Original Title: Oct 10th Red Friday: the root cause of Stream xUSD blowing up, the longer version

Original Author: Trading Strategy

Original Translator: Kaori, BlockBeats

Editor's Note: The collapse of xUSD has sounded a loud alarm for the entire DeFi world. This article delves into how Stream Finance, through opaque operations, extreme leverage, and liquidation priority design, has violated the core spirit of DeFi, and explores how the industry can ensure capital flows to truly responsible, transparent, and robust projects, including measures such as introducing stricter treasury technology risk scoring.

False Neutral Strategy

Stream xUSD is a "tokenized hedge fund" disguised as a DeFi stablecoin, claiming its strategy is "delta neutral." However, Stream recently found itself in a state of insolvency after a series of questionable operations.

Over the past five years, several projects have attempted similar models—generating income through so-called "neutral yield strategies" to create initial liquidity for their tokens. Successful examples include MakerDAO, Frax, Ohm, Aave, Ethena, and others.

Unlike these relatively "more genuine" DeFi projects, Stream severely lacks transparency in its strategy and position disclosures. Of the claimed $500 million TVL, only about $150 million can be tracked on-chain through platforms like DeBank. It was later discovered that Stream had actually allocated part of its funds to off-chain proprietary trading strategies, some of which faced liquidation, resulting in a loss of about $100 million.

According to @CCNDotComNews, the $120 million hack incident that Balancer DEX encountered this Monday is unrelated to the Stream collapse.

According to rumors (which cannot be confirmed as Stream has not disclosed specific information), part of the losses is related to off-chain "selling volatility" strategies.

In quantitative finance, "selling volatility" (also known as short volatility or short vol) refers to a trading strategy that profits when market volatility decreases or remains stable. The logic is that when the price of the underlying asset does not fluctuate much, the value of options shrinks or even goes to zero, allowing the seller to keep the premium as profit.

However, such strategies carry extremely high risks—once the market experiences severe volatility (i.e., a spike in volatility), sellers may face substantial losses. This risk is often vividly described as "picking up coins in front of a steamroller."

Systemic Collapse

On October 10th (October 11th UTC+8), the so-called "Red Friday," I experienced a sharp spike in volatility.

This systemic leverage risk had actually been accumulating in the crypto market for some time, with the trigger being the market frenzy surrounding Trump in 2025. When Trump announced new tariff policies on the afternoon of October 10th, all markets fell into panic, and the fear quickly spread to the cryptocurrency market.

In the panic, the first to panic profited—everyone began to sell liquid assets, triggering a chain of liquidations.

Due to the long-accumulated leverage risk pushing systemic leverage to high levels, the perpetual contract market lacked the depth to support the smooth clearing of all leveraged positions. In this situation, the automatic deleveraging (ADL) mechanism was triggered, beginning to "socialize" some of the losses, distributing them among traders who were still profitable.

This further distorted an already chaotic market structure.

The volatility triggered by this event can be described as a once-in-a-decade upheaval in the crypto market. Similar crashes occurred in the early crypto era of 2016, but at that time, market data was scarce. Therefore, most algorithmic traders today design strategies based on "stable volatility" data from recent years.

Due to the lack of historical samples of such severe volatility, even lightly leveraged positions of around 2x faced total liquidation in this volatility.

The first "corpse" to surface after "Red Friday" was Stream.

The definition of a "Delta neutral fund" is: theoretically, it cannot lose money.

If it loses money, by definition, it is not Delta neutral.

Stream has always claimed to be a Delta neutral fund, but in reality, it secretly allocated funds to non-transparent, off-chain proprietary strategies.

Of course, the term "Delta neutral" is not an absolute black-and-white distinction, but in hindsight, many experts believe that Stream's strategy was too risky to be considered truly neutral—because once this strategy backfires, the consequences are severe. And it has been proven to be the case.

When Stream lost its principal in these high-risk trades, it immediately fell into insolvency.

In DeFi, risk is the norm—losing some money is not terrifying.

If you can recover 100% of your principal, even experiencing a 10% drawdown is not fatal, especially when your annualized return can reach 15%.

But in Stream's case, the problem is that it not only engaged in risky strategies but also used another stablecoin protocol, Elixir, for "circular borrowing" leverage, amplifying the risk to the extreme.

Chaotic Risk Exposure

Circular borrowing is a leveraged yield mining strategy in the DeFi lending market. It involves repeatedly borrowing against deposited collateral—typically using the borrowed assets as additional collateral—to amplify exposure to yields provided by interest rates, liquidity mining rewards, or other lending protocols (such as Aave, Compound, or Euler). This creates a "loop" that allows users to effectively double their capital without needing additional external funds, essentially allowing users to borrow from themselves and then lend back to the protocol.

The Stream xUSD wallet holds 60% of the circulating xUSD, all of which is leveraged.

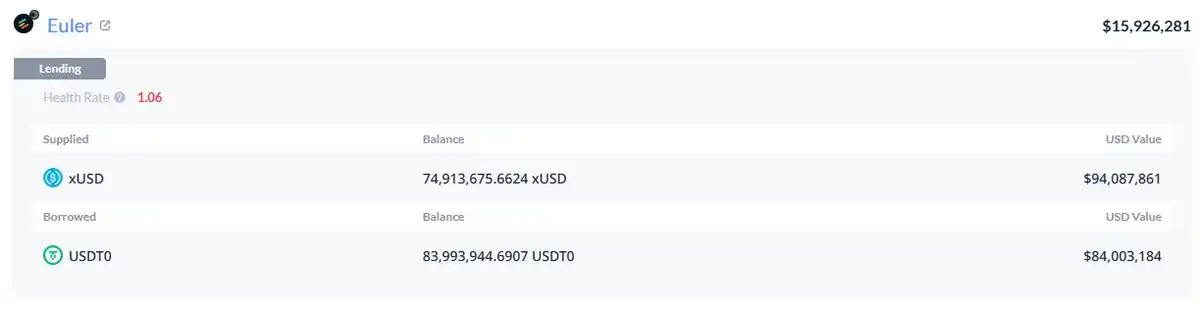

Since they mixed the funds of their products, we cannot know how much of it was achieved through circular borrowing for their own backing. However, it is certain that this includes a $95 million position on Plasma Euler.

The maximum risk exposure of xUSD includes:

mHYPE (whose liquidity buffer seems to be empty).

RLP (where the numbers on its transparency page do not match the wallet data, and it shows a negative balance of $25 million on Binance).

Explanation of xUSD's risk exposure

Other notable risk exposures are directed towards other yield tokens, such as rUSD. About 30% of rUSD's backing is its own rUSD.

Additionally, there is deUSD, which has 30% of its backing in mF-ONE.

Most of mF-ONE's assets are off-chain, claiming to have a $16 million "liquidity buffer," but this fund is actually 100% deposited in mTBILL.

mTBILL is short about $15 million, but it only has a $100,000 "liquidity buffer," while another $5 million is in BUIDL.

Proof of xUSD's transparency

To make matters worse, Elixir also claims to have "liquidation priority" in an off-chain agreement—meaning that if Stream ultimately goes bankrupt, Elixir can reclaim its principal first, while other DeFi users who invested in Stream can only recover less money, or even nothing at all.

Official statement from Elixir

Due to Stream's extremely opaque operations, combined with the existence of circular leverage and privatized trading strategies, we do not actually know how much ordinary users have lost. Currently, the price of the Stream xUSD stablecoin has dropped to just $0.60 for every $1.

What is even more infuriating is that none of this was disclosed to investors in advance. Many users are now furious with Stream and Elixir—not only have they lost money, but they also found that their losses were "socialized," allowing wealthy individuals from Wall Street who cashed out early to escape unscathed and retain their profits.

This incident has also affected other lending protocols and their asset managers:

"Everyone who thought they were doing collateralized lending on Euler was actually doing unsecured lending through an agent." — Rob from InfiniFi

Furthermore, since Stream has neither publicly transparent on-chain data nor disclosed its positions and profit and loss situations, users have begun to suspect that it may have misappropriated user profits for team management or internal purposes.

Stakers of Stream xUSD rely on the project's self-reported "oracle" data to calculate yields, and this data cannot be verified by third parties, nor is there any way to confirm whether its calculations are accurate and fair.

Breaking the Deadlock: Treasury Technology Risk Scoring

How can this issue be resolved?

Events like Stream's are entirely avoidable—especially in an industry like DeFi that is still in its early stages.

The rule of "high risk, high return" always holds, but to apply it, you must truly understand the risks.

Not all risks are equivalent; some risks are entirely unnecessary.

In fact, there are some reputable yield aggregation, lending, or "hedge funds existing in stablecoin form" protocols on the market that are relatively transparent in terms of risk, strategy, and position disclosures.

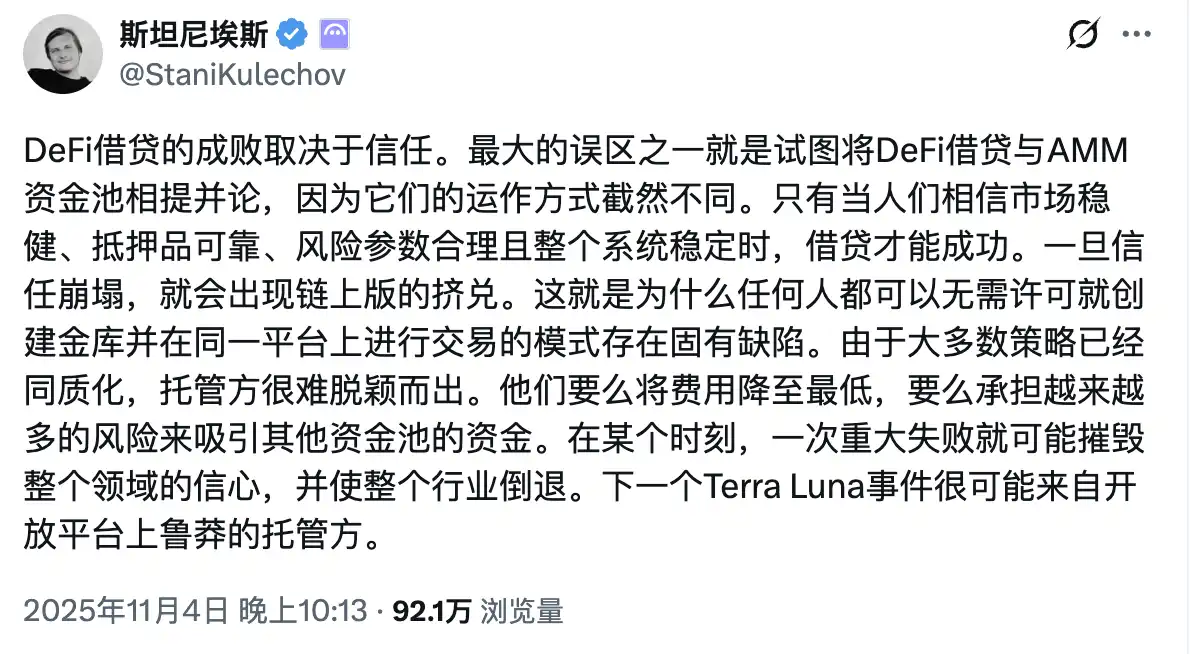

Aave founder @StaniKulechov has discussed the "curator" mechanism of DeFi protocols and when excessive risk-taking behavior might occur:

To help the market more clearly distinguish between "good vaults" and "bad vaults," the Trading Strategy team has introduced a new metric in the latest DeFi Vault report: the Vault Technical Risk Score.

The so-called "technical risk" refers to the possibility of loss of funds in DeFi vaults due to improper technical execution.

The Vault Technical Risk framework provides an intuitive tool for categorizing DeFi vaults into high-risk and low-risk categories.

Example of evaluation dimensions for the Vault Technical Risk Score

This scoring system cannot eliminate market risks (such as trading errors, contagion risks, etc.),

but it ensures that third parties can independently assess and quantify these risks, allowing users to have a clearer understanding of their risk exposure.

When DeFi users can access more comprehensive and transparent information, capital will naturally flow to projects that are responsible, compliant, and operate robustly.

In this way, events like Stream's will become less frequent in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。