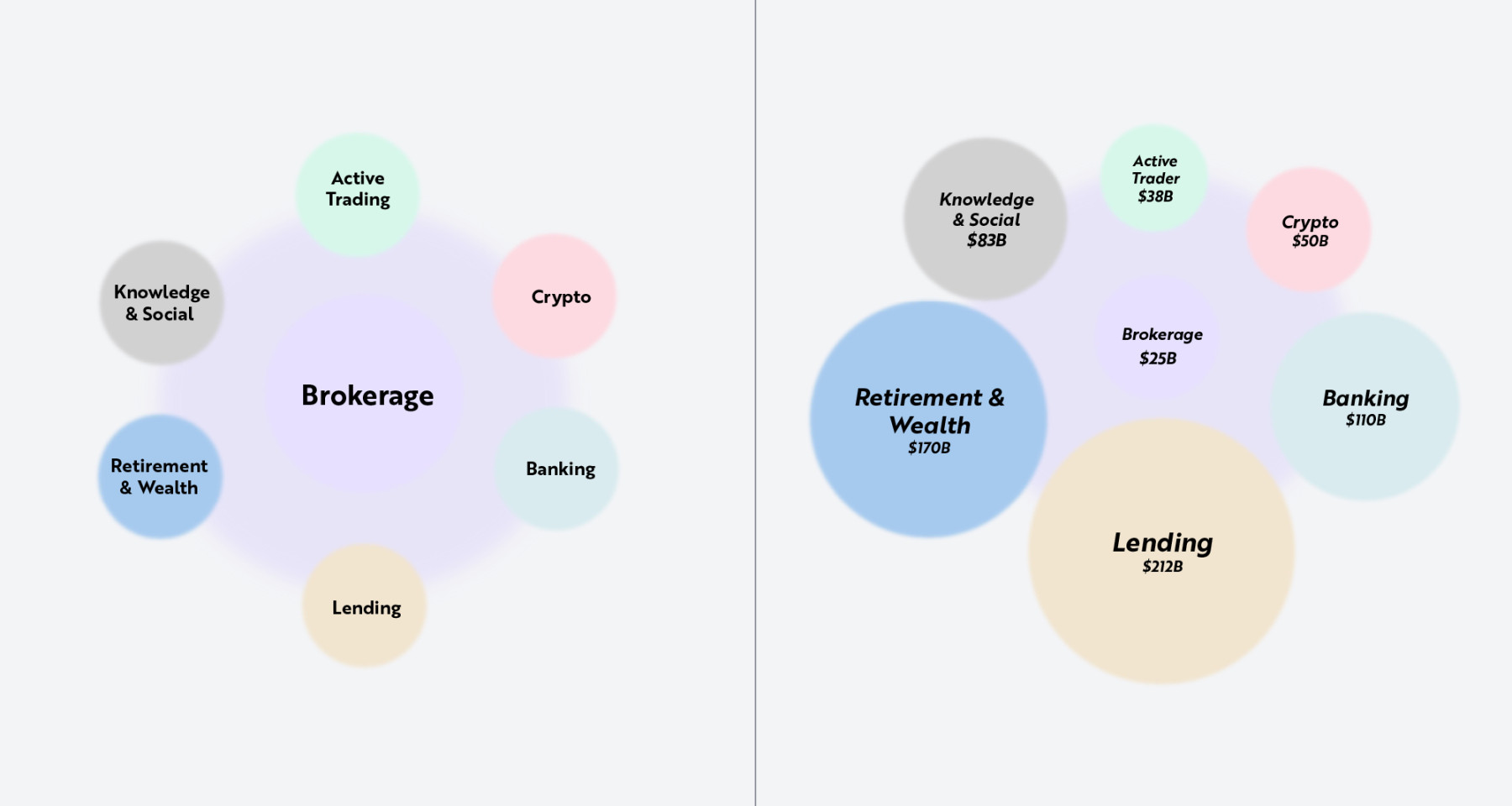

We aim to guide readers through Robinhood's three-phase product roadmap: reshaping brokerage services, integrating a broader financial product system, and preparing for the intergenerational wealth transfer. Each phase builds on the previous one, expanding the company's business scope in banking, lending, cryptocurrencies, and wealth management. As shown, brokerage services are at the core of all Robinhood's activities. As the entry point for a new generation of investors, Robinhood's brokerage services are the foundation of its ecosystem, supporting a multi-layered product range that touches on all aspects of consumer financial life.

Note: The left image shows how brokerage services serve as a link connecting other adjacent financial service verticals. The right image estimates the total addressable market (TAM) for each vertical. Source: ARK Investment Management LLC, based on Robinhood data as of September 15, 2025. For reference only, should not be considered investment advice, nor does it constitute a recommendation to buy, sell, or hold any specific securities.

Mastering Brokerage Services

In this section, we will explore Robinhood's disruption of the brokerage industry and its product expansion aimed at active traders and the cryptocurrency market. At the time of the company's founding in 2013, most online brokerages charged commissions of $7 to $10 per stock trade. Ordinary retail investors spent hundreds of dollars annually just to participate in market trading, which posed a significant barrier for millennials and Gen Z starting their investment journeys with small amounts of capital. Options trading faced similar obstacles, as brokerages charged fees per contract in addition to commissions. In fact, most traditional platforms were designed for professionals, deterring mobile-first consumers.

Robinhood's brokerage service changed this situation overnight and became the foundation of its business. By eliminating commissions and creating a seamless mobile-first interface, the company opened the door for a new generation of investors. Many established industry players believed this model was unsustainable, but it quickly became the industry standard, forcing giants like Charles Schwab, E*TRADE, Fidelity Investments, and TD Ameritrade to adopt the same model. This transformation led to a structural adjustment in the brokerage industry, lowering investment barriers and returning billions of dollars to consumers.

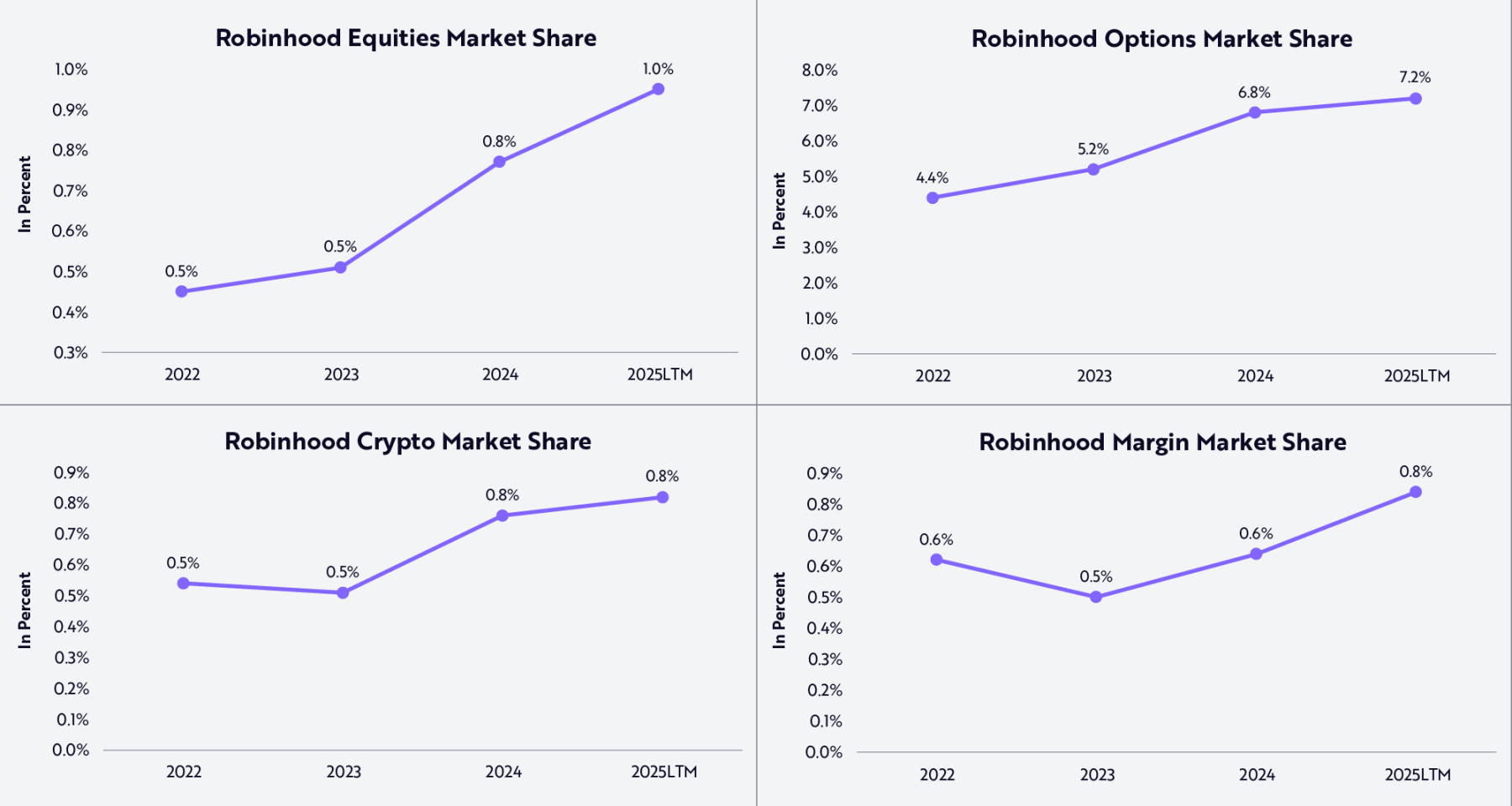

By broadening investment channels early on and attracting a young customer base, Robinhood has steadily increased its market share in stocks, options, cryptocurrencies, and margin trading, as shown below. Its market share has grown steadily, with options and stock trading market shares exceeding 7% and nearly 1%, respectively.

Source: ARK Investment Management LLC, based on Robinhood data as of September 15, 2025. For reference only, should not be considered investment advice, nor does it constitute a recommendation to buy, sell, or hold any specific securities. Past performance does not represent future results.

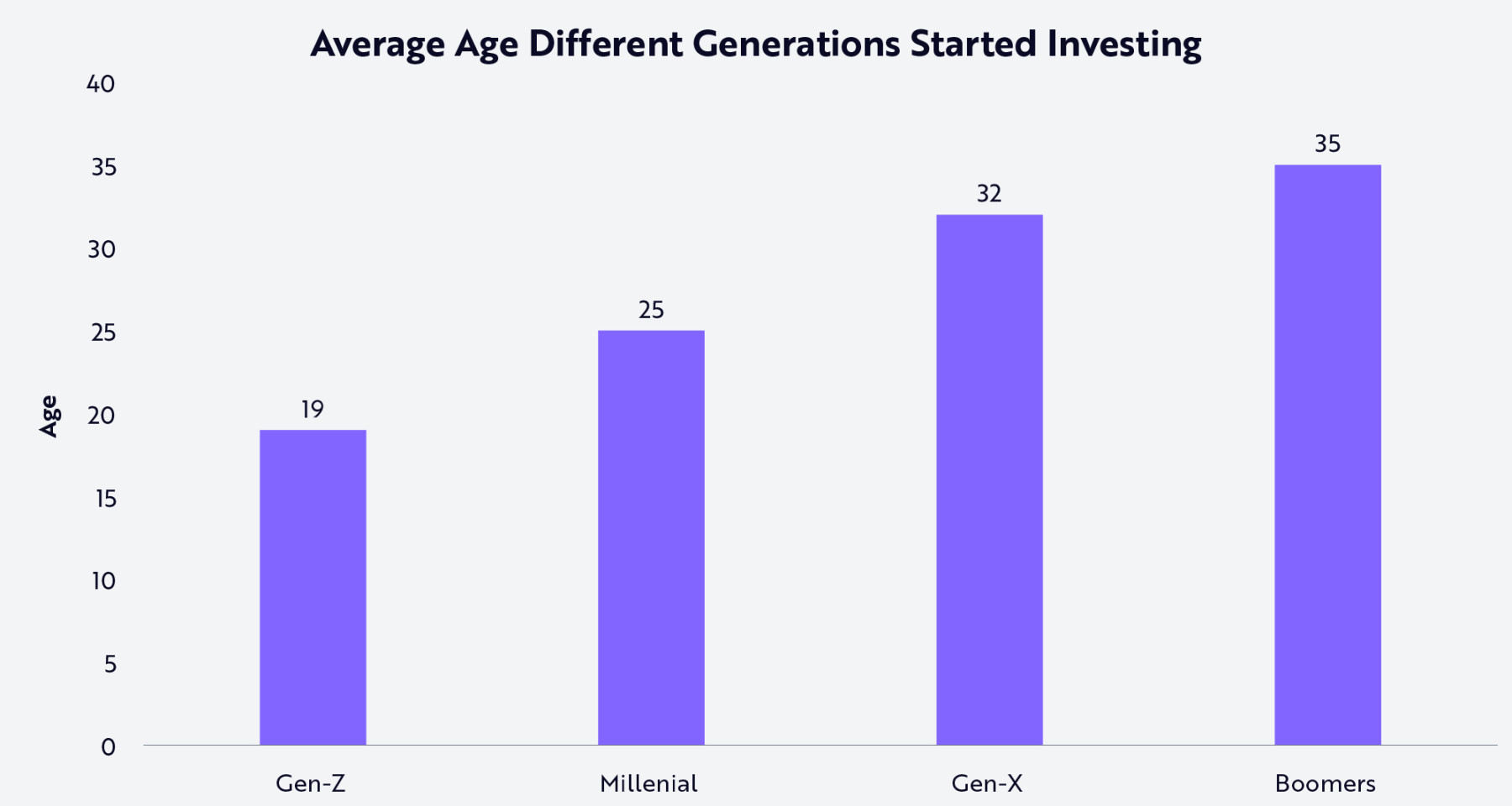

Despite the growth in market share, Robinhood currently occupies only a small portion of the entire market—this fact highlights both the progress the company has made in these multi-trillion-dollar markets and its growth potential. Expanding the scale of brokerage services is at the core of Robinhood's business and the primary demand of its customer base. For millennials and Gen Z, brokerage services often represent their first significant connection to the financial markets. Unlike previous generations who waited until their thirties to start investing, young investors in their late teens and early twenties are now participating in market trading.

As shown, Gen Z typically starts investing at an average age of 19, while millennials start at an average age of 25, which is much earlier than Gen X's average of 32 and baby boomers' average of 35. In our view, as platforms like Robinhood make investing accessible, young people are increasingly influenced by the explosive growth of financial content online, establishing investing as a core part of their financial identity.

Source: ARK Investment Management LLC, based on Charles Schwab data from March 18, 2024. It should be noted that the survey asked, "At what age did you start investing?" The survey did not specify a definition of "investing." This information is for reference only and should not be considered investment advice, nor does it constitute a recommendation to buy, sell, or hold any specific securities.

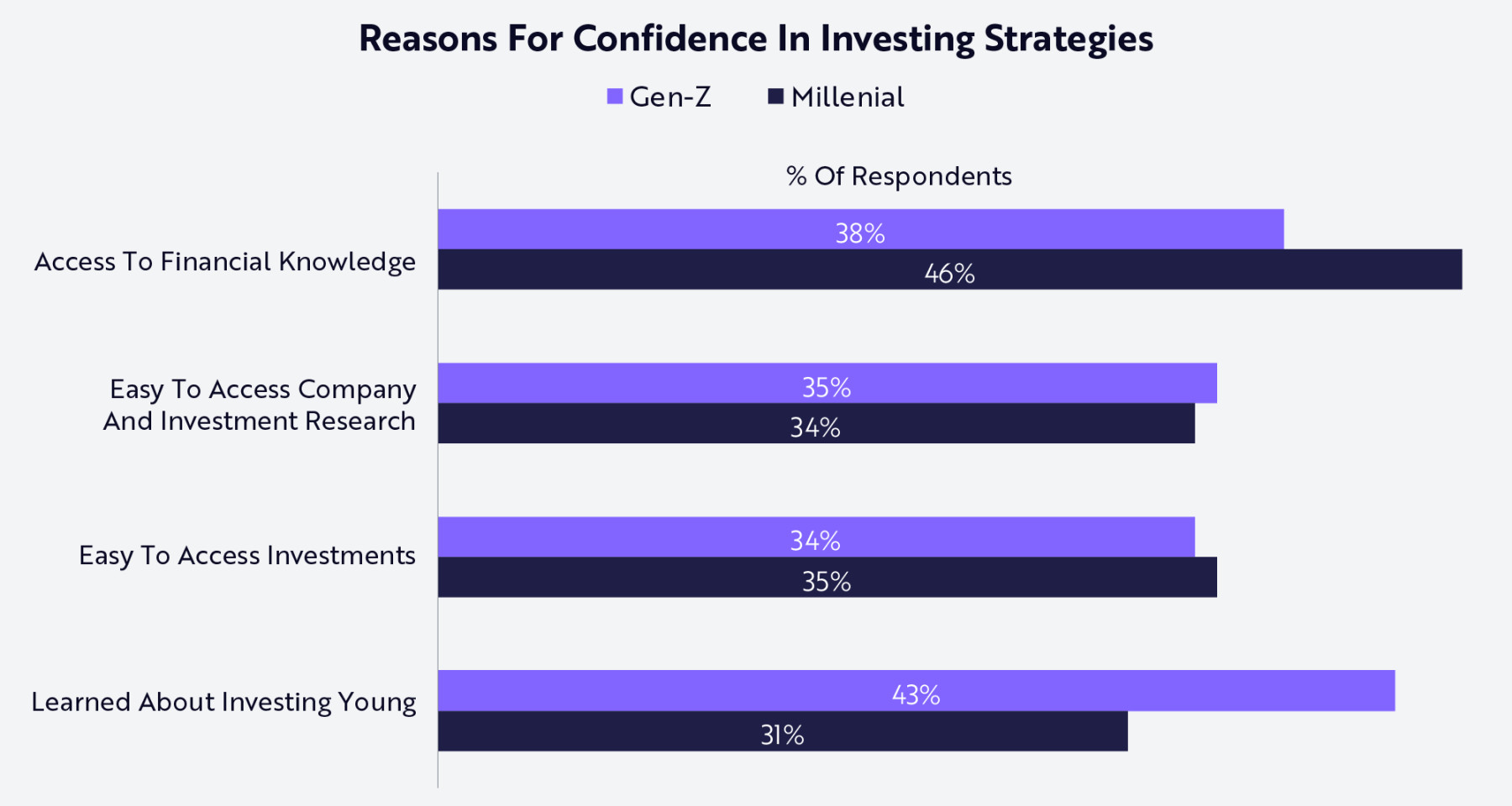

With the widespread dissemination of investment concepts and educational content on social media and digital platforms, millennials and Gen Z have been exposed to the importance and methods of investing at a younger age. Survey feedback, as shown below, indicates that unprecedented access to knowledge and research convenience has sparked their interest in investing and helped them understand the investment process.

Source: ARK Investment Management LLC, based on Charles Schwab data from March 18, 2024. For reference only and should not be considered investment advice, nor does it constitute a recommendation to buy, sell, or hold any specific securities.

The rise of investment content on social media explains why Robinhood has introduced social features on its platform and expanded its product line by adding more market trading varieties to enhance user engagement. Today, Robinhood is further developing from three directions: advanced trading tools, prediction markets, and cryptocurrency infrastructure. These three initiatives will continue to position Robinhood as a hub that combines financial and cultural attributes, allowing users to trade any variety anytime, anywhere.

Robinhood Legend provides users with advanced trading tools. Through these tools, the company aims to narrow the product gap with traditional brokerages, attract active traders, and serve a more mature retail investor group transitioning from casual investing to advanced investment strategies.

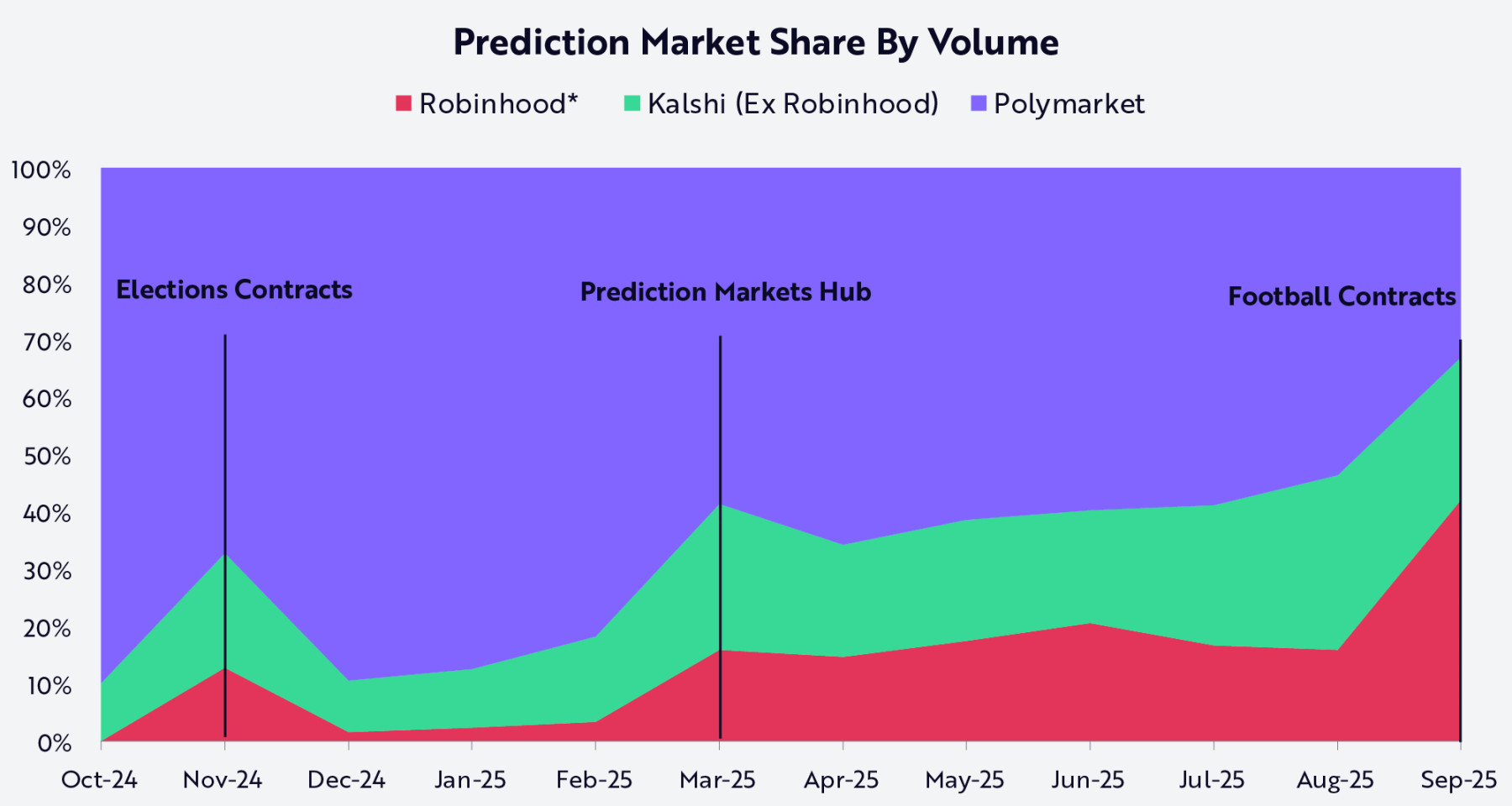

Robinhood's entry into prediction markets also highlights the trend of integrating finance, culture, and entertainment. For young investors, stock trading naturally extends their participation in sports, social media, and cultural events. By integrating with the Kalshi prediction market exchange, Robinhood allows users to trade on real-world outcomes, adding an interactive dimension driven by social engagement to its brokerage services. Since its launch in October 2024, Robinhood has gained extensive retail market coverage, partnering with Kalshi to capture about two-thirds of the market share from other competitors, as shown below.

Note: Robinhood's monthly trading volume data is based on management comments and cumulative estimates provided by management. Source: ARK Investment Management LLC, 2025. This analysis utilizes various external data sources as of September 25, 2025. For reference only, should not be considered investment advice, nor does it constitute a recommendation to buy, sell, or hold any specific securities.

Digital assets have become central to Robinhood's long-term strategy. The company has expanded its token lineup to include Solana, Pepe, and XRP, currently supporting a total of 42 tokens for trading, while offering Ethereum and Solana staking services with yields higher than competitors for U.S. customers. Earlier this year, Robinhood launched tokenized U.S. stocks and exchange-traded funds (ETFs) for its EU customers on the Arbitrum network and announced plans for its own Layer 2 blockchain. This network, built on the Arbitrum architecture, will support the tokenization of real assets, seamless cross-chain bridging, self-custody features, and ultimately achieve 24/7 settlement—blurring the lines between traditional finance and digital assets.

By integrating advanced trading tools, prediction markets, and blockchain products, Robinhood enables young investors to trade any variety anytime, anywhere. Importantly, this expansion of service offerings has established the closest brokerage relationship with this generation of investment-savvy users. As investing becomes central to personal finance, brokerage platforms are becoming gateways to a broader range of financial services. Based on this foundation, Robinhood is preparing to move to the next stage: integrating a more comprehensive personal financial product system.

Integrating Personal Financial Product Systems

Robinhood's first-phase strategy broke down barriers for young consumers to participate in brokerage services. Its success stems not only from its commission-free policy but also from building a mobile-first platform that emphasizes simplicity, intuitive design, and seamless user experience. Now, Robinhood is applying the same strategy to compete in a broader financial services landscape.

Unlike a single brokerage service, personal finance is not a standalone product but encompasses a network of interconnected services, including banking, lending, retirement, wealth management, and financial literacy. Integrating these verticals into a unified ecosystem is Robinhood's next strategic goal.

In the following sections, we will explore Robinhood's expanding product system centered around the Robinhood Gold subscription service. According to our research, targeting a total addressable market (TAM) exceeding $600 billion, the Gold service is to Robinhood what Prime membership is to Amazon— a subscription model that provides higher value to more users by increasing customer engagement.

Robinhood Gold Service

Robinhood Gold charges $5 per month or offers an annual discount price of $50, providing consumers with professional-grade features, including Morningstar research reports, Nasdaq Level II market data, higher-yield cash management, credit card services, managed accounts, and margin trading. Traditionally, these features could cost hundreds or even thousands of dollars annually. By bundling these features into an affordable subscription package, Robinhood not only positions Gold as a predictable revenue source but also as a link to a broader ecosystem. The goal is simple: to make every Robinhood user a Gold user.

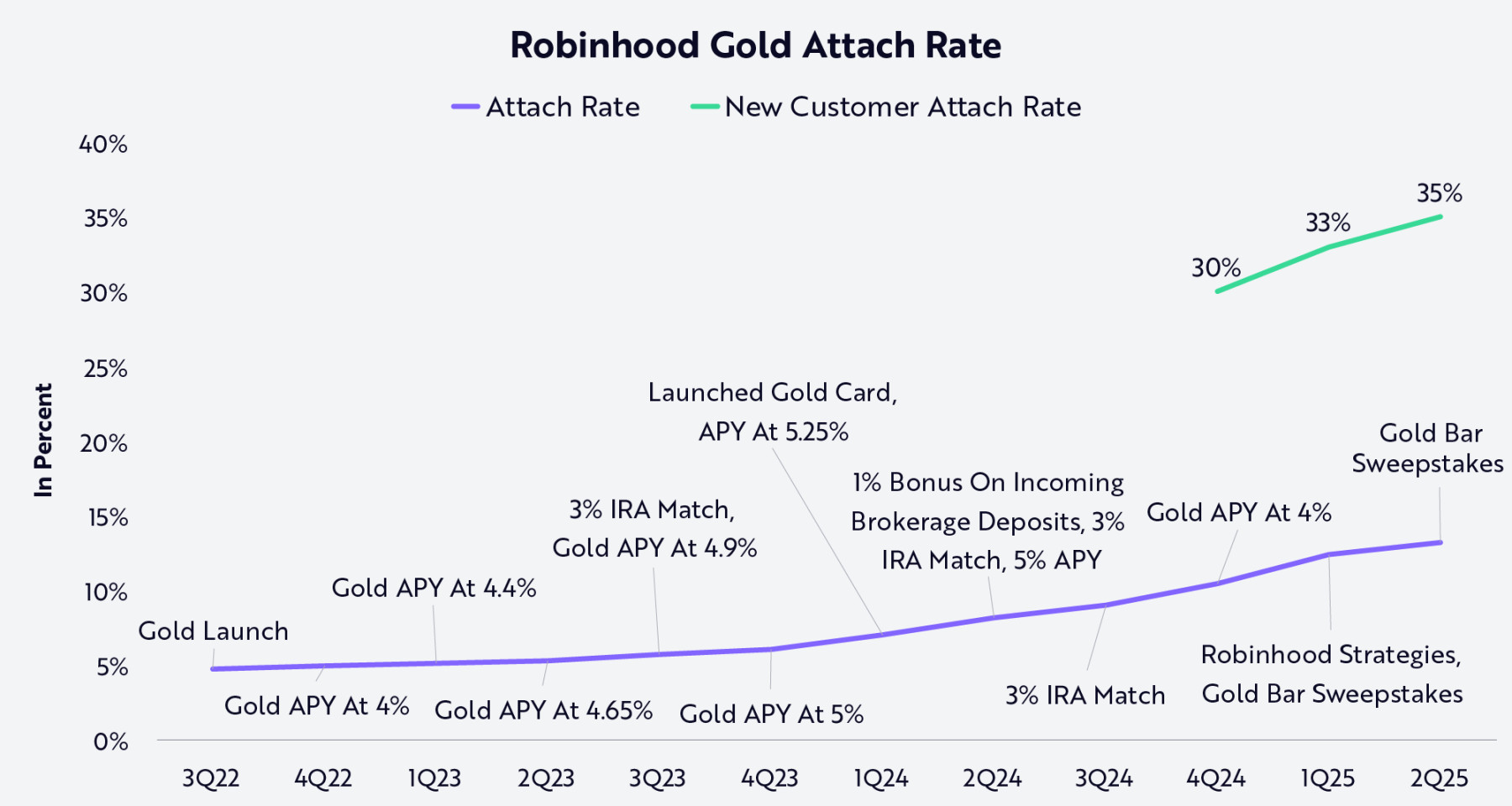

As shown below, the steady increase in the attachment rate of Robinhood Gold services highlights how the company effectively combines product innovation with precise marketing. Incremental value-added services such as higher annual percentage yields (APY), 3% individual retirement account (IRA) matching, brokerage account deposit rewards, and Gold credit cards continuously enhance the value proposition of this subscription service. Creative promotional tactics, including sweepstakes, provide additional incentives. The attachment rate among the latest customer cohort is significantly higher—this strong signal indicates that Robinhood's strategy of continuously enriching Gold service content is resonating and driving customer lifetime value.

Note: "Attachment rate" refers to the proportion of customers who are both Robinhood cash account clients and Robinhood Gold subscribers. Source: ARK Investment Management LLC, based on Robinhood data as of September 15, 2025. For reference only, should not be considered investment advice, nor does it constitute a recommendation to buy, sell, or hold any specific securities. Past performance does not represent future results.

Banking Services

Banking services are a significant initiative in Robinhood's expansion strategy. By partnering with banks to implement a cash balance management program, the company pays interest on idle funds and eliminates overdraft fees, minimum balance requirements, and account maintenance fees. This service will protect Robinhood's customers from the approximately $10 billion in overdraft penalties charged by U.S. banks in 2024, while returning profits that traditional financial institutions would otherwise retain back to users. The Robinhood banking service launched this year will gradually expand to include a comprehensive service system with direct deposits, bill payments, cash delivery, peer-to-peer transfers, and debit card features. As a result, Robinhood is transforming from a trading platform into a comprehensive financial services platform.

Credit and Lending Services

The credit card model has long been a significant profit source for banks, relying on annual fees, high interest rates, revolving credit balances, and interchange fees. In contrast, the Robinhood Gold Credit Card charges no additional fees beyond those associated with the basic Gold subscription service and offers rewards policies competitive with high-end credit cards, seamlessly integrating with Robinhood's entire platform. In other words, Robinhood enhances consumer purchasing power by cutting costs while increasing its share of user spending.

The following chart compares the services of the Robinhood Gold Credit Card with competitor products.

Source: ARK Investment Management LLC, 2025, based on data from Holzhauer 2025 and Moffitt 2025 as of September 15, 2025. For reference only, should not be considered investment advice, nor does it constitute a recommendation to buy, sell, or hold any specific securities.

Credit cards are not Robinhood's only credit product. For Gold members, Robinhood now serves as a recommended partner for Sage Home Loans, which offers more competitive and lower-cost mortgage options. Through this partnership, Gold subscription users can enjoy mortgage or refinancing rates as much as 0.75% lower than the national average, with no minimum asset balance requirements. Additionally, Robinhood offers a $500 closing cost credit.

Retirement and Wealth Management

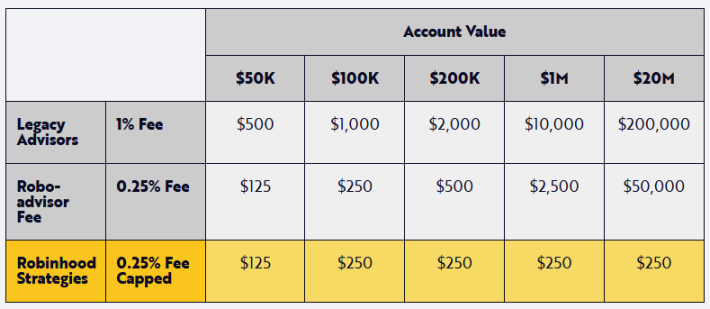

With the launch of Robinhood Strategies, Robinhood extends its business model into the wealth management sector. In traditional financial institutions, only high-net-worth clients can access professionally managed investment portfolios (managed accounts), as these services typically have minimum account thresholds ranging from $100,000 to $1 million. Through Robinhood Strategies, Gold subscription users can open managed accounts for just $50, with an annual management fee of only 0.25%, far below the 1% charged by traditional advisors. In fact, as shown in the comparison chart below, Robinhood caps the annual fee at $250, meaning that the more clients invest, the less they pay in fees.

Source: ARK Investment Management LLC, 2025, based on Robinhood data as of September 15, 2025. For reference only, should not be considered investment advice, nor does it constitute a recommendation to buy, sell, or hold any specific securities.

By lowering the entry barriers for managed accounts, Robinhood is democratizing portfolio management for retail investors: compressing fees, simplifying processes, and expanding participation. In doing so, the company positions "management strategies" as the entry point for the mass market into financial planning and wealth management.

Robinhood further expanded its wealth management product line by acquiring the top registered investment advisor (RIA) custodian and portfolio management platform TradePMR. An increasing number of millennials and Gen Z investors are seeking professional advice as they monitor and manage their growing portfolios. By entering the large RIA space, Robinhood gains access to a rapidly expanding market of approximately $70 trillion. This partnership connects RIA advisors with an attractive new customer base while allowing Robinhood to offer a top-notch referral program through its app, enabling users to seamlessly access advisory services. In the future, Robinhood and TradePMR plan to upgrade the technology platform and optimize the advisor-client connection process, providing Robinhood users with an integrated, mobile-first wealth management experience that extends beyond self-trading capabilities.

Financial Literacy and Social Features

While expanding new financial services for retail investors, Robinhood is taking significant steps to promote the democratization of financial knowledge. Its app offers a rich library of articles and courses covering topics from stock market basics to advanced concepts like ETFs, initial public offerings (IPOs), and cryptocurrencies, catering to the needs of millennials, Gen Z, and other users eager to learn about financial markets. Guided onboarding modules and contextual explanations (such as stock detail page tours) integrate financial literacy into the user journey, lowering participation barriers and building confidence for investors to make important financial decisions.

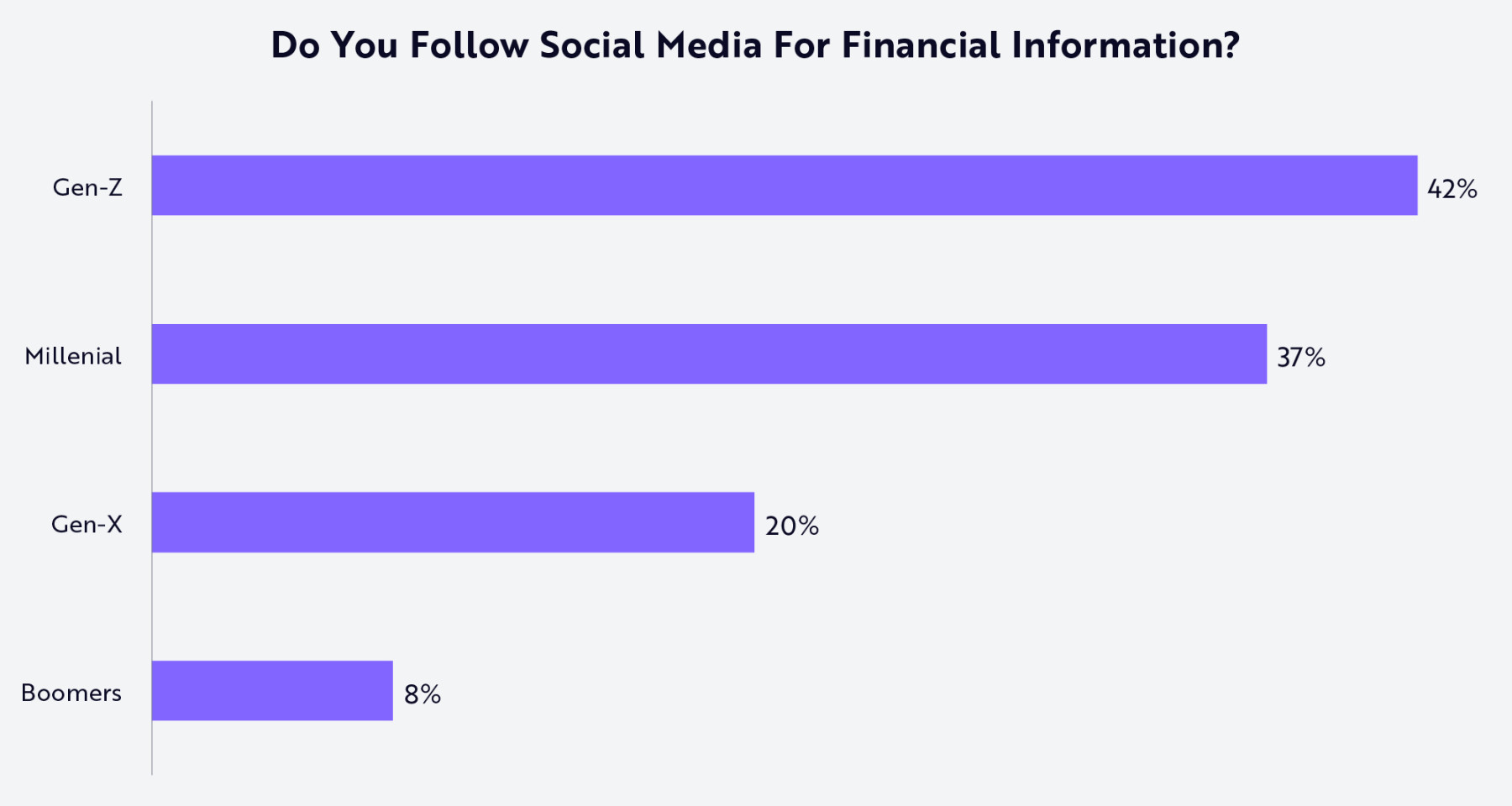

The younger generation no longer relies solely on financial advisors or traditional institutions for financial advice. Instead, social media platforms have become centers for financial education, as illustrated in the chart, where user-generated financial advice, market commentary, and engaging memes create captivating community interactions daily.

Source: ARK Investment Management LLC, based on Schwab data as of September 15, 2025. For reference only, should not be considered investment advice, nor does it constitute a recommendation to buy, sell, or hold any specific securities.

Through Robinhood's social features, investors can share verified trading records, discuss investment strategies, and engage in conversations, transforming investing from a personal activity into a collaborative one. In a social environment filled with spam, bot accounts, and unreliable advice, Robinhood's trade verification feature adds transparency and credibility to community discussions. Features like prediction markets position the platform at the intersection of trading, culture, and community, creating a space for retail investors to connect, learn, and grow together.

In response to advancements in artificial intelligence technology, Robinhood has launched Cortex—an AI investment tool designed to help investors understand the market. From stock briefings that explain price movements to customized trading builders that help users explore new strategies, Robinhood is leveraging AI to democratize financial knowledge for its young retail investor base. Cortex is expected to evolve into a fully functional mobile AI financial assistant. With the tailwinds of social media and AI development, Robinhood's product system is evolving into a personal finance operating system that provides comprehensive insights into users' financial situations, enhancing user engagement, trust, and retention in ways that a single product cannot achieve.

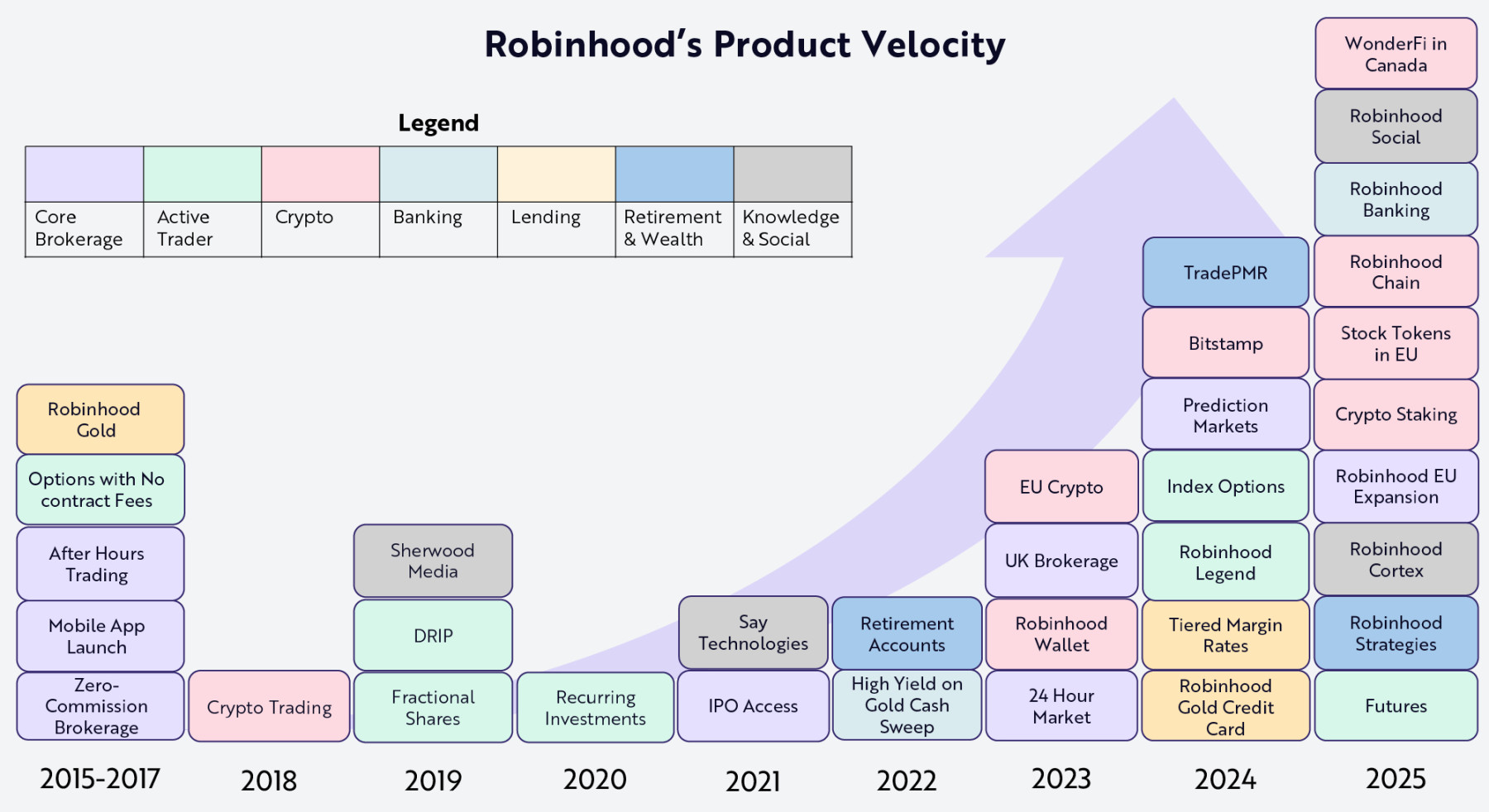

The rapid pace of product iteration at Robinhood is becoming key to realizing its strategic vision of "becoming the preferred personal finance operating system." As shown in the chart below, the company is launching new products year after year across various financial service sectors. Each product suite enhances Robinhood's utility, with each product strengthening the entire ecosystem globally.

Source: ARK Investment Management LLC, based on Robinhood data as of September 15, 2025. For reference only, should not be considered investment advice, nor does it constitute a recommendation to buy, sell, or hold any specific securities.

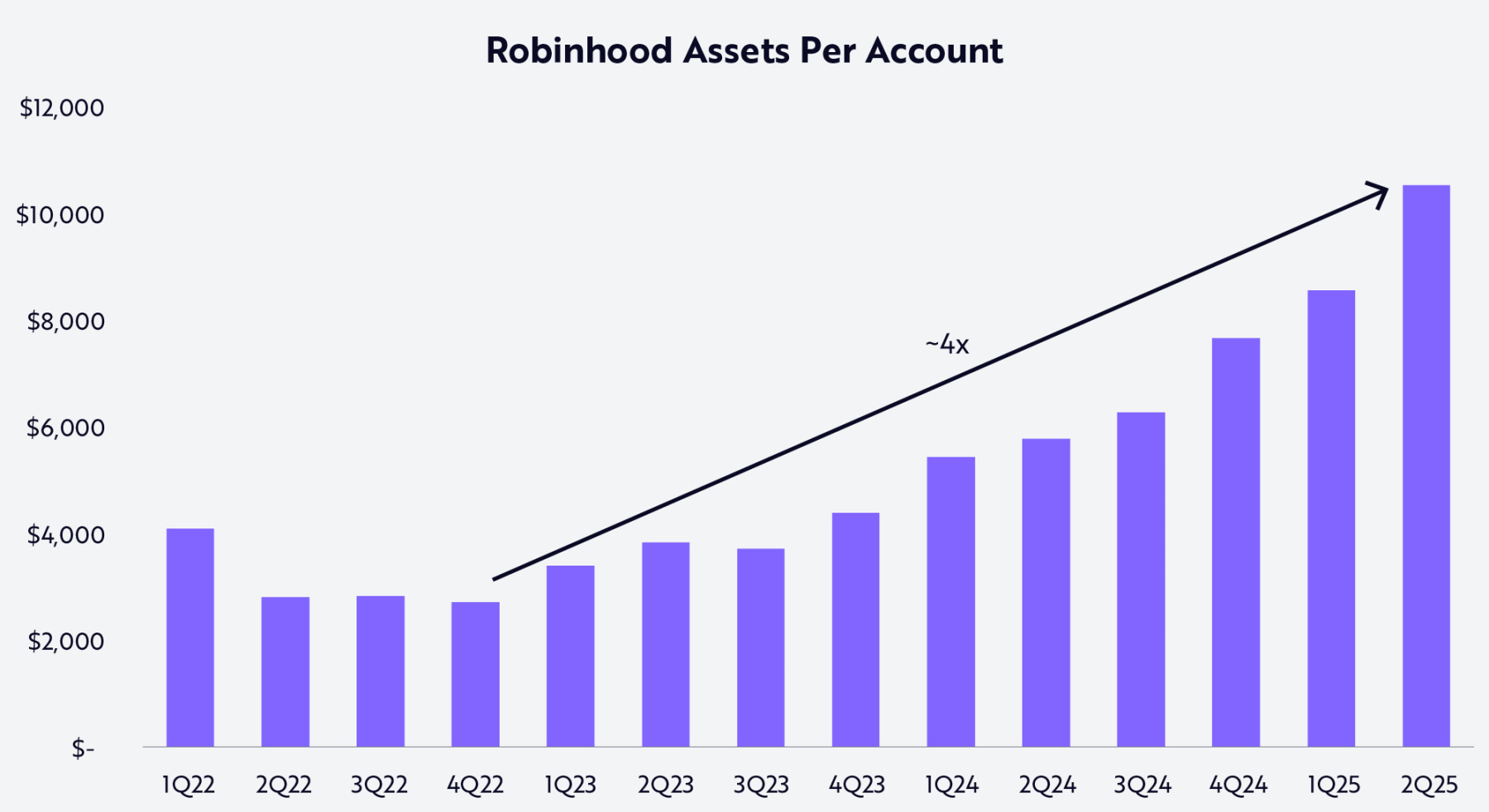

Robinhood's consistently strong product iteration pace is translating into deep user engagement on the platform. Data shows that from the end of the bear market in Q4 2022 to Q2 2025, customer asset sizes grew nearly fourfold—from about $2,700 to approximately $10,500 (see chart below).

Source: ARK Investment Management LLC, this analysis is based on multidimensional data from Robinhood as of September 25, 2025 (primarily financial report data, available upon request). For reference only, should not be considered investment advice, nor does it constitute a recommendation to buy, sell, or hold any specific securities.

As Robinhood transforms traditional brokerage services and reconstructs various verticals of consumer finance, it is poised to become the first truly mobile-native financial operating system, maximizing its benefits from one of the most significant opportunities in modern financial history—the intergenerational wealth transfer.

Intergenerational Wealth Transfer

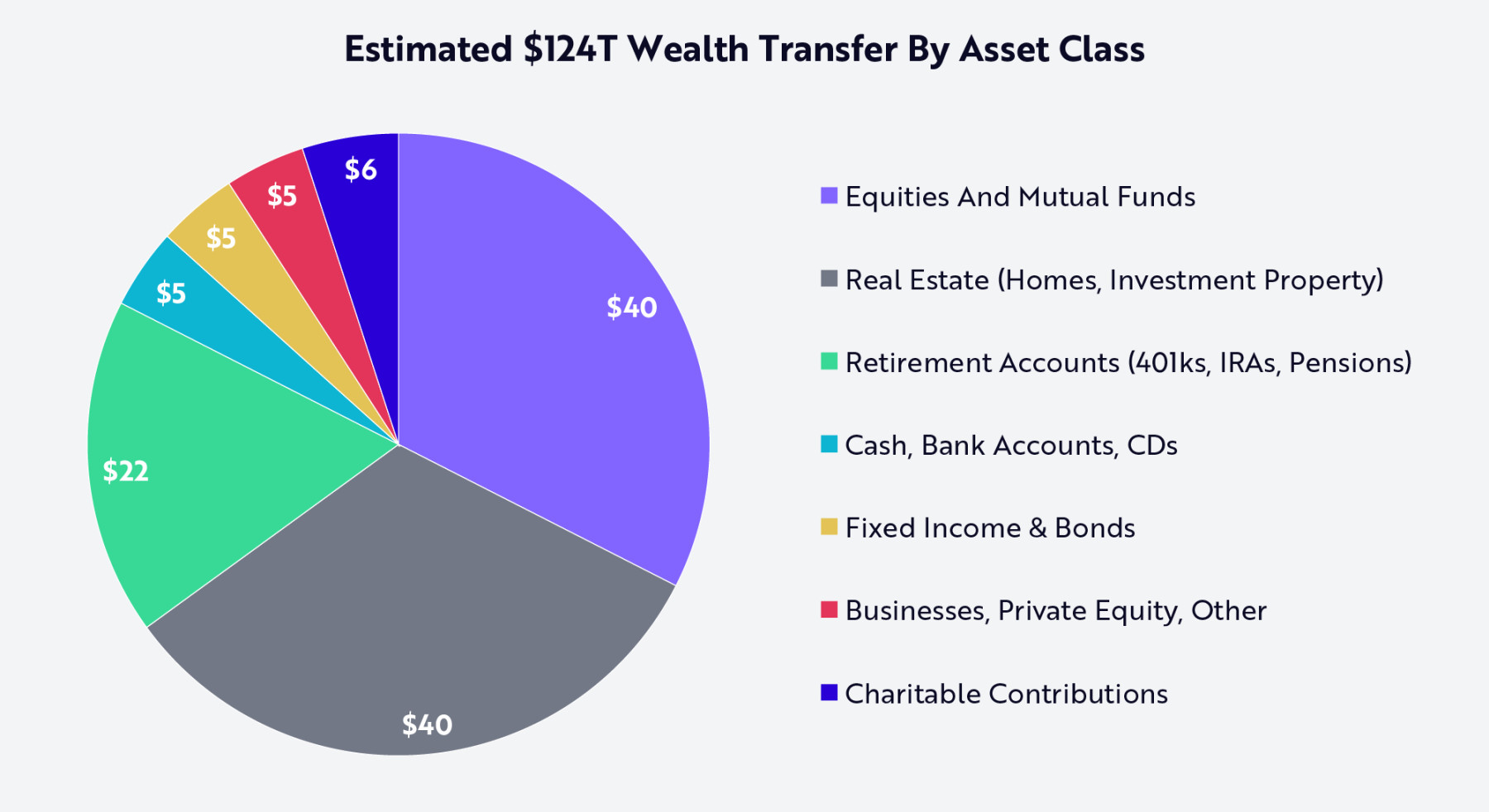

In the coming decades, a record approximately $124 trillion in assets will be transferred from the Baby Boomer generation to their heirs (including Millennials and Gen Z). During this wealth transfer, assets will flow from the "analog era cohort," which relies on offline branches and advisor relationships, to the "digital native generation" on seamlessly integrated mobile-first platforms.

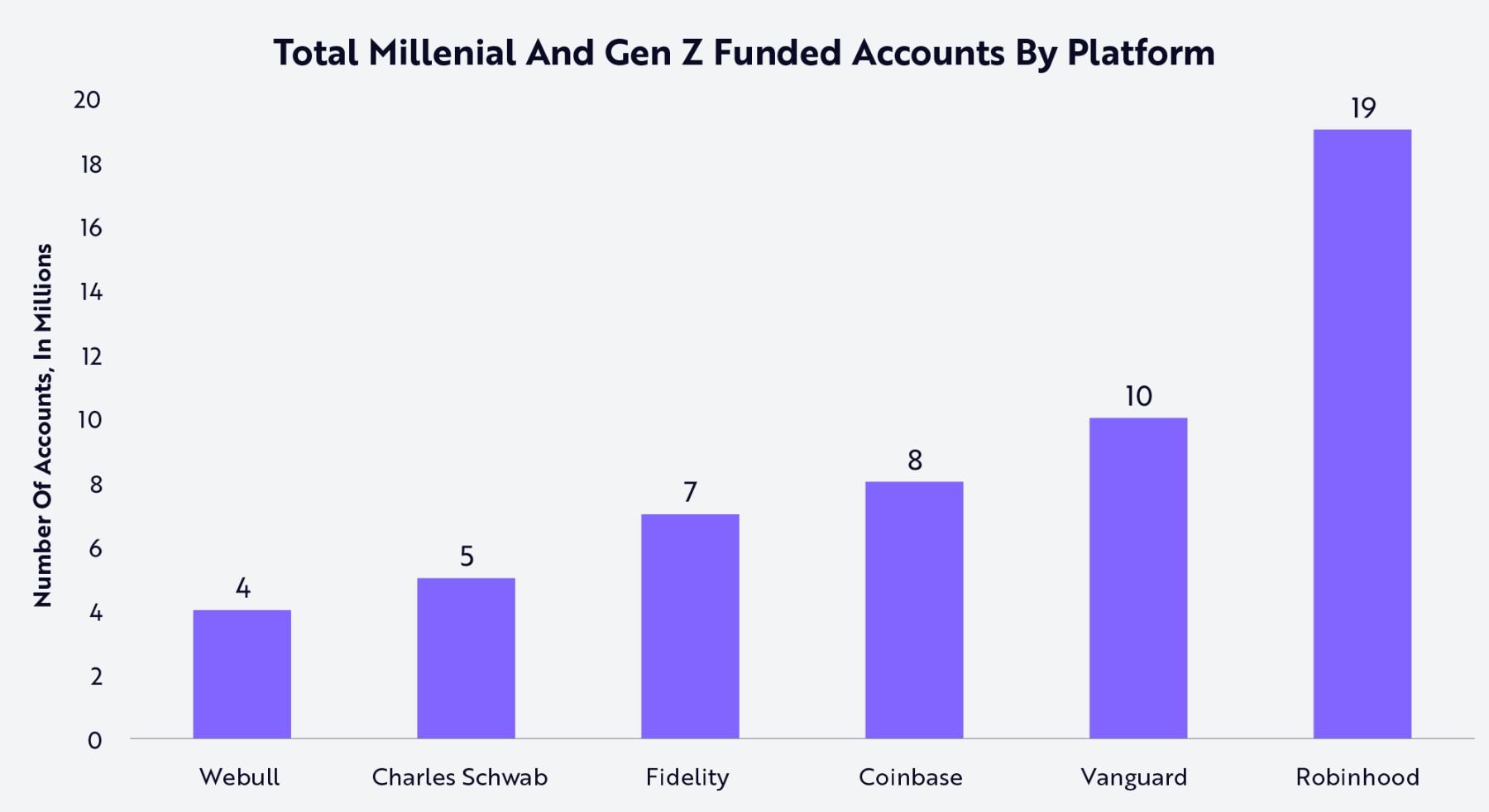

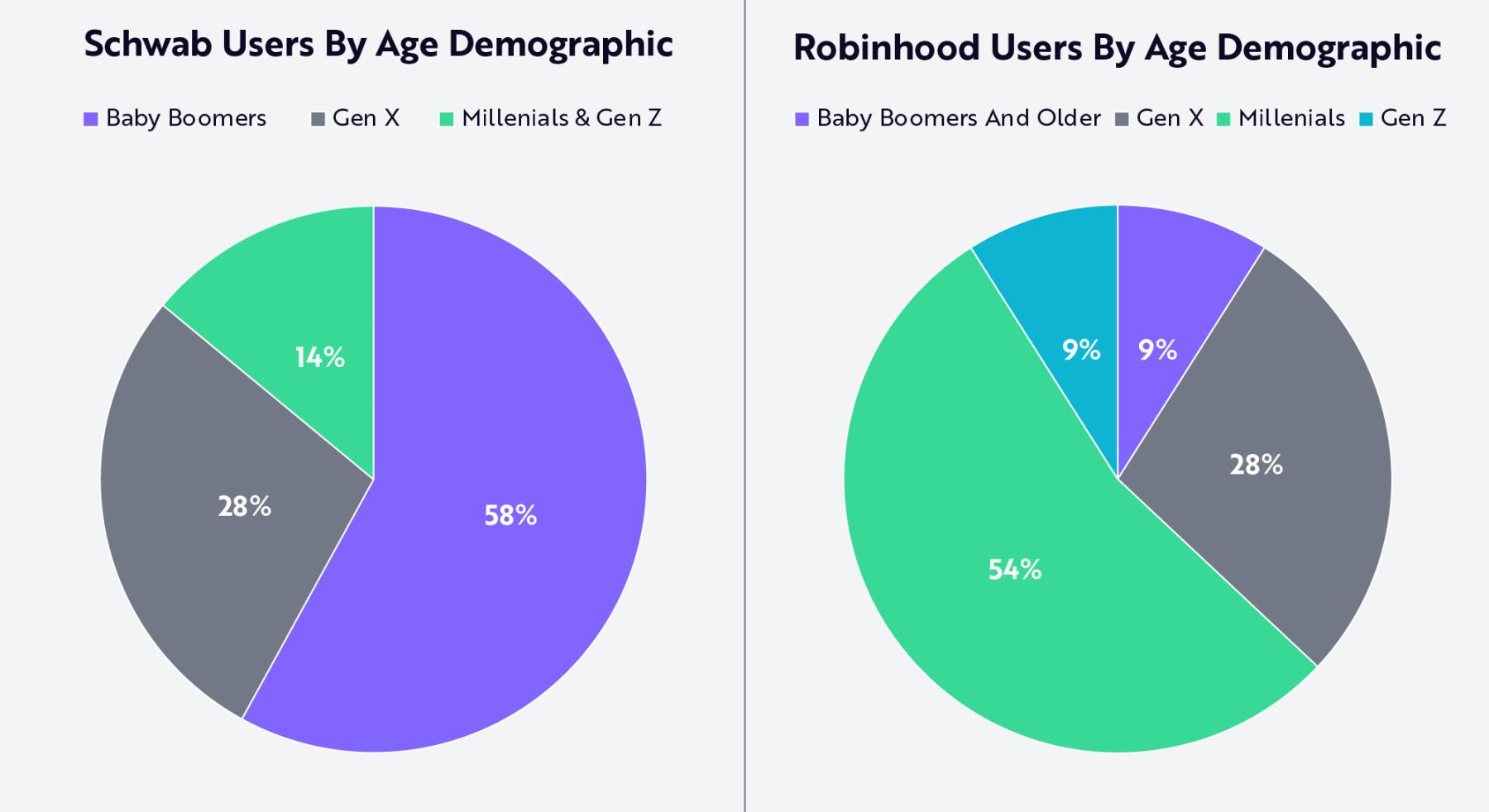

Robinhood has a structural advantage—its number of Millennial and Gen Z accounts is nearly double that of Vanguard and almost four times that of Schwab (see chart below). In fact, 63% of Robinhood's users are Millennials and Gen Z, while that figure for Schwab is only 14%. In other words, as shown in the chart, nearly 60% of Schwab's current clients are still Baby Boomers.

Source: ARK Investment Management LLC, 2025. This analysis is based on multiple external data sources as of September 25, 2025 (including relevant data from Robinhood 2025). For reference only, should not be considered investment advice, nor does it constitute a recommendation to buy, sell, or hold any specific securities.

The cultural shift accompanying this wealth transfer also marks a change in expectations regarding how financial services operate. The Baby Boomer generation built their financial lives in an analog world reliant on offline branches, paper statements, and long-term advisor relationships. In contrast, Millennials and Gen Z prefer intuitive mobile-native platforms that offer digital-first communication, commerce, and entertainment experiences, as well as seamless, transparent, and personalized financial services. Our research indicates that Robinhood, with its rapid product iteration and innovation capabilities, is well-positioned to win over Millennial and Gen Z investors, capturing market share more quickly than new entrants and traditional institutions that attempt to compete through modernized product systems.

Robinhood is uniquely positioned to serve the trillions of dollars in assets that are about to change hands. To capture a disproportionate share of the $124 trillion wealth transfer, Robinhood's product portfolio has undergone significant changes. As shown in the chart below, approximately one-third of the transferred assets ($40 trillion) will include stocks (the foundation of Robinhood's brokerage business) and mutual funds. An additional $22 trillion will involve retirement accounts such as 401(k) plans and IRAs, which Robinhood has expanded into over the past few years. Cash and deposits account for $5 trillion, and Robinhood's banking features can easily meet this demand. Real estate is another $40 trillion sector, representing a long-term opportunity where Robinhood could engage through a range of services from mortgage lead generation to property tokenization.

Source: ARK Investment Management LLC, based on Furio 2025 and Lichtenberg 2025 data as of September 15, 2025. For reference only, should not be considered investment advice, nor does it constitute a recommendation to buy, sell, or hold any specific securities.

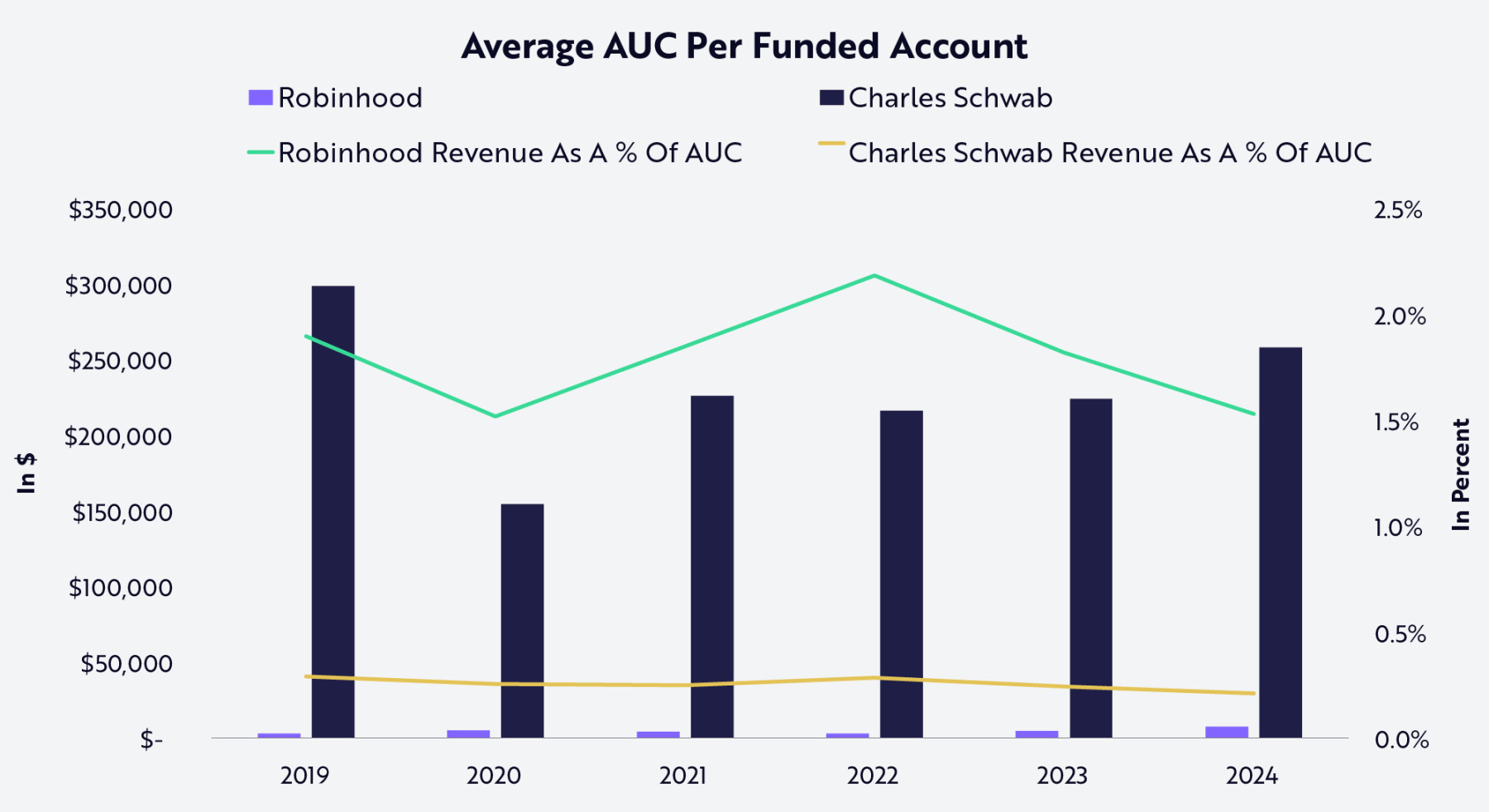

With its leading share among young investors and a product system that aligns with the trillions of dollars in wealth about to change hands, Robinhood not only has the potential to narrow the gap with traditional financial institutions but also the opportunity to fundamentally redefine the economic model of financial services. As shown in the chart below, Schwab, with an older and wealthier client base, has an average assets under custody (AUC) of about $250,000 per client, far exceeding Robinhood's current level. However, as Millennials and Gen Z inherit these assets and integrate their financial lives into the Robinhood platform, this dynamic may reverse over time.

Source: ARK Investment Management LLC, this analysis is based on multiple external data sources as of September 25, 2025 (primarily financial report data from Robinhood and Schwab). For reference only, should not be considered investment advice, nor does it constitute a recommendation to buy, sell, or hold any specific securities. Past performance does not represent future results.

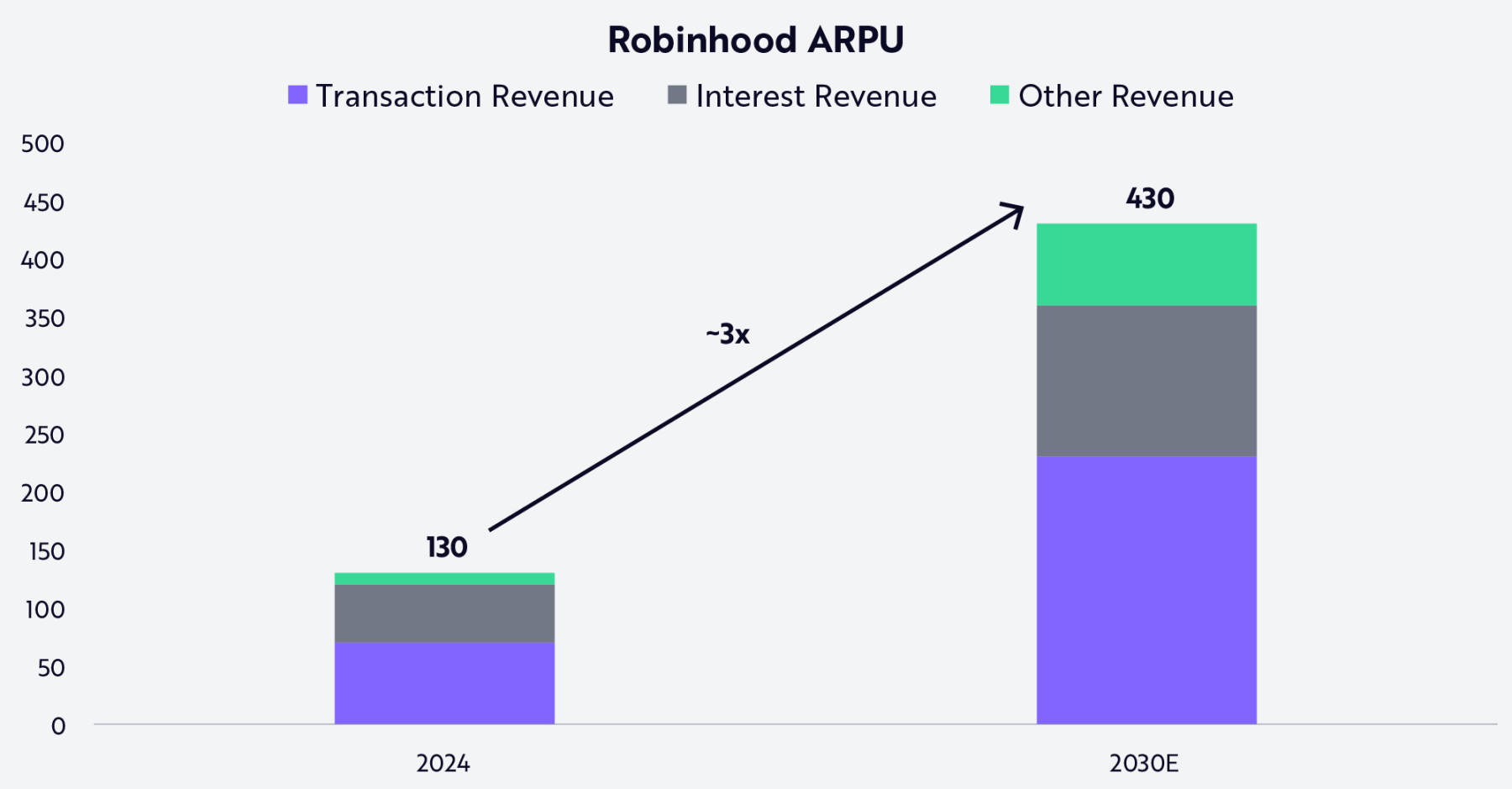

Summary: Robinhood's Potential Average Revenue Per User

Our research indicates that Robinhood, with its mature strategy of disrupting the brokerage industry through zero commissions and intuitive mobile-first design, combined with its rapid expansion in areas such as retirement, banking, credit, and advisory services, is well-positioned to capture a significant share of the ongoing intergenerational wealth transfer. Its bundling service strategy is deepening user engagement, expanding wallet share, and laying the groundwork for monetization across multiple verticals, paving the way for Robinhood to become one of the most important financial operating systems of the next generation.

As Robinhood continues to scale, we believe its monetization flywheel will significantly strengthen. Tokenization and prediction markets will enable users to trade any variety anytime, anywhere; as more users adopt premium services, Gold membership subscriptions are expected to grow; as idle funds flow into cash management, revenue sharing will expand; as transactions flow through its credit card, the economic benefits of credit operations will improve; and Cortex will accumulate value by providing increasingly personalized AI guidance.

Every incremental dollar of revenue will not only enhance Robinhood's unit economics but also increase the value provided to consumers—creating a virtuous feedback loop: growth in scale drives increased engagement, and increased engagement, in turn, fosters growth in scale.

As shown in the chart below, Robinhood's average revenue per user (ARPU) could grow from approximately $130 in 2024 to over $430 by 2030. This growth is expected to come from a balanced combination of trading growth, interest income, and other revenue sources from diversified, sustainable business models.

Source: ARK Investment Management LLC, this analysis is based on multidimensional data from Robinhood as of September 25, 2025 (primarily financial report data). For reference only, should not be considered investment advice, nor does it constitute a recommendation to buy, sell, or hold any specific securities. Forecasts themselves have limitations and should not be used as a basis.

One day, in terms of asset scale and business volume, Robinhood may resemble traditional financial institutions like Schwab. However, it is more likely that, as a technology company built for the digital native generation, Robinhood will redefine the essence of financial institutions. Decades from now, Robinhood may not only be seen as a brokerage but could also be remembered as a platform that defined an era—it reshaped the architecture of consumer finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。