On-chain indicators show that Bitcoin whales are gradually decreasing, while the holdings of smaller retail wallets are increasing.

Written by: He Hao

Source: Wall Street Insight

The cryptocurrency market is undergoing a deep adjustment. Since reaching its historical high in early October, Bitcoin's price has dropped by about 20%. This adjustment is occurring at the tail end of Bitcoin's "four-year cycle." The liquidity crisis triggered by the ongoing government shutdown in the United States is exacerbating the depth and duration of this adjustment.

Historical Trajectory of Bitcoin's Four-Year Cycle

The theory of Bitcoin's four-year cycle is based on its halving mechanism. Every time 210,000 blocks are mined (approximately every four years), the block reward for miners is halved, reducing the supply of new Bitcoin. This mechanism creates predictable supply shocks, which have historically led to cyclical price increases.

Looking back at history, Bitcoin's four-year cycles exhibit remarkable regularity:

After the first halving in November 2012, Bitcoin's price soared from $12 to about $1,100.

After the second halving in July 2016, the price rose from about $650 to nearly $20,000.

After the third halving in May 2020, the price climbed from about $8,700 to over $67,000.

In April 2024, Bitcoin will complete its fourth halving, reducing the block reward from 6.25 BTC to 3.125 BTC.

About a year after each halving, Bitcoin typically reaches a cyclical peak before entering a bear market adjustment. Currently, it has been 18 months since the halving event in April 2024.

However, some research institutions point out that the Bitcoin market may be gradually breaking away from the typical four-year cycle associated with "halving." Bitwise mentioned in its long-term Bitcoin research report that as institutional investors continue to enter the market and spot ETFs provide new demand channels, the market structure is becoming more mature, and price fluctuations may no longer strictly follow the traditional four-year rhythm.

At the same time, the impact of the upcoming halving in 2024 on the supply side has significantly weakened compared to earlier halvings. According to data from Glassnode and Galaxy Research, this halving will reduce Bitcoin's annual issuance rate from about 1.7% to approximately 0.85%. However, since about 19.7 million Bitcoins have already been mined (out of a total supply of 21 million), the newly issued quantity constitutes a very limited proportion of the overall supply, and its marginal impact on the market is decreasing. This means that market pricing will rely more on the structure of capital inflows (especially from institutions and long-term holders) rather than being primarily driven by changes in new supply.

"Whale" Sell-off: A Typical Feature of the Cycle's End

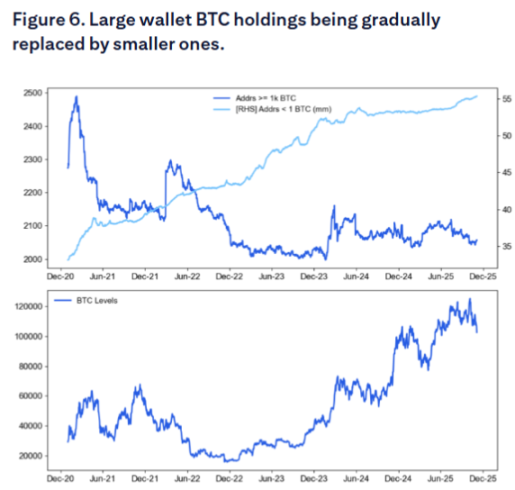

Citigroup's latest report reveals the key driving force behind the current adjustment: on-chain data shows that Bitcoin "whales" (large holders) are gradually decreasing, while the holdings of small "retail" wallets are increasing. This phenomenon aligns closely with the four-year cycle theory, indicating that at the tail end of the cycle, smart money typically sells Bitcoin to new entrants.

On-chain data indicates that since August, whales have cumulatively sold 147,000 Bitcoins, worth approximately $16 billion.

Citigroup's report points out that the number of addresses holding more than 1,000 Bitcoins is declining, while the number of "retail" investors holding less than 1 Bitcoin is increasing. Glassnode's coin distribution analysis shows that entities holding more than 10,000 Bitcoins are in a clear "distribution" phase, while the group holding between 1,000 and 10,000 Bitcoins is generally neutral, with net buying primarily coming from smaller holders who tend to invest for the long term.

There is a deep logic behind this sell-off pattern. Almost all long-term holders are currently in profit and are engaging in large-scale profit-taking. Bitwise's European research director, André Dragosch, points out that these whales "believe in the four-year halving cycle and therefore expect that Bitcoin has reached the peak of this cycle."

CryptoQuant CEO Ki Young Ju notes that the current market structure is evolving from "whales selling to retail" to "old whales transferring chips to new long-term holders (such as institutions, ETFs, and strategic buyers)." This means that although selling pressure is still occurring, the nature of the buyers is changing, and price adjustments may therefore appear more moderate but last longer.

The Liquidity "Siphon" from Government Shutdown

The more direct catalyst for the current Bitcoin adjustment comes from the liquidity crisis triggered by the U.S. government shutdown. The sharp increase in the balance of the U.S. Treasury General Account (TGA) is siphoning off a significant amount of liquidity from the market, with Bitcoin as a risk asset being the first to feel the impact.

By the end of October 2025, the TGA balance exceeded $1 trillion for the first time, reaching a nearly five-year high since April 2021. In the past few months, the TGA balance surged from about $300 billion to $1 trillion, withdrawing over $700 billion in liquidity from the market.

It is important to clarify that the increase in the TGA balance is not solely caused by the government shutdown but is a combination of two factors:

First, the shutdown itself: Since the government shutdown on October 1, 2025, the U.S. Treasury has continued to collect funds through taxes and bond issuance, but due to Congress not approving a budget, most government departments are closed, and the Treasury cannot spend as planned, resulting in the TGA having "only inflows and no outflows."

Second, the ongoing impact of large-scale U.S. Treasury bond issuance. Even during normal government operations, the Treasury issues bonds to replenish the TGA account, which also siphons liquidity from the market.

The impact of this "double siphon" mechanism is significant:

According to official reports from the Federal Reserve and financial institutions, the cash assets of foreign commercial banks have fallen to about $1.176 trillion, a noticeable decline from the peak in July. The total reserves of the Federal Reserve have dropped to $2.8 trillion, the lowest level since early 2021.

The expansion of the TGA balance has triggered a comprehensive tightening in the money market. Overnight repo rates reached as high as 4.27%, far exceeding the Federal Reserve's 3.9% excess reserve rate and the 3.75%-4.00% federal funds target range. SOFR rates have also risen significantly, indicating a clear tightening of market liquidity.

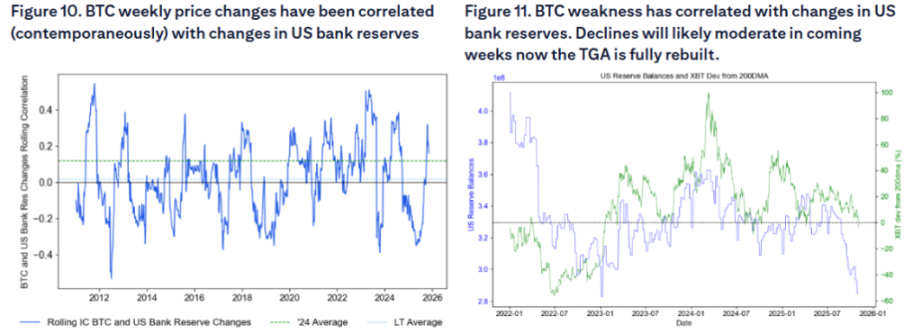

Citigroup's report emphasizes that cryptocurrencies are "very sensitive" to the liquidity conditions of banks. Research shows that Bitcoin's weekly price changes are synchronously correlated with changes in U.S. bank reserves, and a decline in bank reserves often accompanies weak performance in Bitcoin. This sensitivity makes Bitcoin one of the earliest and most sensitive victims of tightening liquidity.

From a policy perspective, the government shutdown is equivalent to implementing multiple rounds of disguised interest rate hikes. Analysts believe that the $700 billion in liquidity withdrawn by the U.S. Treasury has a tightening effect comparable to significant monetary policy tightening.

The Federal Reserve's October meeting announced the end of quantitative tightening (QT), and analysts pointed out that if it weren't for the liquidity tightening, the Fed might not have announced the end of QT. However, this action by the Fed will not take effect until December.

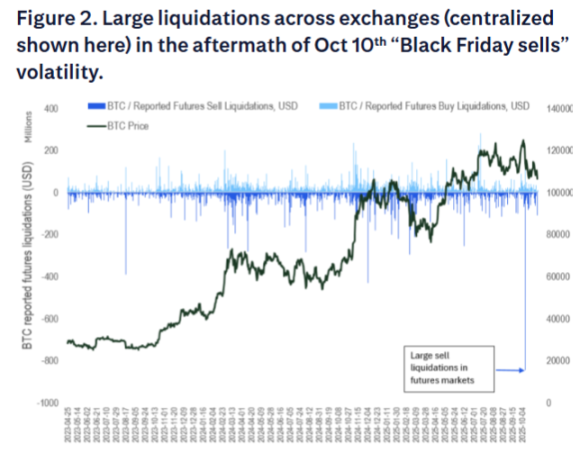

The "Black Friday" Liquidation Event on October 10

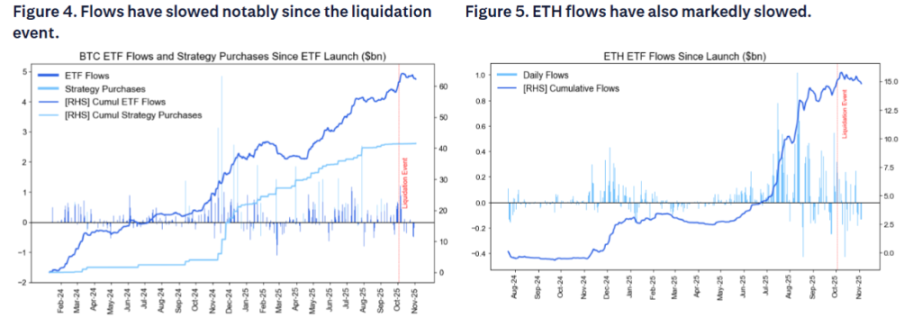

Citigroup's report notes that the "Black Friday" liquidation event on October 10 further damaged the market's risk appetite. Although the futures market is typically a zero-sum game, this liquidation may have harmed the risk-bearing capacity of crypto natives and suppressed the risk appetite of new potential ETF investors.

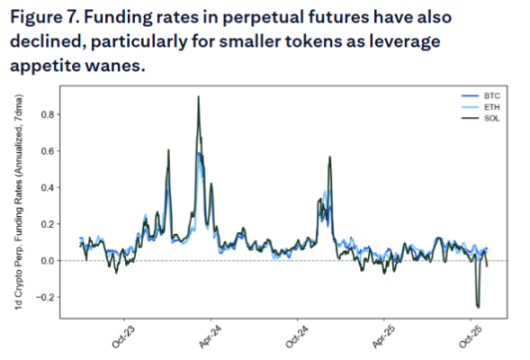

The decline in funding rates also reflects a lack of leverage demand, indicating an overall weakness in market sentiment.

Additionally, the inflow of funds into U.S. spot Bitcoin ETFs has significantly decreased in recent weeks, which was unexpected by the market, as ETF fund flows were thought to be relatively immune to the October 10 "Black Friday" liquidation event in futures and decentralized exchanges. The inflow of Ether ETFs has also noticeably slowed.

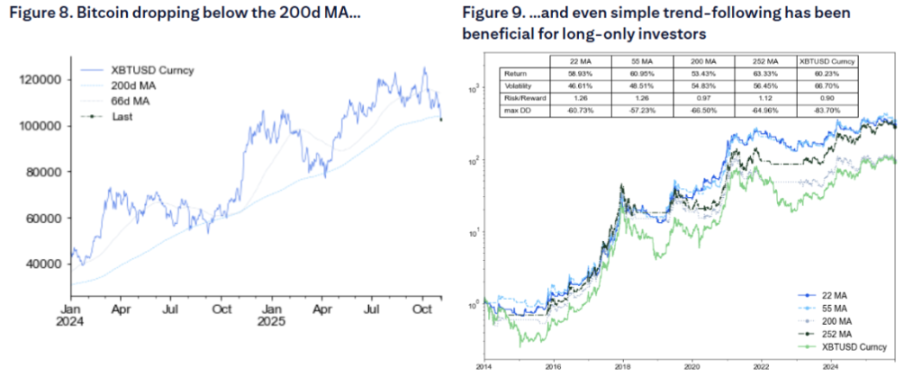

Citigroup's report also points out that Bitcoin's current trading price has fallen below the 200-day moving average, which typically further suppresses demand. Technical analysis shows that even simple moving average rules have helped manage Bitcoin investments over the past decade, highlighting the importance of technical indicators in investment strategies.

A Turning Point in Crisis: Liquidity Release After Government Reopening

Despite the current dire situation, the root of the crisis is also the key to the market's potential turning point. Since the government shutdown is the main driver of liquidity tightening, once the shutdown ends, the U.S. Treasury will begin to consume its massive TGA cash balance, releasing hundreds of billions of dollars in liquidity into the economy.

Goldman Sachs previously estimated that the government shutdown is most likely to end around the second week of November, with key pressure points including the salaries of air traffic controllers and airport security personnel due on October 28 and November 10—similar interruptions in 2019 ultimately contributed to the end of that shutdown. Prediction markets indicate that the probability of the government reopening before mid-November is about 50%, with a likelihood of less than 20% for it to drag past Thanksgiving.

Once the U.S. government reopens, the release of pent-up liquidity could trigger a massive buying spree for risk assets. This liquidity release could be akin to "invisible quantitative easing," a similar scenario occurred in early 2021 when the accelerated consumption of the U.S. Treasury's cash balance drove a significant rise in the stock market. Once the government reopens, the release of pent-up liquidity coinciding with year-end could propel Bitcoin, small-cap stocks, and nearly all non-AI assets to experience a rebound.

The worse the current situation, the more reserve liquidity will be released in the medium term. The current TGA balance is close to $1 trillion, and once it begins to be consumed, the scale of released liquidity will be unprecedented. This sudden influx of liquidity could become a catalyst for a strong rebound in risk assets like Bitcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。