Written by: Wintermute

Translated by: Shaw Golden Finance

With position adjustments and some risk assets returning, the market tone has improved. Bitcoin may need to approach historical highs further for altcoins to rebound and for market breadth to expand. Upcoming U.S. regulatory and political headlines are the next key drivers influencing market volatility.

Market Macro Update

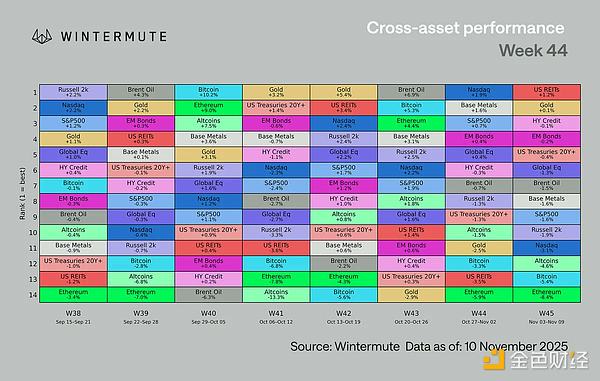

This week, the shift in market tone was more about changes in sentiment than direction. The shock from the October crash has largely subsided, and positions have been adjusted. Although the performance of cryptocurrencies still lags behind other risk assets, the overall atmosphere seems less fragile. News headlines have played a supportive role. Trump's proposed $2,000 "stimulus plan" (through tariff rebates) briefly boosted market risk sentiment over the weekend, although it was later reinterpreted as a tax cut, it still achieved its purpose: reminding the market that fiscal support is still in play. Additionally, hopes for the end of the U.S. government shutdown and soft macroeconomic data have provided traders with reasons to selectively take on risk. Digital assets remain the worst-performing cross-asset class, indicating that while market sentiment may be improving, capital flows have not kept pace.

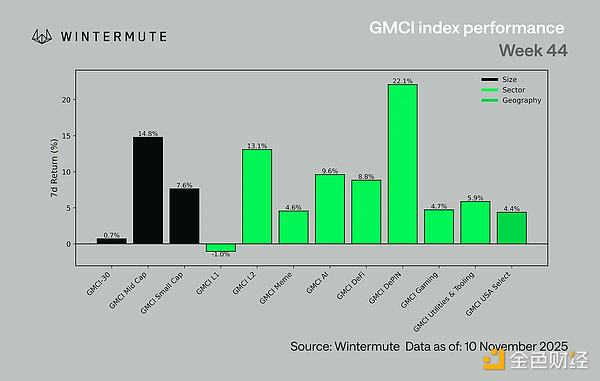

Bitcoin prices have remained around $105,000, while Ethereum prices hover near $3,500. Despite ETF outflows for a consecutive week, both have shown resilience. Altcoins rebounded on Monday, but the recovery was highly uneven. The GMCI-30 index rose 0.7% this week, with leading sectors including:

- DePIN: +22%

- L2s: +13%

- Mid Caps: +15%

- AI: +9.6%

- DeFi: +8.8%

- Utilities: +5.9%

- L1s: -1%

- Memes: +4.6%

This rotation reflects the current level of risk appetite. Investors are increasing their holdings, but the extent of the increase is modest. The rise in GMCI is mainly a result of the weekend rebound rather than a structural shift in capital flows. Market breadth remains extremely narrow, with only a few coins (like FIL, AR, etc.) contributing to most of the gains. Breakout trends still seem forced, concentrated in a few weak and easily fading momentum sectors.

The macro environment remains favorable. Interest rate cuts are underway, quantitative tightening has ended, and global easing policies continue. The overnight financing rate (SOFR) is declining, generally aligning with the trend of policy rates, albeit with a slight lag. However, the performance of cryptocurrencies differs from other risk assets: speculative components are decreasing, rebound amplitudes are limited, and rotations are frequent, with capital more inclined to hold mainstream coins rather than fringe altcoins.

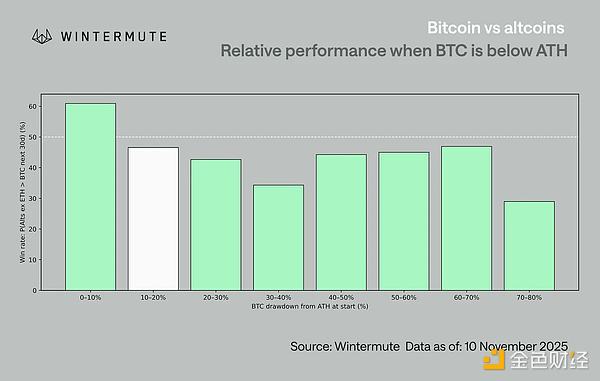

Based on the current trading situation of mainstream coins, the altcoin season seems unlikely to arrive soon. Historical data shows that when mainstream coins approach historical highs, altcoins typically perform better, leading to a wealth spillover effect. When Bitcoin prices are between 10% to 20% away from historical highs (currently at 16%), the probability of Bitcoin outperforming altcoins is about 54%. When Bitcoin prices drop close to $100,000, historical data indicates that the probability of Bitcoin outperforming altcoins can even rise to about 58%.

This indicates that the dynamics of the spillover effect can be seen numerically, and it also explains why the gains of coins like FIL, ICP, and FET were so weak last week, as the market failed to receive confirmation signals for trend continuation from Bitcoin, leading to a complete fade of the gains.

However, this does not mean that all altcoins outside of mainstream coins have perished. A few blue-chip coins (like HYPE, ENA, UNI, etc.) have continued to outperform the market due to catalysts, benefiting from clearer U.S. regulatory signals and rumors of a domestic market restart. But the broader altcoin market remains volatile like the options market: after a brief upward momentum, it is difficult to sustain strength unless Bitcoin prices rise. It is hard to predict a sustained rise in the altcoin market before mainstream coins regain dominance.

Our View

A strong market environment and restored momentum have bolstered confidence in the sustainability of this rally. The current question is whether mainstream coins can rebound to higher levels, after which market breadth may have a chance to recover.

Positions have been readjusted, market sentiment has improved, and after several weeks of turbulence, the market has finally reached a balance. Cryptocurrencies remain the worst-performing cross-asset class, but the overall market tone has shifted: the October crash seems to be behind us, and selective risk appetite is returning. The rebounds in DePIN, L2, and AI sectors indicate that there is still demand in related fields; however, market breadth remains narrow, and the market structure is relatively fragile.

In the upcoming phase, mainstream coins need to lead the market. History shows that altcoins only follow when Bitcoin trading prices are close to their historical highs. Currently, Bitcoin prices are around $105,000 (down 16% from historical highs), which has not triggered this rotation. This appears more like a turning point rather than a stagnation period: the structure is clearer, the macro environment is favorable, and the market seems ready to rise again. With news of U.S. regulatory resumption about to be announced, the next wave of volatility is likely to stem from policy and political factors rather than position adjustments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。