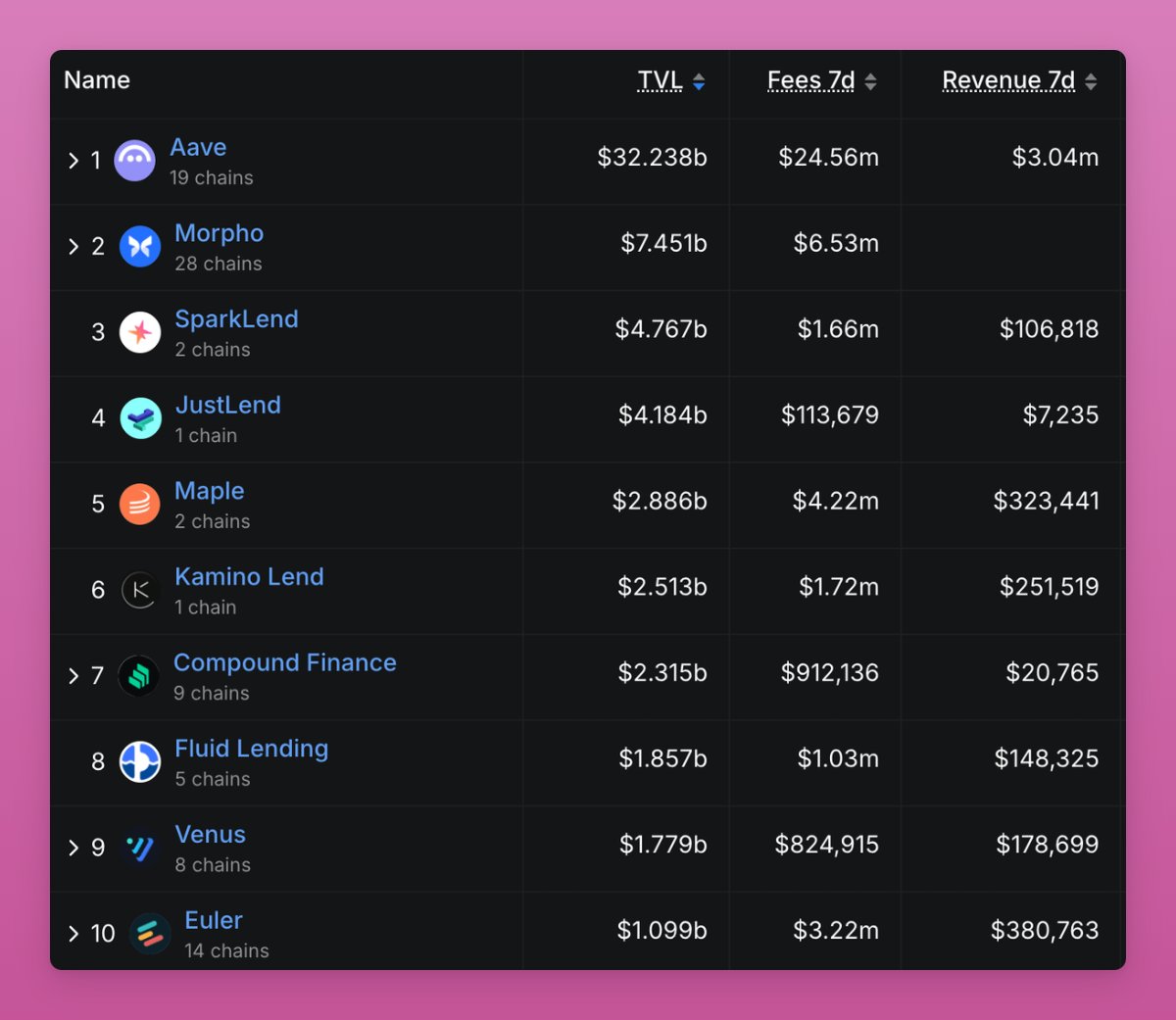

Lending market tokenomics shows how far DeFi has matured.

5 out of 10 top lending protocols now share revenue with holders:

• Aave: Snapshot vote passed to enshrine $50M/yr in buybacks

• Maple: 20–25% of revenue buys back and rewards stSYRUP stakers

• Fluid: Began buybacks Oct 6 after $10M annual revenue, already 0.36% of supply bought back

• Venus: 20% of revenue buys back $XVS and 25% of BNB Chain revenue burns $BNB

• JustLend: 30% of revenue to quarterly JST burns, first $17.7M (5.66% supply) in Oct 2025

Spark and Kamino have point programs for airdrop.

Morpho, Compound, and Euler remain governance only for now.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。