Cryptocurrency News

November 7 Highlights:

1. Bitwise submits 8(a) filing for spot Dogecoin ETF, effective in as soon as 20 days.

2. LD Capital founder Jack Yi: Remains optimistic about future market trends and buying strategies.

3. A giant whale withdraws nearly 115 million USDT from Aave, pushing the USDT utilization rate in Aave's core market to 92.83%.

4. Federal Reserve's Goolsbee: Cautions against rate cuts due to lack of reliable inflation data.

5. Cathie Wood lowers Bitcoin's peak price forecast for 2030 from $1.5 million to $1.2 million.

Trading Insights

Here are some insights for surviving in the cryptocurrency space, which I believe can help you! 1. Capital first: Protecting your principal is the foundation for long-term participation in the crypto space. Without capital, everything is off the table, so prioritize safeguarding it. 2. Don't be greedy! Stability leads to long-term profits; don't always think about getting rich overnight. Greed can lead to mistakes; a stable mindset allows you to seize reliable profit opportunities. 3. Focus on familiar coins: Trade 1-2 coins you understand well, follow market trends, avoid counter-trend operations, and don't recklessly trade with a full position. 4. Strictly control risks: Don't stubbornly hold onto losses, avoid heavily investing in one coin, and don't hold onto a losing position. Trade less frequently; good risk control is essential for long-term profitability. 5. Think clearly before buying, and don't hesitate when selling: Carefully weigh risks and opportunities before buying. When you reach your preset selling point, sell quickly; don't let profits turn into losses. 6. Controlling losses is more important than chasing profits: The market has many opportunities to make money, but a significant loss could lead to exit. Control your losses to go far in the crypto space. 7. Stop-loss must be executed decisively: When the price hits the stop-loss line, run immediately! Stop-loss is your guarantee for future trading opportunities; don't take chances. 8. Take profits: Don't aim for "paper wealth." Regardless of short or long term, turning floating profits into actual cash is the safest approach; don't let profits slip away. 9. Understand cycles: Time your entry and exit with market fluctuations. The crypto market will rise after a fall and vice versa. Recognizing cycles helps you align with trends. 10. Only earn what you understand: Be patient and wait for opportunities. If the market isn't favorable, don't trade; missing out isn't regrettable. Seizing opportunities you understand means you've already outperformed many.

LIFE IS LIKE

A JOURNEY ▲

Below are the real trading signals from the Big White Community this week. Congratulations to those who followed along. If your trades aren't going well, you can come and test the waters.

Data is real, and each trade has a screenshot from when it was issued.

**Search for the public account: *Big White Talks About Coins*

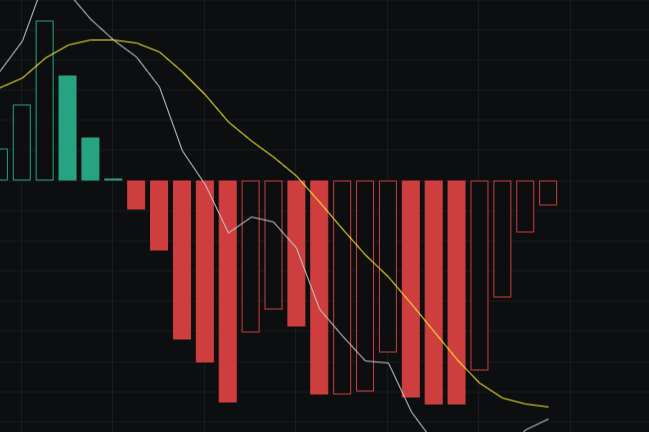

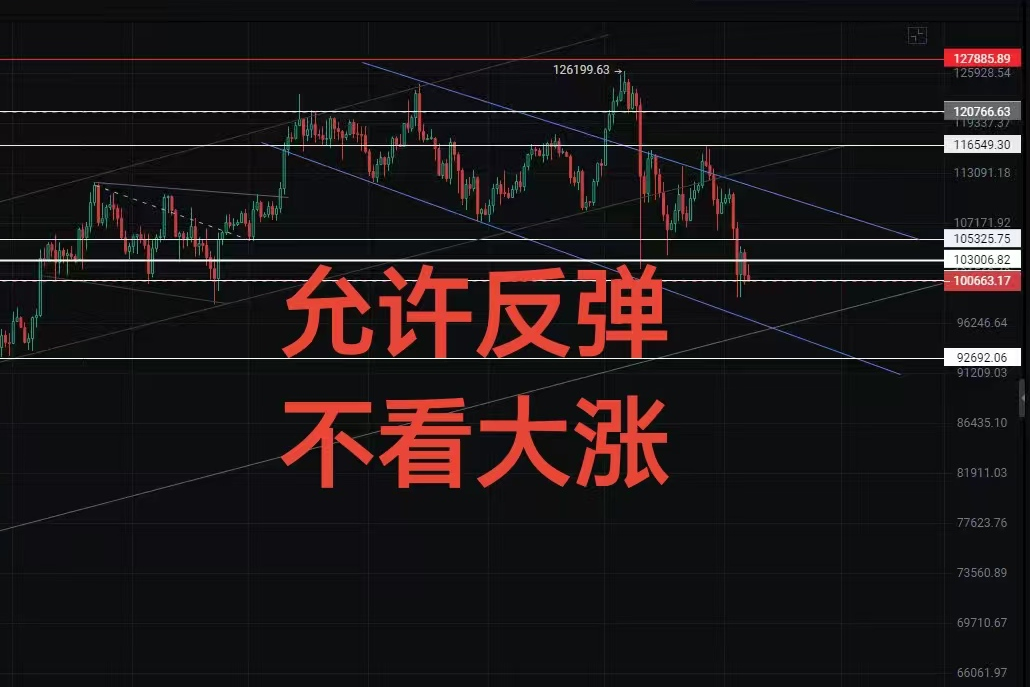

BTC

Analysis

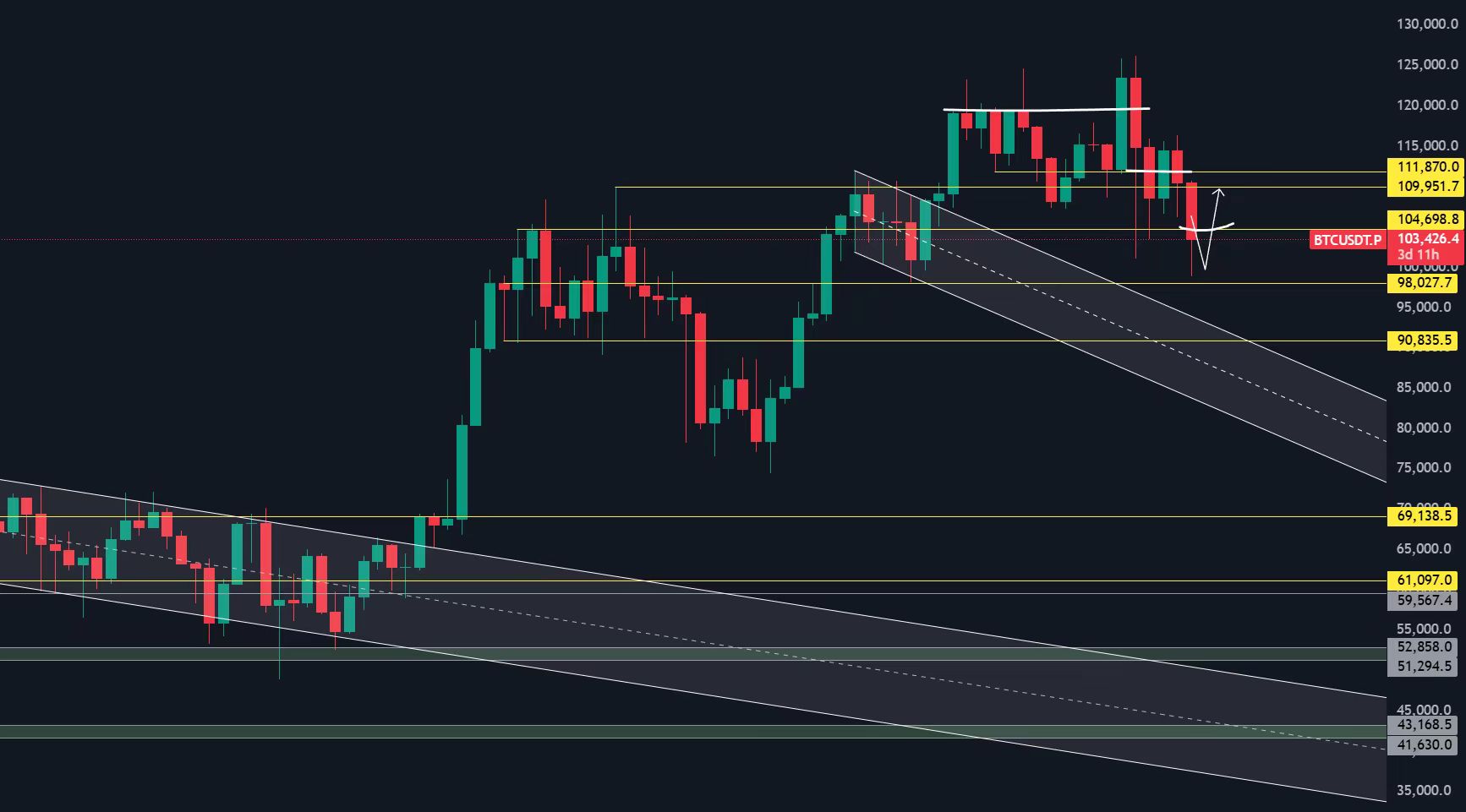

The market has once again experienced volatility, entangled with many factors, making it increasingly complex. The expectation of a standstill has caused panic among investors. Additionally, the New York Fed released the latest consumer credit report today, which also showed poor data, as high interest rates have led to various types of credit reaching historical highs in the third quarter. This indicates that the lives of American citizens are indeed at risk, whether it be credit card loans, home loans, or student loans, all fundamentally tied to the federal funds rate. If the Federal Reserve does not enter a phase of significant rate cuts, a credit crisis could likely occur.

In the short term, after a drop in the early morning, the market began to gradually rebound. First, we should focus on the recovery situation around the key level of 105,000. If this level can be reclaimed, there may be a chance to challenge the upper 110,000 mark after a brief pullback or consolidation. Today's spot ETF saw net outflows, with large on-chain whales buying while retail investors sold off, creating extreme sentiment. Maintain risk control and hold all positions firmly.

ETH

Analysis

The market may be betting on labor data emerging after the standstill, with unemployment rates significantly rising above 4.4% and employment numbers drastically decreasing. Both of these factors could pressure the Federal Reserve to cut rates, so there is still potential for speculation. Moreover, with Christmas approaching, liquidity often hits a low point after the holiday begins, similar to every weekend; as long as there are no major issues, it can be navigated. Even if there are no rate cuts in December, two rate cuts have already been completed in 2025, which aligns with market expectations. However, there are two rate meetings in the first quarter of 2026, and if rates remain unchanged, market pressure will be significant, as discussed yesterday regarding the potential credit crisis in the U.S.

For Ethereum, we should also focus on whether the weekly K can maintain above the key level of 3,370. If it can, there is a chance for a rebound, but it mainly depends on how Bitcoin performs and whether it can reclaim above 105,000.

Disclaimer: The above content is personal opinion and for reference only! It does not constitute specific operational advice and does not bear legal responsibility. Market conditions change rapidly, and the article may have some lag. If you have any questions, feel free to consult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。