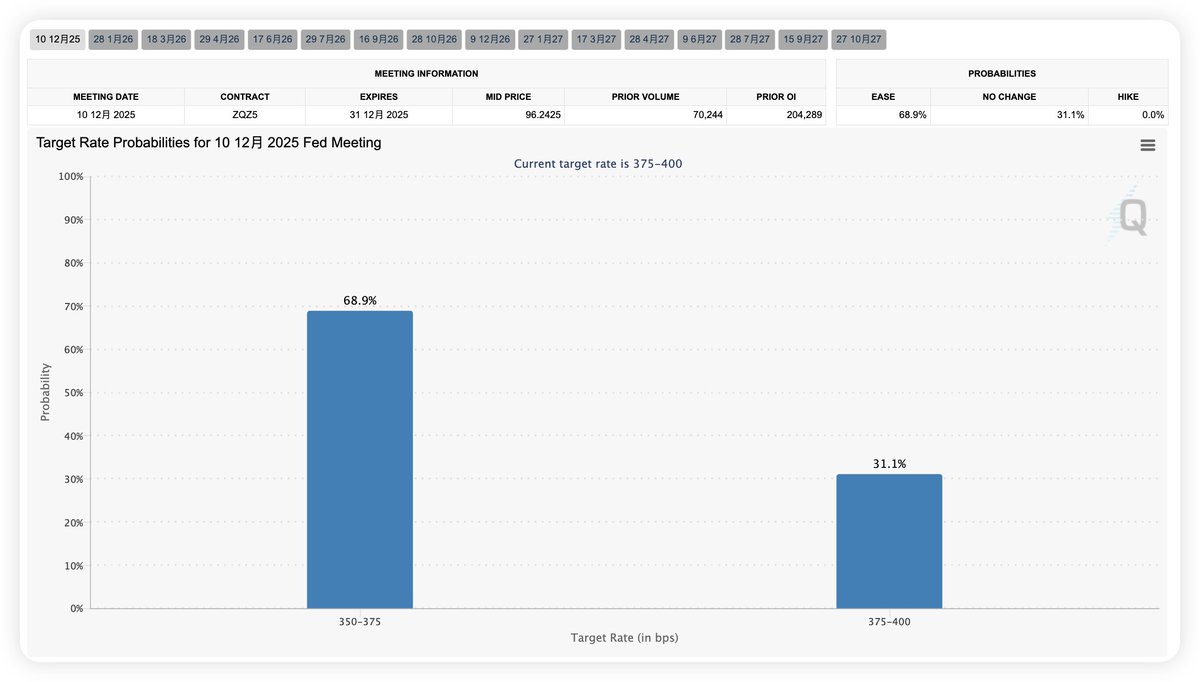

In fact, I think the darkest time might be the first quarter of 2026. Of course, I may not be right; I'm just sharing my thoughts. There is still a possibility of a rate cut in December during the last two months of 2025. After Powell's speech last week, the CME's expectation of a rate cut in December dropped to 74%, and now it has decreased to 68%. However, a lot of layoff information has been released recently, especially the explosive ADP data from yesterday.

The market is likely to bet on the labor data that will emerge after the government shutdown ends, with the unemployment rate significantly rising above 4.4% and a substantial decrease in employment numbers. Both of these factors would pressure the Federal Reserve to cut rates, so there is still a possibility of a game of chance. Moreover, Christmas is just around the corner, and often after Christmas, we enter a liquidity trough, just like every weekend; as long as nothing unexpected happens, we can get through it.

Link: https://x.com/Phyrex_Ni/status/1986491536176259242

Even if there is no rate cut in December, having already cut rates twice in 2025 would still count as fulfilling the market's expectations for that year. However, there are two FOMC meetings in the first quarter of 2026. If rates remain unchanged, the market pressure will be significant. I shared yesterday about the potential credit explosion events in the U.S.; I wonder if everyone still remembers.

Link: https://x.com/Phyrex_Ni/status/1986489458666184924

Christmas will pose an even greater credit challenge, and I don't know if the repayment cycle after Christmas will be the last straw that breaks the camel's back, but I do know that risks will gradually increase. Powell's departure is in May, which is after the third FOMC meeting of the first half of the year. I personally feel that the shift in market sentiment will not begin until at least the second quarter. The market may even worry that the new Federal Reserve Chair will not be able to manage the situation, so it is likely that we will only see whether the new chair can effectively control the Fed in the June or even July meetings.

If they can, a celebration is likely to begin; if not, we will have to wait for the midterm elections.

This article is sponsored by @Bitget | Save the most on fees, receive the most gifts, and become a VIP at Bitget.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。