Author: 1912212.eth, Foresight News

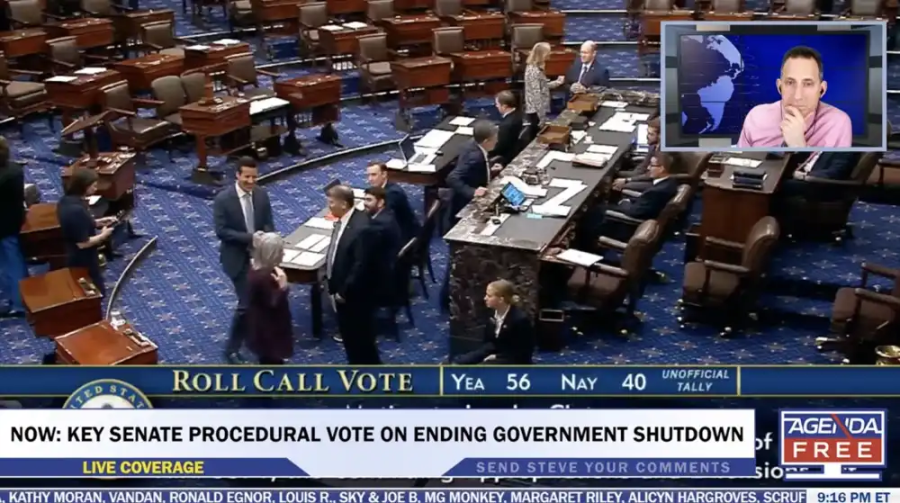

Recently, the cryptocurrency market has welcomed two major pieces of good news. On November 9, Trump announced that everyone would receive at least $2,000 in bonuses. The next day, Trump stated in front of the media that the government shutdown seems to be coming to an end. Currently, the U.S. Senate is conducting test votes on a plan to end the government shutdown, requiring 60 votes to pass. The latest data shows that it is just 1 vote short of passing.

In response to the positive news, the cryptocurrency market reacted accordingly. On the evening of November 9, BTC rose from $102,000 to a recent high of around $106,600, while ETH climbed from around $3,400 to its current level of about $3,600, with a 24-hour increase of over 7%. Altcoins also experienced a slight overall increase.

The Longest Government Shutdown in U.S. History is About to End

The potential end of the U.S. government shutdown is the biggest macro positive for the cryptocurrency market recently. The shutdown began in October this year due to budget disagreements in Congress, leading to a freeze in federal funding that affected various areas from Social Security payments to defense spending. According to data from the U.S. Congressional Budget Office, this shutdown has caused an estimated daily economic loss of about $1 billion, totaling hundreds of billions. This has directly impacted investor confidence, exacerbating uncertainty, and causing institutional funds to shift to safer assets like government bonds, leading to a depletion of cryptocurrency liquidity.

White House National Economic Council Director Hassett stated: If the U.S. government shutdown continues, the GDP for the fourth quarter could be negative. U.S. Treasury Secretary Basant also mentioned that the impact of the government shutdown on the economy is becoming increasingly severe.

On November 10 at around 9 AM, as the U.S. federal government had been "shut down" for 40 days, President Trump told the media: It seems we are getting closer to ending the 'shutdown'. The U.S. Senate is expected to vote that evening on a bill already passed by the House of Representatives, but the bill will be amended to package short-term funding measures (which could fund the federal government until January 2026) with three full-year appropriations bills.

A Fox News reporter stated that the U.S. Senate is conducting procedural votes on plans to end the government shutdown, requiring 60 votes to pass.

The Senate is currently conducting procedural votes on plans to end the government shutdown, and it is just 1 vote short of passing. According to relevant information, after the procedural vote passes, the Senate must amend three appropriations bills (legislative, military construction, and agriculture, including the SNAP program) and then send them back to the House. Each amendment will trigger a 30-hour debate period, which could delay the process. If the Democrats choose to extend these debates, the government may not reopen until Wednesday or Thursday, but if they forgo the time, the "end of the government shutdown" process could be completed tonight, allowing the U.S. government to reopen tomorrow night. The current filibuster rules could significantly affect the timeline.

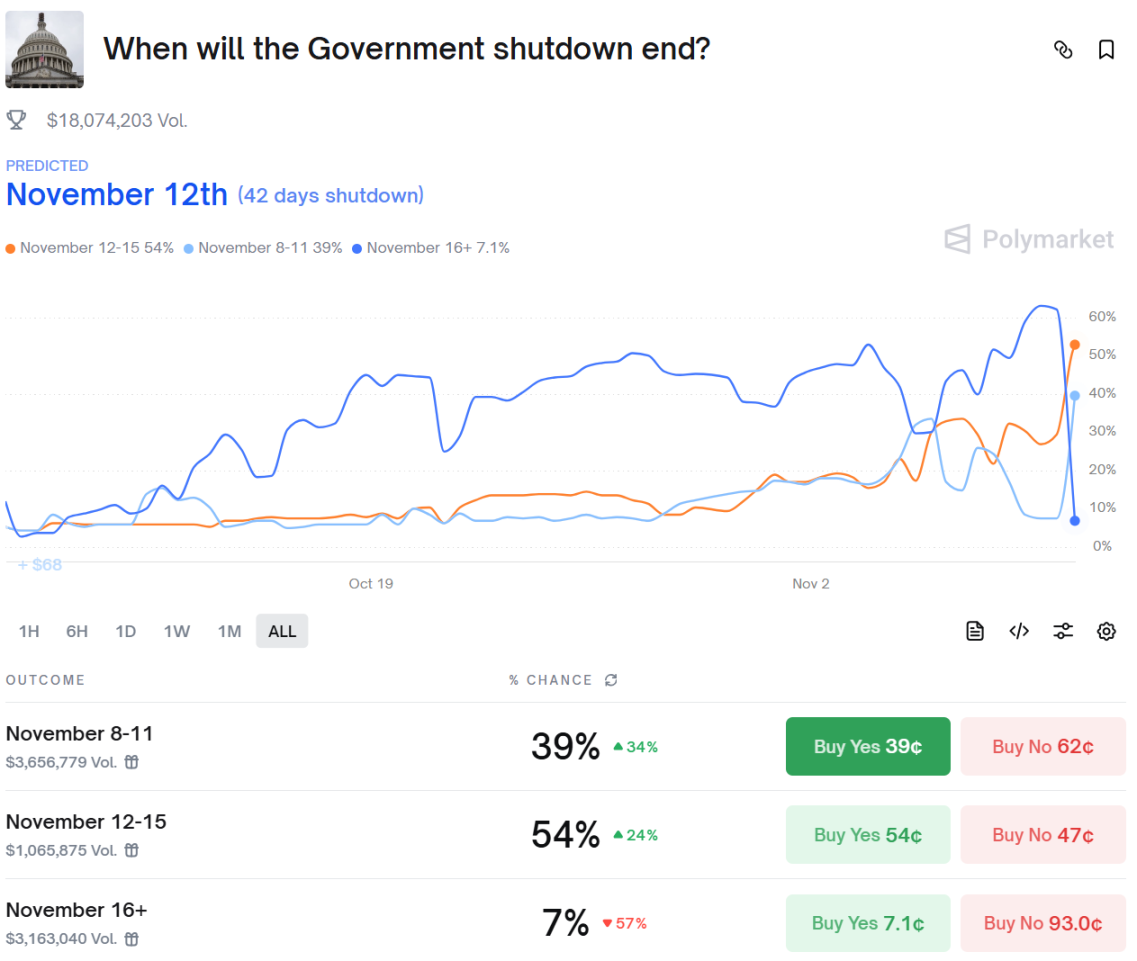

Data from Polymarket shows that the market's bet on the end of the government shutdown before November 11 has risen to 39%, while the probability for November 12 to 15 is 55%. The total trading volume in this prediction market has exceeded $18.1 million.

BitMEX co-founder Arthur Hayes stated that the U.S. government has started doing what it does best again—printing money and distributing benefits. BTC and ZEC are set to take off. Previously, Arthur analyzed that BTC had fallen 5% since the U.S. debt ceiling was raised in July, and dollar liquidity had decreased by 8%. The U.S. Treasury General Account (TGA) has drained liquid dollars from the market. When the U.S. government shutdown ends, the TGA will decrease, benefiting dollar liquidity, and BTC will rise.

Historical data shows that similar to the end of the 2019 shutdown, the cryptocurrency market rebounded by 10%-15% within two weeks. If history repeats itself, the shutdown may once again drive market prices to continue rebounding.

The U.S. Government Will Pay Everyone a $2,000 Bonus

The tariff war initiated by Trump once put global investors on edge. The tariff war even became the trigger for the "10.11 crash" in the cryptocurrency market.

Recently, Trump defended his tariff war by stating: Those who oppose tariffs are fools! We are now the richest and most respected country in the world, with an inflation rate of nearly zero, and the stock market has reached an all-time high. The balance of 401k retirement accounts has also reached a historic peak. We earn trillions of dollars each year and will soon start repaying our massive debt of up to $37 trillion. U.S. investment has reached an all-time high, with factories and businesses springing up like mushrooms after rain. We will pay everyone at least $2,000 in bonuses (excluding high-income groups!).

Trump's tariff bonus plan injects potential funds from the consumption side, amplifying the leverage effect in the cryptocurrency market. This is based on his trade policy: imposing tariffs of 10%-60% on imported goods, expected to generate $1 trillion in revenue by 2026. The Treasury Department's preliminary estimate suggests this will cover hundreds of millions of people, with total spending exceeding $6 trillion, partially achieved through direct transfers.

The positive impact of this plan on cryptocurrency liquidity lies in the spillover effect of funds. U.S. consumer spending accounts for 70% of GDP, and the distribution of bonuses will stimulate retail and investment. According to Federal Reserve data, similar to the pandemic stimulus checks in 2021, retail funds flowing into cryptocurrency reached 15%, driving Bitcoin from $40,000 to $60,000. This time, the scale of bonuses is larger, with an estimated 10%-20% (about $600 billion to $1.2 trillion) flowing into high-risk assets.

With these two major events intertwined, the short-term sentiment in the cryptocurrency market has significantly improved. The end of the shutdown has released frozen institutional funds, while the bonus plan injects fresh blood from the retail side.

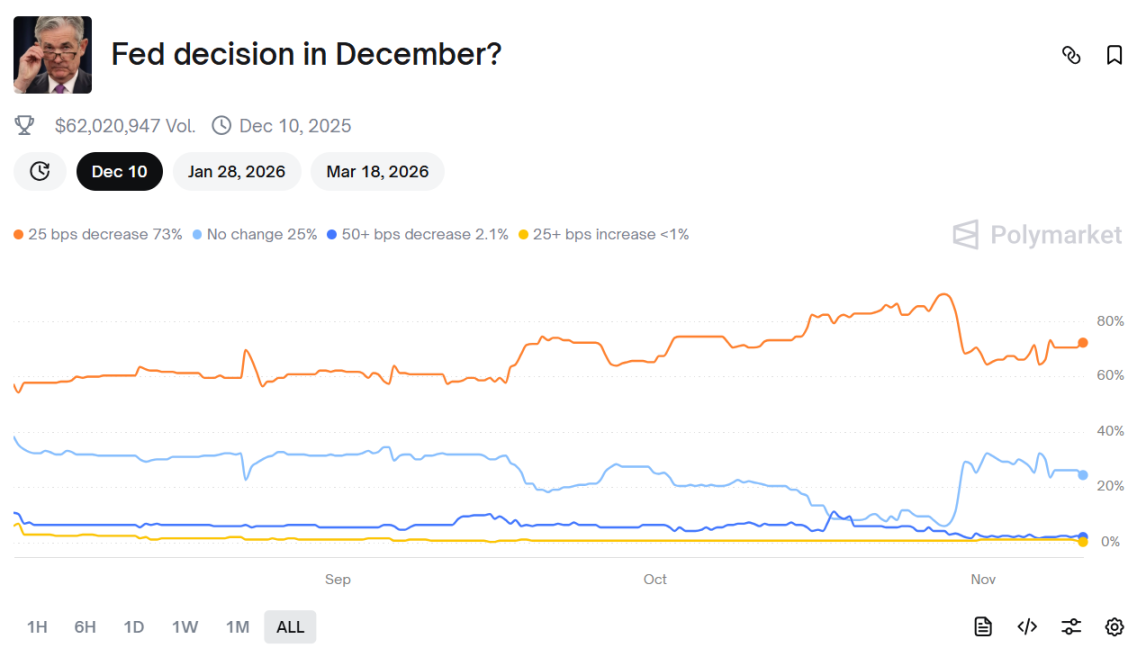

In addition, data from Polymarket shows that the market's bet on a 25 basis point rate cut by the Federal Reserve in December has risen to 73%, which will continue to inject liquidity into risk assets.

Currently, after the cryptocurrency market fell into extreme panic in early November, the panic index remains at 29. Perhaps when market liquidity flows back in, market sentiment will significantly improve.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。