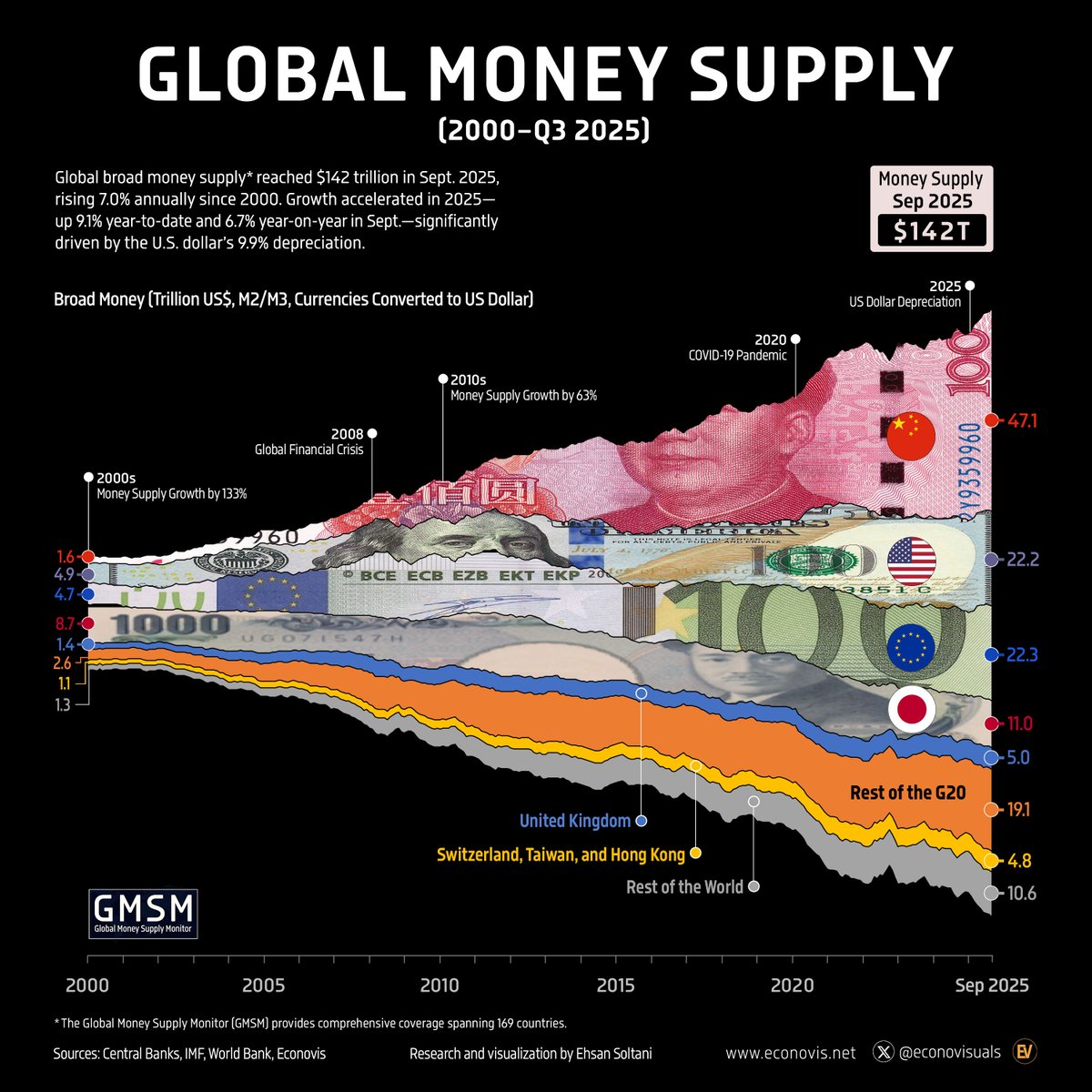

Today I was shocked to see this data: in September, the global broad money supply grew by 6.7% year-on-year, reaching a record $142 trillion.

Over the past 20 years, the global M2 compound annual growth rate has been 7%, while #BTC has seen an annualized increase of over 200%+ since its inception in 2009. The logic behind this is simple: the more fiat currency there is, the more valuable scarce assets become.

This time, it is mainly driven by the two "liquidity engines" of China and the United States.

🇨🇳 China's broad money supply has reached $47 trillion, accounting for 33% of the global total. Today, China is the world's largest contributor to liquidity. Curbing deflation and excessive currency issuance is the only solution to avoid balance sheet recession.

🇺🇸 The United States maintains a broad money supply of $22.2 trillion, accounting for 16%, but don't forget that a new round of interest rate cuts that began in September is heating up—liquidity returning is just a matter of time.

🇪🇺 The European Union is also around 16%, basically tied for second place.

Overall, the three major economies contribute nearly 65% of the total liquidity, raising the "water level" of global financial markets. The prices of quality assets are often closely related to fiat currency liquidity; the more excessive currency there is, the more expensive quality assets become. #BTC and gold, with long-term value, still look bullish! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。