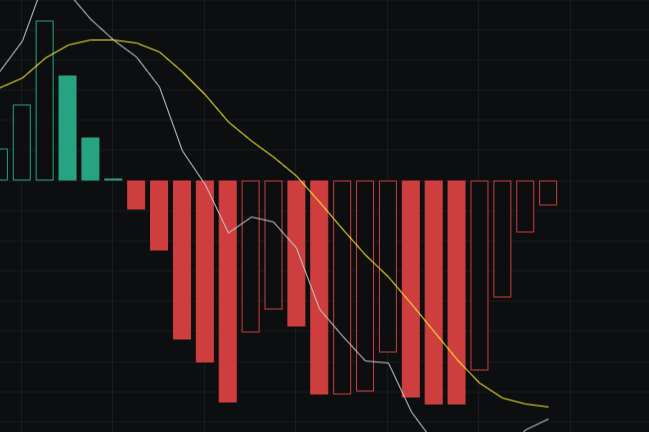

Yesterday, my view remained predominantly bearish.

Some fans left comments reminding me "not to forget to go long." In fact, many people want to go long more out of subjective judgment—thinking that the price has dropped enough and wanting to catch the bottom.

However, this kind of operation is similar to what many did during the previous downturn, often resulting in just a rebound rather than a true reversal. Trading should not rely on subjective feelings but should be based on market structure.

The current fact is: the market has not yet exited the reversal structure.

After the previous rebound, I had already warned against chasing long positions at high levels; instead, one should lay out new short positions at relatively high levels, with the target still seeing below 100,000.

The overall view remains unchanged, and long-term short positions should continue to be held. We have clearly indicated layout points above 122,000 and 115,000.

If you have long-term short positions at these levels and have held them until now, your performance has already surpassed that of most traders. Being able to hold onto a profitable position is a rare trading quality.

Most people take a small profit and leave, but when facing losses, they stubbornly hold on.

This mindset easily causes one to miss out on trending markets.

The current strategy remains: hold long-term short positions, and short-term short positions can be operated in conjunction.

If short-term stop-losses occur, they can also hedge against long-term positions.

From a structural perspective, the recent small V-shaped rebound after the previous decline has not formed a new upward arrangement.

Many people chased long positions yesterday, but I believe this position is still suitable for shorting.

For those who did not follow the long-term shorts, I do not recommend chasing anymore; the best opportunity has passed.

Short-term short positions still have several thousand points of downward space.

Unless the market breaks above the previous high at a higher low, forming a complete bullish structure, the bearish mindset should still prevail.

In the short term, attention can be paid to the Fibonacci 0.5 retracement area—around 107,000 to 108,000, which I believe is the upper limit of the rebound.

Currently, it is not advisable to catch the bottom; the overall trend remains bearish.

The real opportunity to consider going long is after breaking below the 100,000 integer mark, with a clear rebound signal appearing, rather than entering based on feelings.

Now looking at Ethereum (ETH):

Previously, many believed the support was effective for going long, but I had warned that once the support fails, there would be a deeper decline.

If the market is truly going to reverse, it will first form a structure of upward—adjustment—then upward.

Currently, Ethereum has not formed this pattern, so the bearish outlook remains.

Similarly, BTC should not recklessly go long just because it has "dropped enough."

Although there is a small V-shaped rebound, there is no new bullish arrangement after the high point retracement.

Only when the price breaks above the previous high and forms a new bullish structure is there a reason to go long.

Additionally, it is important to pay attention to Bitcoin's weekly 50-week moving average, which is currently around 102,000 to 103,000.

If this week closes below that moving average, the market will continue to be weak.

Continuing to operate below it may lead to further declines. In the next phase, attention can be paid to the weekly VGAS channel range: 50,000 to 70,000.

In the short term, refer to the daily 0.618 retracement level, which is approximately around 94,000.

In summary, the overall structure remains dominated by bears, and the strategy maintains a "bearish focus."

In trading, maintain patience and discipline, and do not blindly catch the bottom.

Follow me for mutual improvement. The article release may be delayed and is for reference only.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。