In the midst of strategizing, we can win from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

Recently, I have been receiving constant private messages from fans asking if the market has entered a bear market. If so, should we just cut losses and exit? First, I want to share a piece of advice: never do anything that will lead to a permanent loss of your principal. Clearly, cutting losses is one such action. I don't want to repeat too much about hedging. Instead of speculating on the trend's development, just follow the trend and take corresponding actions. But what if it is indeed a confirmed downtrend? Let's first take a look at the current market situation.

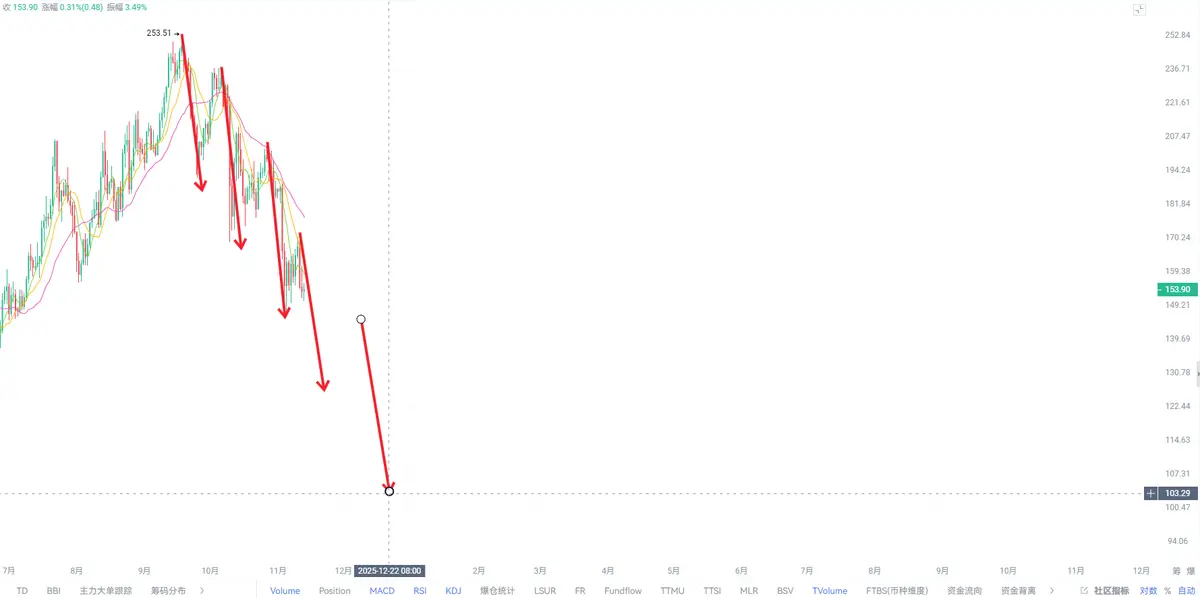

Taking the SOL chart as an example, the current situation shows a continuous decline for three months. Should we run or not?

Let's run; what if this is the last washout, and just as we run, it rebounds to a new high?

If we don't run, what if there are still bottoms below, and more bottoms, and we get buried at the foot of the mountain, with our principal cut down to our ankles, leaving us with no chance to turn over?

Does it feel like every choice is wrong? The reason you find yourself in this dilemma is that you treat trading as a multiple-choice question that requires you to make a decision on the spot, but what is your basis for making that choice? Your feelings and guesses. Lin Chao never makes choices; I only look at timing and systems, and that is the biggest difference between us.

Here's a piece of advice: trading without a system is essentially gambling, and the outcome is already predetermined.

Today, I will thoroughly explain the framework of my top trading system. Note that this article can help you establish clear trading rules and fundamentally break the cycle of losses. Before we start, you must clarify what type of trading this system serves: is it for spot or contracts? Is it for intraday short-term swings or long-term? For example, if we position it as a contract intraday short-term trading system, then the holding principle could be that small positions can consider overnight holding, but most positions must be closed within the day. This is what I mentioned in previous articles about cycles.

First, the first step in establishing a system is to identify the trend.

This is the foundation of the trading system, aimed at ensuring your trades always follow the major trend. 1. Reference cycle, such as the 1-hour chart, which serves one purpose: to tell you which direction to trade today. If the 1-hour chart shows an uptrend, then the system gives you the first instruction: look for opportunities to go long today. 2. Trading cycle, such as the 15-minute chart. Once the major direction is set, we switch to a smaller cycle to find specific entry and exit points; 80% of your operations should be completed on this cycle. The core rule is simple: use the larger cycle to determine direction and the smaller cycle to execute operations. This way, you won't deviate from the main trend while also finding precise entry rates. Similarly, if we don't like high-frequency trading, we can look at the daily trend and trade on the 4-hour candlestick, and so on.

The second step is to find key levels. Knowing the direction, we also need to find the areas where we can take action, which are the key support and resistance levels, or the entry points I often mention.

The purpose of this step is mainly to calculate the risk-reward ratio. The principle is to look for long opportunities near key support levels and short opportunities near key resistance levels. Before entering a trade, you must calculate this. The potential profit of the trade I execute should be at least 3-5 times my stop-loss risk. If the trade isn't worthwhile, no matter how good the signal is, the system should tell you to give up.

A successful trade, in my view, is one where the take profit is more than three times the stop loss.

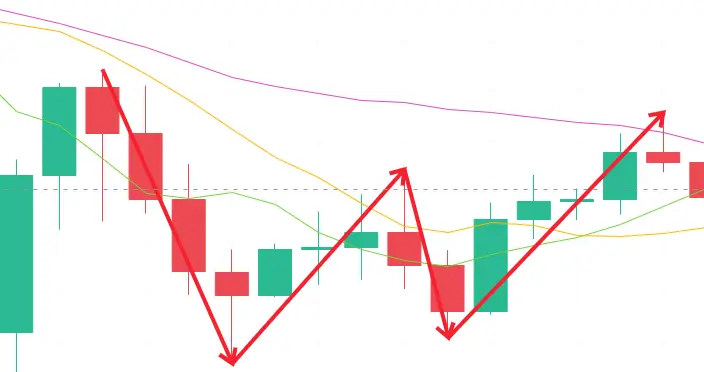

The third step is to find entry signals. This signal can be a classic candlestick pattern, such as a bullish engulfing, or a moving average crossover signal, such as a golden cross, or a classic W-bottom rebound. The core rule here is that this signal must appear at the key levels you identified in the second step to count.

However, a beautiful candlestick appearing halfway up the mountain is likely a trap, not an opportunity. Here’s the crucial question: even if you find a seemingly perfect bullish engulfing signal at a key level, what if the price doesn't rise as you expected and instead turns down? What should you do? If a false breakout occurs, or if the signal fails, should you immediately cut losses and exit, or wait a bit to see if it will pull back? On this issue, 90% of people will think incorrectly. I will write a dedicated article later on how to identify true breakouts versus false breakouts for a detailed breakdown.

Classic W-shaped rebound

The fourth step is to create a detailed plan. Your checklist should at least include the following items: 1. Reasons: why are you making this trade? There must be at least two reasons, such as the price reaching the support level on the 1-hour chart and a bullish signal appearing on the 15-minute chart. 2. Position size: how much money are you planning to invest? Many people make a clear mistake here by only thinking about how much they can earn before entering a trade, but the correct mindset is to think about how much you can potentially lose on this trade. Clearly define your entry point, stop-loss point, and take-profit point.

The fifth step is strict execution.

This is the most difficult step and the key differentiator between professionals and amateurs. Once the trade starts, your thinking should end; your only task is to strictly execute your plan from step four. If the market moves in your favor, adjust your stop-loss or take partial profits as planned. If the market moves against you, do nothing except wait for the price to hit your stop-loss; do not average down, and do not exit early out of fear. The core rule is to let your system make decisions for you, not your emotions.

The sixth step is to summarize and review.

Regardless of whether this trade is profitable or not, it is valuable data to help you optimize your system. After the trade, you should ask yourself several questions: 1. Did I follow the rules completely this time? 2. Was the entry signal accurate enough? 3. Are there any areas for optimization in the stop-loss and take-profit settings? Through continuous review, this system will understand you better, and you will understand this market better.

Today, I shared with you the core framework for building a trading system, and you have now learned it all. But remember, the market is always the market; the harsh reality will not change because of your losses, nor will it stop because of your tears and complaints. To change your fate, you must continuously learn investment skills and improve your abilities to truly stand firm.

The biggest prison in the world is the human mindset. If you can't earn money beyond your current understanding, then learn to leverage. Feel free to comment and share, and you can also message Lin Chao anytime if you need help learning and stepping out of the shadow of losses.

The global market is ever-changing, and the world is a whole. Follow Lin Chao to gain a top-tier global financial perspective.

This article is merely a personal opinion and does not constitute any trading advice. The cryptocurrency market is risky; invest with caution!

For real-time consultation, feel free to follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。