A storm of trust and transparency is sweeping through the cryptocurrency world. "All the USDX that can be borrowed has been borrowed." On November 6, when a user issued this warning on the X platform, a long-simmering stablecoin crisis officially began to surface.

On DeFi platforms like Euler, all assets that could be borrowed using USDX and sUSDX as collateral were almost completely wiped out, with interest rates in some lending pools even soaring to over 800% annualized rates.

Meanwhile, addresses directly associated with the USDX project founder, Stables Labs, were frantically borrowing other stablecoins and transferring them to exchanges, triggering widespread panic in the market.

1. Tracking the USDX Decoupling

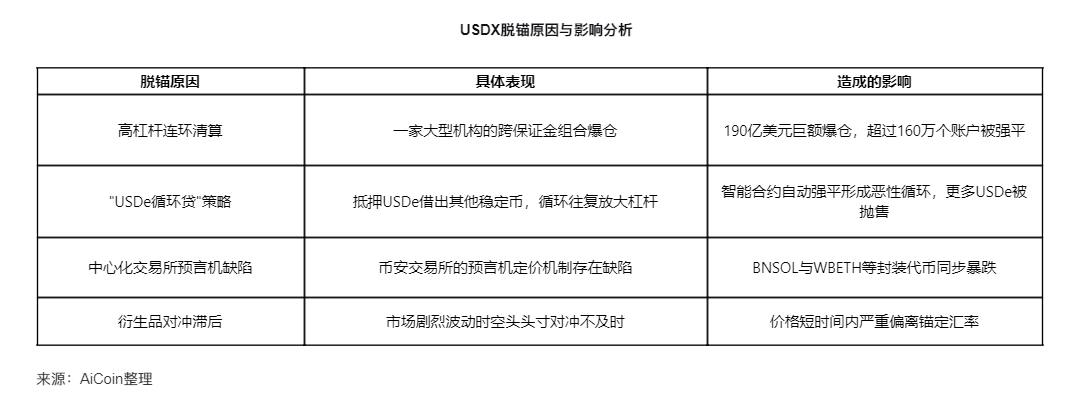

The USDX decoupling event serves as a mirror, reflecting the vulnerabilities of decentralized stablecoins under extreme market conditions.

● USDX is a stablecoin issued by usdx.money, which completed a $45 million financing at a valuation of $275 million at the end of last year.

● Similar to Ethena, USDX adopts a Delta-neutral strategy, but it not only operates with Bitcoin and Ethereum but also allows some altcoins to take center stage in the strategy. While this approach amplifies returns, it also significantly increases risk.

● Before the crisis broke out, some addresses directly associated with Stables Labs founder Flex Yang began exhibiting abnormal behavior. These addresses ignored high borrowing rates and exhausted available USDX and sUSDX as collateral across various markets. Among them, an address starting with 0x50de began receiving large amounts of USDX and sUSDX from late October and was frantically borrowing stablecoins like USDT, USDC, and USD1 from Euler, Lista DAO, and Silo, almost immediately transferring them to Binance after borrowing.

When there was nothing left to borrow, the address directly exchanged USDX for USDT on PancakeSwap and transferred it to the exchange. This reckless escape behavior raised serious doubts about the authenticity of USDX's reserve assets.

2. Lessons from USDe

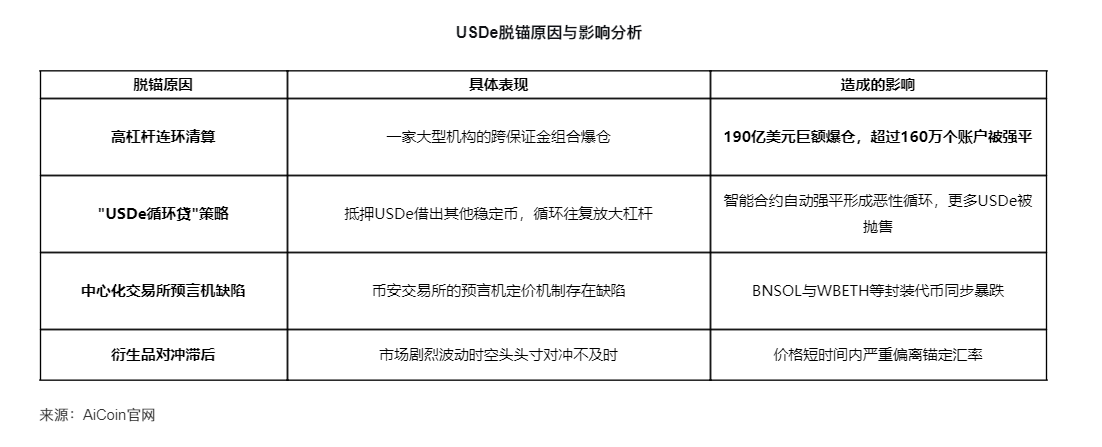

USDX is not the first synthetic stablecoin to face decoupling risks. Just recently, on October 11, the world's third-largest stablecoin, USDe, briefly dropped to $0.65, a decline of about 34% from its $1 peg.

At that time, the crypto market experienced an "epic crash," with Bitcoin plummeting from $117,000 to $105,900, a single-day drop of 13.2%.

● On the decentralized exchange Uniswap, the USDe-USDT liquidity pool depth was only $3.2 million at the peak of the event, shrinking by 89% compared to before the event. This led to a sell order of 100,000 USDe being discounted by 25% due to slippage, with a limit order at $0.70, but the actual transaction price was only $0.62.

● Unlike USDX, USDe began to recover within hours after decoupling, with the price gradually rising back to $0.98.

● This relatively quick recovery was aided by third-party reserve proof disclosed by Ethena Labs, showing that its collateralization ratio remained above 120%, with an over-collateralization scale of $66 million.

● More critically, USDe's redemption function remained normal, allowing assets like ETH and BTC in the collateral to be redeemed at any time, which became a core support for restoring market confidence.

3. Safety Context of Three Types of Stablecoins

Comparing USDX and USDe with traditional stablecoins like USDT and USDC, we can clearly see a safety context.

Here are the key feature comparisons of the three types of stablecoins:

From the table, it is evident that the safety of stablecoins is closely related to their transparency and the quality of collateral. The problem with USDX lies in its highly opaque operating model and questionable quality of collateral assets. In contrast, USDe was able to recover quickly from decoupling because it maintained relatively high transparency and high-quality collateral.

4. Structural Risks in the DeFi Space

The decoupling events of USDX and USDe reveal some deep-seated structural risks in the DeFi space. Stablecoins that adopt Delta-neutral strategies are essentially not true stablecoins but more like structural financial product shares of projects.

They fundamentally differ from traditional fiat-collateralized stablecoins and bring unique risk characteristics.

● High-risk strategies and opaque operations are the primary issues. USDX not only employs complex Delta-neutral strategies but also extends the strategy scope to altcoins, significantly raising the risk level.

Even more concerning is that most of these strategies are executed off-chain on centralized exchanges, leaving no one but the project team aware of the actual situation, creating an opaque "black box."

● Complex nesting and leverage stacking between protocols are also worth noting. The nesting between DeFi protocols is exceptionally complex, with many structured products reaching a level of complexity that may be impossible to untangle.

For example, crvUSD can use a stablecoin issued with crvUSD as the underlying asset to issue crvUSD.

● This complexity means that even when all information is publicly available on-chain, it seems we cannot accurately calculate how many layers of leverage a basic underlying asset has been subjected to.

5. Why Large Stablecoins Are More Reliable

In light of the severe decoupling of USDX and the brief decoupling of USDe, investors cannot help but ask: Why do large stablecoins like USDT and USDC perform more steadily?

● Scale and institutional holdings form a strong moat for traditional stablecoins. According to CertiK's "2025 Skynet Digital Asset Treasury Report," the total amount of digital assets held by publicly listed companies has exceeded $130 billion. These institutions prioritize stablecoins with sound custody solutions, regular audits, and transparent disclosures.

● Regulatory compliance and transparent disclosures are another key factor. The issuer of USDC, Circle, has actively embraced regulatory compliance and regularly discloses its reserve asset composition. In contrast, projects like USDX lack regular third-party audits and transparent reserve proofs, making it difficult to gain market and institutional trust.

● Differences in collateral quality and redemption mechanisms are also very apparent. USDT and USDC are primarily backed by fiat currency, cash equivalents, and short-term U.S. Treasury bonds, which have high liquidity and low volatility.

● In contrast, synthetic stablecoins like USDX are primarily backed by crypto assets and execute complex hedging strategies on centralized exchanges, making them prone to liquidity exhaustion or hedging failures under extreme market conditions.

When the market is turbulent, funds often exhibit a trend of "flight to safety"—moving from higher-risk synthetic stablecoins to relatively safer USDT and USDC. After Bybit experienced a hacking attack, despite a panic withdrawal wave, $4 billion in institutional funds entered the market against the trend, confirming the market's long-term confidence in quality crypto assets.

This indicates that despite continuous innovation, safety and transparency remain the cornerstones of financial markets.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。