Worried that there are no like-minded friends on the road ahead, but on the investment path, there are kindred spirits. Good afternoon, everyone! I am the Coin King of the Coin Victory Group. Thank you for following my articles and videos, where I bring you fresh news and precise market analysis from the crypto world every day.

**Click the link to watch the video: **https://www.bilibili.com/video/BV1Si2MBXEzW/

Let me ask a soul-searching question: Were you staring at the K-line chart yesterday, treating the American layoff data as if it were air? That was not ordinary data; it was a blade hidden in the cake—seemingly harmless, but actually bloody! The U.S. saw 153,000 layoffs in October, up from a previous value of only 54,000. This is not a slight increase; it’s the job market being rubbed against the wall, with companies unable to hold on, and positions collapsing. It’s just short of writing “I can’t do it anymore” on the torch of the Statue of Liberty. Worse still, the U.S. is in a standstill, official data is cut off, and the market can only guess, which is no different from crossing the street with your eyes closed!

But no matter how the market guesses, the expectation for interest rate cuts is very clear: the CME's probability of a rate cut in December has soared to 69%. This is the true core of U.S. Treasuries and the dollar! Those who say “rely on market optimism” are just deceiving themselves, much like saying “losing weight relies solely on drinking water.” Previously, people complained that U.S. Treasuries had no meat, but now with the expectation of rate cuts, the interest rate differential is attracting funds like a second cup at a milk tea shop being half price; the dollar has directly fallen below 100, with no power to fight back.

Currently, global funds are like “headless flies” looking for liquidity. On the surface, everything seems calm, but in reality, a group of people is dancing with torches in an oil depot! What we fear is that one day the U.S. stock market will stop pretending and directly plunge, at which point global assets will scream together, more thrilling than a Double Eleven delivery crash.

Looking at the old Powell of the Federal Reserve, he will step down in the first half of next year and wants to leave gracefully now. Rate cuts won’t be drastic; it’s highly likely he will pretend to be prudent and will leave once inflation is confirmed to be falling. The new chairman will likely loosen monetary policy, and during the midterm elections, Trump may take fiscal actions, which could allow the market to take off. However, by the end of 2027, we are likely to face inflation hell—there’s no such thing as free money; enjoying it will always come at a cost!

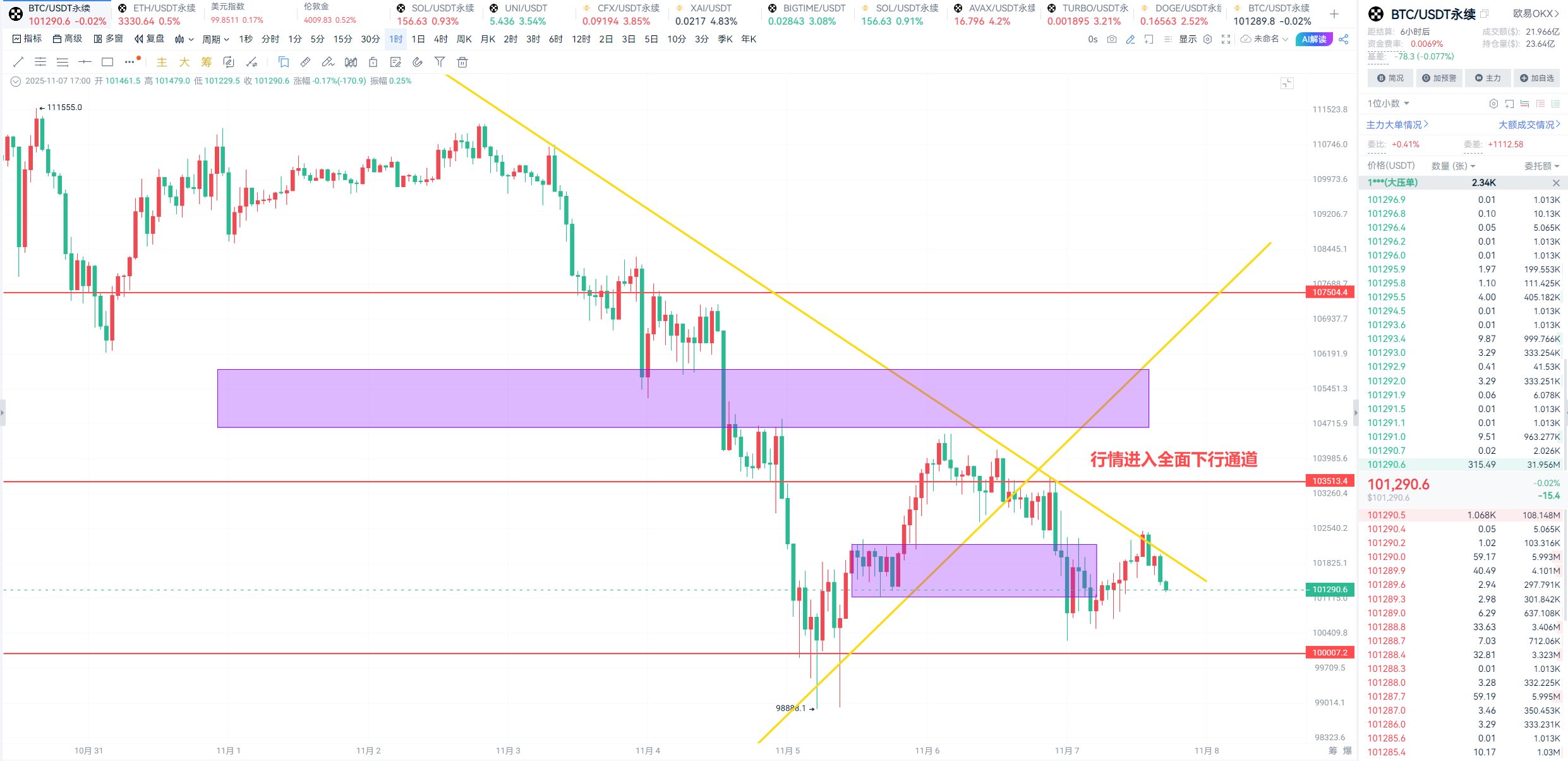

Back to the main battlefield of the crypto world, Bitcoin rose in three waves from April to October. Just when we thought it was going to break out, on October 11, it was abruptly cut off from its daily structure, ending the bullish trend, much like a main character in a drama suddenly meeting their demise. We are now in the second phase of decline, with prices grinding between 105K and 99K, driving people’s mental state to the brink, like waiting for a bus, thinking the next one is about to arrive, only to find oneself still waiting after half an hour.

The key is to watch three levels: 100K, 105K, and 98.2K. If 100K breaks, it will head straight for 98.2K to wash out positions, like a domino effect; if it holds, it will rush to 105K, like clearing a level in a game. If it stabilizes at 105K, it may touch 110K, but at most it will be a short-term rebound, akin to drinking ginger soup for a cold—treating the symptoms, not the root cause.

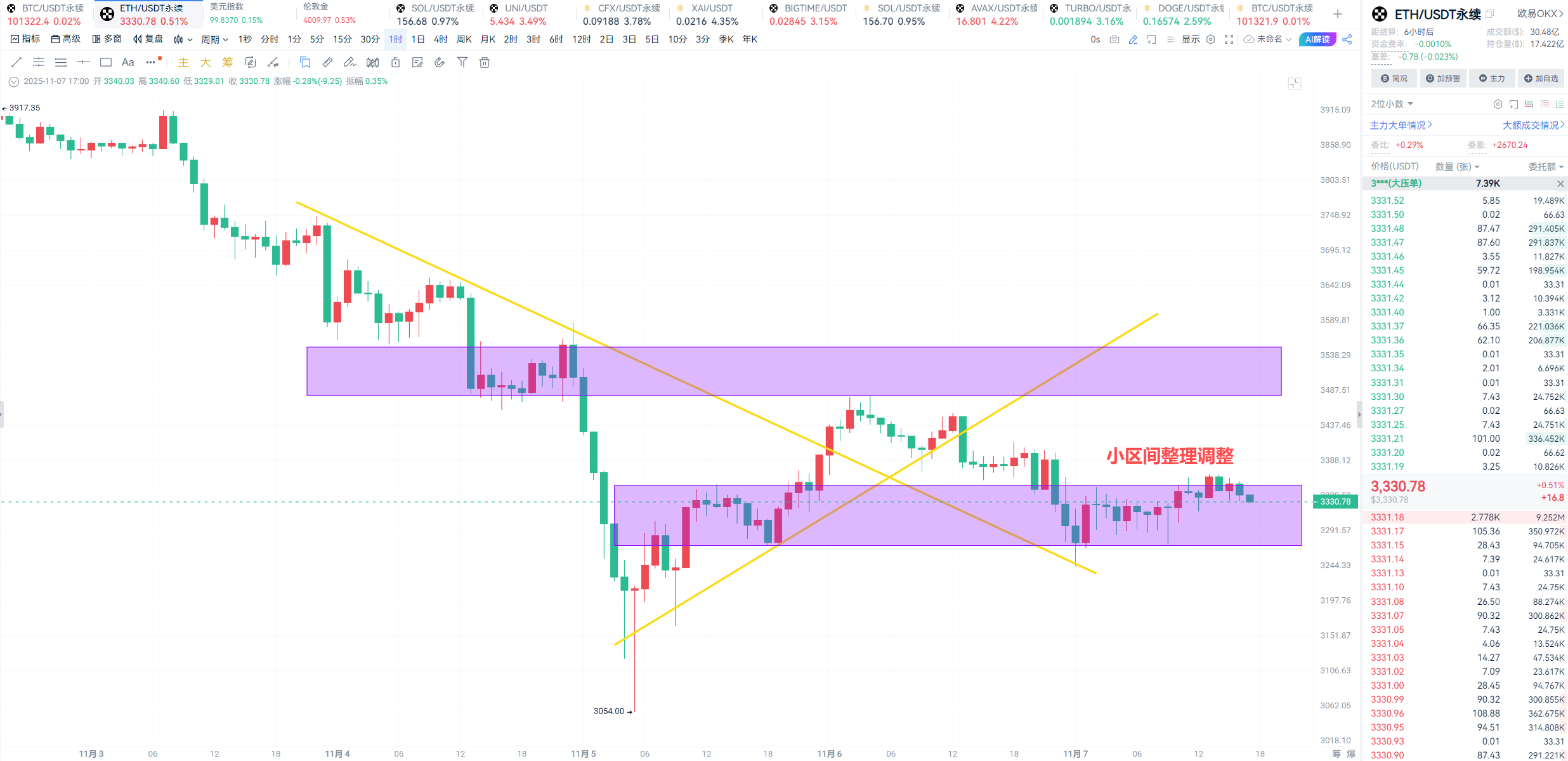

The open contracts are even more interesting; leverage is back, and everyone is once again adding positions without learning from past mistakes, especially the perpetual contract bulls, who are as optimistic as if they’ve won five million. The leverage on Ethereum is even more exaggerated, higher than my hairline, and the upcoming volatility will be crazier than Bitcoin—if it can’t break the 3500 neckline, it will be dragged down; if the bat pattern doesn’t form in two hours, it will be hard to fly!

Coin Victory Group Trend Analysis

Resistance Levels Reference

Second Resistance Level: 105600

First Resistance Level: 104000

Support Levels Reference

First Support Level: 101200

Second Support Level: 100400

100.4K is the short-term bottom line; if it breaks, it will go down directly; 101.2K is the short-term support, and falling below it is also dangerous. Until we break through the 20MA and the downward trend line, all rebounds are just pullbacks, opportunities to escape, not reversals. An RSI oversold rebound is normal, but it does not mean the bulls are taking off.

Additionally, 101.2K is the bottom line for this round of short-term rebounds; if 100.4K breaks, it is highly likely to continue plummeting; 104K is the first hurdle for an upward push, and we will assess the rebound strength when it reaches 105.6K.

11.7 Coin Victory Group Swing Trading Setup

Long Entry Reference: Not currently referenced

Short Entry Reference: Short in the 103500-104000 range, target: 101200

In conclusion: If you want to learn something from the blogger, you need to keep following; don’t just look at the market a few times and jump to conclusions. The market is full of performers, showing off their “top catching and bottom picking,” but in reality, they are just shooting after the fact. What’s truly worth paying attention to are those whose trading logic is consistent and withstands scrutiny. Don’t be fooled by screenshots; only through long-term observation can you know who is genuine!

This article is exclusively published by the Coin Victory Group (WeChat Official Account: Coin Victory Group) and is the same name across the internet. If you want to learn more about real-time strategies, liquidation techniques, and contract methods, you can join the Coin Victory Group for communication. The fan experience group and community live broadcasts are now open; welcome to join!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。