The global payment giant Visa is quietly staging a digital currency revolution, targeting the vast creator and gig economy groups.

"Launching stablecoin payments is to enable anyone, anywhere in the world, to access funds in minutes—rather than days—in a truly universal way," announced Chris Newkirk, President of Visa's Business and Cash Flow Solutions, at the Web Summit on November 12, 2025.

Visa has launched a groundbreaking Visa Direct stablecoin payment pilot, allowing businesses to pay directly in USD stablecoins to the stablecoin wallets of recipients. This service targets the growing creator economy and freelance workforce, who often face delays and high costs associated with traditional cross-border payments.

1. Targeting Pain Points: The Speed and Cost Revolution in Cross-Border Payments

This pilot by Visa directly addresses the core pain points of traditional cross-border payments—speed and accessibility. According to Visa's "2025 Creator Economy Report," 57% of digital content creators cite quick access to funds as the primary reason for their preferred digital payment methods.

For millions of freelancers, creators, and gig economy workers worldwide, payment speed directly impacts their cash flow and business stability.

Visa's new pilot program allows businesses to pre-fund using fiat currency, while recipients can choose to receive USD stablecoins like USDC directly. This model reduces cross-border payment times from several days in traditional banking systems to just minutes, fundamentally changing the game.

2. Strategic Layout: Visa's Diversified Stablecoin Ecosystem

● Visa's exploration of the stablecoin space is not a spur-of-the-moment decision but a gradual strategic layout. As early as 2021, Visa began settling USDC on Ethereum and later expanded to the Solana blockchain in 2023.

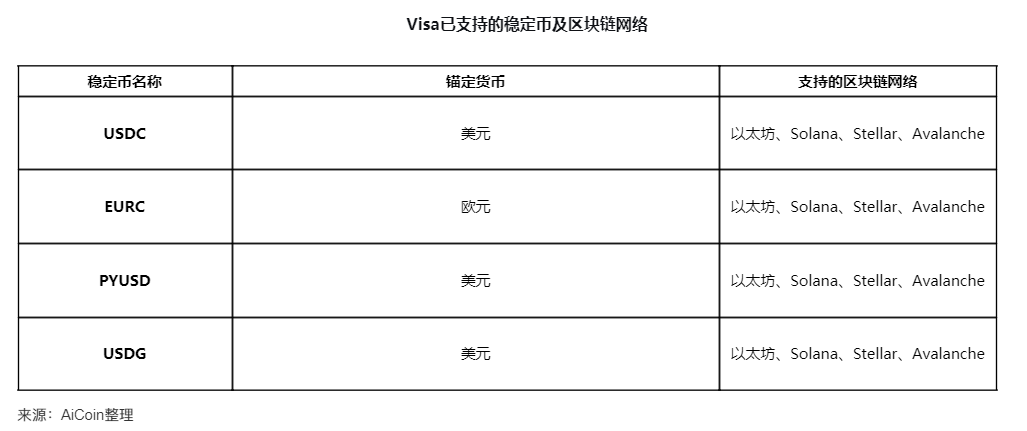

● In October of this year, Visa CEO Ryan McInerney revealed during an earnings call that the company would support four new stablecoins on four "unique blockchains."

These initiatives will enhance the list of stablecoins and blockchain networks already supported by Visa. McInerney noted that Visa has seen "particular momentum for stablecoins," facilitating $140 billion in cryptocurrency and stablecoin flows since 2020.

3. Market Shift: From Speculation to Practicality

● As Visa intensifies its stablecoin efforts, the market is undergoing a fundamental shift from speculation to practicality. According to the stablecoin retail payment index released by Orbital for Q3 2025, the retail stablecoin payment market is showing signs of maturity, shifting from explosive, incentive-driven growth to more sustainable organic activity.

● The index indicates that after a promotional surge in previous quarters, total transaction numbers have eased from 1.33 billion to 1.21 billion, but real payments such as P2P transfers, remittances, and small to medium-sized business transactions are driving a healthier market share.

● Orbital co-founder Luke Wingfield Digby pointed out: "Stablecoins are no longer just about growth; they are about utility. The next step is to make stablecoins usable everywhere—connecting networks, use cases, and regions to make them a truly universal payment layer."

4. Regulatory Breakthrough: The Catalytic Effect of the GENIUS Act

● The passage of the U.S. GENIUS Act has cleared the way for traditional financial giants like Visa to enter the stablecoin space. This act, signed into law by President Donald Trump in July 2025, establishes a federal regulatory framework for stablecoins, clarifying compliance requirements for issuance and services.

● The clarity in regulation has led to a massive entry of traditional financial institutions. A group of major international banks, including Goldman Sachs, Deutsche Bank, Bank of America, BNP Paribas, and Citigroup, has formed an alliance to explore issuing "reserve-backed" digital currencies on public blockchains.

● At the same time, other players in the payment sector are also taking action. Mastercard joined Paxos' global dollar network in June 2025 to enable stablecoin settlements for its merchants and payment rails.

5. Empowering Banks: Building Stablecoin Infrastructure

● Visa's stablecoin strategy not only focuses on end users but also aims to provide infrastructure for traditional banks. McInerney stated during the October earnings call: "We are enabling banks to mint and burn their own stablecoins through Visa's tokenized asset platform, and we are adding stablecoin functionality to enhance Visa Direct's cross-border fund transfers."

● This strategic positioning makes Visa a bridge between traditional finance and the digital currency world, rather than just a competitor. By providing banks with the technological capabilities for stablecoin issuance and management, Visa is building a hybrid ecosystem that leverages the advantages of blockchain technology while maintaining the stability of the existing financial system.

● Visa's cryptocurrency head Cuy Sheffield stated at the Singapore FinTech Festival: "We are working with banks around the world to help them formulate digital asset strategies and determine how to effectively build in the stablecoin space."

6. Full Rollout in 2026 and Industry Competition

Visa plans to conduct a broader rollout in the second half of 2026 as customer demand grows and the regulatory framework advances. This timeline aligns with the overall development pace of the stablecoin market.

● An increasing number of companies are entering the stablecoin space, with Citigroup exploring stablecoin payments and Western Union planning to launch a digital asset settlement system on Solana. Meanwhile, Wall Street banks like JPMorgan and Bank of America are also in the early stages of developing their own stablecoin plans.

● Industry competition is intensifying, with different entities choosing various models, from fully collateralized retail stablecoins to tokenized deposits and wholesale settlement tokens. In this context, Visa, with its extensive network advantages and gradual implementation strategy, is poised to occupy a central position in the digital currency payment ecosystem.

The global payment market is undergoing a silent revolution. While Wall Street giants like JPMorgan and Bank of America are still exploring their own stablecoin plans, Visa has already pushed the monthly transaction volume of stablecoin settlements to an annualized run rate exceeding $2.5 billion.

In the competitive landscape of future payments, Visa is no longer satisfied with merely connecting traditional bank accounts; it aims to be the bridge between the world of digital currencies and traditional finance.

As Visa's cryptocurrency head Cuy Sheffield stated: "By embedding Visa credentials in every stablecoin wallet, we position Visa as the universal acceptance network for stablecoins."

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。