Author | @litocoen

Compiled by | Odaily Planet Daily (@OdailyChina)

Translator | Dingdang (@XiaMiPP)

A year and a half ago, I wrote my first article about Fluid. At that time, it was still called Instadapp, and the token price was $1.74. Today, Fluid is widely recognized as one of the blue-chip money markets in the crypto space and ranks among the top three DEXs in the entire crypto industry. The price of the FLUID token has increased by 133% (compared to a 130% increase for Instadapp), and at its peak, it rose by as much as 450%.

Although the ultimate development trajectory did not completely align with my initial vision, its performance still surpassed many tokens during the same period.

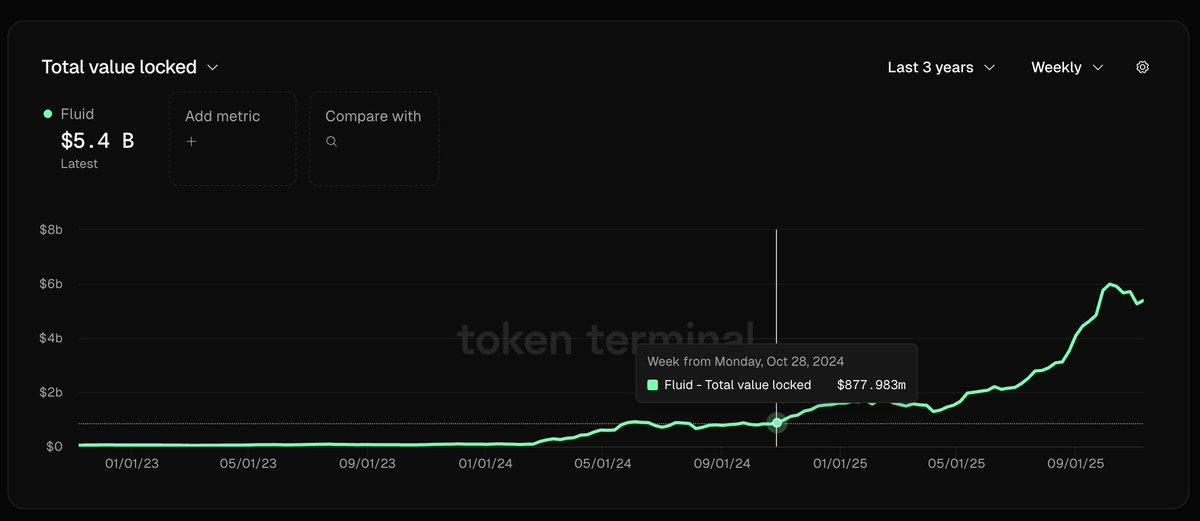

More importantly, the adoption metrics for Fluid continue to maintain good momentum:

Since the launch of Fluid DEX a year ago, Fluid's TVL (Total Value Locked) has grown by 515%.

This article aims to briefly summarize the current stage of the project and its future development direction.

Key Progress Review

- Fluid has become the third-ranked lending protocol by active loan volume and the fourth-ranked DEX by trading volume.

- Aave DAO has invested in Fluid and collaborated on strategic projects such as GHO liquidity.

- Fluid has launched on Solana and partnered with Jupiter to introduce "Jupiter Lend."

- Fluid's annualized holder earnings exceed $10 million.

- FLUID has been listed on Upbit, Bybit, and OKX, and is about to be listed on Coinbase.

- Fluid has initiated a token buyback, having repurchased 0.5% of the total supply within just two months.

What Makes Fluid Unique?

In simple terms, Fluid is the first money market that integrates a DEX. In this system, assets in the money market can be used both as collateral and as debt; at the same time, these assets can also participate in liquidity provision to earn trading fees.

Since its launch, lenders and borrowers on the Fluid platform have collectively earned an additional $25 million through the so-called "Smart Collateral" and "Smart Debt" mechanisms. You don’t need to be a rocket scientist to understand the logic: on Fluid, you can use collateral that earns additional fees and debt that is cheaper (due to the ability to offset trading fees). As shown in the image below, my USDC-USDT debt position enjoys a -0.4% discount interest rate:

Debt positions provide liquidity while earning trading fees.

How Can Debt Earn Trading Fees?

This part often confuses many people because this mechanism is entirely new and fundamentally different from the logic of other lending protocols. How can you borrow funds, withdraw and spend them (even in the real world), while also receiving a discount from trading fees?

In other words, how can assets that have already "left the account" (i.e., debt) still participate in providing liquidity?

Like all debts, my debt is a liability to Fluid. When I open a Smart Debt position for USDT–USDC on Fluid, I am essentially expressing this stance: "I am willing to hold debt in USDT and/or USDC, and I do not care about the specific composition of the debt." I view these two assets as equivalents, so it makes no difference to me whether I ultimately repay $5,000 in USDT or $5,000 in USDC.

Based on this setup, Fluid can utilize the excess liquidity in its liquidity layer to provide assets for external traders to use—after the trade is completed, it simply adjusts the composition of my debt.

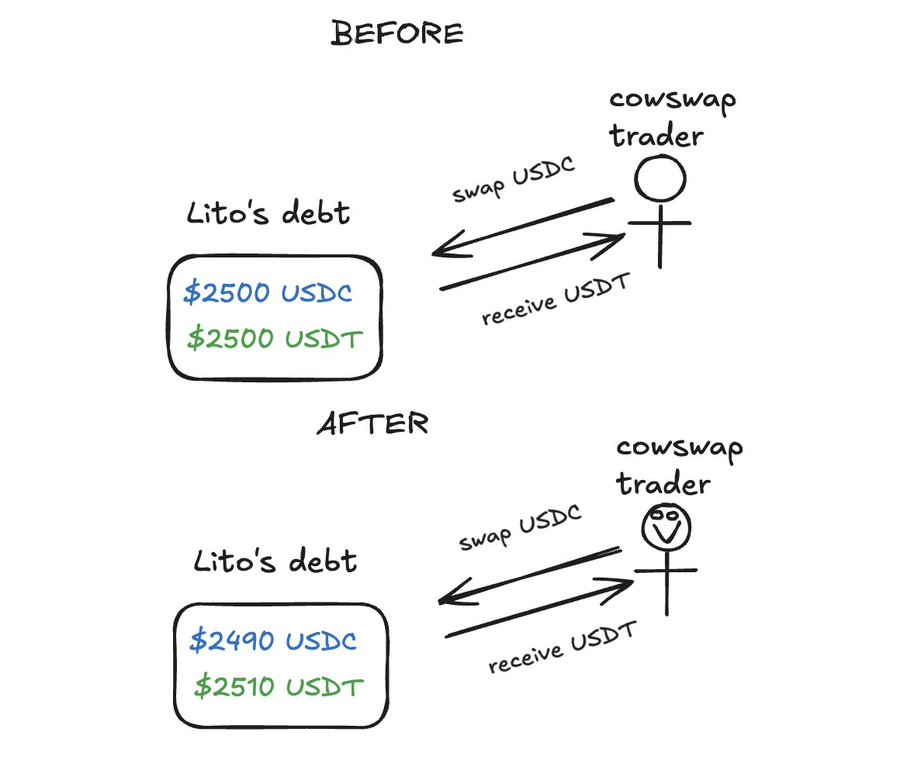

For example: suppose I borrowed $5,000 worth of USDT–USDC and withdrew the money to buy a watch in the real world—this money has already been spent.

Next, a trader wants to exchange 10 USDC for USDT on Cowswap, and the trade is routed to Fluid's USDT–USDC debt pool. The trader will deposit USDC into Fluid's liquidity layer and withdraw USDT—the trader is very satisfied.

How external trades change my debt structure through Fluid DEX

At this point, my liability still exists, but its composition has changed. As shown in the image above, I now owe slightly less USDC and slightly more USDT. In fact, I will also earn some trading fees from this, which will offset or even completely cover my borrowing costs. However, for simplicity, we will not consider the fee portion here.

Fluid can utilize assets more efficiently and create additional income, making it the best place for depositing collateral and borrowing. This also positions Fluid as the optimal DEX for stablecoin trading pairs.

Some typical examples of "Smart Collateral/Smart Debt" pools (all fully allocated)

Compared to Curve, LPs (liquidity providers) on Fluid:

- Can earn both lending interest and trading fee income on their assets;

- Can leverage their LP positions to enhance returns;

- Even the debt itself can earn trading fees.

To illustrate the advantages of this model, consider the following scenario: on Curve, the annualized trading fee yield (APR) for the USDC–USDT pool is 0.6%. Normally, any rational person would not deposit stablecoins into that Curve pool because they could earn 4% by depositing directly into Aave. But on Fluid, you would be happy to use this 0.6% debt yield to lower your borrowing costs or make your collateral more efficient.

In other words, the opportunity cost for LPs on Fluid is 0—because they would have deposited collateral or borrowed anyway, any marginal reduction in capital costs is worthwhile and results in positive net income. This means that Fluid's "cost structure" is lower than all competitors, allowing it to provide stablecoin swaps at a lower cost.

Upcoming Major Catalyst: DEX V2

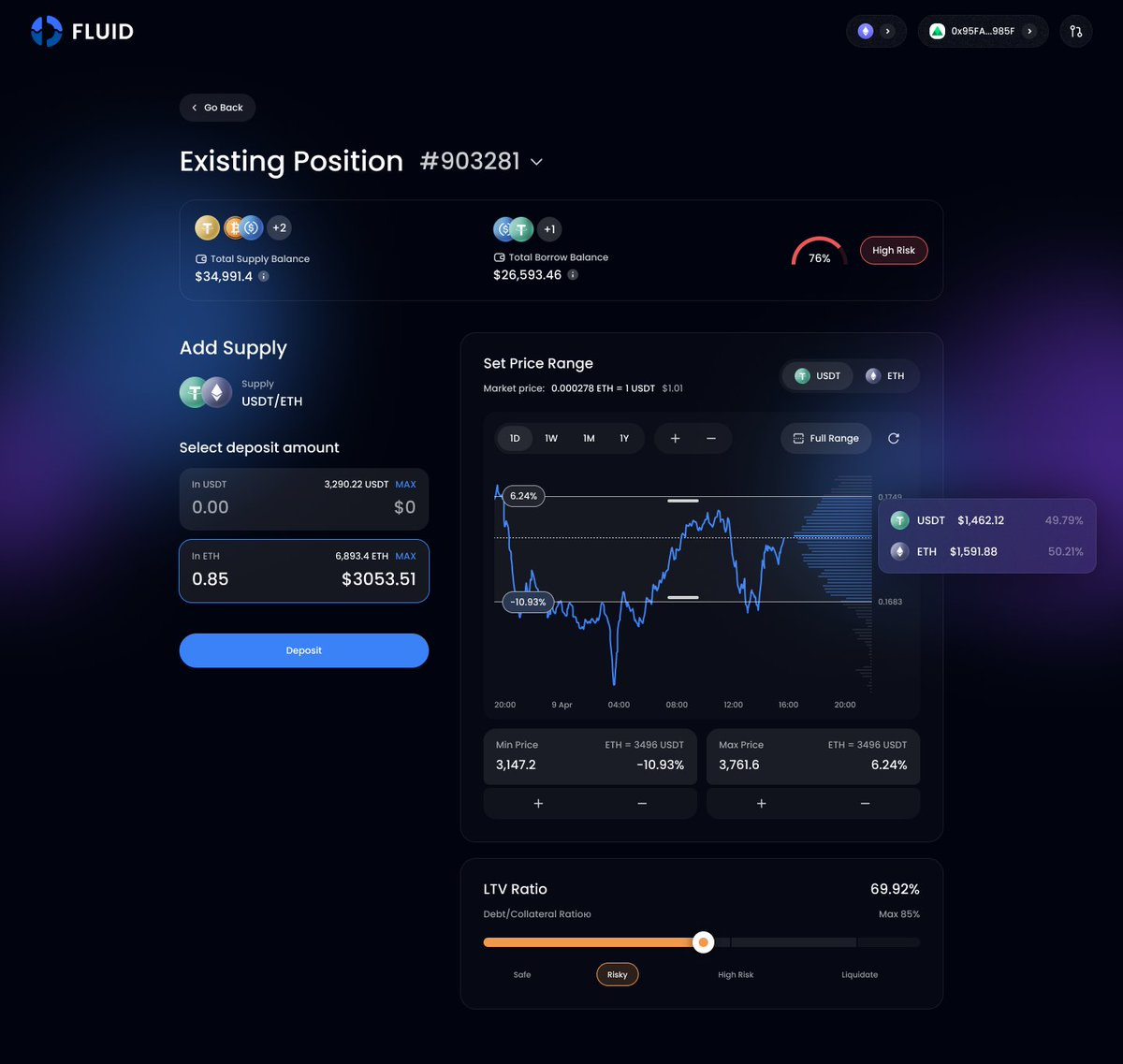

Sneak peek: DEX V2 with custom ranges

Previously, Fluid's DEX used a concentrated liquidity mechanism similar to Uniswap V3, but the liquidity ranges in each pool were set by governance at the time of pool creation, resulting in fixed ranges. This design is perfectly adequate for stablecoin trading pairs that do not require active position management, but it is not suitable for more volatile trading pairs.

From a revenue perspective, more volatile trading pairs are more attractive to Fluid. Just look at the top protocols ranked by holder income on DeFiLlama: three of the top ten are spot exchanges (Pancakeswap, Aerodrome, and Uniswap, the latter of which will take effect after implementing fee conversion).

Therefore, I believe that after the release of DEX V2, Fluid has the opportunity to become the largest DEX in the entire crypto space.

Why?

In short, Fluid DEX V2 will outperform competitors in every aspect.

Let’s look at a few example liquidity pools:

1) A typical volatile altcoin pool, such as LINK/USDC (no debt): everything is the same as Uniswap, but note that the USDC in the pool will earn 5% native yield from the liquidity layer.

Result: Fluid is superior

2) An ETH/USDC smart collateral pool that supports borrowing USDC against it.

Result: Fluid is superior

3) An ETH/USDC smart collateral pool that leverages USDC/ETH smart debt (this is only suitable for those who love leverage and can hedge against impermanent loss).

Result: Fluid is superior

Custom ranges also allow for some interesting operations, such as setting "stink bid" limit orders on tokens like FLUID to prevent crashes like 10/10, while the USDC in your limit order can still earn yield from Fluid's liquidity layer. This is impossible on CEXs because idle funds on CEXs always have an opportunity cost.

In a blog post a few months ago, Fluid also mentioned that DEX V2 will introduce dynamic fees (which can differentiate pricing for liquidity during volatility spikes to generate more income), multi-token collateral baskets (imagine using ETH, XAUT, and ENA-ETH LP as collateral), and Hooks for MEV capture, among other features.

Finally, DEX V2 seems to pave the way for a whole new batch of cool protocols in the future, such as perpetual contract protocols (Samyak hinted at this in the Fluid TG group) and making stablecoin pair trading more efficient.

Price Target

My baseline assumption is that DEX V2 will increase Fluid's revenue from the current approximately $12 million to over $100 million, a tenfold increase. It sounds crazy, but if you look at the market size, this expectation is not exaggerated.

For example, just yesterday, the ETH/USD trading pair on Ethereum generated $800 million in trading volume, bringing about $400,000 in fees for LPs. If we assume Fluid captures 50% of this market and charges a 10% fee, that would add $7 million in revenue annually (almost double the current revenue). This is just for ETH on Ethereum, not accounting for L2, Solana, and other assets like BTC, SOL, and blue-chip altcoins.

I believe FLUID is one of the most worthwhile tokens to bet on for the following key trends:

- Stablecoins (the most important infrastructure for stablecoin trading)

- Forex on-chain (look at the signals from collaborations with Plasma, Arc, etc.)

- Exposure to Solana DeFi

- DEX and money markets

My "crystal ball" prediction: FLUID will reach $20 in the next 6 months. If you ask me for a real target price, it would be much higher (a comparative valuation with Uniswap would put it at around $70). However, I've learned from past experiences that my price predictions tend to be overly optimistic—this is a mistake I don't want to make again. I think a more reliable approach is to base judgments on revenue estimates, allowing everyone to build their own assumptions based on these numbers.

Frequently Asked Questions (FAQ)

Why does FLUID's performance look "bad" despite significant growth?

The best explanation I can think of is that Pantera has sold nearly $30 million over the past 14 months because they needed to return this investment from 2019 to their LPs (limited partners).

What is FLUID's FDV?

Fluid's market cap is approximately $300 million, and the FDV is also $300 million. The DAO still holds about 25% of the token supply, and this portion should not be counted in the current market cap or FDV, as these tokens are not intended to be sold in the short term.

Will DEX V2 be an immediate success?

I believe it will take at least 3 months to complete the integration with upstream aggregators and liquidity migration before we can see the full potential of DEX V2. However, we will certainly see some promising data and initial signals during this process.

Will DEX V2 launch on Solana?

Yes. Currently, Fluid has only launched a lending protocol on Solana. They will not launch DEX V1 on Solana but will go directly to DEX V2. Given Solana's spot trading volume, this could become a significant driver of fees.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。