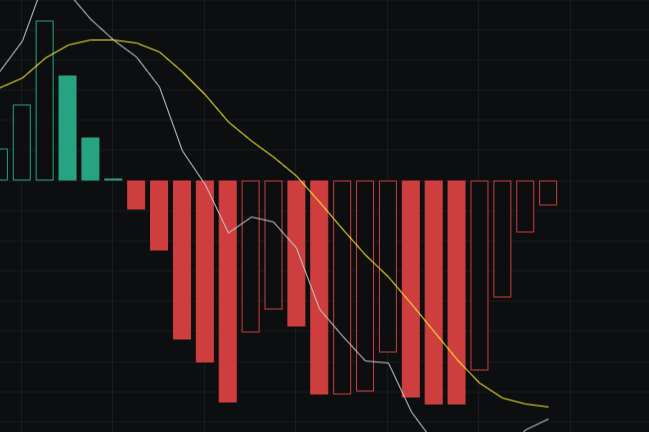

From the daily technical indicators of Ethereum, today's KDJ technical indicator shows a slight upward trend; however, the golden cross has not yet formed, and the overall trend still leans towards a fluctuating downward movement. Meanwhile, the MACD technical indicator and BOLL technical indicator are both in a state of resonant decline. From the daily technical indicators, the MA three-day moving averages are also continuously arranged in a bearish formation. Currently, the bearish pressure from above is very strong. Judging from the current daily candlestick chart, Ethereum is now in a state where 3-4 consecutive candlesticks are at the bottom as support, with bottom support focusing on the range of 3267-3195.

From the 4-hour technical indicators, the short-term MA5 moving average shows a slight upward pressure, and the short-term coin price has also continuously shown green TD2, indicating a slight rebound rhythm. From a technical perspective, the bottom support at the range of 3267-3195 is very strong, and in the short term, it is difficult for the bears to cause any substantial damage to this support. However, currently, the KDJ technical indicator and MACD technical indicator continue to show a resonant downward trend, and the short-term MA10 and MA30 moving averages continue to accelerate downward. Considering both the daily and short-term indicators, I personally believe that the trading strategy for today’s afternoon and evening should focus on short positions.

Finally, I believe that the coin price will undergo a fluctuating adjustment in the afternoon and evening, so a slight rebound in the coin price is quite normal. Our trading strategy should still primarily focus on short positions.

The above is my personal analysis of the market in the afternoon, for reference only. Specific point direction changes should be based on real-time guidance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。