Original Title: Defending $100k

Original Authors: Chris Beamish, CryptoVizArt, Antoine Colpaert, Glassnode

Original Compiler: Luffy, Foresight News

Abstract

· Bitcoin has fallen below the short-term holder cost basis (around $112,500), confirming weakened demand, marking the official end of the previous bull market phase. The current price is consolidating around $100,000, down about 21% from the all-time high (ATH).

· Approximately 71% of Bitcoin supply remains in profit, consistent with characteristics of a mid-term correction. A relative unrealized loss rate of 3.1% indicates that the market is currently in a mild bear phase rather than a deep capitulation.

· Since July, the supply of Bitcoin held by long-term holders has decreased by 300,000 coins, continuing to sell off even as prices decline—this differs from the "sell on rallies" pattern seen in the early stages of this cycle.

· There has been a sustained outflow of funds from U.S. spot Bitcoin ETFs (daily outflows of $150 million to $700 million), and the cumulative volume delta (CVD) of major exchanges shows continued selling pressure, with diminished demand for self-directed trading.

· The directional premium in the perpetual contract market has dropped from $338 million per month in April to $118 million, indicating that traders are reducing leveraged long positions.

· Demand for put options with a $100,000 strike price is strong, with rising premiums, showing that traders are still hedging risks rather than buying on dips. Short-term implied volatility remains sensitive to price fluctuations but has stabilized after a spike in October.

· Overall, the market is in a fragile balance: weak demand, manageable losses, and a cautious sentiment. To achieve a sustained rebound, it will need to attract new capital inflows and reclaim the $112,000 - $113,000 range.

On-Chain Insights

Following the release of last week's report, Bitcoin has struggled to reclaim the short-term holder cost basis after multiple attempts, ultimately falling significantly to around $100,000, about 11% below the key threshold of $112,500. This breakdown confirms weakened demand momentum, ongoing selling pressure from long-term investors, and marks a clear departure from the bull market phase.

This article will assess the structural weakness of the market through on-chain price models and spending indicators, combined with data from the spot, perpetual contract, and options markets, to gauge market sentiment and risk positions for the upcoming week.

Testing Lower Support Levels

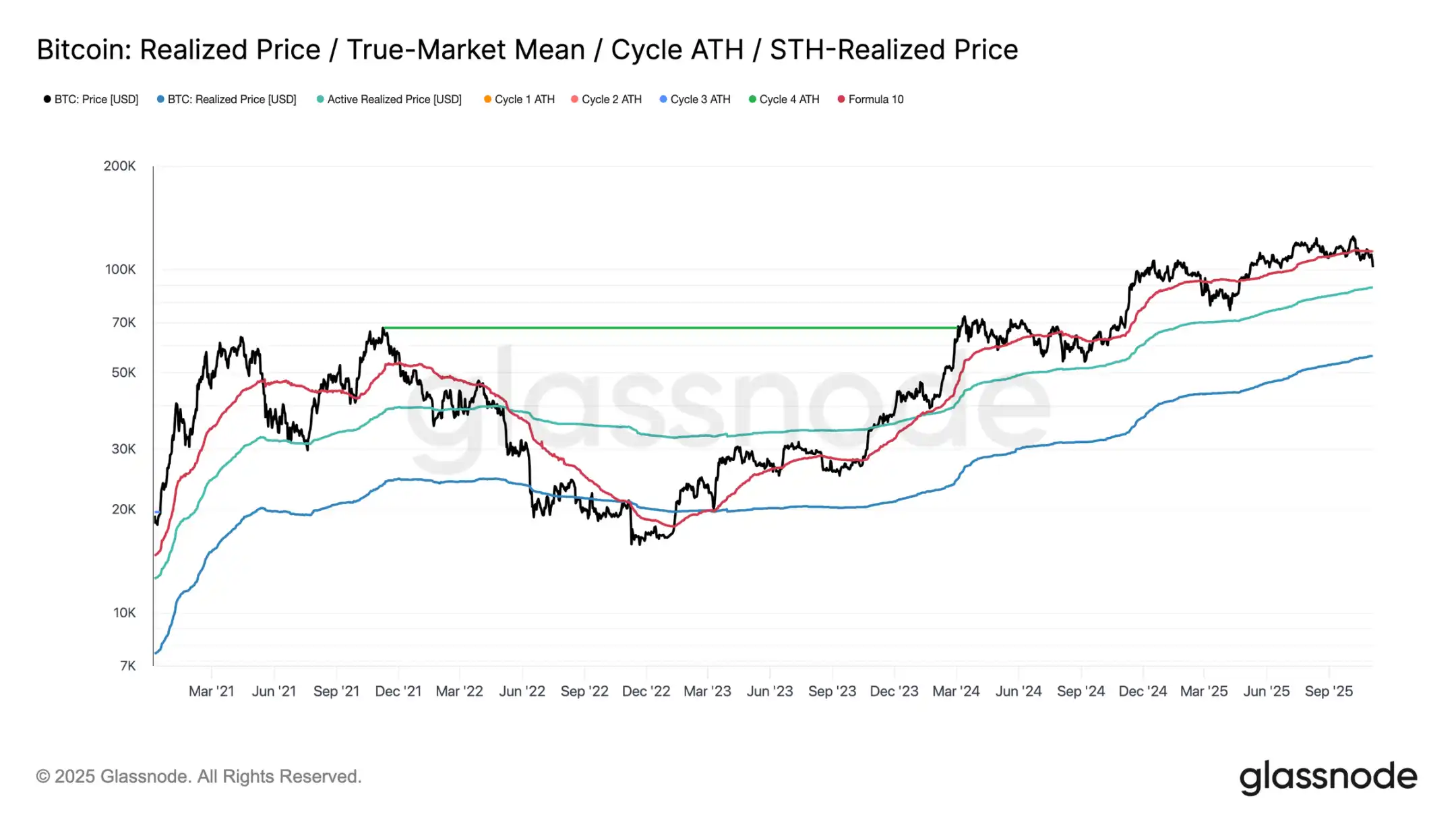

Since the market crash on October 10, Bitcoin has consistently struggled to hold above the short-term holder cost basis, ultimately dropping significantly to around $100,000, approximately 11% below the key threshold of $112,500.

Historically, when the price forms such a large discount to this level, the likelihood of further declines to lower structural support levels increases—such as the current active investor realization price of about $88,500. This indicator dynamically tracks the cost basis of actively circulating supply (excluding dormant tokens) and often plays a key reference role during long-term adjustment phases in past cycles.

At a Crossroads

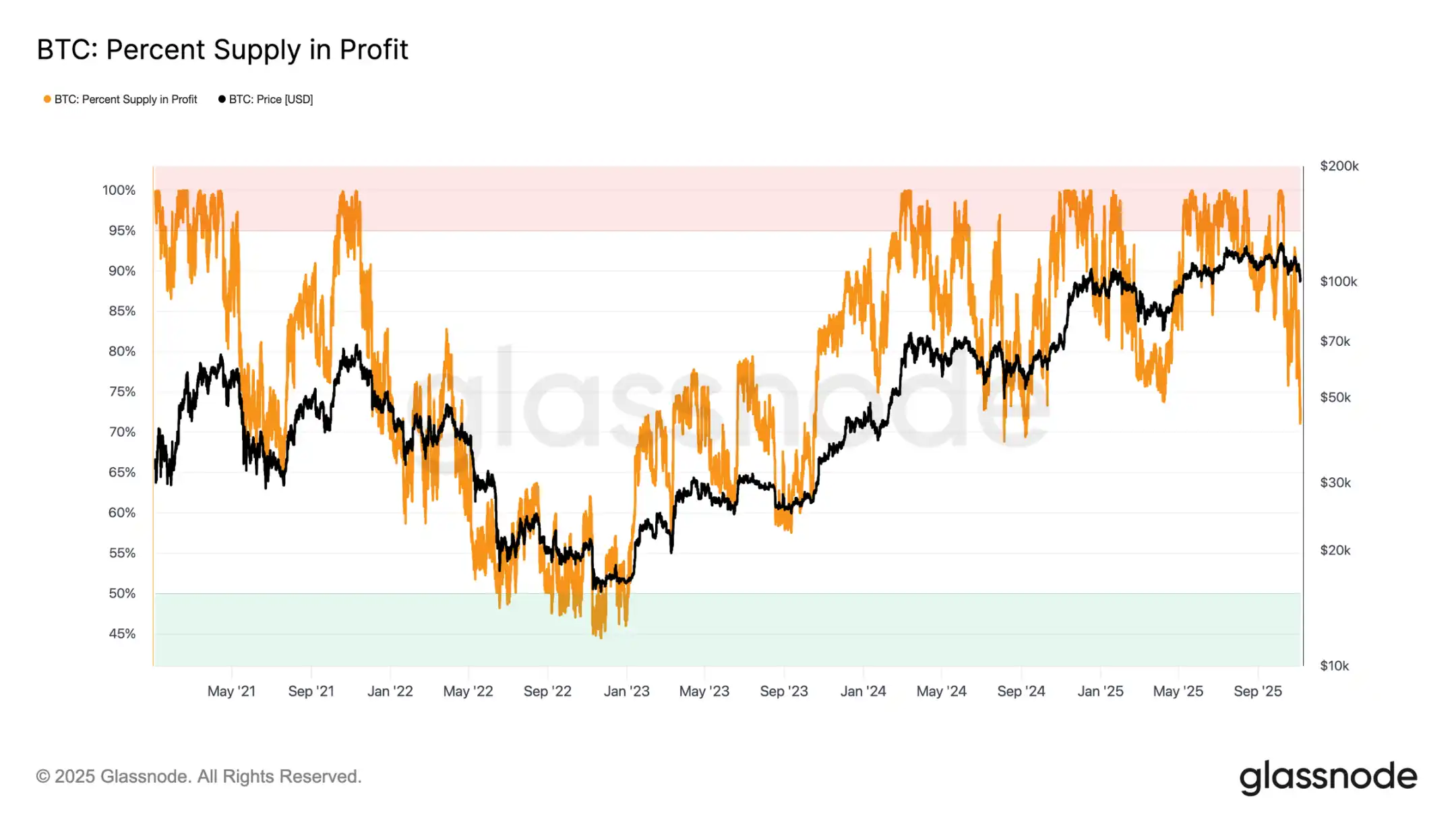

Further analysis reveals that the structure formed during this adjustment is similar to that of June 2024 and February 2025—during which Bitcoin was at a critical crossroads between "rebound" and "deep contraction." Currently, below the $100,000 level, about 71% of the supply remains profitable, placing the market at the lower bound of the typical 70%-90% profitable supply equilibrium zone characteristic of mid-term slowdowns.

This phase typically sees a brief corrective rebound towards the short-term holder cost basis, but sustained recovery often requires long-term consolidation and new demand inflows. Conversely, if further weakness leads to more holders falling into losses, the market may transition from the current mild decline to a deep bear phase. Historically, this phase is characterized by capitulative selling and long-term reaccumulation.

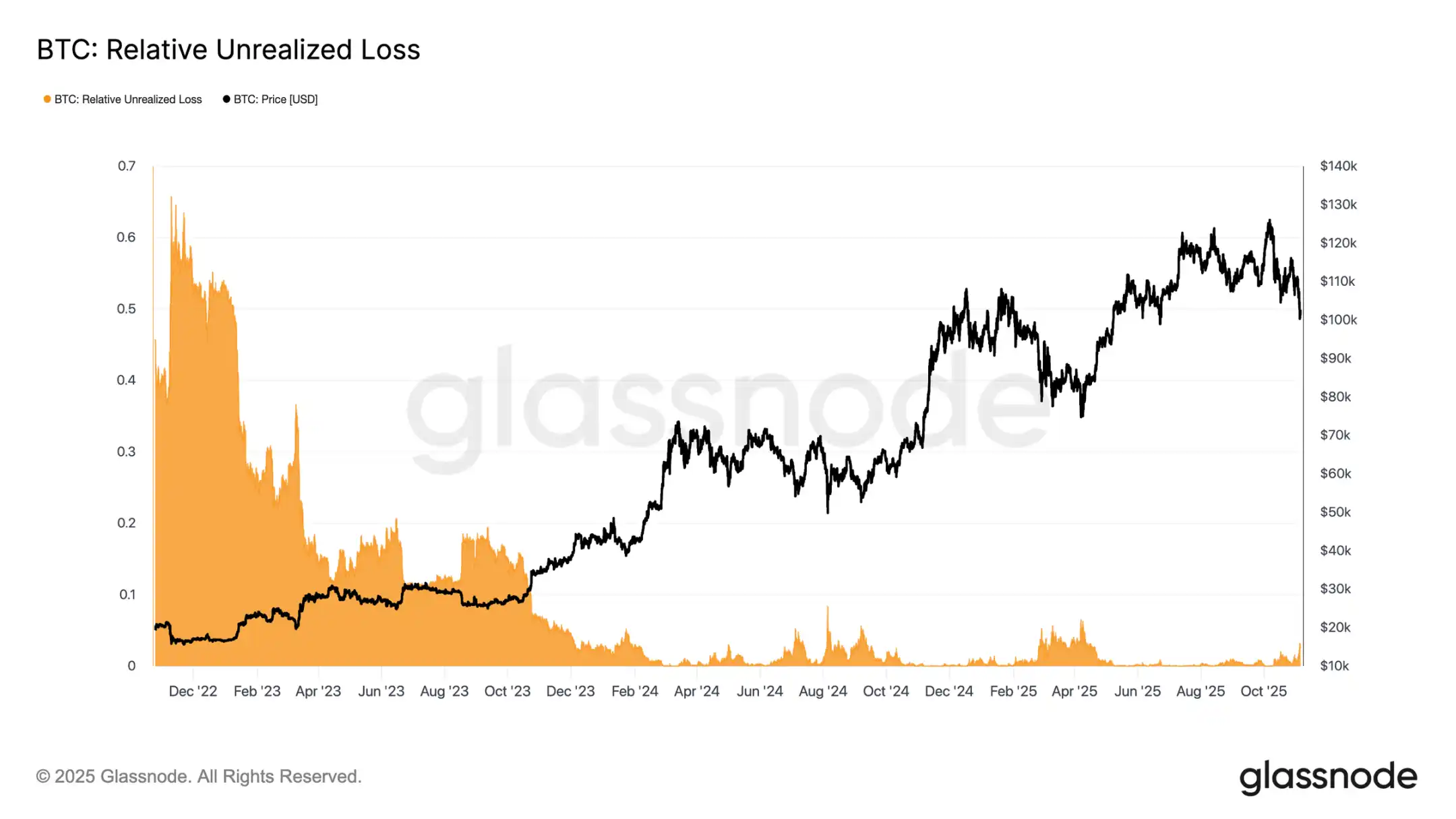

Losses Remain Manageable

To further distinguish the nature of the current pullback, we can refer to the relative unrealized loss rate—this indicator measures the proportion of total unrealized losses in USD relative to market capitalization. Unlike the extreme loss levels during the 2022-2023 bear market, the current unrealized loss rate of 3.1% indicates moderate market pressure, comparable to mid-term adjustments in Q3 and Q4 of 2024 and Q2 of 2025, all remaining below the 5% threshold.

As long as the unrealized loss rate remains within this range, the market can be classified as a "mild bear market," characterized by orderly revaluation rather than panic selling. However, if the pullback intensifies and this ratio exceeds 10%, it could trigger widespread capitulative selling, marking the market's entry into a more severe bear pattern.

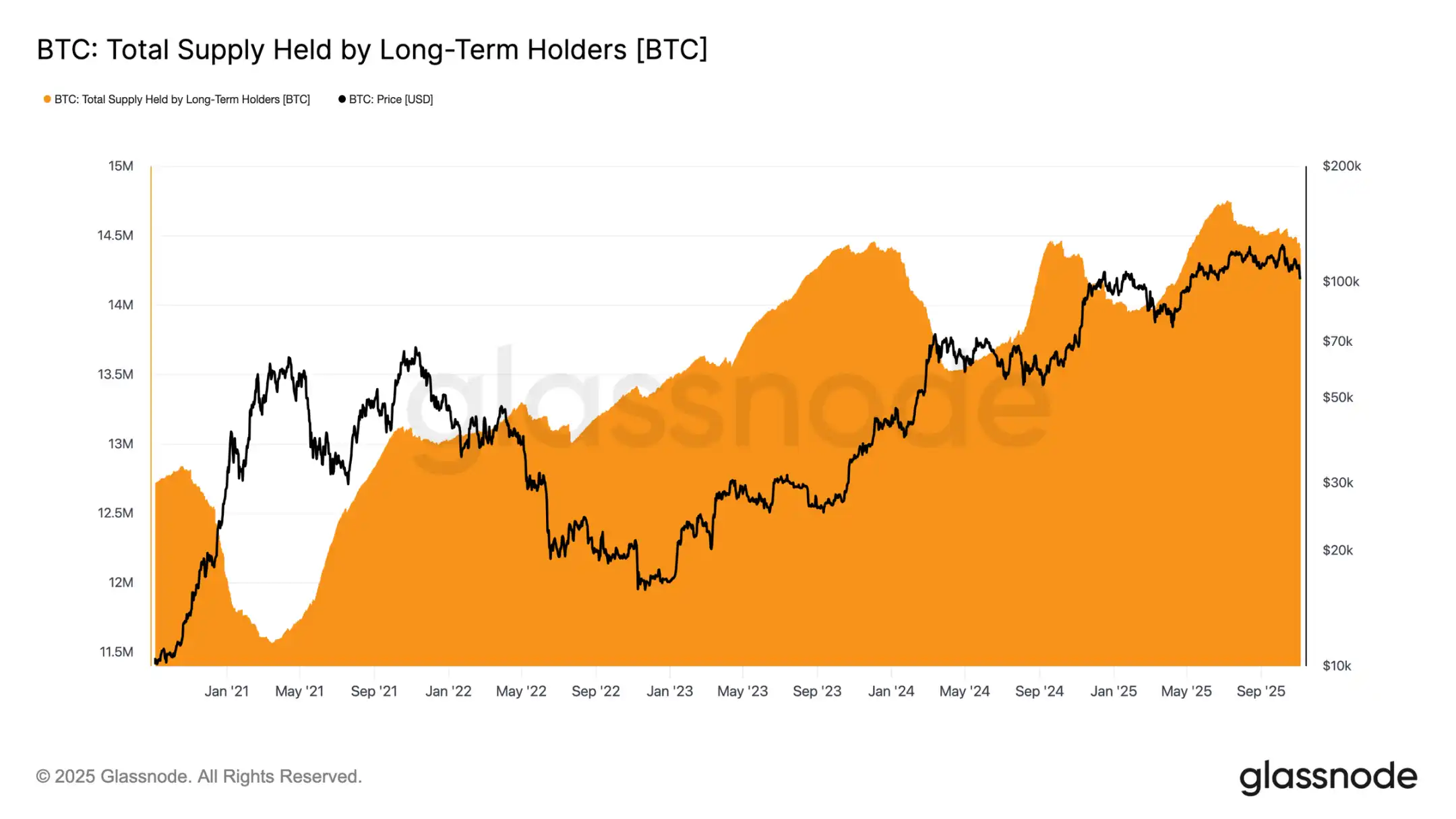

Long-Term Holders Continue to Sell

Despite the relatively manageable level of losses and a 21% drop from the historical high of $126,000, the market still faces mild but persistent selling pressure from long-term holders (LTH). This trend has gradually emerged since July 2025, and even when Bitcoin reached new highs in early October, this situation did not change, surprising many investors.

During this period, the Bitcoin holdings of long-term holders have decreased by about 300,000 coins (from 14.7 million to 14.4 million). Unlike the selling wave in the early stages of this cycle, when long-term holders "sold on rallies" during significant price increases, this time they have chosen to "sell on weakness," reducing their holdings as prices consolidate and continue to decline. This behavioral shift indicates that experienced investors are showing deeper fatigue and a decline in confidence.

Off-Chain Insights

Ammunition Shortage: Institutional Demand Cools

Turning to institutional demand: over the past two weeks, inflows into U.S. spot Bitcoin ETFs have significantly slowed, with daily net outflows of $150 million to $700 million. This contrasts sharply with the strong inflows from September to early October, which provided support for prices.

Recent trends indicate that institutional capital allocation is becoming cautious, with profit-taking and a decreased willingness to open new positions dragging down overall buying pressure in ETFs. This cooling of activity is closely related to the overall price weakness, highlighting a decline in buyer confidence after several months of accumulation.

Clear Bias: Weak Spot Demand

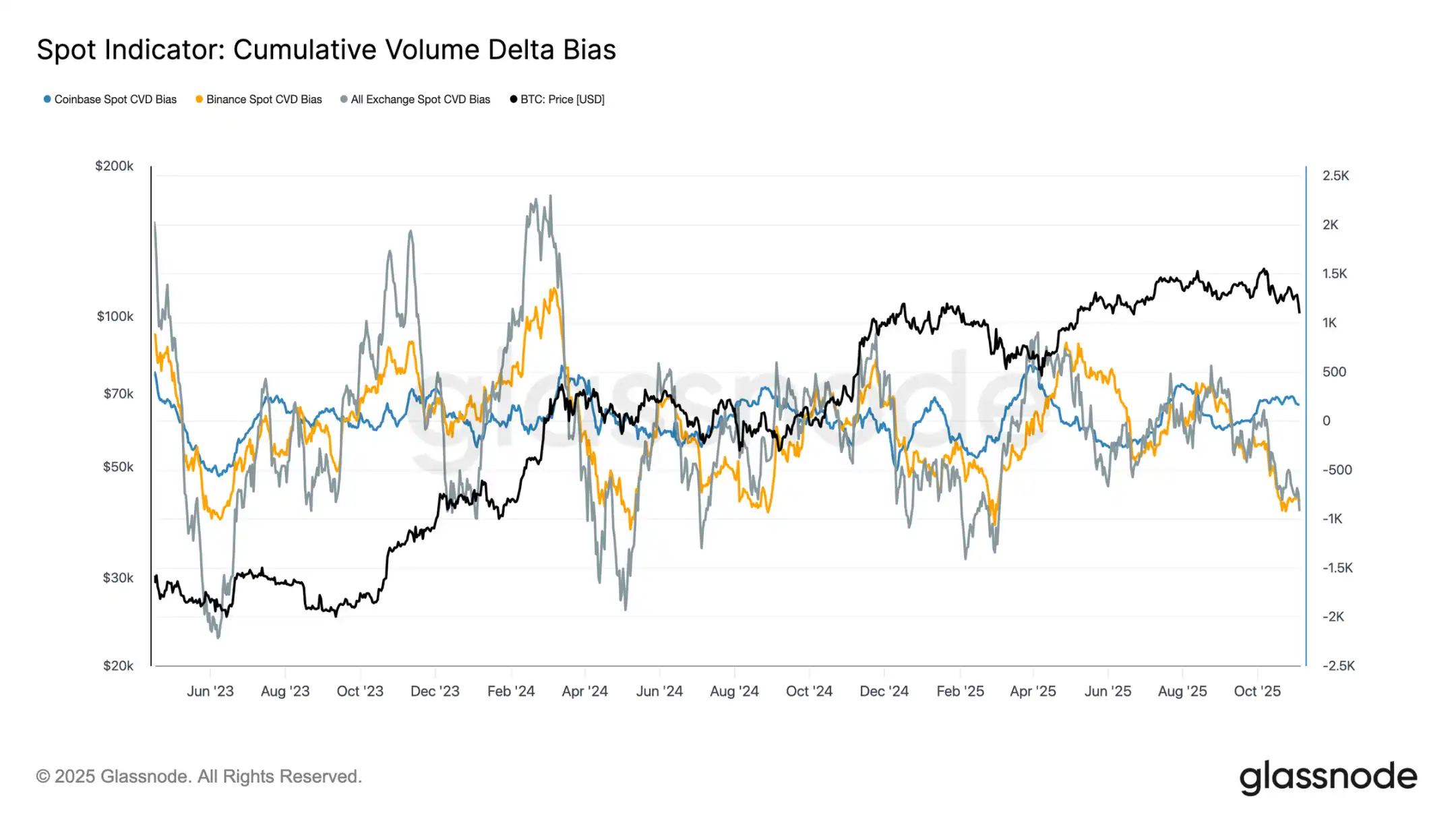

In the past month, the activity in the spot market has continued to weaken, with the cumulative volume delta (CVD) of major exchanges showing a downward trend. Binance and the overall spot CVD have turned negative, at -822 Bitcoin and -917 Bitcoin respectively, indicating ongoing selling pressure and limited active buying. Coinbase remains relatively neutral, with a CVD of +170 Bitcoin, showing no significant signs of buyer absorption.

The deterioration in spot demand corresponds with the slowdown in ETF inflows, indicating a decline in self-directed investor confidence. These signals collectively reinforce the cooling tone of the market: low buying interest and rapid profit-taking during rebounds.

Diminished Interest: Deleveraging in the Derivatives Market

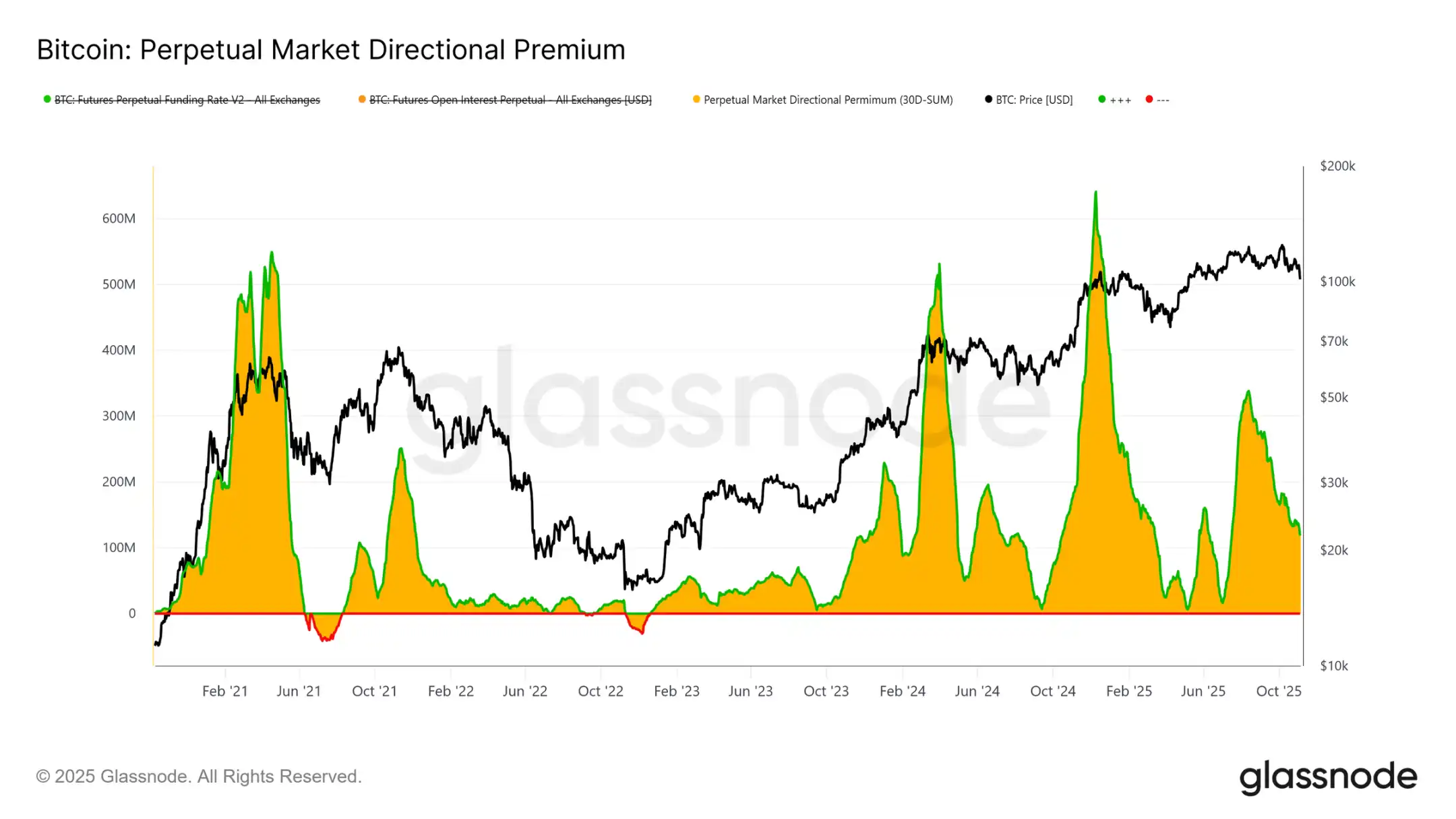

In the derivatives market, the directional premium in the perpetual contract market (the cost paid by long traders to maintain their positions) has dropped significantly from a peak of $338 million per month in April to about $118 million. This notable decline marks widespread liquidation of speculative positions and a clear cooling of risk appetite.

Following a sustained high positive funding rate earlier in the year, the steady decline of this indicator suggests that traders are reducing directional leverage, leaning towards neutral rather than aggressive long exposure. This shift aligns with the overall weakness in spot demand and ETF inflows, highlighting that the perpetual contract market has transitioned from an optimistic bias to a more cautious risk-averse stance.

Seeking Protection: Defensive Stance in the Options Market

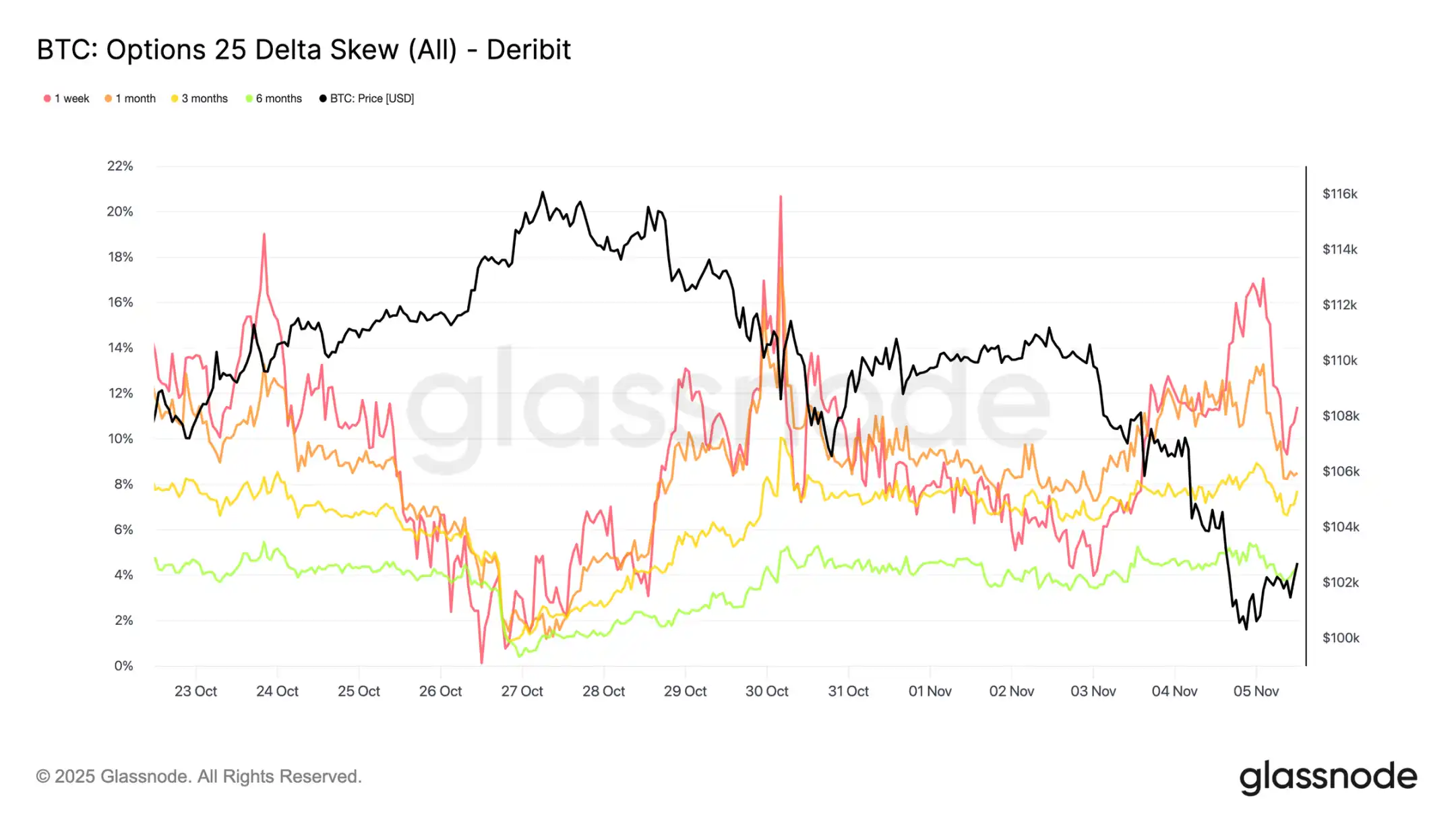

As Bitcoin hovers near the psychological level of $100,000, the options skew indicator unsurprisingly shows strong demand for put options. Data indicates that the options market is not betting on a reversal or "buying the dip," but rather paying high premiums to guard against further downside risk. The high prices of put options at key support levels indicate that traders are still focused on risk protection rather than accumulating positions. In short, the market is hedging, not bottom-fishing.

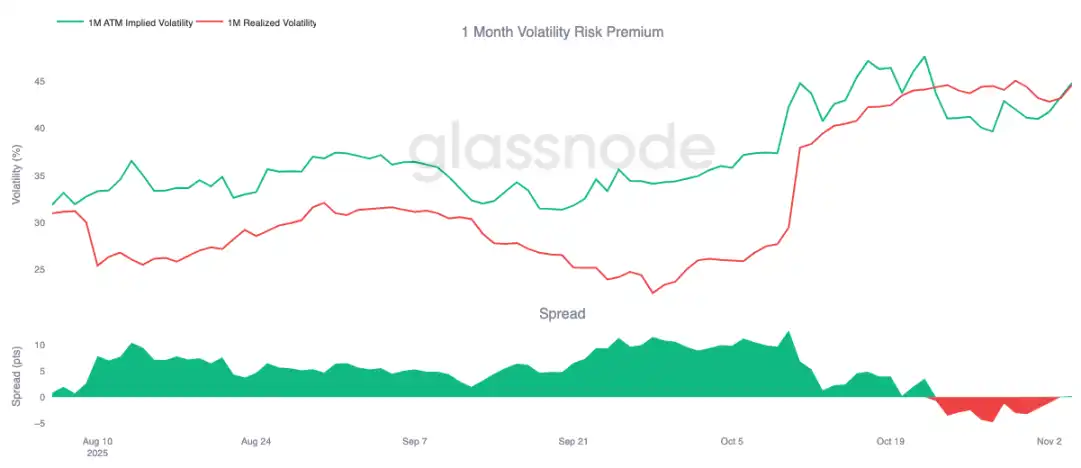

Risk Premium Rebounds

After ten consecutive days of negative values, the one-month volatility risk premium has slightly turned positive. As expected, this premium has shown mean reversion—after gamma sellers experienced a tough time, implied volatility has been repriced higher.

This shift reflects that the market is still dominated by cautious sentiment. Traders are willing to pay high prices for protection, allowing market makers to take opposite positions. Notably, when Bitcoin fell to $100,000, implied volatility rose in tandem with the reestablishment of defensive positions.

Volatility Spikes and Retreats

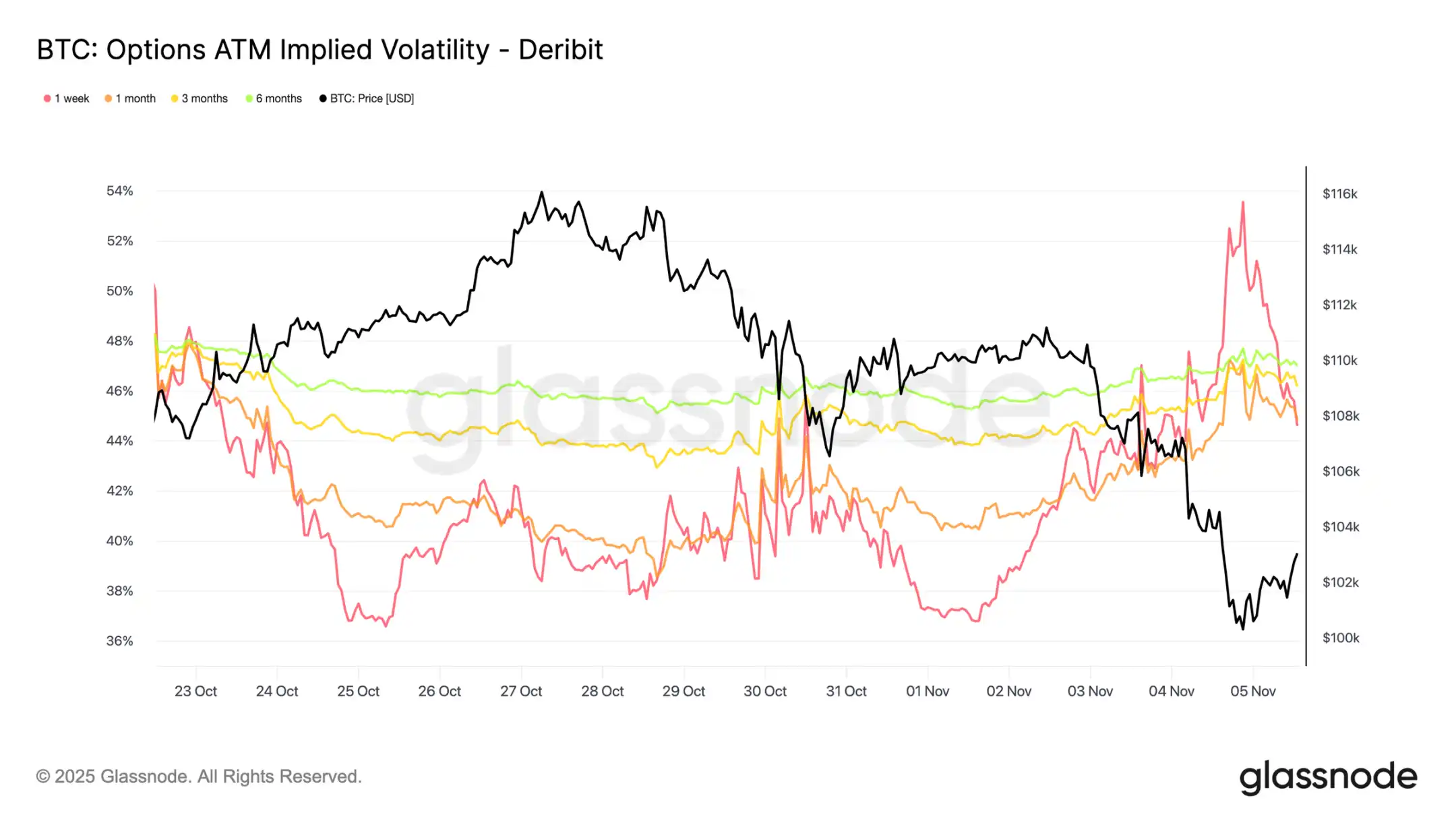

Short-term implied volatility remains closely negatively correlated with price movements. During the Bitcoin sell-off, volatility surged significantly, with one-period implied volatility reaching as high as 54%, before retreating by about 10 volatility points after finding support near $100,000.

Long-term expiration volatility also increased: one-month volatility rose by about 4 volatility points from the pre-adjustment level near $110,000, while six-month volatility increased by about 1.5 volatility points. This pattern highlights the classic "panic-volatility" relationship, where rapid price declines still drive short-term volatility spikes.

The Defensive Battle at the $100,000 Threshold

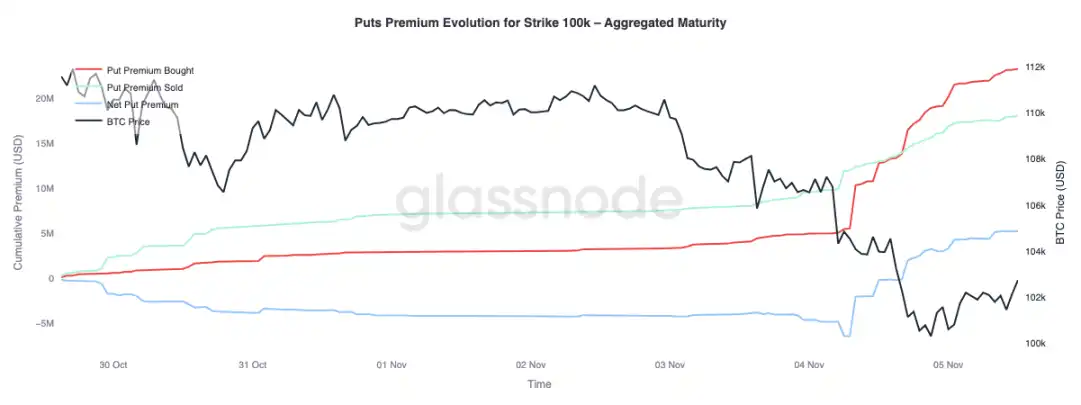

Observing the put option premiums with a $100,000 strike price can provide further insights into the current sentiment. Over the past two weeks, the net premium for put options has gradually increased, and yesterday, as concerns about the potential end of the bull market intensified, the premium surged significantly. During the sell-off, the put option premium spiked, and even as Bitcoin stabilized near support levels, the premium remained elevated. This trend confirms ongoing hedging activity, with traders opting for protection rather than re-taking risks.

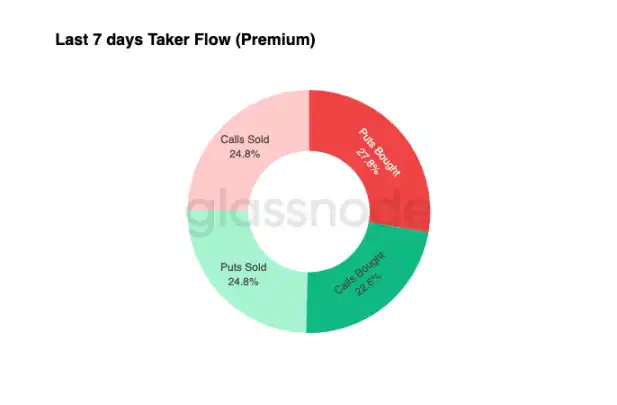

Capital Flows Towards Defense

The capital flow data from the past seven days indicates that eating orders are primarily based on negative delta positions—mainly achieved through buying put options and selling call options. In the past 24 hours, there are still no clear bottom signals. Market makers continue to hold long gamma, absorbing significant risk from yield-seeking traders, potentially profiting from bidirectional price fluctuations.

This pattern keeps volatility high but manageable, maintaining a cautious tone in the market. Overall, the current environment favors defense over aggressive risk-taking, lacking clear upward catalysts. However, due to the high cost of downside protection, some traders may soon begin to sell risk premiums in search of value investment opportunities.

Conclusion

Bitcoin's drop below the short-term holder cost basis (around $112,500) and stabilization near $100,000 marks a decisive shift in market structure. So far, this adjustment resembles past mid-term slowdown phases: 71% (within the 70%-90% range) of the supply remains profitable, and the relative unrealized loss rate is controlled at 3.1% (below 5%), indicating a mild bear market rather than deep capitulation. However, the ongoing selling by long-term holders since July, along with outflows from ETF products, highlights a weakening confidence among both retail and institutional investors.

If selling pressure continues, the active investor realization price (around $88,500) will be a key downward reference; recovering the short-term holder cost basis would signify a resurgence in demand. Meanwhile, the directional premium in the perpetual contract market and the CVD bias both indicate a retreat of speculative leverage and a decline in spot participation, reinforcing a risk-averse environment.

In the options market, strong demand for put options, rising premiums at the $100,000 strike price, and a slight rebound in implied volatility all confirm a defensive tone. Traders continue to prioritize protection over accumulation, reflecting a hesitant attitude towards the "bottom."

Overall, the market is in a fragile balance: oversold but not panicked, cautious but structurally intact. The next directional move will depend on whether new demand can absorb the ongoing selling by long-term holders and reclaim the $112,000 - $113,000 range as solid support; or if sellers continue to dominate, extending the current downward trend.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。