Author: Nancy, PANews

After the U.S. "GENIUS Act" was implemented in July, Circle, known as the "first stock of stablecoins," recently released its first financial report following the new policy. Although revenue slightly exceeded expectations, the stock price still fell due to a single profit structure, low profitability, along with downward pressure on interest rates and a large number of shares set to be unlocked soon, raising short-term market concerns. However, Circle is actively building a second growth curve through new business layouts such as the Arc public chain and the USYC tokenized currency fund, exploring diversified income sources to reduce dependence on interest rates.

USDC Supports Revenue, Distribution Costs Further Erode Profit Margins

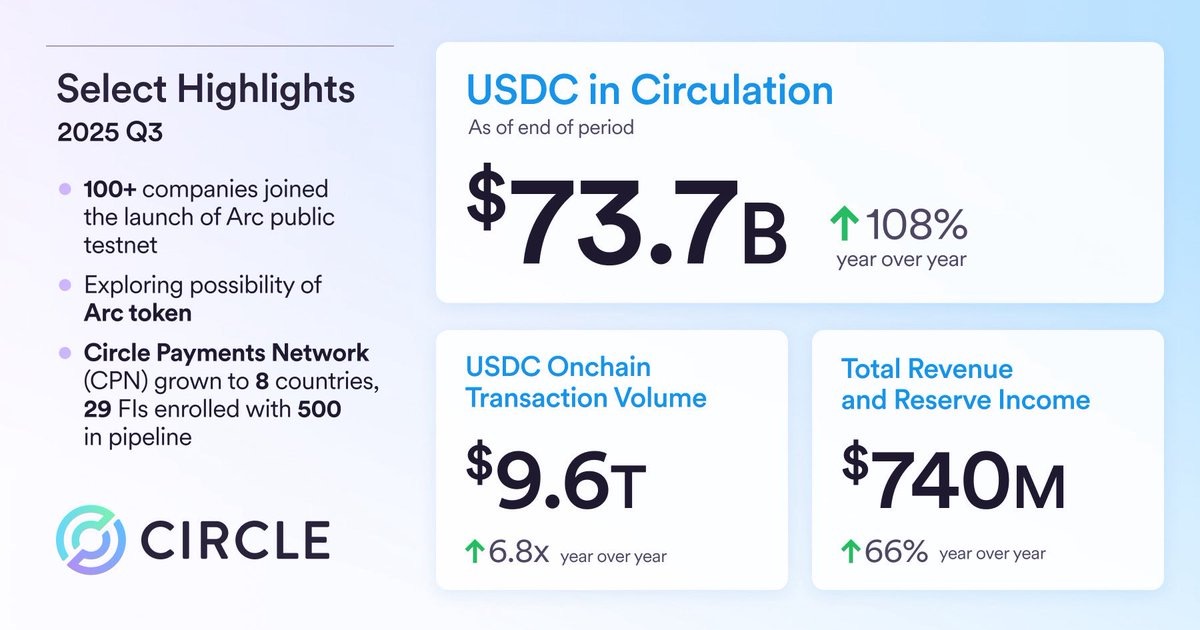

Circle's latest financial report shows that total revenue for this quarter approached $740 million, with USDC reserve income reaching $711 million, a year-on-year increase of 60%, accounting for 96.1% of total revenue (slightly down from the same period last year), making it Circle's absolute core income source. The growth in this revenue segment is mainly attributed to the market growth of USDC, with a circulation volume reaching $73.7 billion, an average circulation volume growth of 97% year-on-year, and market share increasing from about 22.6% to 29%. The official forecast for USDC's long-term compound growth rate is 40%, indicating a certain sustainability in revenue growth.

In contrast, contributions from other income sources still account for less than 4% (approximately $28.51 million), mainly from subscriptions, APIs, payment networks, etc., but this has increased more than 52 times year-on-year, prompting Circle to raise its full-year forecast to between $90 million and $100 million. However, in the short term, this type of income still has a limited impact on overall revenue, indicating that Circle's revenue structure remains highly singular and very sensitive to interest rate changes. The market generally expects the Federal Reserve to cut interest rates by another 25 basis points at the December meeting, while Circle's reserve return rate has already dropped by 96 basis points to 4.15% this quarter. This means that if interest rates continue to decline, Circle's interest income may be further compressed, significantly impacting overall profitability.

In terms of profitability, Circle achieved a net profit of $214 million this quarter, successfully reversing the massive loss from the second quarter due to IPO-related expenses, with a year-on-year increase of 202%. However, excluding the $56.21 million gain from the fair value decline of convertible debt and the $61.29 million tax benefit (from stock compensation, R&D tax credits, and new tax law impacts), the real operating profit is approximately $96.5 million. In other words, the profit generated from Circle's main business only accounts for about 45.1% of the total net profit, significantly discounting its profitability.

It is worth noting that the rapid growth of USDC is inseparable from Circle's "money-splashing" distribution cooperation model, which has also become a "stumbling block" for its performance. This quarter, Circle's distribution and trading costs amounted to $447 million, accounting for about 62.8% of reserve income, compared to 42% in the same period of 2024; the official explanation states that the increase in distribution costs is mainly due to the increase in USDC circulation balance and the average holdings of Coinbase, as well as other strategic partnerships. Circle's self-retained income as a percentage of reserve income dropped to 37% in the third quarter, down from 42% in the same period last year. This indicates that the growth rate of Circle's distribution costs is higher than that of its revenue. Regarding the decline in RLDC (revenue minus distribution costs), the official response during the earnings call stated that the priority partner distribution incentives and market reward dynamics have led to increased costs, but economies of scale are expected to improve leverage, with an estimated RLDC gross margin of about 38% for the year.

On the other hand, Circle's operating expenses in the third quarter were $211 million, a year-on-year increase of 70%, mainly due to increased compensation (including $59.08 million in stock compensation) and rising IT, management, and R&D expenditures. Circle has also raised its annual adjusted operating expense forecast to between $495 million and $510 million, citing increased investment in platform capability building and global partner expansion.

Overall, Circle continues to maintain rapid growth in its USDC reserve business, but profit margins are constrained, and diversified income has yet to form a strong support. This has raised market concerns, with CRCL affected, dropping to $86.3, currently down about 12.2%, and a decline of about 64.1% from its historical peak. Meanwhile, as Circle is set to face a large-scale unlock on November 14, the previously disclosed lock-up shares from the prospectus can be sold after 180 days or on the second trading day after the public disclosure of the third-quarter financial report (whichever comes first), potentially increasing selling pressure and further amplifying stock price volatility.

Exploring a Second Growth Curve, Circle's Three New Moves

As more new stablecoin players enter the market, competition in the sector is becoming increasingly fierce. In this trend, the market's distribution capability and ecological expansion ability have become new core competitive dimensions, no longer solely relying on first-mover advantages or compliance. To this end, Circle is continuously expanding its core business ecosystem around USDC.

According to the financial report, since the second quarter, Circle has announced several key partnerships and collaborations related to USDC, including Brex, Deutsche Börse Group, Finastra, Fireblocks, Hyperliquid, Kraken, Itaú Unibanco, and Visa, covering areas such as corporate payments, traditional finance, custody, DeFi, and cross-border payments, accelerating its deep penetration from crypto-native to mainstream financial infrastructure.

At the same time, to quickly mitigate the risk of its profit model being overly reliant on USDC issuance, Circle is accelerating the diversification of its income structure.

On one hand, Circle is entering the underlying infrastructure field. In August this year, the company announced the launch of its self-developed Layer 1 blockchain, Arc. On October 28, the Arc testnet officially went live, attracting over a hundred institutions to participate in testing, covering multiple industries including capital markets, banking, asset management, insurance, payments, and technology. Circle hopes to provide developers and enterprises with programmable financial infrastructure to promote the scaling of on-chain economic activities. At the same time, Circle plans to explore the issuance of Arc's native tokens to incentivize network participation, promote the implementation of ecological applications, and build a long-term sustainable network economic model.

On the other hand, Circle continues to deepen its layout in the payment and settlement field. In May this year, the company launched the cross-border payment network Circle Payments Network (CPN), which currently covers 8 countries, with 29 financial institutions officially connected, another 55 under review, and 500 still waiting to connect. As of November 7, 2025, the annualized transaction volume of CPN over the past 30 days has reached approximately $3.4 billion.

Additionally, asset tokenization has also become a key exploration direction. Circle launched the tokenized money market fund USYC mid-year, aiming to provide liquid, tradable, and stable-yield digital asset tools for institutions and high-net-worth investors. From June 30, 2025, to November 8, USYC's scale has grown over 200%, reaching approximately $1 billion.

Overall, although Circle's business continues to show steady growth, short-term profitability faces pressure. The company is actively expanding its business boundaries beyond stablecoins, accelerating its transformation from a stablecoin issuer to a provider of on-chain financial infrastructure. However, in the fiercely competitive stablecoin sector, this transformation is not easy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。