According to reports, Robinhood Markets' cryptocurrency revenue unexpectedly surged, helping its third-quarter performance exceed Wall Street expectations.

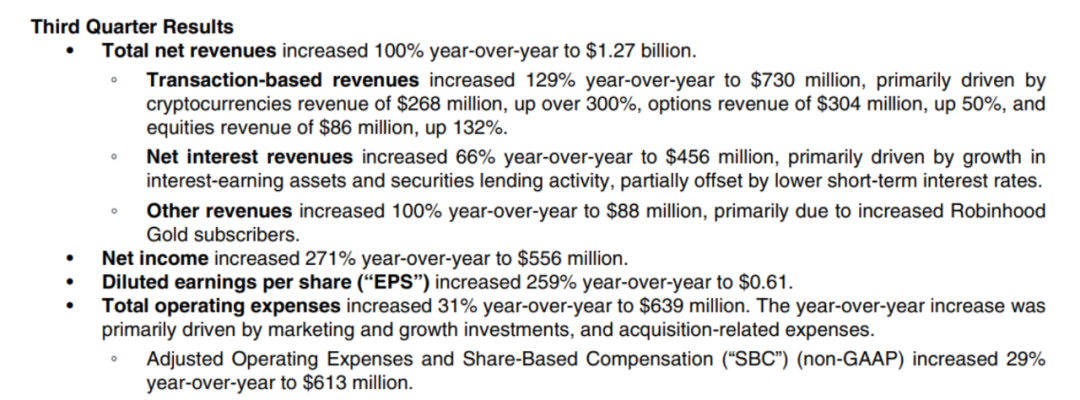

For the three months ending September 30, the company's total revenue increased to $1.27 billion, double that of the same period last year, and also higher than analysts' previous expectations of $1.2 billion.

The company stated that cryptocurrency trading generated nearly $270 million in revenue during the quarter, more than a 300% increase compared to the same period last year.

Overall trading revenue grew nearly 130%, reaching $730 million, with earnings per share increasing nearly 260% to $0.61, surpassing analysts' forecast of $0.51.

These figures indicate how much the volatility of cryptocurrency trading can impact Robinhood's quarterly performance.

New business lines are beginning to play a significant role. Robinhood's Chief Financial Officer Jason Warnick told investors that the company’s acquisition of Bitstamp in June and its prediction market could generate about $100 million or more in annual revenue. This portion of revenue has been incorporated into the company's growth plans.

The company, initially known for free stock trading, has now expanded its product line. Currently, the company offers tokenized versions of stocks and prediction market trading, with the completion of the Bitstamp acquisition being part of this strategic initiative.

The report indicates that executives believe there is room for expansion in global prediction markets, but they noted that specific promotions will depend on local regulations.

CEO Vladimir Tenev also discussed how tokenized stock issuance currently operates and potential changes in the future.

He stated that these products "are not as interoperable as we expected," as they have not yet been deployed to decentralized finance (DeFi) platforms, but he anticipates that interoperability will improve over time as developers build bridges and wrappers.

He believes this pathway could make it easier for tokenized assets to transfer between networks and services.

On the day the report was released, Robinhood's stock price rose 4% to $142 in regular trading but fell back below $140 after the market closed.

The stock has risen over 280% year-to-date and reached an all-time high of $152 on October 9, but subsequent sell-offs in the cryptocurrency market have cooled its momentum.

These figures have left investors with mixed feelings. The strong revenue growth is evident, but the business is closely tied to cryptocurrency trading volumes, which are highly volatile.

Revenue from emerging sectors like Bitstamp and prediction markets is becoming substantial, but regulatory bodies and market fluctuations could quickly change this situation.

Analysts will closely monitor whether cryptocurrency revenue can maintain high levels and how regulators will respond to the expanding issuance of tokenized stocks.

For now, Robinhood's transition to cryptocurrency and related services has been reflected in its performance.

The company reported significant growth, primarily driven by cryptocurrency trading users and several recently acquired or launched businesses that have generated substantial revenue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。