🚨 The chain reaction of USDX is still ongoing | Those recently involved in on-chain finance really need to be careful!

Previously, I had some leftover USD1 from participating in Buildpad's new project, and I was too lazy to move it around, so I directly put it into @lista_dao for finance.

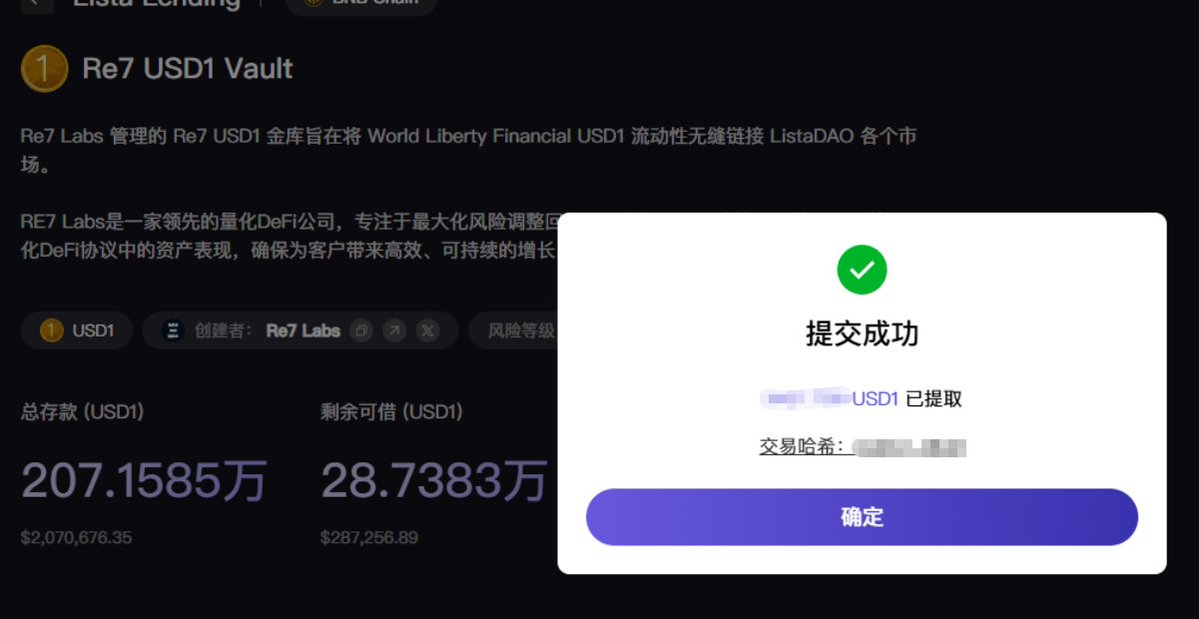

Coincidentally, I chose the Re7 USD1 vault, which has an annualized return of about 30%.

Unexpectedly, a couple of days ago, Stream Finance had a major incident, causing the xUSD-related assets to devalue. There is a high overlap of collateral and recursive loops between xUSD→USDX/sUSDX, which directly affected the Re7 USD1 Vault that supports USDX collateral.

After USDX dropped to 0.68, the collateral value evaporated by 30% in an instant, LTV passively increased, and borrowers couldn't maintain their positions or repay their loans.

Even though Lista urgently removed the interest rate cap, no one still repaid, and liquidity completely dried up.

Just now, a friend reminded me to check the vault, and upon entering, I found that it had already formed 2 million in bad debts, and not a single cent could be withdrawn.

Fortunately, @lista_dao reacted in a timely manner and directly voted to start the liquidation process. The current liquidation progress is:

- Liquidation: 3,526,011 USDX

- Recovered: 2,927,163 USD1

- Remaining: 180,000 in debt has been moved to the public liquidation area

I managed to withdraw a few thousand U just in time during the recent liquidity supplement, and it arrived instantly, so it was a false alarm.

Brothers who haven't withdrawn can keep an eye on the liquidation area and vault page: 👉 https://lista.org/lending/liquidation

Keep refreshing; every time a liquidation occurs, a portion of liquidity will be released, so withdraw immediately if there is any.

Sigh, the whole process has been another lesson! —

In on-chain finance, the risk never starts on the day of the incident, but rather:

The more layers of design, the more layers of risk.

The more layers of interaction, the more layers of risk.

All high-yield finance essentially involves dreaming on someone else's leverage. When the dream ends, even the principal is part of the liquidity.

I have some new thoughts on on-chain Low Risk DeFi and Curator models, and I’ll find a time to write a separate article!

By the way, another MEV USDT Vault on Lista is in the same situation, but it seems that liquidation hasn't occurred yet, currently having 11.8 million in bad debts. I hope it can be resolved smoothly!

After all, at times like this, every U is hard-earned!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。