The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and refuse any market smoke screens!

First, let's review the market trends. Yesterday, Bitcoin started from a high point of 105,297 and has been on a downward trend; it reached 100,711, and although it was a pin bar formation, it can be considered as breaking a new low. Have you all purchased Bitcoin around the 100,000 mark? The current quote has reached around 101,897, which aligns with our previous speculation of a downward oscillation state. Today is also quite special; according to the original plan, the CPI data for October was supposed to be released, but it has surprisingly become a pending status. The recovery situation in the U.S. shows that most positions will return to work tomorrow, and it is also possible that the announcement tonight may be postponed. The latest prediction is 3.10%, higher than the previous forecast of 3%. I would like to remind everyone that the interest rate decision for December will be announced on December 11, not in the second half of the month. We should be able to get a clear answer on interest rate cuts around the 10th, when the CPI data for the end of November will be released. These two time frames need your close attention.

Recently, there have been no major events that require your attention; the only market events that could disrupt the market come from the U.S. During this gap, let’s talk about the issues in the market. Many friends look at Lao Cui's market and seem to find a certain gap with their own positions. This is because Lao Cui observes the Binance market with an 8 AM delivery line, not a midnight reset. Additionally, Lao Cui is looking at the contract market, which will also differ from the spot market. Perpetual contracts do not involve spot delivery; the funding fee constrains the price of perpetual contracts, and it is merely a tool that aligns with the spot price. In other words, the inflow of funds in these two markets does not affect each other, and the funding fee is a factor that constrains the contract market's trend to be close to the spot. Normally, the trend should be that the spot market moves first, and the contract market follows, but the current technology can shorten this to milliseconds, making it difficult for humans to identify the gap. This is the reason for the tens of points difference between the spot and contract markets. It is not that Lao Cui's market observation is flawed.

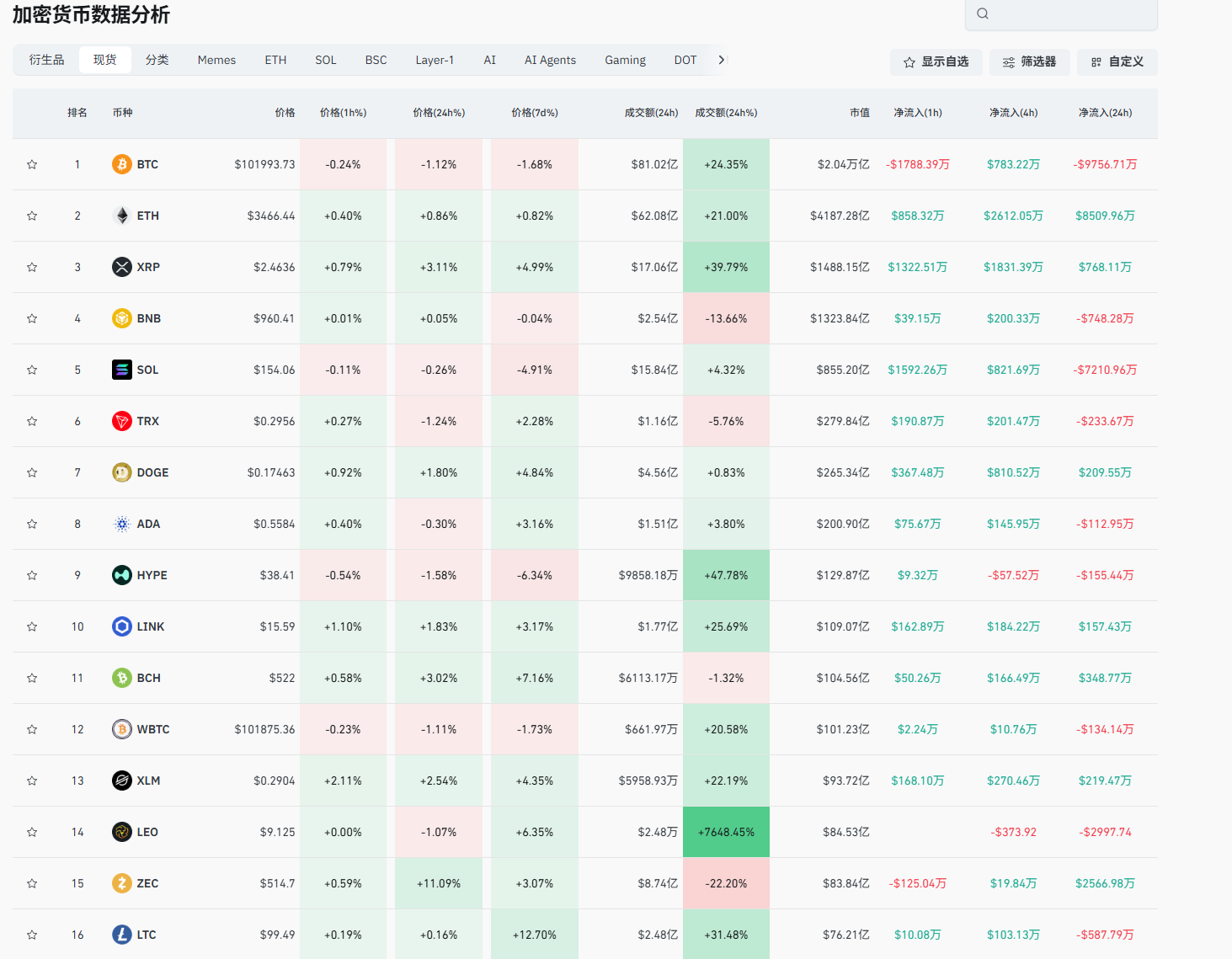

If you entered the industry early, around 2015, the technology could still reference spot trends for contract arbitrage, playing on the time difference, and platforms often make such mistakes. To get back on track, since Trump’s promotion, the entire on-chain data has been extremely promising. Lao Cui's view is that the funds accumulated on-chain are sufficient to drive the birth of a bull market. Currently, the cryptocurrency market is just one opportunity away from explosive growth. Looking at the market cap, Bitcoin has evaporated a trillion assets since its new high, and the entire cryptocurrency market has dropped from nearly 4 trillion to currently less than 3 trillion in market cap, with a very obvious outflow phenomenon. In fact, apart from Bitcoin, the outflow of other cryptocurrencies is even more pronounced, as Bitcoin's price has not experienced a crash. The foreign trade settlement in December is approaching; do not make wrong judgments at critical moments, as there may be a surge in the market after the settlement.

The exchange rate issue is also gradually climbing, and stabilizing above 7.1 is not a big problem. The appreciation of the dollar, which can accompany the increase in dollar assets, will only appear in this year-end settlement wave. For those holding USDT, December will be a good choice to exit. Currently, Bitcoin is under capital scrutiny; it needs to prove whether it is worth a market cap of 300 billion. The cryptocurrency market and the AI market are also synchronized, with enough bubbles in between, leading to an unstable bottom structure. The current process of de-bubbling is not too big of an issue. Lao Cui's view will not change; as long as the channel exists and people use the cryptocurrency market to transfer assets, this circle and the bottom price will not change. Therefore, regarding the future bull market, this is not something we need to discuss; for this year's new high, Lao Cui still has high expectations, remaining in the range of 130,000 to 150,000, and confidence remains.

Including your concerns, the domestic WEB3 and its own blockchain will not have an impact on the cryptocurrency market. It is almost disconnected from the outside world, posing no threat, and the inflow of funds will not be too much. Similar to Hong Kong, it merely provides a channel for inflow, not outflow. If there are users interested in this area or have certain capital, they can consider the domestic market, but ordinary investors should not easily enter, as there will be no profits. On the exchange rate level, as long as it stays above 7, it is still high, which is good news for dollar assets. This also proves that Trump's weak dollar policy has been successful. The appreciation of dollar assets will drive the growth of the cryptocurrency market; do not confuse this. The current endorsement of the cryptocurrency market is based on the U.S., including Goldman Sachs and BlackRock, which estimate that Bitcoin will reach 170,000 dollars by 2026. Lao Cui's estimate is only around 150,000, so everyone can prepare to exit.

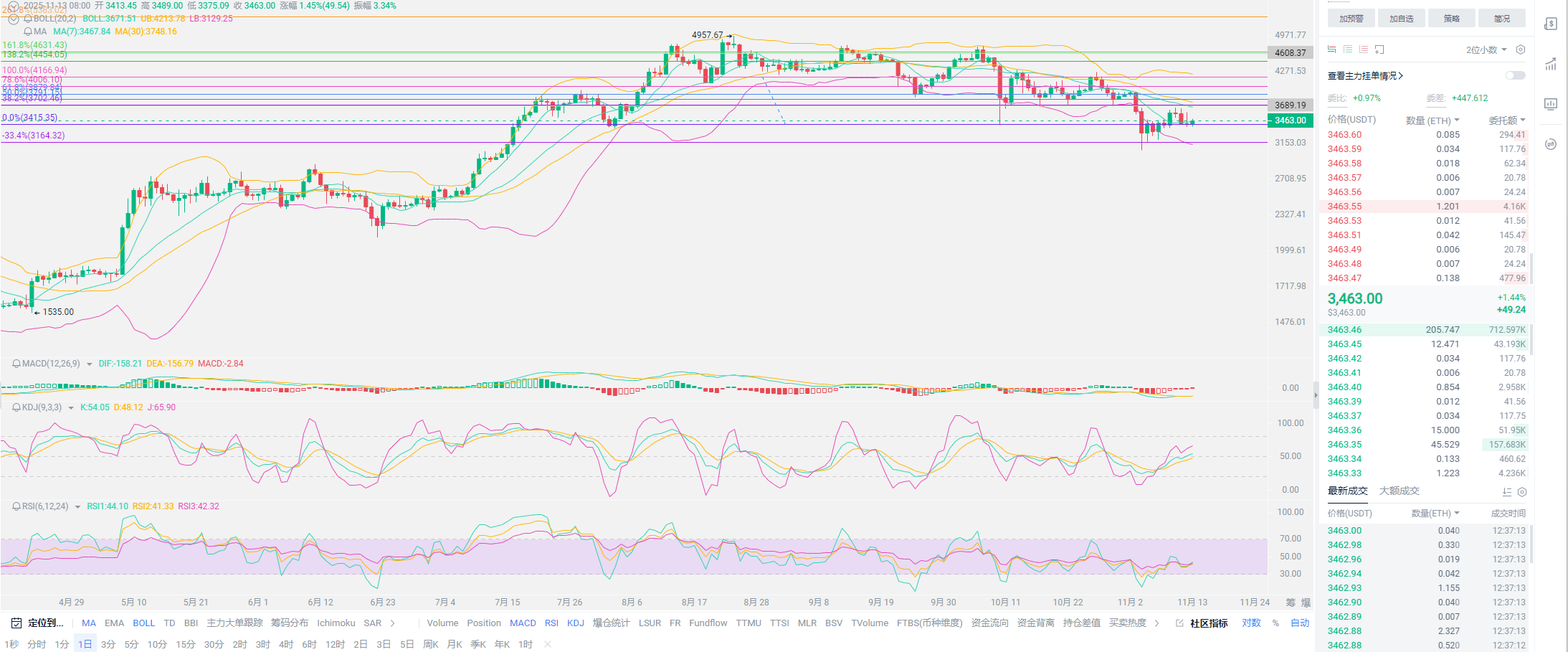

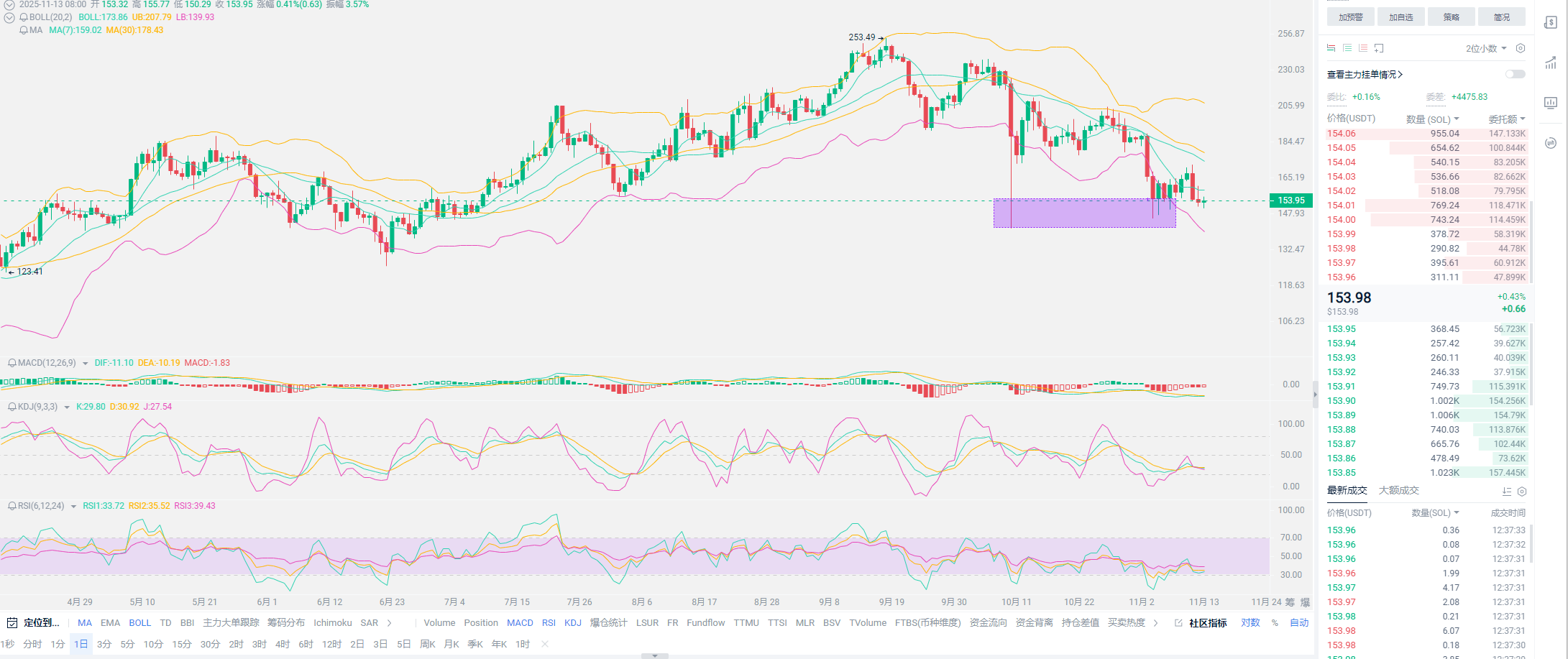

Lao Cui summarizes: There is not much to discuss in the current cryptocurrency market; most of it is speculation. Only when the market in December unfolds can you know where this year's new high truly lies. Therefore, the short-term arrangement for spot users is to accumulate more at the bottom and hold more. Contracts are more flexible; the current trend is actually beneficial for contract development. The bottom support at 100,000 basically creates a back-and-forth oscillation situation. Everyone should try to use this trend to gain more profits and hedge against spot losses. Today is a day to watch for rebounds, with fluctuations between 100,000 and 105,000; you need to operate patiently. As long as the stop-loss position is set around 10,000, there will not be too much loss. Ethereum is waiting for good news; its on-chain data is among the best of all cryptocurrencies, and it may reach new highs in the next bull market. Holding SOL depends on your position arrangement; be cautious below 160. Have enough chips before making arrangements! At the end of the article, if you have questions, feel free to ask, and Lao Cui will respond!

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, you can contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the final victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。