BUIDL, USYC, and XAUT Dominate Tokenized Asset Board as RWA Holders Top 532K

The RWA stack just keeps thickening — a buffet of private credit, tokenized Treasuries, commodities, and alternative funds getting plated up onchain. The tokenized asset sector climb comes just as two stablecoins slipped off their pegs and the broader stablecoin sector stumbled over the past week.

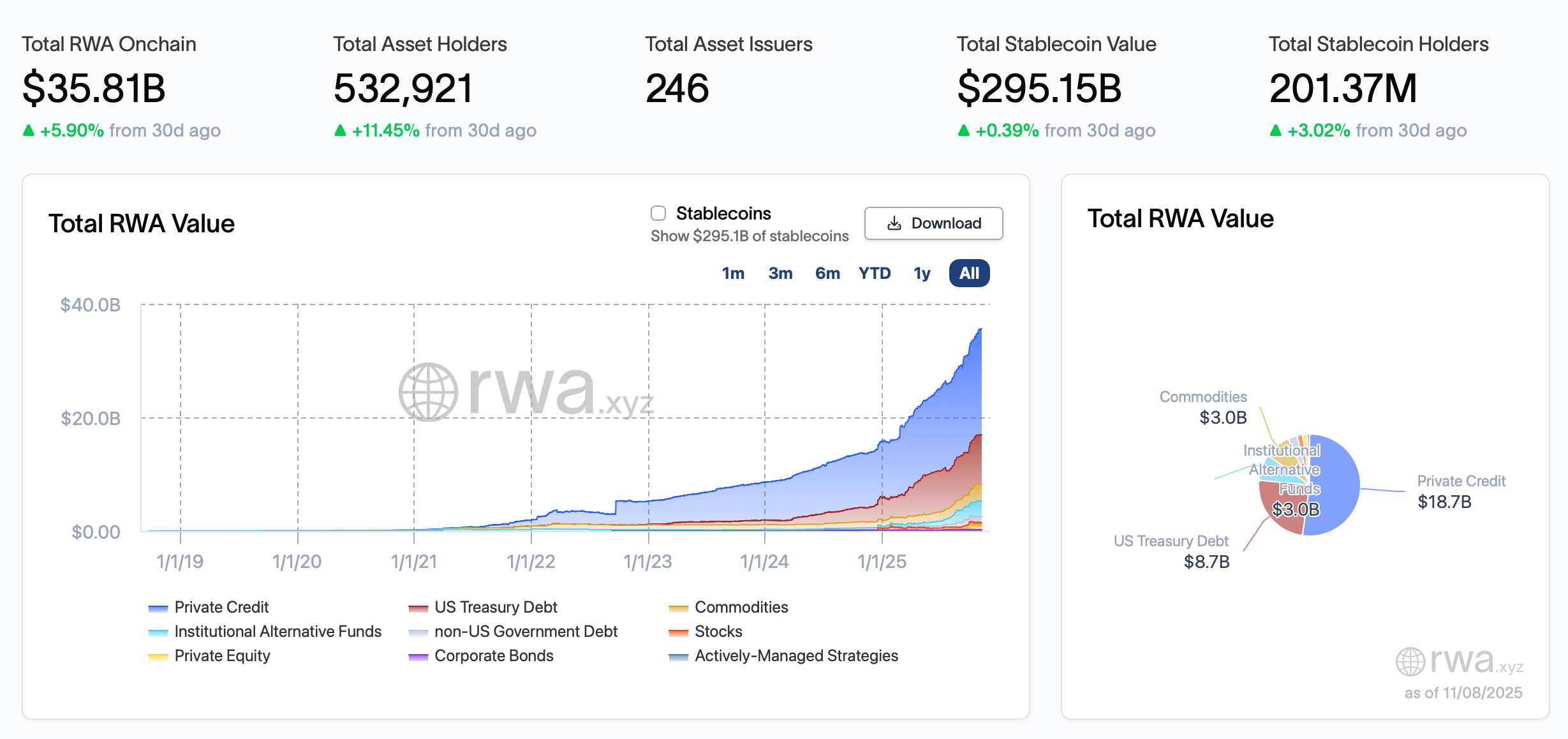

Rwa.xyz figures show, over the past 30 days, the number of RWA holders jumped 11.45% to 532,921, while 246 issuers are now in the mix, proving this isn’t just a passing fad — it’s still a full-blown tokenized asset party. Unlike much of the crypto economy lately, tokenized RWAs are still enjoying an upswing of growth.

Rwa.xyz on Nov. 9, 2025.

Private credit continues to flex as the heavyweight, clocking in at $18.7 billion, while U.S. Treasuries trail with $8.7 billion in tokenized glory. Commodities and institutional alt funds each circle near or over the $3 billion mark, leaving the smaller-cap RWAs to fill out the rest of the blockchain charcuterie board.

Inside tokenized private credit, the numbers read like a high-yield fever dream: $18.72 billion in active loans out of $33.31 billion total, with a juicy 9.78% average base APR spread across 2,712 loans. Figure still hauls most of the freight, with about $13.5 billion of those loans parked on Provenance.

Tradable posts $2.08 billion active on Zksync Era with an 11.08% base APR, Maple’s sitting around $1.75 billion at 9.23%, and PACT on Aptos steals the show with a bold 22.22% APR on $606 million active — though with $138.48 million in defaults, it’s not all sunshine. The rest of the pipeline — Centrifuge, Goldfinch, Mercado Bitcoin, Credix, and TrueFi — rounds out the lending circuit like a tour of DeFi’s credit frontier.

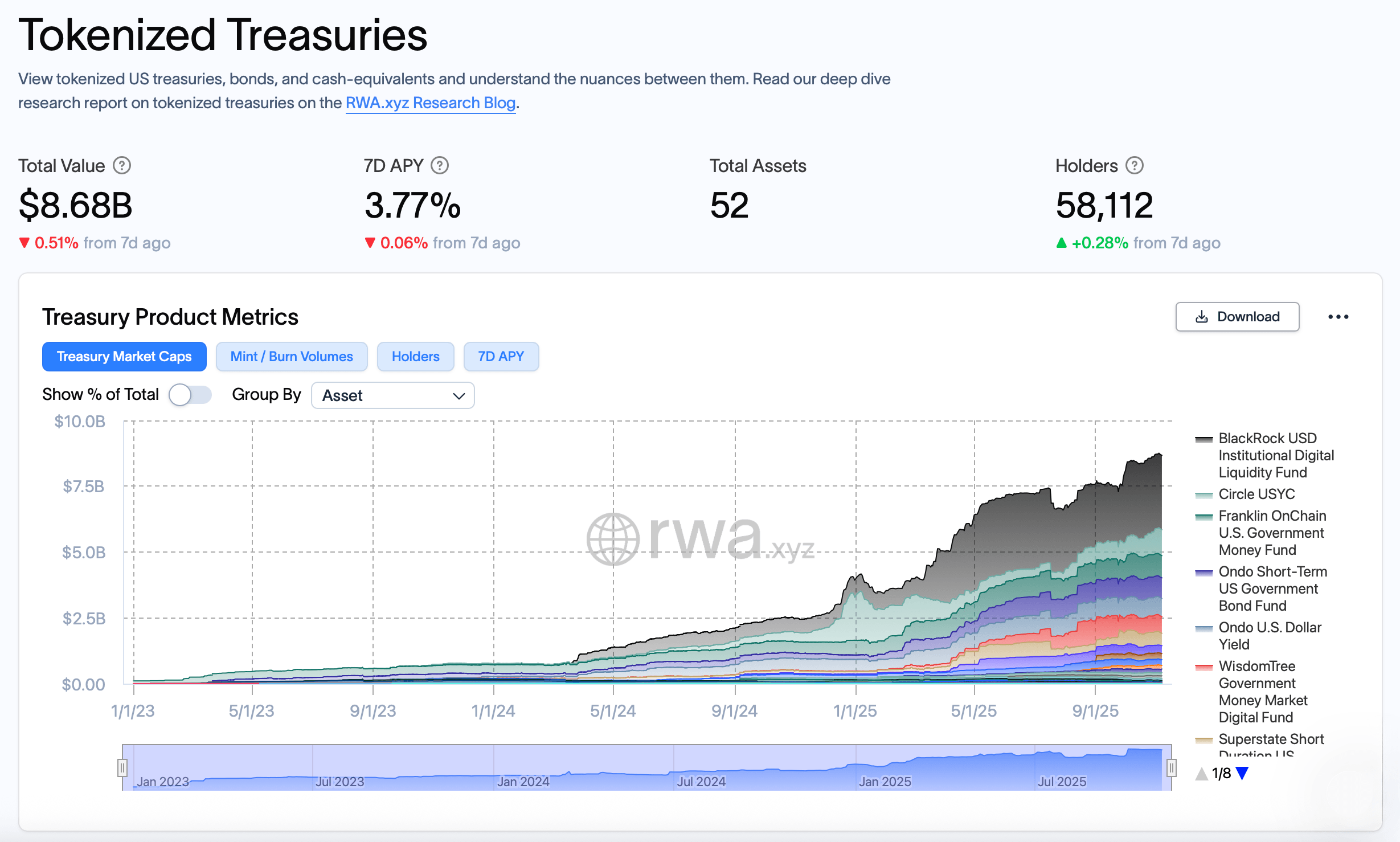

On the government-debt side, tokenized Treasuries are holding steady at $8.68 billion across 52 products, pulling a seven-day APY near 3.77%. There are 58,112 holders now (up a modest 0.28% on the week), and the leaderboard looks familiar: Blackrock’s BUIDL leads with roughly $2.82 billion, Circle’s USYC follows near $986 million, and Franklin Templeton’s BENJI trails close behind at $845 million.

Rwa.xyz on Nov. 9, 2025.

Over the last 30 days, USYC booked the fattest inflows — about $295 million — while BENJI, Openeden’s TBILL, and Superstate’s USTB all leaked capital. Janus Henderson’s JTRSY added $51 million, and Wisdomtree’s WTGXX brought in $45 million. Outflows of –$82 million at Superstate’s USTB show not every Treasury token gets to ride the yield train.

As far as chains go, Ethereum still dominates tokenized Treasuries real estate with $4.2 billion in market cap, followed by BNB Chain ($852.7 million), Avalanche ($633 million), Stellar ($620.7 million), Aptos ($583.9 million), and Solana ($528.5 million). XRP Ledger ($182.3 million) and Arbitrum ($179.3 million) bring up the next tier — not small, but not yet stealing headlines.

Among the standouts, like the metal-backed crowd, tether gold (XAUT) gleams at $1.557 billion, up 32.57% over 30 days, while paxos gold (PAXG) sits comfortably at $1.328 billion, up 9.32%. Circle’s USYC, meanwhile, pumped 43.35% in a month. Syrup USDC and Syrup USDT are having mood swings — both down on the week (–10.24% and –8.05%) but still up for the month (+2.75% and +46.06%).

Tokenized corporate bonds remain the quiet kid at the table — $258.99 million across 10 assets, held by 13,848 investors (a slight dip of 0.86% week over week). Still, it’s a growing niche that hints at the next chapter for digital debt.

Altogether, the RWA market’s pulse is strong and getting more interesting by the week. Private-credit venues are scaling even as a few take hits from defaults ($185.5 million total), while tokenized Treasuries keep pulling in steady inflows — especially USYC — likely from investors chasing safe, short-duration yield. The onchain financial system isn’t just maturing; it’s doing it live, one public ledger entry at a time.

FAQ ❓

- What is the total onchain RWA value now? Tokenized real-world assets total $35.81 billion, up 5.90% in 30 days, per rwa.xyz.

- Which RWA category is largest today? Private credit leads at about $18.7 billion, followed by U.S. Treasuries near $8.7 billion.

- Which tokenized Treasury product saw the biggest net inflow? Circle’s USYC led 30-day net flows with roughly $295 million.

- Which networks host the most RWAs? Ethereum tops with about $4.2 billion, then BNB Chain, Avalanche, Stellar, Aptos, and Solana.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。