Original | Odaily Planet Daily (@OdailyChina)

In the early hours of November 5, the cryptocurrency market suffered a heavy blow. The amount of liquidations in derivatives reached $2.1 billion, with long positions liquidated amounting to $1.68 billion. Although these figures are far lower than the over $20 billion "historic liquidation" on October 11, this drop proved to be more damaging.

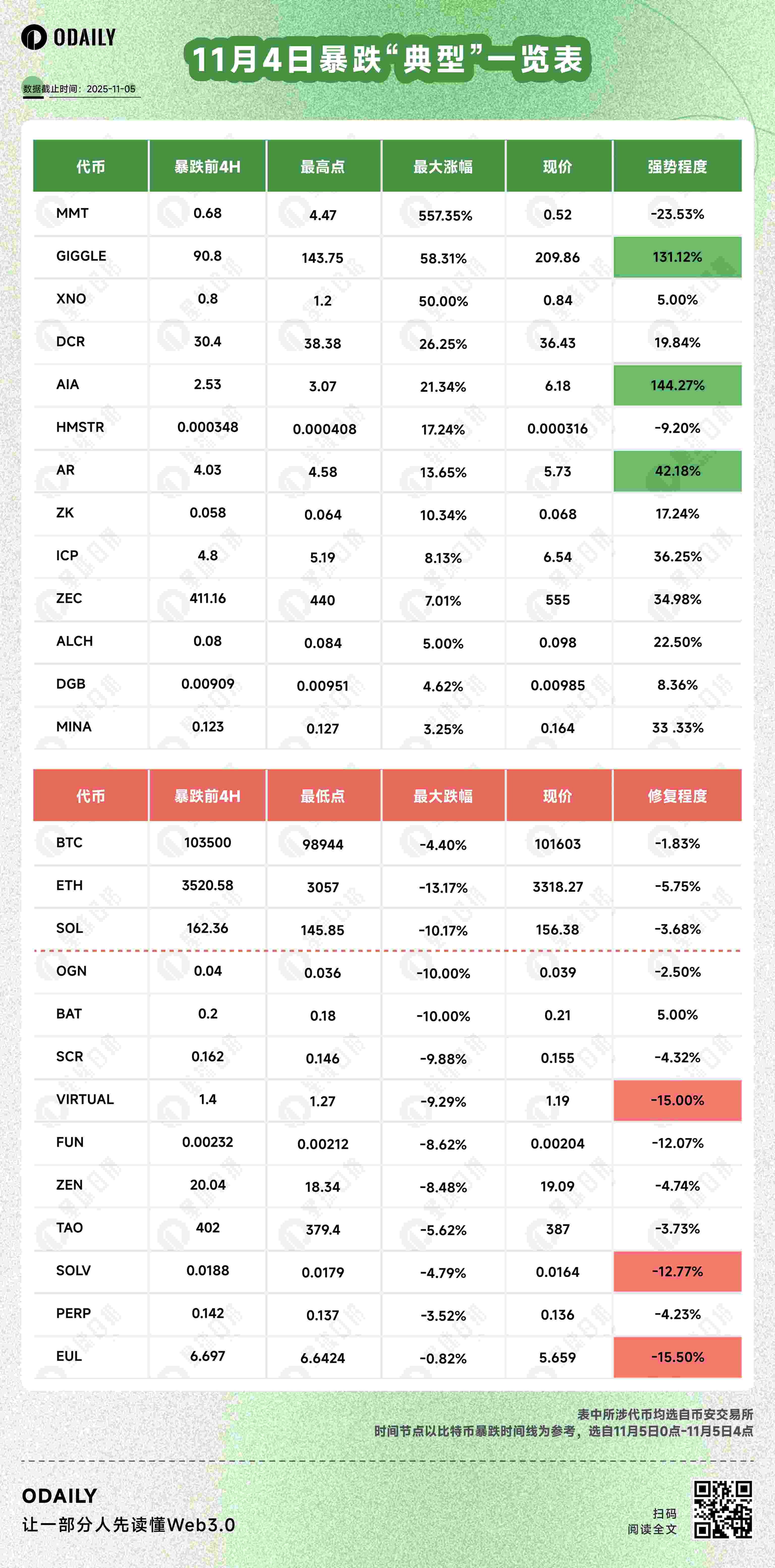

Bitcoin fell below the $100,000 mark, dipping as low as $98,944, with a daily decline of 4.8%; during the last flash crash, Bitcoin only dropped to $102,000. ETH and SOL saw declines of 8.8% and 6.6%, respectively.

At a time when liquidity is being choked, who possesses the most resilience against declines, and who is heading towards "zero"?

Due to the reference to Bitcoin's crash timeline and the tokens being sourced solely from Binance, the decline leaderboard data may not be as explosive, but it reveals an undeniable fact: most altcoins have long been drained of liquidity, and chronic blood loss is their regular performance.

From the data charts, MMT and AIA are the standout tokens in this market cycle. Both belong to the Sui ecosystem, with MMT being the native token of Momentum, a leading DEX on Sui, which just launched on November 4. MMT performed strongly in its early days, with significant short-term gains, but by the time of publication, the price had seen a notable correction, still unable to escape the iron law of new tokens on Binance experiencing a drop. AIA focuses on AI infrastructure and has increased over 30 times since its launch on Binance on September 25.

Even more surprisingly, during the market downturn on November 4, many "outdated" old coins suddenly became active. A number of "old era stars," such as XNO, ZEC, ICP, and DCR, rose against the trend in this storm. Since ZEC reignited the privacy narrative, these tokens, once buried by time, seem to have found their narrative window again.

Especially two days after the crash event, when we tracked the prices of these tokens, most still performed well, with the privacy sector remaining a backbone force. ZEC led the way, with MINA and ZK also showing impressive performance. Meanwhile, XNO, ICP, and DCR, which continue the fundamental logic of digital cash, are attempting to repair their existing flaws outside the Bitcoin framework using different technological paths. ICP continues to rise strongly, while XNO and DCR have already retreated, entering a pressure test.

(Personal observation: Currently, the liquidity of altcoins has been drained, and governance tokens have basically become "useless," which has almost become a market consensus. However, since the privacy narrative has warmed up, although we see many old coins starting to engage in sentimental speculation again, we may only be focusing on their "old" aspect. A more noteworthy signal is that funds seem to be leaning towards the "practical" sector, such as the storage sector that surged today. In fact, whether it is privacy or storage, both seem to be gravitating towards "practicality." Therefore, I boldly speculate that the next sector to rise may also lean towards "practical." This is merely my personal feeling and does not constitute investment advice.)

Below, Odaily Planet Daily has also selected several of the most representative projects amidst this turmoil and panic:

GIGGLE: Binance's Plaything Under Control

The development team of GIGGLE is the BSC community team GiggleFund, inspired by the educational charity project Giggle Academy founded by former Binance CEO CZ. On September 21, Giggle Academy announced it would start accepting public donations in cryptocurrency to help more children access free, high-quality education. GiggleFund seized this opportunity to launch GIGGLE and announced that all GIGGLE transaction fees would be donated to Giggle Academy. This excellent angle allowed GIGGLE to quickly achieve a breakout, with Giggle Academy receiving over $1 million in donations just 12 hours after opening donations, about 90% of which came from GIGGLE transaction fees. CZ even specifically praised this in a post and later listed it on Binance's spot market.

GIGGLE holders called on the community to donate the GIGGLE spot and contract trading fees on the platform to continue the token's original vision, which was successfully realized on November 3. Stimulated by this positive news, GIGGLE quickly surged from around $70 to a high of $113.99, with a short-term increase of over 60%.

Perhaps to prevent excessive speculation by the community, on the evening of November 3, CZ posted to clarify that "GIGGLE is not the official token of Giggle Academy," triggering panic selling: the price collapsed from $230 to $50 (a drop of 78%), with a market cap evaporating by over 70%.

However, dramatic turns often come just as fiercely.

On the evening of November 4, CZ quoted the official statement from Giggle Academy and announced that 25% of Binance's GIGGLE fees would be directly burned, and 25% would be donated to Giggle Academy. Meanwhile, Binance spokesperson He Yi also engaged in interactive discussions. This narrative of burning transformed panic into FOMO, with GIGGLE seeing a 24-hour increase of 155%.

ZK: The Resurgence of Privacy and Buyback Logic

ZK (the native token of ZKsync) is the governance and utility token of the Ethereum Layer 2 scaling solution ZKsync. ZKsync achieves high throughput and privacy protection through zero-knowledge proof (ZK-Rollup) technology, primarily used for DeFi, NFTs, and cross-chain applications.

On November 1, Ethereum founder Vitalik Buterin praised ZKsync for its "low-key but valuable contributions to the Ethereum ecosystem." This tweet acted as a signal flare, and in the atmosphere of the revived privacy narrative, ZK became the focus, with short-term gains exceeding 160%.

Although it later retreated, on the evening of November 4, ZKsync founder Alex released the "ZK Token Proposal Part I," proposing significant updates to the ZK token economic model: all network revenue would be used to buy back and burn ZK tokens, transforming it from a purely governance token into an asset with value capture functionality.

Against the backdrop of a general market decline, this update allowed ZK to rise against the trend. Of course, the community was not entirely convinced. Some voices questioned the limited scale of ZKsync's network revenue, which may not support buyback actions. In other words, while the narrative is enticing, whether it can be fulfilled still needs verification.

EUL: The Collapse of DeFi's "Leverage Illusion"

Euler (EUL) is a platform on Ethereum that focuses on "permissionless lending." Its platform features allow anyone to become a Curator (vault manager), freely create lending pools, allocate user deposits, and earn performance fees. To attract funds, curators began pursuing high TVL (Total Value Locked) and high APY (Annual Percentage Yield).

The recent explosion at Euler stemmed from xUSD. xUSD (Staked Stream USD) is a yield-bearing stablecoin issued by the Stream Finance protocol. This coin promises "stable anchoring at $1 + up to 18% annual yield," which sounds enticing. Its mechanism is: users deposit USDC, the protocol mints xUSD to lend to lending platforms, and then through leveraged cycles, xUSD is repeatedly collateralized, borrowed, and deposited, creating the illusion of "infinite liquidity" and "super high yields." Euler's curators saw an opportunity. They invested all the USDC deposited by users into Euler into the xUSD cycle strategy.

However, problems were also buried: the price oracle for xUSD was hardcoded to be greater than $1, meaning that regardless of how the market fell, the system always believed xUSD = over $1. Once the real price of xUSD dropped, the liquidation mechanism could not be triggered, and bad debts could not be automatically processed.

On November 3, a hacker attack on Balancer was exposed, with $128 million in funds stolen, affecting multi-chain liquidity pools, and Stream's xUSD pool began to experience selling pressure, with the price first showing abnormal fluctuations, dropping to $0.98. At this point, it seemed someone discovered its cyclical minting was a Ponzi structure: there was no real yield support, relying entirely on new funds to pay off old ones. But the oracle in the Euler system still showed "xUSD > $1." This meant that borrowers could use xUSD worth $0.10 to collateralize and borrow $1 of USDC, but the system would not trigger liquidation because it "could not see" the price drop. In just a few hours, $93 million in USDC was withdrawn, and xUSD dropped to a low of $0.1. Euler detected a surge in bad debts, paused the xUSD-related pools, and ultimately the scale of bad debts reached $285 million.

The impact was not limited to Euler, but the decoupling of xUSD served as a magnifying glass, revealing the full picture of the DeFi leverage illusion: seemingly high-yield stablecoins exposed under-collateralization and mechanism flaws in panic, further revealing the fragility of the entire DeFi ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。