🚨 In the past week, the stablecoin yield sector has experienced the largest capital outflow since the Luna crash.

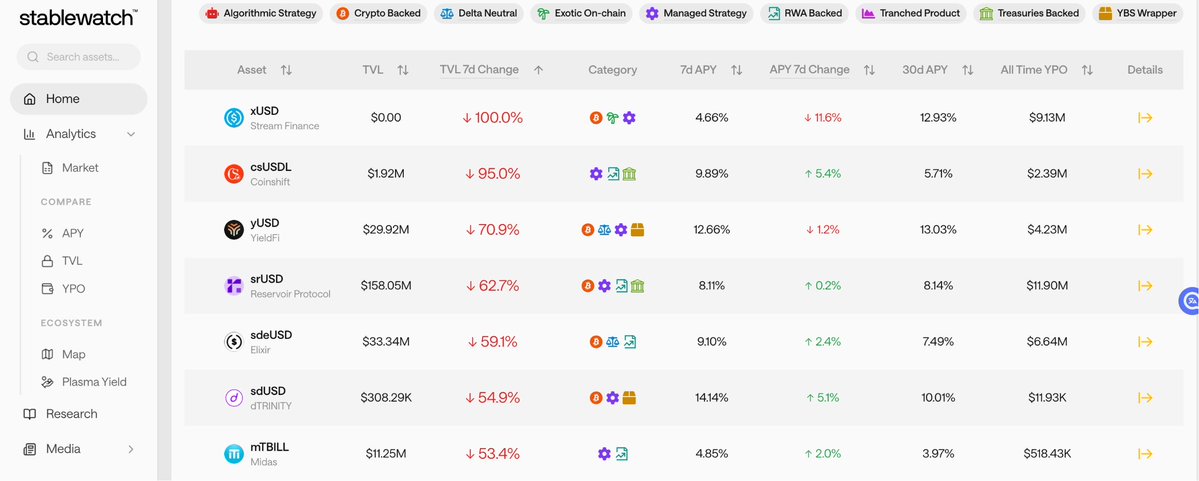

According to stablewatch data, in the last 7 days, the following yield-bearing stablecoins have seen a decline of over 50% in TVL:

1️⃣ xUSD: TVL has dropped to zero

2️⃣ csUSDL / sdeUSD: Significant liquidity pressure has emerged

3️⃣ Others like yUSD, srUSD, and sdUSD have also accelerated redemptions to varying degrees

The total outflow for the week exceeds $1 billion.

The well-known public account article author "Cat Pen Knife" wrote a few days ago:

The balance hack attack and stream leverage collapse have triggered many mainstream protocols. I have always adhered to the principle of diversified investment, putting eggs in as many baskets as possible, or on as many different vehicles as possible, but the more dispersed it is, the result is that any explosion can take everything down.

So what we should see at this time is not "single point risk," but the overall structural fragility of the yield stablecoin sector:

It seems like "putting eggs in different baskets," but in reality, the baskets are already tied to one vehicle through liquidity pools, re-staking, and cross-protocol lending.

The implications of this matter are very realistic:

1️⃣ Diversification ≠ Safety

2️⃣ Correlation is underestimated

3️⃣ The less transparent the source of yield, the more interconnected the risks

Next, we need to focus on observing:

1️⃣ Whether the project has a real and sustainable source of yield (rather than circular lending APY)

2️⃣ Whether there are leverage amplification chains and re-staking links within the protocol

3️⃣ Whether it can withstand large-scale redemption pressure

Currently, it is in a black box period, and the scope of impact remains uncertain.

In the short term, this sector is likely entering a risk repricing phase.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。