Original | Odaily Planet Daily (@OdailyChina)

In recent months, decentralized exchanges (DEX) have continued to capture market share from centralized exchanges (CEX), especially in perpetual contract trading, where the competitive gap between the two has narrowed to unprecedented levels.

According to statistics, the total trading volume of Perp DEX soared to a record $1.2 trillion in October, nearly doubling from the previous month. Additionally, DefiLlama data shows that the 24-hour trading volume of Perp DEX exceeded $45 billion, almost catching up with mainstream centralized platforms. In terms of market landscape, Binance (with a 24-hour trading volume of $74.8 billion) still holds the top position, but the total trading volume of Perp DEX has surpassed OKX ($33.2 billion), Bybit ($26.6 billion), and Bitget ($11.4 billion).

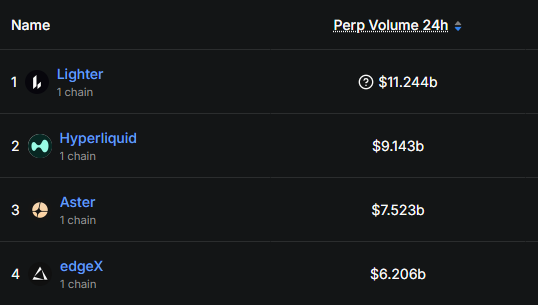

Specifically, among the leading Perp DEX, Lighter's 24-hour trading volume has surpassed $11.2 billion, ranking first among Perp DEX, followed by Hyperliquid ($9.1 billion), Aster ($7.5 billion), and edgeX ($6.2 billion).

24-hour trading volume of leading Perp DEX

The reason leading Perp DEX can maintain such high trading volumes is primarily due to the ongoing "money-splashing" activities. Next, Odaily Planet Daily has compiled three key activities worth paying attention to and participating in from the top Perp DEX platforms (the Hyperliquid S3 airdrop activity is currently only speculation, with no official evidence, so it will not be discussed for now).

Lighter: Re-raising $68 million, second quarter activities still ongoing

Following Lighter's announcement of completing a $68 million funding round, coupled with its second quarter incentive activities still in progress before the TGE, the platform has quickly become the most attractive trading target in the eyes of "profit seekers."

With users flocking in and trading volume surging, Lighter's 24-hour trading volume has jumped to the top of all Perp DEX (more content can be read here: Will Lighter be the next Aster with a TGE around Christmas?). In addition to previous speculations about the TGE timing and basic interaction tutorials, the details of the second quarter points system are also worth noting.

Regarding the second quarter points, the official allocation is set to be distributed every Friday, with market makers receiving 50,000 points weekly (only advanced accounts are eligible to earn points through market making). Regular trading users will be allocated 200,000 points weekly, influenced by factors such as trading volume, open contract volume, account funds, leverage, profit and loss, and trading categories, but the specific weights have not yet been disclosed, making it a "blind box."

It is worth mentioning that the relationship between points and trading metrics is not a simple linear one. For example, double the trading volume may yield 1.5 times or 3 times the points; this non-linear design aims to encourage more diverse trading behaviors. Additionally, the platform employs a combination of fully automated and semi-automated witch detection systems, allowing each user to have up to 10 accounts without penalty, while exceeding this number will result in penalties.

Aster: Monthly airdrops + regular buybacks and burns, "splashing money" while stabilizing the token price

As an important carrier of Binance's DeFi narrative extension, Aster (Read Aster project introduction: Starting with a 1,650% increase, is Aster taking over the narrative torch from Hyperliquid?) is currently the most stable "airdrop seeker" among Perp DEX projects.

Although Aster has completed its TGE, its airdrop activities are still ongoing, with a monthly cycle, short interaction periods, and clear rewards. Currently, the third phase Aster Dawn officially ended at 7:59 AM Beijing time on November 10, and the activity has now entered the fourth phase Aster Harvest, which will continue until 7:59 AM Beijing time on December 22, 2025.

In the fourth phase, the Aster team announced that they will allocate 1.5% of the total supply of ASTER tokens, releasing them evenly over six epochs, with 0.25% allocated per epoch. According to document information, the following points are noteworthy:

- Starting from the third phase, spot trading on the Aster platform will also earn activity points;

- The points calculation formula (specific weights have not been disclosed): Final points = (trading points + holding points + Aster asset points + profit and loss points) × team bonus + referral points.

- Trading points: Both contract trading and spot trading are counted, updated hourly; holding points: the larger the holding amount and the longer the holding time, the more points earned, updated daily; Aster asset points: using Aster assets (e.g., ASTER/asBNB/USDF) as margin counts towards this part of the points, updated daily; profit and loss points: net profit and loss (excluding funding fees and other costs) count towards this part of the points, updated hourly.

In addition to the monthly "money-splashing" activities, to enhance the token economy, the team announced that 50% of all buyback funds (including S2 and S3) will be burned through a public buyback address (Address link: https://bscscan.com/address/0xe307f534eec7256331c347ad73e7a08446f1d7a7) to reduce supply and solidify the long-term value of ASTER. The remaining 50% will flow back to the locked airdrop address, thereby reducing circulation and reserving more shares for potential future airdrops to reward genuine Aster users and long-term holders.

edgeX: Current season will end in 3 weeks

On October 28, edgeX officially launched a token name voting on the X platform and mentioned that the project mascot is MARU, possibly hinting at an upcoming TGE.

edgeX may hint at an upcoming TGE

Similar to Lighter, edgeX points are "weekly settled (currently in week 24), split by contribution," used to reward real trading and ecological participation.

The current Open Season weights are 60% for trading volume, 20% for invitations/ambassadors/events, 10% for treasury and TVL, 5% for liquidation, and 5% for open interest (OI), settled every Wednesday at 8 AM Beijing time, with distribution at 4 PM the following week. Scoring dimensions include trading volume, trading volume of invited users, holdings, and frequency of feature usage, with weights adjustable. The prize pool is set based on the weekly transaction volume across the network, commonly at 150,000 or 200,000 points, with actual values subject to change.

Additionally, for every 5 points accumulated by a referred user, the referrer earns 1 point.

Summary

In the current phase where there are no other popular new tracks, these leading Perp DEX are undoubtedly the most worthy of attention. For "profit seekers," the goal is to maximize trading volume while controlling slippage; for regular contract players, the current mainstream trading pairs on-chain (such as BTC, ETH) have sufficient depth to support large trades and high-frequency operations, allowing for token airdrops while trading normally, making it worthwhile to engage in on-chain trading.

Related Content

CEX to the left, DEX to the right: Why is the "third road" of Perp DEX igniting the crypto market?

Searching for the next Hyperliquid: A panoramic comparison of 14 Perp DEX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。