Original Author: Sleepy.txt

The world of stablecoins has never lacked stories, but it does lack a respect for risk. In November, stablecoins faced another crisis.

A stablecoin called xUSD experienced a flash crash on November 4, plummeting from $1 to $0.26. As of today, it continues to decline, having dropped to $0.12, evaporating 88% of its market value.

Source: Coingecko

The incident involved a star project, Stream Finance, which manages $500 million in assets.

They packaged their high-risk investment strategy as a dividend-paying stablecoin, xUSD, claiming it was "pegged to the dollar and automatically accruing interest," essentially wrapping investment returns into it. If it were an investment strategy, it could not guarantee perpetual profits. On October 11, the day of a massive crash in the crypto market, their off-chain trading strategy failed, resulting in a loss of $93 million, equivalent to about 660 million yuan. This amount is enough to buy over forty 100-square-meter apartments in Beijing's second ring road.

A month later, Stream Finance announced a suspension of all deposits and withdrawals, and the price of xUSD decoupled.

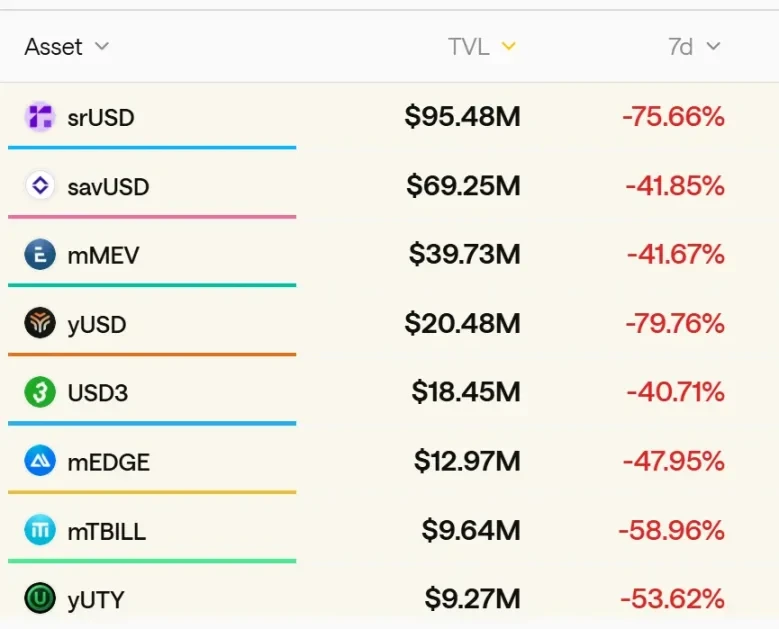

Panic spread rapidly. According to data from research firm stablewatch, over $1 billion fled from various "dividend-paying stablecoins" in the following week. This is equivalent to the total deposits of a medium-sized urban commercial bank being completely withdrawn in just seven days.

The entire DeFi investment market sounded alarms, with borrowing rates in some protocols even reaching an astonishing -752%, meaning collateral became worthless, and no one would repay to redeem it, plunging the market into chaos.

All of this stemmed from a seemingly beautiful promise: stability and high interest.

When the illusion of "stability" was pierced by a large bearish candlestick, we must re-examine which stablecoins are truly stable, which are merely high-risk investments disguised as stablecoins, and why high-risk investments can brazenly call themselves "stablecoins" now.

The Emperor's New Clothes

In the world of finance, the most beautiful masks often hide the sharpest fangs. Stream Finance and its stablecoin xUSD are a typical example.

They claimed that xUSD employed a "Delta-neutral strategy." This is a complex term originating from professional trading, aimed at hedging market volatility risks through a series of complex financial instruments, sounding very safe and professional. The story they told was that regardless of market fluctuations, users could achieve stable returns.

In just a few months, it attracted as much as $500 million in funding. However, peeling back the mask, on-chain data analysis revealed that xUSD's true operational model was riddled with flaws.

First, there was extreme opacity. Of the claimed $500 million in assets, less than 30% could be traced on-chain, while the remaining "Schrödinger's $350 million" operated in unseen places. No one knew what was happening in this black box until the moment it collapsed.

Second, there was astonishingly high leverage. The project used only $170 million of real assets to repeatedly collateralize and borrow in other DeFi protocols, leveraging up to $530 million in loans, with a real leverage ratio exceeding 4 times.

What does this mean? You thought you were exchanging for a stable "digital dollar," while looking forward to a stable high interest rate of over ten percent annually. In reality, you were buying a share in a 4x leveraged hedge fund, and you couldn't see 70% of the fund's positions.

The "stability" you thought you had was actually your money engaging in high-frequency trading in the world's largest digital casino.

This is precisely where these "stablecoins" are most dangerous. They use the label of "stability" to mask the essence of a "hedge fund." They promise ordinary investors the safety of bank savings, while the underlying operations are high-risk strategies that only the most professional traders can handle.

Deddy Lavid, CEO of blockchain security company Cyvers, commented after the incident: "Even if the protocol itself is secure, external fund managers, off-chain custody, and human oversight remain key weaknesses. The collapse of Stream was not a code issue, but a human issue."

This viewpoint hits the nail on the head. The root of Stream Finance's problems lies in the project team packaging an extremely complex, high-risk, and unregulated financial game as a "stable investment product" that ordinary people could easily participate in.

Domino Effect

If Stream Finance created a bomb, then the Curator in DeFi lending products became the courier of this bomb, ultimately leading to a widespread chain explosion.

In emerging lending protocols like Morpho and Euler, Curators play the role of "fund managers." Most of them are professional investment teams responsible for packaging complex DeFi strategies into "strategy vaults," allowing ordinary users to deposit with one click and enjoy returns, just like in a bank app. Their main income comes from taking a percentage of the users' returns as performance fees.

In theory, they should be professional risk gatekeepers, helping users filter quality assets. However, the performance fee business model also sows the seeds for them to chase high-risk assets. In the highly competitive DeFi market, higher annualized returns mean attracting more users and funds, thus earning more performance fees.

When the "stable and high-yield" asset packaged by Stream Finance appeared, it immediately became a hot commodity in the eyes of many Curators.

In the Stream Finance incident, we saw the worst-case scenario. According to on-chain data tracking, in protocols like Euler and Morpho, several well-known Curators, including MEV Capital, Re7 Labs, and TelosC, heavily allocated high-risk xUSD in their managed vaults. Among them, TelosC alone had a risk exposure of up to $123 million.

More critically, this allocation was not a careless mistake. There is evidence that several industry KOLs and analysts publicly warned on social media about the transparency and leverage risks of xUSD days before the incident, but these Curators, who held significant funds and should have been the first line of risk responsibility, chose to ignore it.

However, some Curators were also victims of this packaging scam. K3 Capital is one of them. This Curator, managing millions of dollars in assets on the Euler protocol, lost $2 million in this explosion.

On November 7, the founder of K3 publicly spoke in Euler's Discord channel, revealing how they were deceived.

Source: Discord

The story begins with another "stablecoin" project. Elixir is a project that issues the dividend-paying stablecoin deUSD, claiming to use a "basis trading strategy." K3 based its allocation of deUSD in its managed vault on this promise.

However, in late October, without any Curator's consent, Elixir unilaterally changed its investment strategy, lending about $68 million USDC to Stream Finance through Morpho, transforming from basis trading to nested investment.

These are completely different products. Basis trading directly invests in specific trading strategies, with relatively controllable risks. Nested investment means lending money to another investment product, adding another layer of risk on top of the existing high risk.

When Stream's bad debts were made public on November 3, K3 immediately contacted Elixir's founder, Philip Forte, demanding assurance for a 1:1 redemption of deUSD. But Philip chose silence, completely unresponsive. In desperation, K3 had no choice but to forcibly liquidate on November 4, ending up with $2 million in deUSD. Elixir announced insolvency on November 6, stating that its solution was to allow retail investors and liquidity pool deUSD to be exchanged 1:1 for USDC, but the deUSD in Curator vaults would not be exchanged, requiring everyone to negotiate a solution together.

Currently, K3 has hired top lawyers in the U.S. and is preparing to sue Elixir and Philip Forte for unilaterally changing terms and false advertising, seeking compensation for reputational damages and forcing the redemption of deUSD back to USDC.

When gatekeepers start selling risk themselves, the collapse of the entire fortress is just a matter of time. And when the gatekeepers themselves are also deceived, who can we rely on to protect users?

Same Soup, Different Ingredients

This "packaging - diffusion - collapse" model is eerily reminiscent in financial history.

Whether it was LUNA, which evaporated $40 billion in 72 hours with the story of "algorithmic stability and 20% annualized returns" in 2022, or earlier in 2008, when Wall Street elites packaged a pile of high-risk subprime mortgages into AAA-rated "quality bonds (CDOs)" through complex financial engineering, ultimately triggering a global financial crisis. The core is astonishingly consistent: complexly packaging high-risk assets to make them appear as low-risk products, then selling them to investors who cannot fully understand the risks behind them through various channels.

From Wall Street to DeFi, from CDOs to "dividend-paying stablecoins," the technology changes, the names change, but human greed remains unchanged.

According to industry data, there are still over 50 similar dividend-paying stablecoin projects operating in the DeFi market, with a total locked value exceeding $8 billion. Most of them are using various complex financial engineering to package high-leverage, high-risk trading strategies as stable and high-yield investment products.

Source: stablewatch

The root of the problem lies in the fact that we have given these products a misleading name. The term "stablecoin" brings an illusion of safety and a numbness to risk. When people see stablecoins, they think of dollar reserve assets like USDC and USDT, not a highly leveraged hedge fund.

A lawsuit cannot save a market, but it can awaken a market. When the tide goes out, we should see not only those who swim naked but also those who never intended to wear swimsuits in the first place.

$8 billion, 50 projects, the next Stream could emerge at any time. Before that, please remember a simple common sense: when a product needs to attract you with ultra-high annualized returns, it is definitely unstable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。